Less Optimistic Consumer Opens Door For Further Dovish Fed Pivot - Midday Macro – 5/10/2024

Color on Markets, Economy, Policy, and Geopolitics

Less Optimistic Consumer Opens Door For Further Dovish Fed Pivot

Midday Macro – 5/10/2024

Market’s Weekly Narrative:

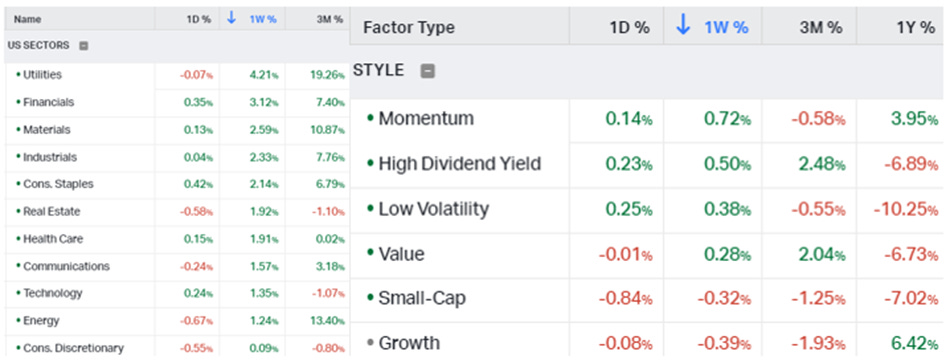

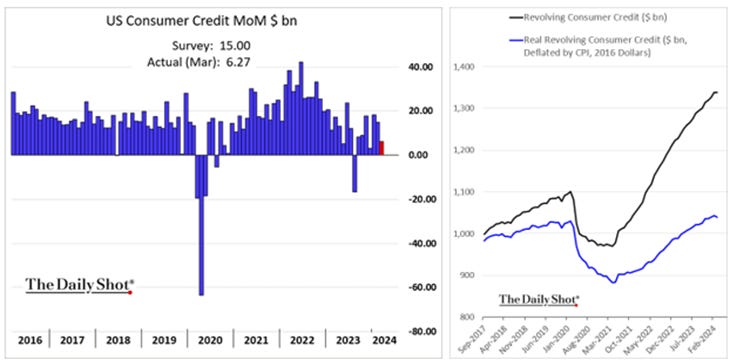

The S&P is ending the week flat on the day after a notable drop in consumer sentiment and higher inflation expectations weighed on risk sentiment, especially for small caps. However, on the week, the S&P is higher by close to 1.7%, closely followed by the Nasdaq (assuming prices close near here). Utilities continued their outperformance, followed by more cyclical sectors such as financials, materials, and industrials, while consumer discretionaries and energy performed the worst on the week. Momentum was the best-performing factor, with value and growth changing little in relation to the broader index during the week. Implied vol is near a 90-day low, with traders waiting for next week’s inflation and retail sales data, as well as Nividia earnings the week after. This week’s Treasury auctions saw mixed results; however, a better-received 30-yr auction was a welcome sign for long-duration demand. It was a light week on the data front, with today’s University of Michigan Consumer Sentiment report being the most important piece of new info, coming in broadly weaker and indicating inflation expectations were de-anchoring ever so slightly. Elsewhere, the Fed’s credit report showed a much lower use of credit cards in March, indicating a higher rate sensitivity for consumer borrowing may be occurring. The SLOOS report showed a still tightening credit availability backdrop and low loan demand. There were numerous Fed speakers, with Powell’s May FOMC message largely intact, with the Fed willing to be patient, needing more evidence that disinflation progress would continue, and willing to keep policy where it is until then. However, a few policymakers noted the softer jobs report, and there was an ever so slight dovish tilt in the mosaic of speakers.

Elsewhere, there was a lot of central bank activity this week. The RBA did not get more hawkish despite inflationary data running hotter than expected so far this year, which surprised markets somewhat. Less surprisingly, Sweden followed Switzerland, Hungary, and the Czech Republic in easing monetary policy for the first time since hiking cycles began. The Riksbank lowered its policy rate by 0.25 basis points to 3.75%, making it more likely that the ECB will also jump on the bandwagon in June. The Bank of England is getting very close to its first rate cut, and while keeping rates on hold at 5.25%, had a distinctly more dovish flair in its recent policy statement/assessment. Mexico’s central bank kept borrowing costs unchanged after inflation reaccelerated last month, taking the remote possibility of a second straight interest rate cut off the table. Brazil’s central bank cut rates again but decreased the size to 25bps, given greater uncertainty and a desire to keep policy somewhat restrictive. Finally, Malaysia’s central bank held its benchmark interest rate unchanged again, extending its policy pause to a year as it keeps a watchful eye on growth and inflation.

Oil is ending the week flat due to a selloff today but rallied earlier in the week on a combination of geopolitical risk, rising demand, and supply concerns. International organizations are increasingly highlighting shrinking crude inventories, with the IEA indicating Q2 2024 would see demand surpass supply by 900K b/d, the first two consecutive negative quarters since late 2021. