MIDDAY MACRO - DAILY COLOR – 10/22/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are negative, sharply dropping after Powell acknowledged inflation could be more sticky, moving rate hike expectations up and changing sentiment after 7-days of S&P gains

Treasuries are higher, as the more risk-off tone following Powell’s remarks helped the long-end get a stronger bid, flattening the curve to new lows

WTI is higher, as Saudi Arabia and Russia separately comment on restraints to future investment and production capacity for OPEC+

Analysis:

Equities are off all-time high levels reached this morning following a better U.S. PMI report and mixed earnings, as a barely audible Powell spooked the market (despite giving no new message) by acknowledging that supply-side disruptions will last longer. This caused the Treasury curve to flatten, the dollar to strengthen, and the probability of a summer rate hike in 2022 to increase. Equities are now recovering slightly on more positive (fewer tax increases) infrastructure news out of D.C as well as positive technicals and optionality.

The S&P is outperforming the Russell and Nasdaq with Low Volatility, High Dividend Yields, and Value factors, and Financials, Consumer Staples, and Real Estate sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4464 while the Call Wall rises to 4550. The Call Wall moved higher as continued call buying increased gamma levels, reducing implied vol and now cementing 4500 as solid support.

The technical levels have support at 4510, then 4480, and resistance at 4575 for the S&P. The S&P made a slightly higher ATH, but thanks to Powell, it quickly reversed with RSI still very high.

Treasuries are higher, with the 5s30s curve flatter by -3.6bps to 87bps, its flattest level since Q1. However, the belly is still positive on the day, reflecting increased growth concerns from tighter monetary policy due to Powell's comments.

*Despite being near all-time highs, only a little over 60% of S&P companies are trading at or above their 50-day moving average

*Five-year breakeven rates are up sharply, but 5Y5Y forwards, expected inflation over the five years that begins five years from today, is 2.37%, still below the longer-term average - RenMac

Uncertainties emanating from China have cooled slightly this week as drops in coal prices have reduced energy shortage and inflation concerns. At the same time, Evergrande appears to be able to make a weekend debt payment, helping improve investor sentiment in China and more broadly.

Chinese coal prices continue to tumble as pressures from Beijing/NDRC to increase domestic supply and imports as well as punish speculators and improve logistics have the most-traded thermal coal future down over 30% on the week.

*A week of “limit-downs” action in coal markets following Beijing's change in tone/direction

This will not immediately end the power shortages, as many analysts expect the supply shortfalls to persist through the end of the year. Still, Beijing directives, increases in oil and natural gas imports, and market reforms allowing power generators to raise prices in wholesale markets should enable/incentivize greater energy production, leaving us to believe the worst may be over.

*Recent rises in coal prices/costs will have less of an effect on CPI than PPI due to fixed-rate contracting, something that has become a common problem for electricity providers elsewhere as well

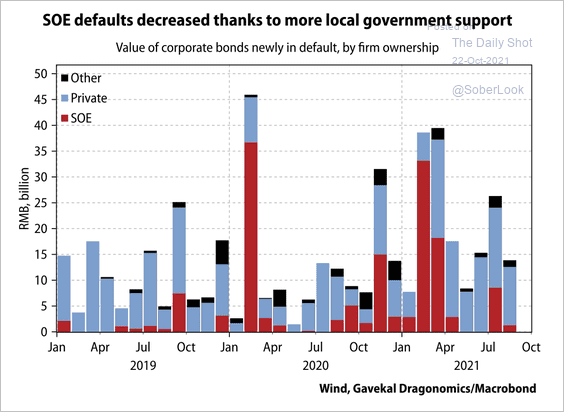

At the same time, China Evergrande Group seems to have pulled off an $83.5M bond coupon payment due Saturday, helping its stock and the property developer sector rally today. But the drama is still far from over as Evergrande still needs to pay $573M on another four dollar notes before the end of this year and faces $7.7B in bond maturities in 2022.

