MIDDAY MACRO - DAILY COLOR – 12/16/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, with yesterday’s rally notably reversing, dropping the Nasdaq back to near pre-FOMC levels as a steeper curve has cyclical sectors outperforming

Treasuries are higher, with the FOMC results helping the belly outperform as traders took comfort in the more inflationary focused policy pivot but still doubt the long-run fed funds target will ever be reached

WTI is higher, as a post-FOMC rally is continuing despite the more risk-off tone in equities and growing/continued Covid concerns/restrictions

Narrative Analysis:

Equities could not maintain yesterday’s post-FOMC momentum after the S&P reached all-time-highs overnight with the BoE surprising markets with a rate hike, while the ECB gave a more neutral message, which markets saw to be more hawkish for them. The generally positive domestic data failed to reverse the post-BoE selling, especially in tech, as more cyclical orientated names are outperforming on the day. The significant steepening of the Treasury curve post-FOMC is adding pressure to growth/tech-orientated sectors while the dollar has fallen to its pre-FOMC level.

The S&P is outperforming the Russell and Nasdaq with High Dividend Yield, Value, and Low Volatility factors, and Energy, Financials, and Materials sectors are all outperforming.

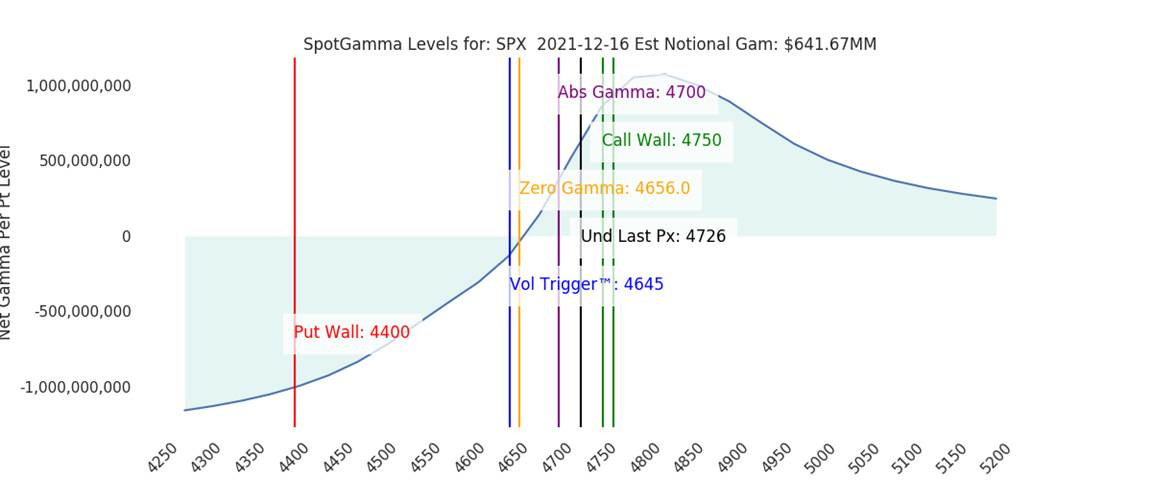

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4656 while the Call Wall is at 4750. Positive gamma from yesterday’s rally is now bleeding off given the loss of ATHs and the S&P now increasingly falling below 4700. Tomorrow will see a lot of optionality expiration (significant puts) which will open up trading ranges next week.

S&P technical levels have support at 4685, then 4665-70, and resistance is at 4720, then 4775. Markets are certainly cooling off after yesterday’s rally with RSI(4hr) now neutral. The S&P needs to hold around current levels, or pre-FOMC levels will likely be tested again with price action made worse closer to 4600 by tomorrow’s OPEX.

Treasuries are higher, as yesterday’s FOMC meeting is steepening the curve notably as markets question the ability of the Fed to reach rate targets in the next few years. The 5s30s curve is higher by 7bps, moving to 68bps.

