MIDDAY MACRO - DAILY COLOR – 10/18/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with the Nasdaq/growth outperforming following weaker economic data out of China last night and a decline in the U.S. Industrial Production data this morning

Treasuries are also mixed, as a weaker global growth outlook continues to flatten the curve, although overnight declines (in the belly to 10s) stabilized pre-NY-open on the weaker IP data.

WTI is lower, falling from new recent highs reached overnight post-NY-open despite OPEC+ compliance with oil cuts falling slightly and outlook by IEA on their spare capacity in 2022 dropping significantly

Analysis:

U.S. Equities are pushing higher following a weaker overnight session due to China’s GDP, FAI, and IP data all coming in significantly below expectations, but the notable miss in U.S. Industrial Production had more of a one-off feel (from Hurricane Ida), which, when coupled with a better outlook from homebuilders, helped improve the domestic backdrop/sentiment. Falling oil and a flat dollar are also helping reduce financial conditions tightening fears on the margin. Treasuries continue their impressive curve flattening move, with the 30yr yield looking (technically) poised to fall further.

The Nasdaq is outperforming the S&P and Russell with Momentum, Growth, and Small-Cap factors, and Consumer Discretionary, Communications, and Energy sectors are all outperforming.

S&P optionality strike levels have the zero-gamma level higher to 4411 while the call wall is still 4500. As expected, gamma was significantly reduced by Friday’s OPEX, but still remains strongly positive. With the Call Wall at 4500 and the S&P currently in the 4470 area, the level of positive gamma should support a further melt-up.

The technical levels have support at 4460, then 4430 (50-dma area), and resistance at 4520 for the S&P. The 4515-20 area remains the immediate upside target but daily RSI(5) is currently above Sept highs. A basing/corrective day may be needed before a push higher.

Treasuries are mixed, with significant duration demand further out the curve, again flattening the 5s30s curve, which is down 5.4 bps today, now approaching its yearly downtrend channel resistance level. The 30yr yield looks to be forming a head and shoulder formation, now on the neckline.

*There was a slight pullback in net exposure from the buy-side community in August/September, but exposure increased recently and generally remains high

*Value and Quality continue to be favored over the next year in a recent Scotiabank PM client survey

Econ Data:

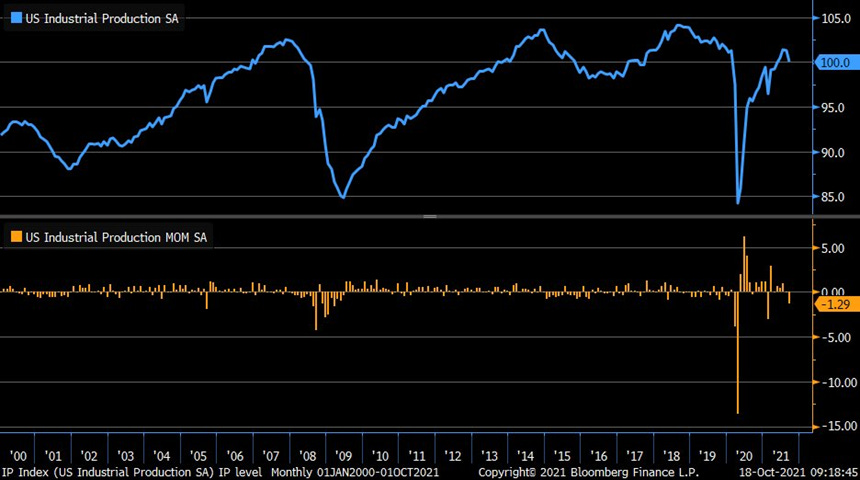

Industrial production in the United States decreased by -1.3% MoM in September, following a revised -0.1% contraction in August (previously +0.4%) and missing market expectations for an increase of 0.2%. Despite the decrease in September, total industrial production rose 4.3% at an annual rate for the third quarter as a whole, its fifth consecutive quarter with a gain of at least 4%. The Federal Reserve, which produces the data, credited the impact of Hurricane Ida for a -0.6% drag on the headline number. Manufacturing output decreased -0.7%, as the production of motor vehicles and parts slumped -7.2% due to shortages of semiconductors while factory output elsewhere declined -0.3%. Utility output declined -3.6% due to warmer-than-expected weather. Finally, mining production was down -2.3%.

