MIDDAY MACRO - DAILY COLOR – 10/19/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, with yesterday’s more positive price action continuing overnight as large-cap growth continues to outperform due to earnings reports increasingly highlighting the known logistical/cost challenges

Treasuries are lower, with the curve giving back yesterday’s flattening as pressure on rates in Europe began to weigh on long-end sentiment overnight

WTI is higher, bouncing around in a $2 range since hitting recent highs yesterday as analysts continue to pontificate on how supply and demand fundamentals and winter weather will affect future price levels

Analysis:

U.S. Equities are higher as earnings season gets underway in earnest, further clarifying profit margin pressures and outlook. At the same time, housing starts/permits came in significantly weaker than expected, highlighting the known supply-side disruptions and renewing inflation/growth concerns, helped by continued global energy shortages overseas, all of which are weighing on Treasuries, reversing the recent flattening of the curve.

The S&P is outperforming the Nasdaq and Russell with Value, High Dividend Yield, and Growth factors, and Health Care, Utilities, and Financials sectors are all outperforming.

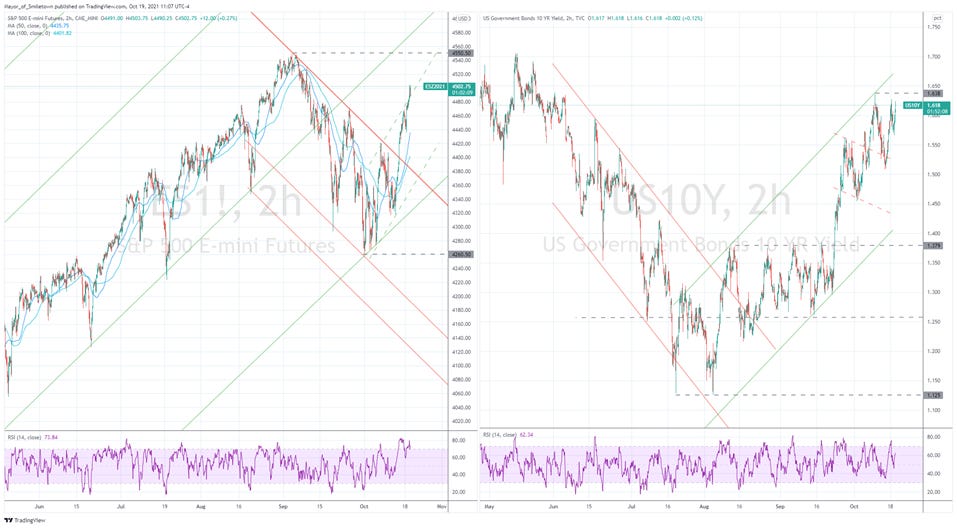

S&P optionality strike levels have the zero-gamma level moving higher to 4413 while the call wall remains at 4500. Resistance is now around the current 4500 area, which will likely be sticky for a few sessions, potentially allowing gamma to build around current levels, which in turn should decrease realized volatility, further supporting market levels.

The technical levels have support at 4475, then 4455, and resistance at 4510-15 for the S&P. Daily RSI continues to be elevated, but the trend supports a break out to new all-time highs following a more tactical consolidation/flag formation period.

Treasuries are mixed, with the belly better bid and 10yr yields again over 1.60% as the 5s30s curve is steeper by 5.1 bps. Corporate debt supply is increasingly picking up as financials come out of earnings blackout, increasing hedging activity.

*BofA’s Global Fund Manager survey reported a 4.7% increase in cash holdings in October

*A stock positioning sentiment indicator by GS also fell sharply, indicating that a reversal in sentiment along with cash re-entering the market could support the current rally further

The bond market is currently reflecting concerns over future growth and central bank policy error, with the worry being that now persistent inflationary pressure will force a faster/stronger tightening cycle. We caution that markets may be at peak inflationary fears while overly discounting future growth potentials and the growing dovish tilt major central banks have developed.

A flattening Treasury curve (which is not reflecting a greater term premium) during a period of rising breakeven rates indicates a fear that the Fed will hike too fast, choking off growth and creating a more deflationary environment further down the road.

Instead, we believe the major central banks will continue to expand their mandates, something already clearly underway with developments like average inflation targetting coupled with maximum employment objectives, increasingly taking on social and environmental issues and use growing levels of forward guidance to execute policy objectives while maintaining views that r* will not meaningfully rise due to the structural backdrop and headwinds (demographics, technology, and globalization).

*FOMC participants' assumptions about the appropriate federal funds rate level in the longer run (r*) were added to the SEP for the first time on 1/25/2012, and they have only decreased over time since then.

And although we do not advise putting a curve steepener trade on currently (do not catch a falling knife), we caution against the view that there will be an overly hawkish response to the current persistent inflationary pulse (hurting future growth and eventually being seen as a policy error) both from the Fed and more generally globally given the cultural changes that major central banks are undergoing and our belief that cyclical inflationary forces will subside next year while structural increases will take longer to become problematic and are more multi-faceted.