*Chinese high yield markets saw some relief following reports Evergrande would be able to make Saturday's coupon payment but still have a long way to go to signal normality

Beijing is beginning to throw more support behind the property sector, which makes up 25% of Chinese GDP. It is doubtful a long-awaited property tax will be announced, and banking regulators said Thursday banks should support first-time homebuyers in terms of downpayment ratio and mortgage rates, both of which have started to fall slightly. This should help alleviate recent falls in housing prices and stabilize investor/consumer confidence.

*Home mortgage rates in major Chinese cities fell in October for the first time this year as banks are being encouraged by Beijing to increase their lending activity to the sector as home prices come under growing pressure

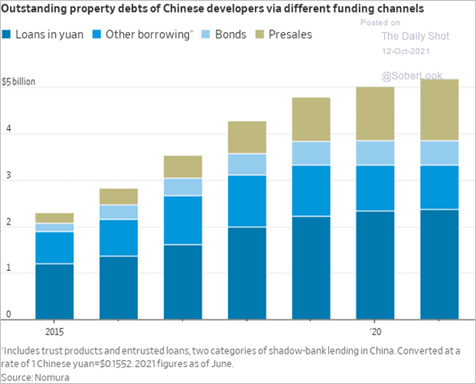

*Although debt growth in the property sector is slowing, developers still have significant liabilities to manage, likely meaning there will be bouts of concerns and volatility as individual firms fail to make payments moving forward

China’s overall macro picture is still very mixed. However, if drags from lockdowns, property market uncertainty, and energy shortages have peaked, a more positive first half of 2022 is likely. Capital inflows, improving liquidity and credit impulse, as well as the potential for a more significant release of pent-up demand from consumers (travel and services) into the Chinese New Year’s, should support financial and real asset prices and improve investor, business, and consumer confidence.

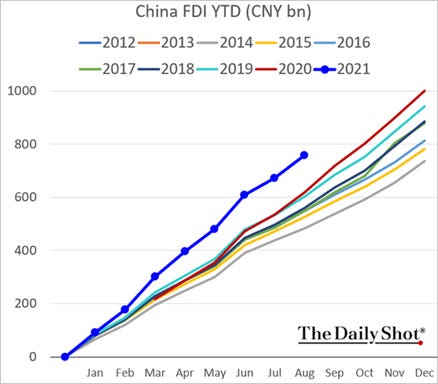

*Despite talks of supply-chain security and reshoring as well as a more hostile macro environment, foreign direct investment has only increased this year

*China’s credit impulse tends to improve into the Chinese New Year, and the 6-month impulse looks to be now breaking higher with the 12-month likely to follow

*Beijing is increasingly instructing local governments to support businesses and consumers

It's also important to quickly highlight that geopolitical risks remain notable with Biden firmly committing to the U.S.’s defense of Taiwan (yesterday), increased flyovers and a submarine incident, and developments between Western allies (Auzzie/UK sub-sales, Quad intel sharing, and NATO’s pivot) worrying China enough to increase first-strike nuclear abilities (hypersonic missiles and increased silos).

*BlackRock’s Geopolitical Risk Dashboard has risks from U.S.-China relations as likely to increase moving forward

Relations will also be strained by renewed trade negotiations (and the Biden Admin’s expectations that Beijing will honor the Phase I trade deal), Winter Olympics diplomatic boycotts, continued WHO investigation into the origins of Covid, completion of numerous China bills in Congress as well as a new U.S. National Security Strategy.

*There has been little change in trade relations with China by the Biden Administration

The bottom line is that the usual rational and methodical relationship between the U.S. and China has structurally changed with increased levels of nationalism and “Wolf Warrior” mentality making its way into everyday life in China while bi-partisan support in the U.S. to confront/contain China has never been stronger. As a result, the increased level of “incidents” and coming “escalations” increase geopolitical risk dynamics (and room for error).