The Fed successfully pivoted to a significantly more hawkish stance yesterday, focused now on the risk-management of inflation while giving a more mixed message on how close they are to achieving “maximum employment”. In the end, the passage of the risk event and faster-tightening path in 2022 but not further out gave markets one less thing to worry about at least until the spring, when quantitative tightening plans will be finalized, and rate hikes could begin.

The committee got spooked by the growth of inflation since September’s FOMC meeting with Powell shifting focus from supply-side induced longer-lasting price pressure to more wage-spiral thoughts by highlighting the tightness of markets and increases in the employment cost index. He went to great lengths to tell us the current inflationary forces are not yet wage induced but indicated this was a growing concern.

“So far, we don’t see—wages are not a big part of the high inflation story that we’re seeing…”

“This inflation has really nothing to do with tightness in the labor market...”

“Would be worried if real wages were above productivity growth…”

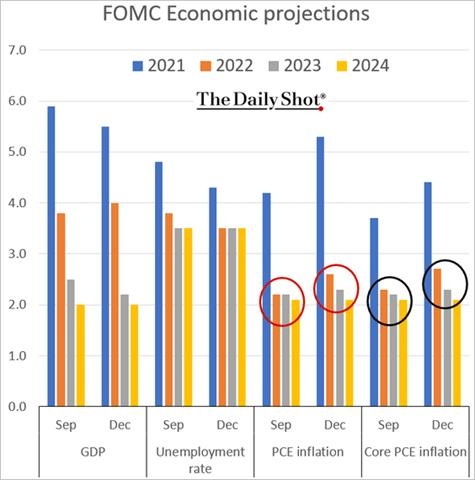

*The Fed retired “transitory” and declared victory in achieving AIT

Interestingly, the only part of the Summary of Economic Projections (SEPs) that didn’t make much sense (again) was the unemployment rate forecast which bottoms at 3.5% next year and then stays at that level till 2024 despite declining growth and fed funds rising towards the longer-run expected levels over the same period. Coupled with the mixed message Powell gave on labor markets being tight but labor-force participation “remaining subdued” due to structural changes and pandemic reasons, it leaves some uncertainty on where their views are on “maximum employment” and ultimately whether raising rates (to r*) or quantitative tightening (QT) will be the primary tool further out.

*FOMC increased inflation expectation but left UER projection little changed, showing policymakers see a disconnect in the traditional relationship between the two

Powell indicated that FOMC had not decided how long it plans to wait between the end of purchases and first-rate hike, but they did talk about it while also having the first discussion on the balance sheet reduction or QT. With Delta/Omicron clouding the outlook, it is no surprise the Fed will be patient in telegraphing intentions here, and Powell stressed that the now close to 4 rate hike projection in the SEPs for ‘22 is not a set path despite being highly optimistic on the economy and repeatedly noting that past experiences are not very applicable currently.

“I don’t foresee that there would be that kind of very extended wait at this time. The economy is much stronger.”

“We’ll make this decision in coming meetings, and it’s not a decision that the committee has really focused on yet.”

“We’ll have another at the next meeting and another at the meeting after that.”

*The tightening of the balance sheet will be the ultimate ender of the bull market but where the ultimate BS* level will be is still highly uncertain

The market still believes the Fed will be unable to meet their ultimate fed funds rate target level, which is why price action following the announcement saw the belly of the curve outperform while breakevens rose. In the end, the SEPs projected the most hawkish version of 2022 while giving us fewer rate hikes than feared for ’23 and ’24, which explains the rally in equities. If the virus worsens and growth slows or if inflationary pressures decrease due to improvement in supply-side impairments, projections/actions moving forward will only become more dovish than what is currently expected. At the same time, there is a much higher bar for the Fed to get more hawkish.