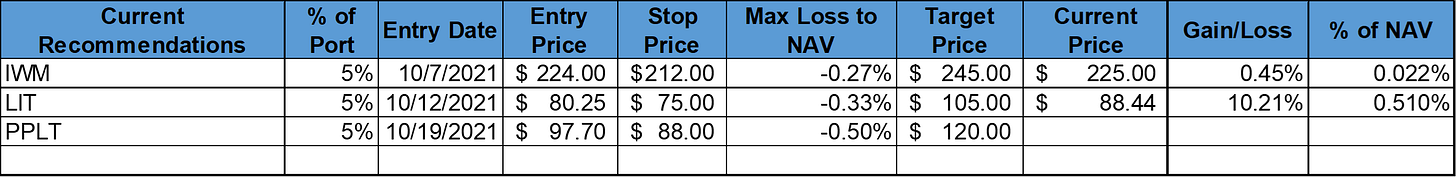

Last week we recommended a lithium/battery ETF position (+10% since then), and in keeping with our growing electrification and digitalization theme, we are adding a long position in platinum to our portfolio today as it will play an increasingly significant role in advanced electronics, transportation systems, and energy storage.

Platinum (and the PGM family more generally) has strong electrical conductivity, outstanding catalytic capabilities, and resistance to corrosion, making it ideal for use in catalytic converters, a device used to remove harmful emissions from automobile exhaust, something governments are increasingly mandating for automakers.

*Although EV sales are growing, the vast majority of the world still uses traditional vehicles, which are increasingly being regulated to have fewer emissions

However, demand for platinum will increasingly come from uses elsewhere. For example, it is needed in hydrogen fuel cells, a market expected to significantly grow globally, driven by a rising focus on alternative energy sources, efforts to de-carbonize energy usage, adoption of hydrogen in transportation, all promoted by increasing government regulations and fiscal incentives.

*PGMs are going to be increasingly used to unlock green hydrogen in both stationary power generation and transport

*The global market for Fuel Cells was estimated at $7.6 Billion in 2020 and projected to reach around $20 Billion by 2026, growing at a CAGR of 17.9% over that period

*Increasing numbers of future hydrogen projects are being announced, and this is before the current energy shortages in Europe, China, and India.

The platinum market is forecast to remain in deficit for the third year in a row, with the shortfall expected to deepen according to the World Platinum Investment Council. The majority of supply currently comes from just two sources, South Africa and global recycling efforts.

Platinum should also see increasing demand due to uses in other industrial processes, jewelry, and for investment purposes, all things we believe the global reopening and continued inflationary fears will support.

As a result of the above points, we are adding a 5% position in the Aberdeen Platinum ETF (ticker = $PPLT) with an entry-level of $97.70, a target of $120, and a stop of $88. As always, do your own research on our highlighted points, but we believe over the long run, platinum prices should appreciate due to the trends we identified.

*platinum has broken out of its 2021 downtrend and is now attempting to form a new up channel

Econ Data:

Housing starts decreased by -1.6% MoM SA annual rate of 1.555 million in September, compared to market forecasts of 1.62 million. It is the lowest reading in five months as shortages of materials and labor again disrupted production capacity. Single-family housing starts were virtually unchanged from August, while the multi-family segment dropped -5.1%. Sales declined in the Northeast (-27.3%) and the South (-6.3) but rose in the Midwest (6.9%) and the West (19.3%). Building permits dropped -7.7% MoM SA, the lowest level in a year and well below market expectations. The volatile multi-segment tumbled -18.3%, while single-family authorizations declined only -0.9%. Permits were down in the South (-6%), West (-10.9%), and Northeast (-20%). Permits in the Midwest, however, were 0.5% higher.

Why it Matters: A very uneven report with little change in single-family unit starts and permits. At the same time, the more volatile multi-family saw significant declines in both starts and permits. Of course, multi-family had a larger run-up in production/supply over the summer. There were also considerable differences between the four regions, showing that labor shortages increasingly vary across the nation. However, as we highlighted yesterday, the builder outlook improved in yesterday's NAHB survey, and we continue to believe that there should be an improvement in material and labor shortages. Demand will likely stay strong for some time, and we have yet to see troubling signs of excess inorganic demand creation (lowering credit score levels for mortgages), while inventories are still historically low, all of which should keep the housing market as a positive contributor to growth.

