MIDDAY MACRO - DAILY COLOR – 10/21/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, as a general consolidation continues over the last two days despite generally positive earnings so far and claims and housing data beating expectations this morning

Treasuries are lower, also trying to consolidate but not yet finding a new range as 5yr yields hit their highest post-pandemic level

WTI is lower, coming off recent highs reached overnight following yesterday’s greater than expected EIA reported inventory draws due to profit-taking by speculators at the NY-open

Analysis:

Equities are generally flat, cooling after impressive recent gains, with 84% of earnings announced so far beating expectations (although still much more to go). Today’s positive UEB claims and housing data countered a more negative Fed Beige Book yesterday (and Philly Fed regional this AM), keeping the overall economic outlook stable. Falling energy costs elsewhere and the possibility for a compromise in D.C. are helping market sentiment generally.

The Nasdaq is outperforming the S&P and Russell with Growth and Low Volatility factors, and Consumer Discretionary, Utilities, and Real Estate sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level higher at 4445 while the Call Wall remains at 4500. The Call Wall will need to rise before markets can meaningfully move higher, and with increased call buying activity, this is what is starting to happen.

The technical levels have support at 4505-10, then 4480, and resistance at 4530, then 4570 for the S&P. The S&P rallied 200 points in a week and now needs to cool, chopping around, and consolidating in a new range before a further move higher can occur.

Treasuries are lower, with the 5s30s curve flatter by 3.2bps as better than expected weekly claims data continued overnight pressure on the belly while the long-end looks to have stronger support at current levels.

*Traders are again increasing their call positions

*Risk reversal metric has registered a -.04, a level last seen in March ’20, suggesting that traders are “extremely” favoring calls over puts

*Inflation is by far the biggest worry on fund managers minds, according to a recent survey by BofA, but there was a notable pick up in concerns regarding China

*Real rates have yet to meaningfully rise even with nominals now near their highs of the year, helping keep financial conditions accommodative

Econ Data:

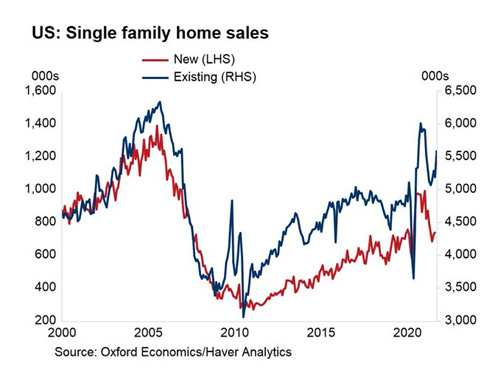

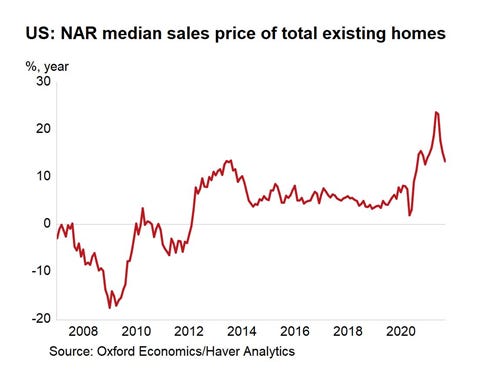

Existing-Home sales increased a robust 7% MoM to 6.29 million units in September, the highest level in 8 months. Each of the four major US regions saw increases in home sales on the month. Inventory of available homes decreased -0.8% on the month. The inventory of unsold homes decreased 13% YoY to 1.27 million, equivalent to 2.4 months at the monthly sales pace. The median existing-home price for all housing types was $352,800, up 13.3% from September 2020. Properties typically remained on the market for 17 days in September, unchanged from August and down from 21 days in September 2020. Eighty-six percent of homes sold in September 2021 were on the market for less than a month. First-time buyers were still disadvantaged by higher prices, while activity by second-home buyers decreased slightly.

Why it Matters: It looks like shortages of labor and materials are at least stabilizing, helping available inventory/supply improve slightly. "Some improvement in supply during prior months helped nudge up sales in September," said Lawrence Yun, NAR's chief economist. "Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year… As mortgage forbearance programs end, and as homebuilders ramp up production - despite the supply-chain material issues - we are likely to see more homes on the market as soon as 2022".