*Market is still capping fed funds at 1.5% verse the Fed’s long-run projection of 2.5%

When we step back and look at the current macro picture, there is certainly the potential for a year-end rally on more technical/optionality factors, but the overall macro backdrop is worsening, not improving. There has been a mixed picture in recent domestic data, increased geopolitical tensions, a Chinese economy (and markets) that is increasingly weakening. Even more alarming is the growing threat to H1 ’22 growth from the still increasing uptick in Delta cases which will likely be worsened by a further surge in Omicron. There also continues to be profit margin pressures from persistent inflationary forces. For a more sustainable rally in risk assets to occur in Q1, markets will need to see significant improvement across these identified risks. Until then, tread carefully as the end-of-year lower liquidity will likely keep volatility high.

Econ Data:

Industrial production in the United States rose 0.5% from a month earlier in November, following an upwardly revised 1.7% growth in October, but missed market expectations of a 0.7% advance. Manufacturing output rose 0.7%, driven by gains in the production of durables (0.8%) and nondurables (0.5%). Within durables, the largest increases were posted by motor vehicles and parts, aerospace, and miscellaneous transportation equipment. Mining output increased 0.7%, while utilities output shrank -0.8%. Capacity utilization increased to 76.8% from 76.5%, helped by improvements in manufacturing and mining.

Why it Matters: although missing street expectations, industrial production and capacity utilization improved solidly in November, with gains driven by aerospace, computer, metals, and furniture manufacturing. Automotive products increased 2.8% in November after rising 8% in October as shortages of parts continue to decrease. November saw the highest motor vehicle assemblies total in the second half of the year. High-technology industries saw a solid increase helped by computers and semiconductor production, as strong IT Capex continues to drive demand there.

*IP and Capacity Utilization are at their highest pre-pandemic levels

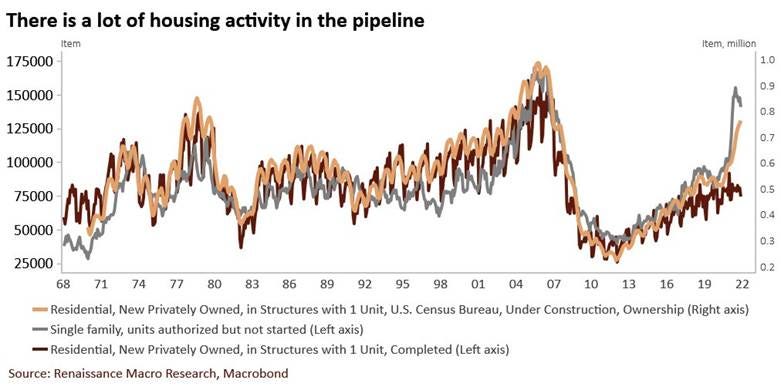

Housing starts jumped 11.8% to an annualized rate of 1.679 million in November, the highest level since March and well above market consensus of 1.568 million. Single-family housing starts jumped 11.3%, while the rate for buildings with five units or more increased 12.9%. Building permits in the United States rose 3.6% MoM, above market expectations. Permits for single-family rose 2.7%, while buildings with five units or more jumped 6.1%. The Northeast saw the largest gains in both starts and permits, while the Midwest saw declines in both.

Why it Matters: There were strong gains in housing starts and building permits during November. Homebuilders have a lot of work to do which is good news for residential construction activity next year. Pricing pressure will continue to be strong, given the lack of inventory and increased production costs have not meaningfully changed.

The NAHB housing market index increased yesterday by 1 point to 84 in December, the highest since February and beating market forecasts of 83. The current single-family sub-index increased to 90 from 89 in the previous month, and the home sales over the next six months sub-index was steady at 84. The gauge for prospective buyers advanced to 70 from 69.

Why it Matters: It is very much the same song. There continues to be strong demand and scarce inventory while material and labor shortages are still a problem. “While demand remains strong, finding workers, predicting pricing, and dealing with material delays remains a challenge,” said NAHB Chairman Chuck Fowke. “Policymakers need to work on supply chain improvements and controlling costly inflation. Addressing lumber tariffs would be a good place to start.”