Why it Matters: September's weakness in production came from significant decreases in consumer goods and materials. The index for consumer goods fell -1.9%, with large declines in durables, particularly automotive and consumer energy products. Likewise, the index for materials dropped -1.7% as both chemical and energy producers posted decreases of more than -3% due to prolonged hurricane-related outages for production near the Gulf of Mexico. The lingering effects of Hurricane Ida also accounted for the drop in mining (offshore oil and gas production) in September. The bottom line, there was undoubtedly supply-side disruption affecting production, but outside motor vehicles and parts, durables moved up 0.5% with gains over 1% in many sub-categories. This leads us to believe that Hurricane Ida and chip shortages were mainly responsible for the weaker than expected print, but there were no deeper warning signs here.

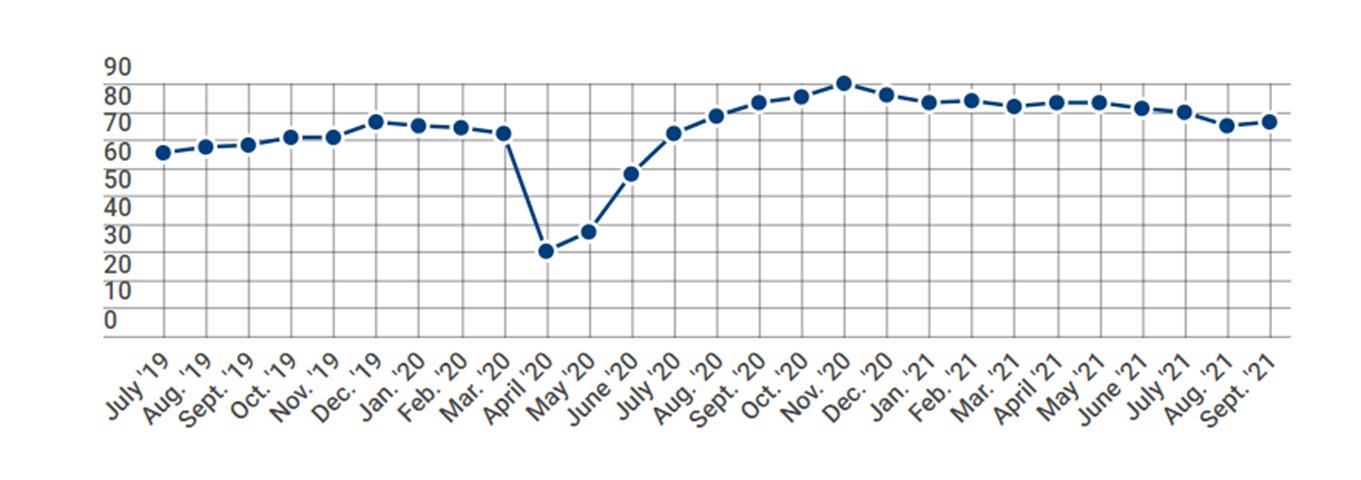

The NAHB Housing Market Index rose four points from a month earlier to 80 in October, the largest monthly increase since last November and easily beating market expectations of 76. The current single-family sub-index increased to 87 from 82, while home sales over the next six months sub-index was up to 84 from 81. The gauge for prospective buyers advanced to 65 from 61.