*Improving inventory/supply should help reduce price increases and help affordability moving into 2022

*Median existing-home sales price, although up significantly, is lagging other metrics of home price appreciation

The Philadelphia Fed Manufacturing Index fell to 23.8 in October from 30.7 in September. The New Orders (30.8 vs. 15.9) and Employment (30.7 vs. 26.3) subindexes increased while the Shipments held steady (30). Both Prices Paid (70.3 vs. 67.3) and Prices Received (51.1 vs. 52.9) remained elevated. The Future General Activity subindex rose 4 points to 24.2, indicating a slight improvement in outlook from last month, although expectations for future New Orders and Shipments fell.

Why it Matters: Today’s manufacturing survey aligned somewhat with what we saw in the Philly Fed’s section of the Beige Book yesterday, differing slightly as new orders increased significantly in October’s regional survey. The Beige Book highlighted that the Philadelphia region saw “manufacturing activity continued to grow moderately. However, while net increases of shipments continued, new orders fell further from the prior period’s level. Net backlogs and delivery times continued to increase, but among fewer firms.” In this month’s Philly Fed Survey’s special question, manufacturers were asked about their plans for different categories of capital spending next year. For five out of six categories of investment spending (software, noncomputer equipment, computer equipment, energy-saving investments, and other), the share of firms expecting to increase capital spending was higher than the share of firms expecting to decrease spending.

*The fall in Future Activity expectations finally stopped its drop from summer highs, although the underlying subindexes continue to point to expectations for a supply-side impaired backdrop in six months

*Still no decreases in price increases with both current and future Prices Paid increases outpacing Prices Received

Policy Talk:

Fed Governors Waller and Quarles gave speeches on their economic outlook this week. Both outlooks struck a similar tone, noting the recent slowdown in growth, persistent inflationary pressures, distance to employment goals, but also believing it was time to begin tapering the bond-buying program. “I believe the pace of continued improvement in the labor market will be gradual, and I expect inflation will moderate, which means liftoff is still some time off,” Waller said at the Stanford Institute for Economic Policy Research Associates Meeting. He added that “if my upside risk for inflation comes to pass, with inflation considerably above 2% well into 2022, then I will favor liftoff sooner than I now anticipate.” While giving a speech at the Milken Institute Global Conference, Quarles agreed that current high inflation is “transitory” and that the central bank is not “behind the curve.” He, however, noted that “if those dynamics should lead this “transitory” inflation to continue too long, it could affect the planning of households and businesses and unanchor their inflation expectations. This could spark a wage-price spiral that would not settle down even when the logistical bottlenecks and supply chain kinks have eased.” During a question and answer session, he said that “if we are still seeing 4% inflation or in that area next spring, then I think we might have to reassess the speed with which we would be thinking about raising interest rates.”

Why it Matters: Again, both gave similar remarks that showed a belief that inflation is still transitory and inflation expectations have yet to become unhinged. As a reminder, projections published after September’s FOMC meeting show the committee was evenly split on whether increases in the Fed Funds rate would be warranted (under the current forecast) next year. The fact that both Waller and Quarles (who are on the more middle-hawkish side) are willing to be patient, which we believe echoes most of the committee and Fed leadership community, means the potential for two rate hikes (in September and December) still looks pretty remote us. Of course, recent increases in measures of inflation expectations in household surveys and financial markets need to stabilize and begin to fall into next summer, something we believe is likely given our expected improvements in supply-side disruptions and the longer-term time frame we expect structural inflationary forces need to become problematic.

*Not precisely our current view on members/voters, but BofA’s Dovish/Hawkish spectrum is a helpful way to see what’s coming in regards to voters

The Fed’s October Beige Book highlighted all the known supply-side disruptions that we have covered here in-depth for some time:

“Economic activity grew at a modest to moderate rate, according to the majority of Federal Reserve Districts. Several Districts noted, however, that the pace of growth slowed this period, constrained by supply chain disruptions, labor shortages, and uncertainty around the Delta variant of COVID-19.”

“Outlooks for near-term economic activity remained positive, overall, but some Districts noted increased uncertainty and more cautious optimism than in previous months.”

“demand for workers was high, but labor growth was dampened by a low supply of workers... The majority of Districts reported robust wage growth.”

“Most Districts reported significantly elevated prices, fueled by rising demand for goods and raw materials. Reports of input cost increases were widespread across industry sectors, driven by product scarcity resulting from supply chain bottlenecks. Many firms raised selling prices indicating a greater ability to pass along cost increases to customers amid strong demand.”

Why it Matters: Instead of focusing on the above “problems,” which we all know by now, we want to highlight that the majority of districts saw an increase or at least stable lending activity (although not New York). Loan demand increased or remained strong for residential and credit cards, while auto lending activity was restrained due to lower sales related to falling inventories. Commercial and business lending activities were more mixed, reflecting the drag Delta and supply-side shortages have had on activity and sentiment.

The lending market for commercial real estate stayed highly competitive, driven by banks and institutional investors flush with capital. – Boston

The volume of bank lending (excluding credit cards) held steady during the period; by contrast, loan volume growth was strong – Philadelphia

While business lending remained relatively soft, multiple contacts reported an improvement in demand and a stronger loan pipeline. – Cleveland

Financial institutions indicated a slight increase in demand for commercial real estate and business loans but noted that firms are reluctant to make capital investments due to uncertainty related to the Delta variant and supply chain shortages. – Richmond

Loan demand growth remained solid, pushing up overall loan volumes. - Dallas

“Bankers across the District highlighted that loan competition was reportedly at record highs.” - SF

*Firms should continue to shift away from pandemic fears to continued/growing supply-side disruptions and inflation concerns

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, but little changed today as retail and transport sectors are outperforming due to stronger earnings reports by specific firms there

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, flat today despite new warnings from Beijing’s that they will curb speculation worries steel markets sending China's most-traded futures contracts of coking coal, thermal coal, steel rebar, and glass all limit-down on Thursday.

5yr-30yr Treasury Spread: The curve is steeper on the week but flatter today as the belly makes new post-pandemic lows

EUR/JPY FX Cross: The euro is flat on the week, as the Yen finally recovers some of its recent losses, helped by an improving energy backdrop

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

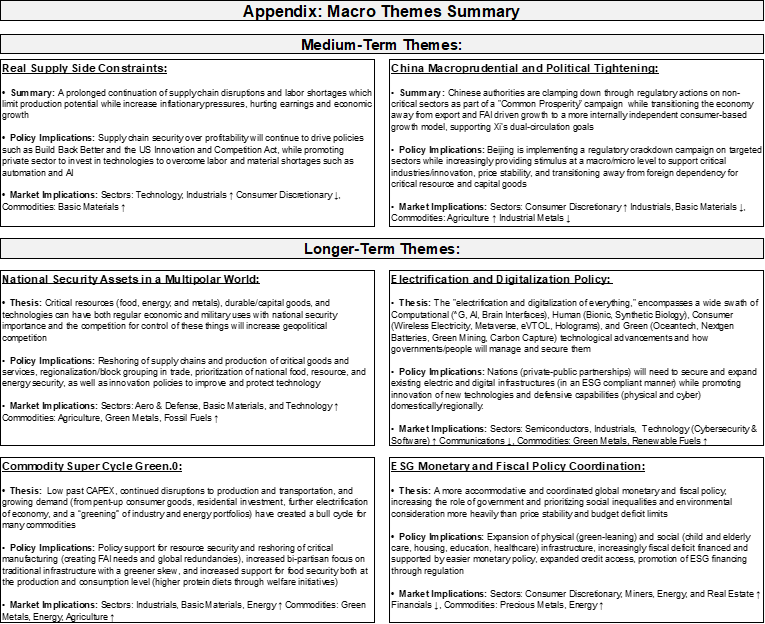

Real Supply-Side Constraints:

Food Inflation: China’s Curbs on Fertilizer Exports to Worsen Global Price Shock - Bloomberg

Chinese authorities are imposing new hurdles for fertilizer exporters amid growing concerns over surging power prices and food production, a move that could worsen a global price shock and food inflation. The new measures implemented by Chinese authorities follow a customs regulation that kicked in on Oct.15, requiring additional inspection of fertilizer exports. The increased scrutiny comes as global fertilizers costs have soared to new records, spurred by energy crises in Europe and China as coal and natural gas are important feedstocks.

Why it Matters:

According to a notice this month, China added new inspection requirements on 29 categories of products, including urea to ammonium nitrate. Despite that, the blistering rally in China’s fertilizer market shows no sign of cooling, with benchmark urea futures holding near a record. China’s move to curb fertilizer exports will be felt worldwide as it is a crucial supplier of urea, sulphate, and phosphate, accounting for about 30% of global trade. The biggest buyers of China’s fertilizers include India, Pakistan, and countries in Southeast Asia.

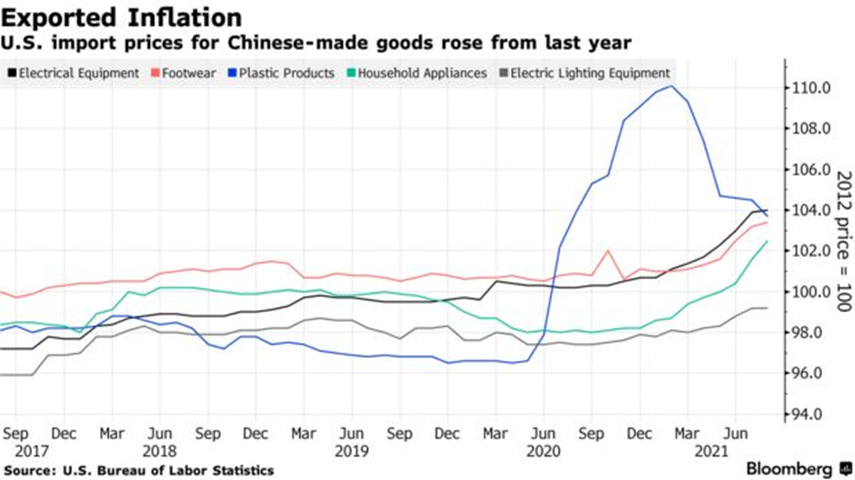

Export Inflation: Double-Digit Price Hikes on China Exports Add to Inflation Risk - Bloomberg

A spike in demand for Chinese exports since the pandemic has led to a backlog of orders lasting well into next year for many firms. As a result, many firms are beginning to raise prices incrementally, something that was recently repeatedly heard at the world’s biggest trade fair in Guangzhou. Hong Kong’s export price index, which serves as a good proxy for China’s export prices because the city’s port mainly handles made-in-China goods, was about 5.6% higher than year-ago levels in July.

Why it Matters:

For years, China’s factories have acted as a brake on global inflation. They cut costs to keep foreign customers amid sluggish demand and increased competition from up-and-coming manufacturing rival nations like Vietnam. But China’s export boom since the pandemic has changed all that, giving manufacturers the confidence to ask foreign customers for more. Price hikes by exporters come on top of record shipping costs, paid mainly by importers rather than manufacturers, which are almost 300% higher than a year ago.

China Macroprudential and Political Tightening:

Reversing Course: China Takes the Brakes Off Coal Production to Tackle Power Shortage – WSJ

China is reversing course on earlier ambitions to curb coal use as it sets new policies to revive production and loosen imports. It has ordered all coal mines to operate at full capacity even during holidays, issued approvals for new mines, and ordered major coal production bases in north and northwestern China to lower prices. Beijing’s push to meet stricter environmental and labor safety targets, stepped up this summer, aggravated the shortage of coal, of which the country consumes half the world’s supply.

Why it Matters:

The National Development and Reform Commission has summoned key coal producers and industry associations to discuss ways to deter price increases. The commission also sent a team to the Zhengzhou Commodity Exchange on Tuesday afternoon to inspect coal-price movements since the start of the year. Beijing often targets unspecified speculators when it wants to cull surging commodity prices. Finally, China ports have unloaded Australian coal, although these have yet to clear customs. The amounts are too small to make much of a difference but may signal the level of desperation Beijing now has (if allowed through customs) in dealing with the current energy crisis.

* China's most-traded thermal coal futures contract in Zhengzhou hit limit-down again in the night session now lower by over -20% from recent highs

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Critical Software: New U.S. Rule Would Limit Sales of Hacking Tools to Russia and China – WSJ

The Commerce Department on Wednesday unveiled export controls intended to curb the sale of hacking tools to countries including China and Russia. The near-final rule from the agency’s Bureau of Industry and Security will require companies to obtain a license to sell hacking technology to certain countries deemed threats to U.S. interests. It will take effect in 90 days.