*A Chinese war movie about the strategic defeat of the United States during the Korean War is set to become the country's highest-grossing movie of all time

Finally, the big question is, has Beijing cracked down enough on the wealthier south whose financials (Shanghai Clique), digital tech firms, property developers, multi-national corporate industrials, and energy producers all represent threats to more centralized (Beijing) control? We believe we have seen peak crackdowns for now. Xi, aiming for an unprecedented third term as head honcho, and the CCP more generally wanting a stable/growing economy going into next year’s 20th National Party Congress. As a result, they will promote a more neutral/positive fiscal/monetary policy moving forward.

*Xi and the 19th CPC Central Committee conclude the 5th plenary session

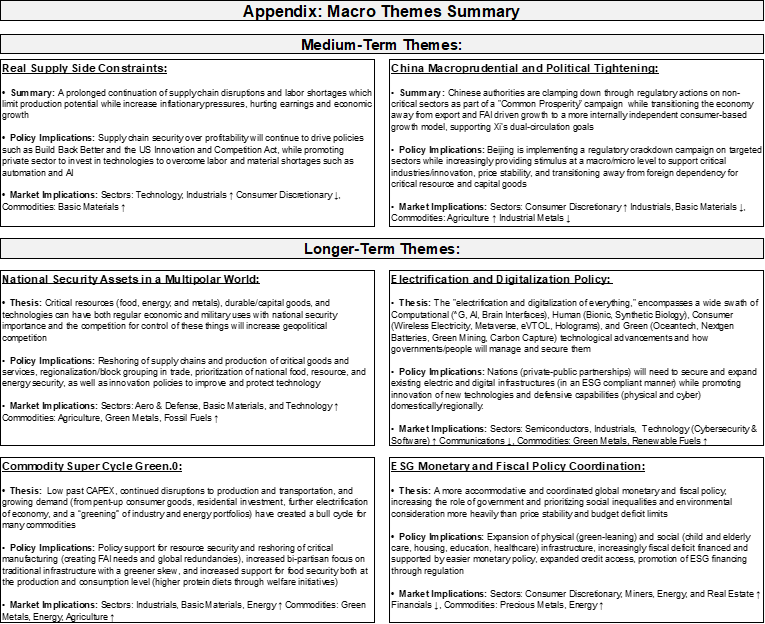

All of the above gives us confidence that China’s negative drag on global risk appetite has bottomed, and they will increasingly be a more positive macro pulse in the first half of 2022 despite growing geopolitical risks.

Econ Data:

The IHS Markit US Composite PMI rose to 57.3 in October, from 55 in September. This signals the fastest pace of expansion in business activity in three months. The majority of gains in the overall composite came from a solid increase in the service sector, with Service PMI reaching 58.2. Manufacturing activity increased at the slowest pace in 15 months amid reports of material shortages and supply chain delays. New Orders continued to expand, although at the softest pace since December 2020, while the level of outstanding business rose at a series record pace and the rate of job creation was the fastest since June. On the price front, both input and output costs rose at record rates. Finally, the level of sentiment regarding output in the year ahead dipped to the joint-lowest in eight months.

*Increases in service activity helped the overall PMI composite improve in October while manufacturing activity continues to be capped by supply-side disruptions

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week but down on the day as earnings from tech firms overnight were not supportive, while (despite lower yields) value is benefiting from better PMI data

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, and the day, as Chinese iron ore port inventories hit their highest level since April 2019 due to declines in steel production

5yr-30yr Treasury Spread: The curve is flatter on the week, and despite a general rally across the curve today, the long-end is better bid on Fed-tightening/growth concerns

EUR/JPY FX Cross: The Yen is higher on the week, as Japan’s inflation rate and private flash PMIs came in stronger than expected, while the EZ Markit PMIs slightly missed expectations. Comments regarding the defense of Taiwan by Biden also helped

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply-Side Constraints:

Conductors Needed: Rail-Yard Congestion Holds Down Shipping Volumes – WSJ

The chief executives at CSX and Union Pacific said a lack of truck drivers, equipment, and warehouse workers caused congestion in their yards, forcing the railroad operators to turn down some business during a time of high demand for shipping companies. The railroads are also facing issues within their own operations, from damaged bridges to difficulty hiring conductors that they say are hampering them from transporting more goods.