*Increases in current sales and prospective buyers drove up the overall index

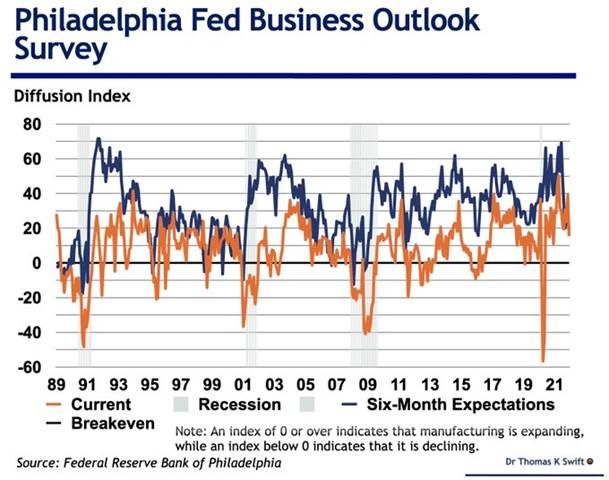

The Philadelphia Fed Manufacturing Index fell to 15.4 in December from a seven-month high of 39 in November and well below market forecasts of 30. The reading pointed to the weakest growth in factory activity in Philadelphia since December last year. The survey’s indicators for general activity, shipments, and new orders all declined to their lowest readings in 2021. However, the employment index improved somewhat. Both price indexes declined. The survey’s future general activity and new orders indexes moderated, but the surveyed firms generally remained optimistic about growth over the next six months.

Why it Matters: Growth in production/manufacturing was certainly less widespread this month in the Philly region as it ends the year on a low note. The significant decreases in New Orders, Shipments, and Unfilled Orders are a little alarming as it indicates a loss of demand, not capacity constraints, given employment increased. The special question also confirmed capacity utilization had improved in Q4, with supply chain issues being the number one constraint followed by labor issues. Finally, price and delivery time sub-indexes declined slightly, as seen in the NY Fed survey

*Significant drops in demand orientated sub-indexes moved the general Business Activity Index significantly lower in December

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week, and again today, with the ratio lower by an impressive -2.5% given the weakness in tech. Large-Cap value is the best size/factor performer today.

Chinese Iron Ore Future Price: Iron Ore futures are higher on week and day as steel output is expected to drop -2.3% this year and fall another -2.2% in 2022, according to a government think tank

5yr-30yr Treasury Spread: The curve is steeper on the week and moving steeper by 6bps today as the Fed’s hawkish pivot is leading markets to believe growth will be weaker sooner due to the tightening while inflation will subside faster

EUR/JPY FX Cross: The Euro is stronger on the week, but little changed on the day as the ECB sent the Euro initially higher, but more dovish comments in the presser dropped it back down

Other Charts:

*Q4 earnings estimates have fallen in several sectors despite better than expected growth

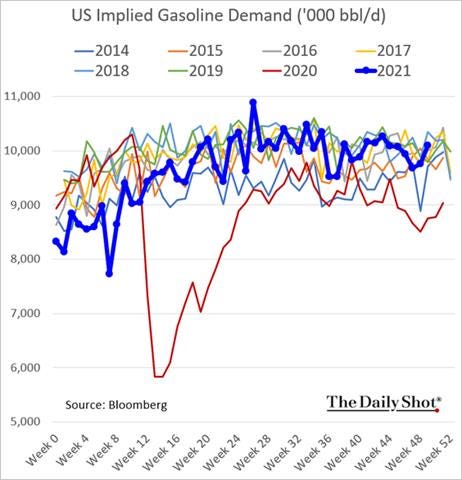

*Despite or perhaps because of the recent uptick in Delta cases, gasoline demand has been improving