Why it Matters:

Commerce Secretary Gina Raimondo said the controls aim to balance national security with the expansion of a cybersecurity industry that creates tools to defend computer networks and has grown at a breakneck pace as the global economy becomes increasingly digitized. Under the new rule, U.S. officials will take a tiered approach to regulate “intrusion software” that can help users break into computer networks to monitor them, steal data or disrupt systems.

Electrification and Digitalization Policy:

Compromise: U.S. Closes In on Deal This Week to Halt Europe’s Digital Taxes – Bloomberg

The deal to reach an agreement over digital taxes will include the U.S., U.K., France, Italy, Spain, and Austria, with the European countries pledging to withdraw so-called digital services taxes when a broader international pact on corporate taxation comes into force between now and 2023. In exchange for abolishing their national digital taxes in the future, European governments expect the U.S. to drop the threat of retaliatory tariffs.

Why it Matters:

The breakthrough would end more than two years of a transatlantic confrontation that overshadowed negotiations on how to share the rights to tax the world’s largest companies. Both sides have at times used the digital taxes and related tariffs to leverage the global multilateral talks, which produced an agreement earlier in October. It’s unclear exactly when and how the taxes will be withdrawn, although countries including France have said they will only give up their DST once the OECD deal is fully implemented.

A network of digital spies with a nexus to Chinese interests has successfully compromised parts of the global telecommunications network, in some cases allowing access to subscriber information, call metadata, text messages, and other data, according to research released Tuesday by CrowdStrike. The hacking group, dubbed “LightBasin,” has targeted the telecommunications sector since at least 2016, investigators found. New research has identified 13 telecommunications companies as having been compromised by the network dating back to 2019.

Why it Matters:

The report lays out how this group has developed highly customized tools and precise working knowledge of global telecommunications network architectures such that it can emulate network protocols to allow scanning and “to retrieve highly specific information from mobile communication infrastructure.” The nature of the data targeted aligns with information likely to be of significant interest to foreign government intelligence operations, in line with other expected activities the Chinese government and its adjacent hackers have already done.

Commodity Super Cycle Green.0:

Out Door Dining?: U.S. Propane Market Headed for ‘Armageddon’ This Winter, IHS Says - Bloomberg

U.S. propane prices are so high and supplies so scarce that the market appears headed for “armageddon” during the depths of winter, according to research firm IHS Markit Ltd. Prices for the first quarter of 2022 are far above later-dated supplies and indicate an extreme mismatch between demand and supply is coming this winter. Some regions may face outright shortages before the end of winter.

Why it Matters:

U.S. propane prices have almost doubled this year and are on course for the strongest rally since 2009. According to DTN Energy, North American propane touched a 7 year high of more than $1.50 a gallon earlier this month. Restaurants and outdoor venues hoping to capitalize on exposed space may need to rethink their ability to heat that area as price increases limit profitability.

ESG Monetary and Fiscal Policy Expansion:

Where are We? Sinema’s Opposition Stymies Democrats’ Planned Tax-Rate Increases – WSJ

Senate Democrats are considering abandoning central funding elements of their social-policy and climate package, now expected to cost around $2 trillion over a decade, as Sen. Kyrsten Sinema continues to oppose raising the top corporate tax rate, income-tax rate, or capital-gains-tax rate. This may drive Democrats to seek alternative increases. Other planks of President Biden’s tax agenda, including a tighter net on U.S. companies’ foreign earnings and enhanced enforcement, are still on the table. Democrats are also struggling to fill the void created by Senator Joe Manchin’s opposition to key parts of the climate program, with hopes fading that Congress will reach an agreement on climate legislation before world leaders gather in Scotland for a summit on global warming.

Why it Matters:

As talks on cutting the package’s cost continue, lawmakers said Mr. Biden indicated the two years of tuition-free community college would likely go, but universal prekindergarten will stay. Expanding Medicare to include dental, vision, and hearing benefits remains a sticking point. Stepping back, as we suspected from day one, a deal will eventually get done. It will be much smaller and likely pave the way for the physical infrastructure plan to finally pass the House. The bottom line, fewer “pay fors” and much of the core hard and social infrastructure improvements (as pre-K, Medicare expansion, and general hard infrastructure improvements) will improve labor availability/productivity and marginally increase consumer activity/confidence while not creating a drag on financial assets from lower investor sentiment due to higher taxes.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.