Why it Matters:

Rail shippers saw a drag to shipping volumes in the third quarter due to declines in auto-shipments but generated greater revenue due to higher prices. “We are definitely getting more price than we are experiencing in inflation,” Union Pacific Chief Executive Lance Fritz said on Thursday’s earnings call. Union Pacific is buying more chassis that can carry shipping containers and opening facilities outside of Los Angeles and Minnesota to handle the increased volume. Although we still have months of supply-side drag still ahead, there are signs logistical companies are starting to increase capacity. We also continue to believe the labor situation will increasingly improve as workers are incentivized by higher wages/benefits and reduced savings.

Missing Milk: ‘People Are Hoarding’: Food Shortages Are The Next Supply-Chain Crunch - Bloomberg

The supply of basic goods at U.S. grocery stores and restaurants is again falling victim to intermittent shortages and delays. In Denver, public-school children are facing shortages of milk. In Chicago, a local market is running short of canned goods and boxed items. But there’s plenty of food. There just isn’t always enough processing and transportation capacity to meet rising demand as the economy opens up further.

Why it Matters:

The shortages aren’t as acute as they were earlier in the pandemic. At supermarkets, on-shelf availability has stabilized since dropping drastically in November last year, according to data from NielsenIQ. Still, one key metric is trending down a bit. The total on-shelf availability rate was 94.6% in September, a decrease from 95.2% in August. That means that 94.6% of expected revenue was generated last month, NielsenIQ says.

China Macroprudential and Political Tightening:

Household Wealth: China’s Falling Home Prices Cast Another Shadow Over Economy – Bloomberg

The 0.08% drop in new-home prices across 70 cities in September may be small, but it poses a potentially big blow for an economy that counts on property-related industries for almost a quarter of output. Developers are struggling with regulatory tightening that has helped to choke off fresh financing and made it harder to pay bills. Evergrande alone owes more than $300 billion and has yet to finish homes for 1.6 million buyers who put down deposits.

Why it Matters:

September is traditionally a peak season for the home market. Yet residential sales tumbled 17%, investments slid for the first time since early 2020, and the rate of failed land auctions climbed to the highest since at least 2018 -- potentially hurting local government coffers. Homebuyer sentiment is evaporating as a crisis at China Evergrande Group ripples through the industry. With prospective buyers already wondering whether cash-strapped builders can deliver their apartments, the risk is that they stay away in droves on fears that real estate is no longer a safe bet.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Hidden Links: US intelligence officials warn companies in critical sectors on China - FT

The National Counterintelligence and Security Center wants to raise awareness about the links that Chinese companies have with the government, military, and intelligence services. The effort is targeted at five sectors: artificial intelligence, quantum computing, biotechnology, semiconductors, and autonomous systems. Michael Orlando, acting director of the NCSC, said Beijing was “using an array of legal, illegal and quasi-legal” methods to obtain intellectual property and data on American citizens that it would use to try to dominate critical industries.

Why it Matters:

American officials have increasingly voiced concerns about China as it closes the gap with the U.S. in industries such as AI, and shows signs of pulling ahead in specific areas there regarding surveillance/facial recognition. Quantum computing is an example of where the US had to ensure American companies were not helping Chinese groups make gains that would help them break the security encryption codes used by US intelligence agencies. The bottom line, China has evolved from an economic rival to a full-out adversary under Xi’s Wolf Warrior pivot, the relationship may cool/improve slightly under Biden, but there will be no increased integration or sharing of critical technologies ever again.

Appendix: Portfolio Results and Macro Themes

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.