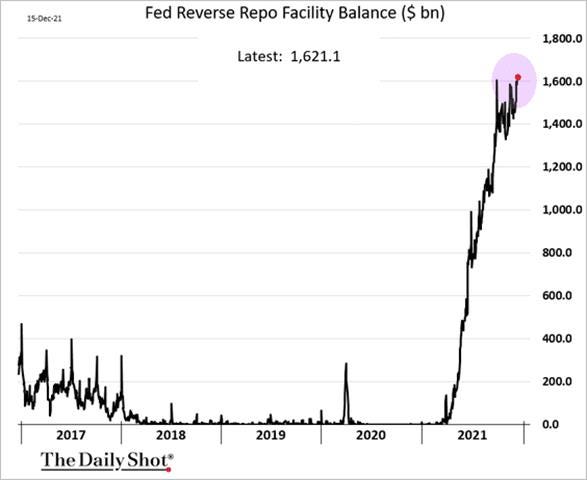

*The Feds RRP facility will likely only stop growing when QE concludes in March

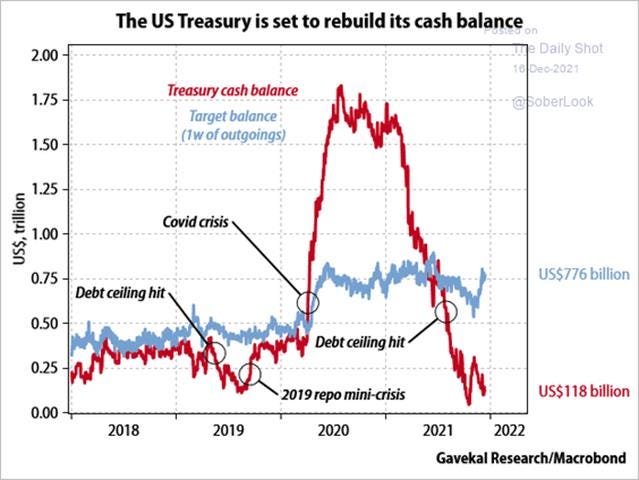

*The rebuilding of the TGA will reduce liquidity/reserves and likely also correlate with RRP usage declines as higher-yielding alternatives become available

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Fake Line: Container Imports Tumble at Los Angeles, Long Beach Ports – WSJ

The ports of Los Angeles and Long Beach handled the lightest traffic since June 2020. The import volume was down -9.6% from a year ago and -10.1% from October. Gene Seroka, the executive director of the Port of Los Angeles, attributed the decline to an influx of smaller ships that have been dispatched by retailers, manufacturers, and logistics companies as they scramble to get around bottlenecks and satisfy consumer demand.

Why it Matters:

The import slowdown has also coincided with a growing backlog of vessels waiting to enter the ports. The backup reached a record 101 container ships on Monday, according to the Marine Exchange of Southern California. The figures suggest the logjam is undercutting efforts by the ports to speed cargo flows. The bottom line is that things still have a way to go to return to normal but action taken so far seems to be moving containers in and out of the ports quicker even if the line of ships queuing is growing.

China Macroprudential and Political Loosening:

Quota: China to Boost Outbound Investment to Try to Curb Strengthening Yuan - Caixin

The State Administration of Foreign Exchange (SAFE) has recently added $3.5 billion in fresh quotas for one bank and four fund managers to invest abroad under the Qualified Domestic Institutional Investor (QDII) program, official data show. It’s the seventh QDII quota increase this year and comes after an earlier hike by Nov. 25. Granting fresh QDII quotas and allowing more outbound investment could ease the appreciation pressure on the yuan.

Why it Matters:

The QDII program provides a major channel for domestic investors to invest in offshore assets through financial institutions, including brokerages, fund managers, insurers, banks, and trust companies. But domestic investors may not have a strong demand for QDII products, given the more nationalistic fervor and worries over protectionist foreign policy. However, it is a good signal that Beijing is not happy with the yuan's current (stronger) level and will increasingly try to depreciate it as part of its growing broader pro-growth policies.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