Why it Matters: Very positive report given worries over sentiment across consumers and firms more generally. Housing remains an essential contributor currently to the overall growth picture and a good gauge on whether supply-side disruptions are stabilizing. For builder confidence to have improved so significantly in October, shortages of materials and labor are stabilizing/improving while demand continues to be strong. Finally, the improvement in all three sub-categories (Single Family Sales Present, Next 6-Months, and Traffic of Prospective Buyers) kicks off a week of additional housing data on a positive note.

*NAHB Housing Market Index edged up to 80 in October due to broad gains

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is higher on the week, outperforming today following the weaker Chinese data

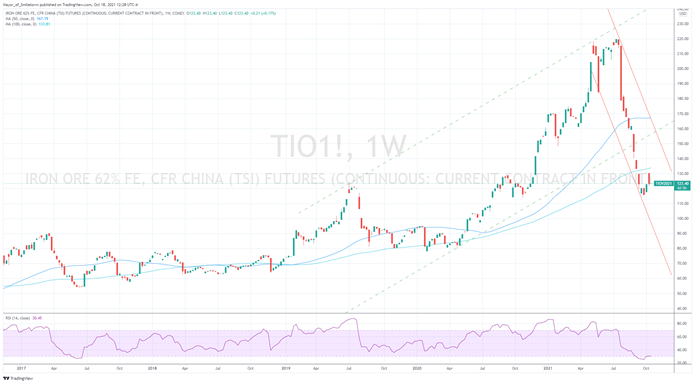

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, as GDP, FAI,and Industrial Output all came in weaker than expected while Coal futures on the Zhengzhou Commodity Exchange increased over 10%, all signaling growth troubles ahead

5yr-30yr Treasury Spread: The curve is flatter on the week, quickly approaching the bottom of its yearly down-channel as a perfect storm of Fed tightening and weaker global growth is developing

EUR/JPY FX Cross: The euro is higher on the week, as the Yen has yet to see any meaningful retracement from recent weakness as higher commodity prices and political change are causing traders to move the cross into a new range

HOUSE THEMES / ARTICLES

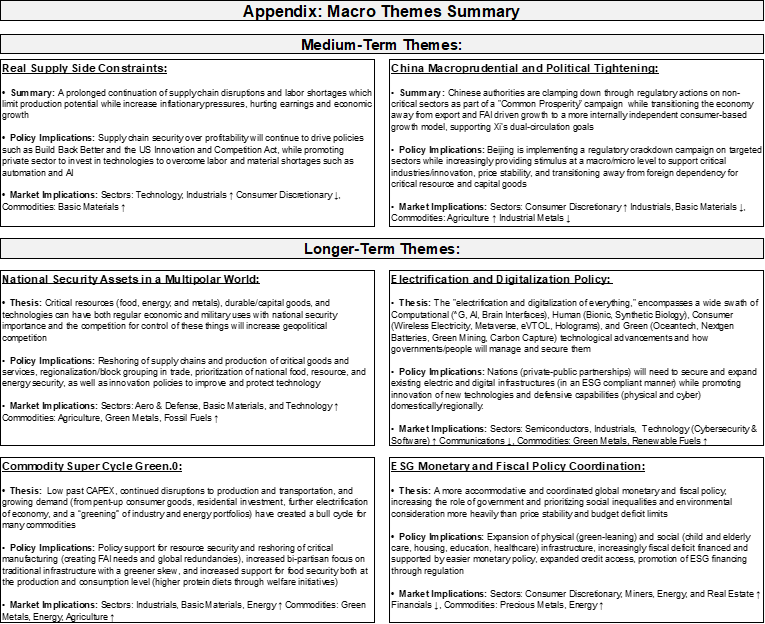

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Core Theme: Just-in-Time Economy Becoming a Problem for Europe, Lagarde Says – Bloomberg

European Central Bank President Christine Lagarde warned that the globalized nature of the euro area’s economy makes it highly vulnerable to systemic shocks from supply chain disruptions. Bottlenecks affect the “euro area more than other economies by virtue of our exposure to globalization,” she said. The just-in-time inventory management that has ruled global trade for decades is “highly vulnerable to systemic shocks,” Lagarde said. The current dynamics of international trade may shift as more firms end up holding permanently higher inventories as an insurance policy against disruptions.