*Both starts and permits missed expectations by a wide margin (especially permits)

*Multi-family has been giving back gains after an impressive run in the first half of 2021

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, with the trend continuing today as the ratio has nicely bounced off the bottom of its channel and resumed its post 1st qtr longer-term up-trend

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, slightly higher today, with China’s National Bureau of Statistics issuing figures showing steel production falling to a four-year low in September. Elsewhere coal prices/futures have climbed 110% since September 1, with physical coal “to deliver” much higher, making the steel production costs and demand for iron ore unclear until energy costs stabilize

5yr-30yr Treasury Spread: The curve is steeper on the week, as yesterdays big drop is reversing today as the belly is currently positive on the day

EUR/JPY FX Cross: The euro is higher on the week, again higher today by 0.21%, with no signs that a new range has yet been established

HOUSE THEMES / ARTICLES

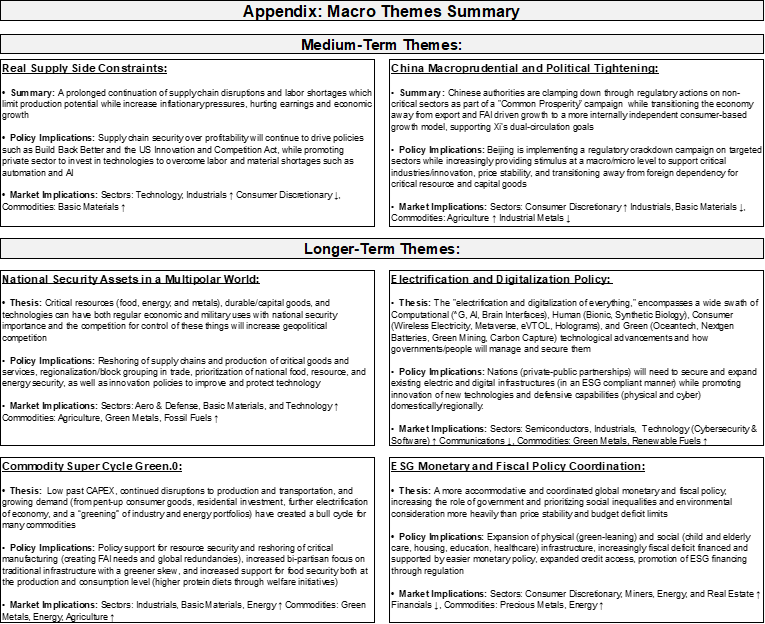

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Head Honcho: China’s Xi Flexes Power With Plan to Rewrite Communist Party History – WSJ

At a closed-door conclave in Beijing next month, Mr. Xi and other senior officials will review a draft resolution that lays out an authoritative accounting of the party’s “major achievements and historical experiences” since its founding 100 years ago. The resolution would be the third such document enacted by the party, putting Mr. Xi on a par with Mao Zedong and Deng Xiaoping as leaders who commanded the preponderant authority needed to reinterpret modern Chinese history formally.

Why it Matters:

Historians say Mao and Deng’s resolutions on history, adopted in 1945 and 1981 respectively, were aimed at consolidating control over the party by excoriating dissenting views and enshrining their own ideological perspectives as party canon. The resolution’s passage, which observers say is a formality, would signify Mr. Xi’s strong hold over the party even as China struggles to shore up an economy buffeted by power shortfalls, supply-chain disruptions, and Beijing’s crackdown on the technology, private education, and real-estate sectors. The bottom line, Xi has used this year to consolidate power further and bolster his image as “champion of the people,” a message that the nation and world have fully received. Although we have yet to see it meaningfully, we believe Xi will eventually pivot back to a growth-focused model next year, prioritizing China’s economic growth in an effort to overtake the West and further his Dual Circulation goals.

LONGER-TERM THEMES:

Electrification and Digitalization Policy:

Player One: Facebook to Hire 10,000 Workers in EU to Build Up ‘Metaverse’ – WSJ

Facebook said Sunday it would embark on a recruiting drive for highly skilled workers in the region to help build a “metaverse,” an online realm where users engage with one another using technologies including virtual and augmented reality. The company said it would focus on hiring in Germany, France, Italy, Spain, Poland, the Netherlands, and Ireland.

Why it Matters:

Mark Zuckerberg laid out his vision for the metaverse over the summer, describing it as a successor to the mobile internet that would significantly drive new technology investment. The company last month unveiled plans to invest $50 million to build the virtual space, noting that parts of it could take 10 to 15 years to develop fully. Facebook is under increased regulatory scrutiny on both sides of the Atlantic, so employing ten thousand EU citizens certainly helps gain leverage against any overly burdensome regulatory changes. As for the Metaverse, we are increasingly thankful to have grown up in the 80s and 90s.

ESG Monetary and Fiscal Policy Expansion:

No Money for You: EU to Use Rule-of-Law Tool ‘in Days’ With Poland on Defense – Bloomberg

The European Union may trigger a new tool as soon as this week that allows it to withhold budget payments to member states that fail to adhere to the bloc’s democratic standards. The EU has been hinting for a while it may soon trigger the conditionality mechanism, which withholds payments from the budget -- as well as its 750 billion-euro ($870 billion) pandemic recovery package -- to member states accused of democratic backsliding. Hungary and Poland are challenging the conditionality mechanism in the EU’s top court.

Why it Matters:

The conditionality mechanism is just one tool in the EU’s toolbox. The commission has already withheld approval of Poland’s and Hungary’s recovery plans, which is needed to unlock stimulus funds worth €36 billion for Poland and €7.2 billion for Hungary. Polish Prime Minister Morawiecki will speak to EU lawmakers in the European Parliament about the latest developments today, which will be closely watched as the EU struggles to reign in more right-wing governments in their bloc.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.