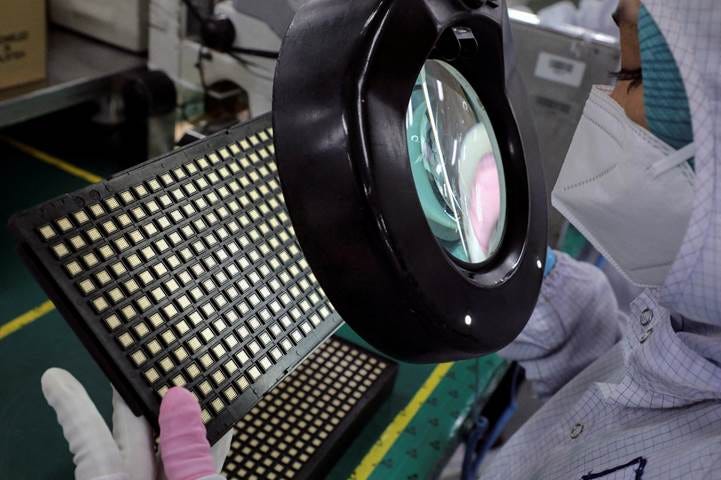

Tougher: Biden Team Mulls New Clampdown on China’s Largest Chipmaker - Bloomberg

The Biden administration is considering imposing tougher sanctions on China’s largest chipmaker. The proposal that’s being examined would tighten the rules on exports to Shanghai-based Semiconductor Manufacturing International Corp (SMIC). If one proposal is adopted, companies such as Applied Materials, KLA, and Lam may find their ability to supply gear to SMIC severely limited.

Why it Matters:

Current rules specify that machinery “uniquely required” for making advanced chips can’t be exported. One proposal being considered at the meeting would change that to “capable for use,” which would include machinery that’s also used for making less advanced electronic components. Beijing is “seriously concerned about the relevant reports,” Foreign Ministry spokesman Zhao Lijian said Wednesday at a regular press briefing in Beijing. Limiting its access to crucial machinery imperils Xi’s dual-circulation objectives that still have critical industries needing foreign IP and capital goods before China can become completely self-reliant.

Start Wooing: India outlines $10 bln plan to woo global chip makers – Reuters

India has approved a $10 billion incentive plan to attract semiconductor and display manufacturers, its technology minister said on Wednesday, as part of a deepening push to establish the country as a global electronics production hub. Under the plan, India's government will extend fiscal support of up to 50% of a project's cost to eligible display and semiconductor fabricators.

Why it Matters:

Prime Minister Narendra Modi's government has already offered about $30 billion in incentives to woo some of the world's largest electronics manufacturers to set up shop in India, helping make India the second largest smartphone producer behind China. This, coupled with the new incentive plan, has also helped India win investment commitments from Foxconn, Wistron, and Pegatron, three of Apple's top contract manufacturers. Tata group is also venturing into the semiconductor business.

Commodity Super Cycle Green.0:

Greenwashing: EU countries at odds over green investment label for nuclear energy - Reuters

The European Commission is considering whether to include nuclear and natural gas in its "sustainable finance taxonomy," a rulebook that will restrict which activities can be labeled as climate-friendly investments. The Commission has said it aims to decide this month on whether nuclear and gas are labeled green but has struggled to resolve in-fighting between the bloc's countries, including France and Germany, who are split over the fuels.

Why it Matters:

The taxonomy does not ban investments in activities not labeled "green." But by limiting the green label to those activities deemed truly climate-friendly, the EU aims to steer cash into low carbon projects and stop companies or investors from making unsubstantiated environmental claims. It is likely there will be a compromise given there seems to be an even split in views between EU members. The current energy shortage situation also exposed the problems with moving too quickly to an all-renewable energy portfolio.