Why it Matters:

The core of the “Real Supply-Side Constraints” theme is security, whether it is the security of materials or labor. Lagarde high-level critique of the weakness in the current global supply chain situation, something that is increasingly become a problem for policymakers, continues to encourage our view that (over many years) we will see an increased regionalization and reshoring of production, likely creating global manufacturing redundancy that will first be inflationary from the initial CAPEX/FAI activities but ultimately deflationary. We have a far way to go but want to step back and link Lagarde’s comments to our long-term views.

China Macroprudential and Political Tightening:

Trending Lower: China’s Third-Quarter Economic Growth Slows Sharply to 4.9% - WSJ

China’s economy grew 4.9% in the third quarter from a year earlier, slowing sharply from the previous quarter’s 7.9% growth rate, as lock-downs, power shortages, and supply-chain problems added to the impact of Beijing’s efforts to rein in the real estate and technology sectors. FAI, IP, were also were weaker than expected with the UER and Retail Sales holding steady. The question now is whether Beijing’s campaign to impose greater discipline on its economy, as well as surging commodity costs and continued coronavirus-related distortions to the global economy, will take a larger-than-expected toll and force policymakers to re-emphasize growth.

Why it Matters:

There can’t be a meaningful rally in global risk assets if China’s growth is significantly falling. Despite the third-quarter slowdown, economists are generally confident that the Chinese economy will be able to make senior leaders’ annual GDP growth target of 6% or more, which was set in March. We, however, believe 4th quarter growth will again be weaker than expected, or at least actual activity will be lower than what the official target/number implies. This is assuming Beijing doesn’t become meaningfully more supportive, and continued uncertainties regarding the current power shortages and property sector weigh on business and consumer activity/sentiment. As we said numerous times here, Xi still seems willing to take the pain, but maybe this changes.

Stay Calm, Carry On: PBOC’s Yi Says China Can ‘Contain’ the Risk From Evergrande – Bloomberg

PBOC Governor Yi said Evergrande’s liabilities were spread across “hundreds” of entities in the financial system so that there is “not much concentration.” “The rights and interests of creditors and shareholders will be fully respected in strict accordance with the law. And also, the law has clearly indicated the seniority of those liabilities,” he said. Beijing is also trying to protect consumers and homebuyers, he added.

Why it Matters:

Following significant weaker growth data out of China Sunday (although not higher unemployment), we increasingly wonder how much pain Xi is willing to keep taking to achieve his political goals? With the CCP meeting for its Sixth Plenary session in November, we are expecting some easing in both the “Common Prosperity” campaign as well as commitments to carbon targets. We view recent comments by the PBOC as a slight dovish tilt towards further policy support but again need to see rhetoric shifting at the highest level from the one man who matters in order to gain confidence that growth will bottom in the 4th quarter.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

East and West: Nato to expand focus to counter rising China - FT

Countering the security threat from the rise of China will be an essential part of Nato’s future rationale, the alliance’s chief has said, marking a significant rethink of the western alliance’s objectives. The military alliance has spent decades focused on countering Russia and, since 2001, terrorism. The new focus on China comes amid a determined shift in the US’s geopolitical orientation away from Europe to a hegemonic conflict with Beijing.

Why it Matters:

Nato will adopt its new Strategic Concept at a summit next summer, which will outline the alliance’s purpose for the following ten years. The current version, adopted in 2010, does not mention China. “China is coming closer to us . . . We see them in the Arctic. We see them in cyberspace. We see them investing heavily in critical infrastructure in our countries,” Nato secretary-general Jens Stoltenberg said. We highlight this as a reminder that defensive alliances are national security assets, and this shift by Nato is a notable shift from its original purpose.