ESG Monetary and Fiscal Policy Expansion:

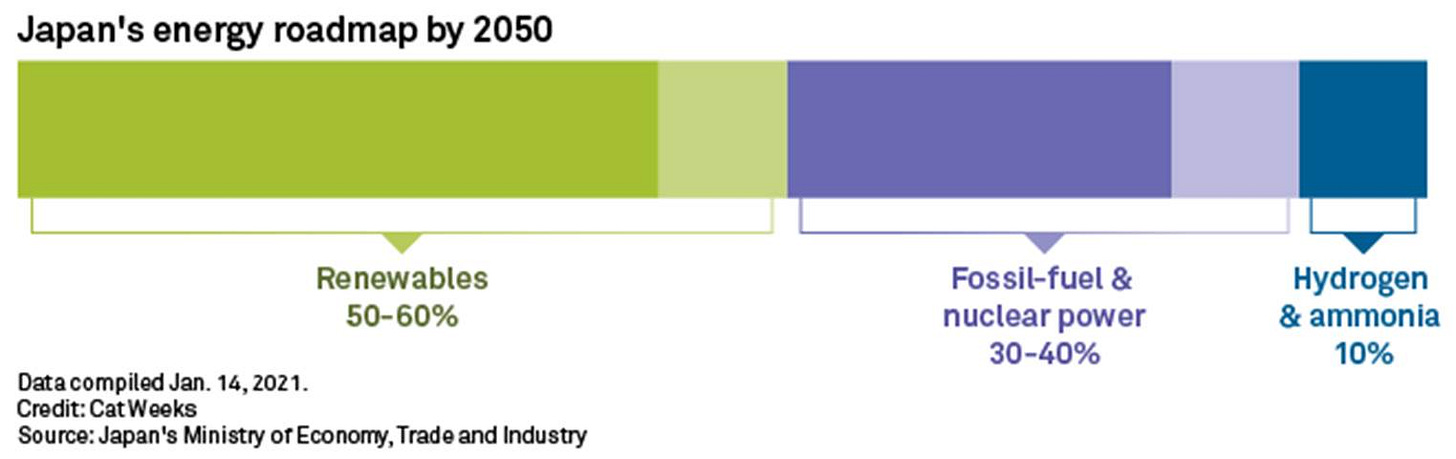

Goals: Japan eyes carbon credits with decarbonization drive - Argus

Japan is gearing up to develop a carbon credit market in the country, which it views as increasingly necessary for offsetting remaining greenhouse gas (GHG) emissions to achieve its 2050 carbon-neutral goal. Japan's trade and industry ministry Meti is currently discussing the details of the market framework, including the effective use of carbon credits and the possible use of new credits through new technologies, to clarify policy direction and establish an ideal market.

Why it Matters:

Meti is eyeing credits from direct air capture (DAC) and absorption by algae, to be traded in the carbon credit market in the future. This is on top of the more traditional carbon credit market structure that will initially allow participants to trade credits through the Joint Crediting Mechanism (JCM), J-credits, and voluntary credits, as well as credits generated by companies. Japan has pledged to cut GHG emissions by 46% by 2030-31 compared with 2013-14 levels, before achieving a carbon-neutral society by 2050.

Portfolio Returns:

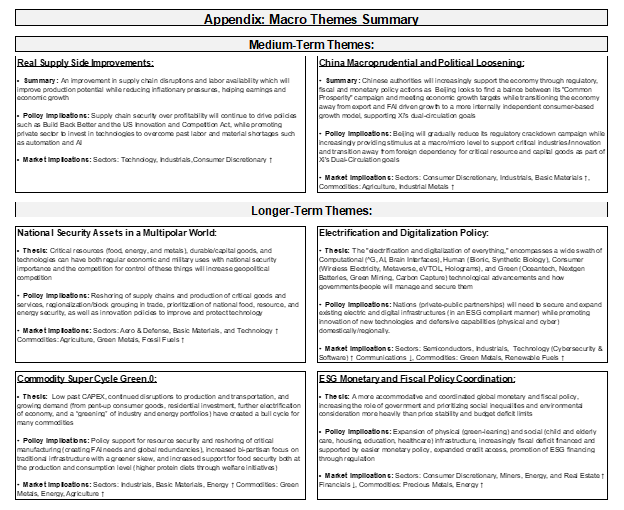

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.