Electrification and Digitalization Policy:

Further to Go: Why Artificial Intelligence Isn’t Intelligent – WSJ

AI has fallen short of many of the promises made by some of its most vocal advocates—from the disappointment of IBM’s Watson to the forever-moving target date for the arrival of fully self-driving vehicles. This hasn’t stopped the money from pouring in. Globally, $37.9 billion has been invested in AI startups in 2021 so far, on pace to roughly double last year’s amount, according to data from PitchBook. And there have also been a number of exits for investors in companies that use and develop AI, with $14.4 billion in deals for companies that either went public or were acquired.

Why it Matters:

Recent shortfallings by Facebook to use AI to moderate hate speech have brought the “abilities” of AI back into question. Whenever computers accomplish things that are hard for humans (like being the best chess or Go player in the world), it’s easy to get the impression that we’ve “solved” intelligence. But all we’ve demonstrated is that in general, things that are hard for humans are easy for computers, and vice versa. As a result, we continue to believe the over-reliance on AI to police humans will fall short, and despite growing computer power and AI development, we still have some ways to go.

Voice Recognition?: Fraudsters Cloned Company Director’s Voice In $35 Million Bank Heist, Police Find - Forbes

AI voice cloning the director of a company was used to fool a bank manager in the U.A.E. to release funds for “an upcoming acquisition, sending instruction emails from a fake law firm as well. The bank manager, who personally knew the other companies director, believed everything was legitimate and ended up making the transfers, according to Dubai investigators. This type of fraud could grow in use as cybercriminals increasingly have access to this new type of technology.

Why it Matters:

It’s only the second known case of fraudsters allegedly using voice-shaping tools to carry out a heist. “Audio and visual deep fakes represent the fascinating development of 21st-century technology, yet they are also potentially incredibly dangerous posing a huge threat to data, money, and businesses,” says Jake Moore, a cybersecurity expert at security company ESET.

Commodity Super Cycle Green.0:

Canceled: Malaysia’s Petronas requests more LNG cancellations – Argus

Malaysia's state-owned Petronas has asked more off-takers from its 30mn t/yr Bintulu LNG export complex to cancel cargoes meant for delivery in the first quarter of next year on the back of continuing upstream issues at the Pegaga gas field offshore Malaysia. This has renewed concerns about supply availability during the northern hemisphere's peak winter demand season, which typically runs from the end of October to the following March.

Why it Matters:

The impact of the delays and cancellations to the November-January cargoes was minimal, with many of the affected offtakers being Japanese buyers that had earlier already secured winter cargoes and had sufficient stocks to tide them over. But the impact of the additional cancellations that extend until next year's first quarter could be more severe, with the region poised to experience a colder than usual winter. This means that affected term buyers will likely need to seek replacement cargoes from the spot market to meet their downstream requirements, potentially putting further upward pressure on prices this winter (for China, SK, and Japan).

ESG Monetary and Fiscal Policy Expansion:

Trillions: To Strike a Climate Deal, Poor Nations Say They Need Trillions From Rich Ones – WSJ

Without poorer countries on board, the world stands little chance of preventing catastrophic climate change, say many climate scientists. Emissions in the U.S. and Europe are falling as both regions push to adopt renewable energy and phase out coal-fired electricity. But emissions in the developing world are expected to rise sharply in the coming decades as billions rise out of poverty unless those economies can shift onto a lower-carbon path. The article gives an overview of the ongoing debate on how to subsidize the needed innovations/realignments developing countries need to become more carbon neutral.

Why it Matters:

Western officials say the Glasgow negotiations need to focus first on raising enough money to meet the Paris goal. That sum is expected to be too large to pay from the government budgets of rich nations alone, officials say. Instead, they are counting on private investors to pick up most of the bill. Stepping back, the politics of climate change are increasingly becoming a place for developed nations to share technologies and gain soft power over developing ones. It’s also proving to be a further contention area between the West and China (who refuses to be classified as developed).

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.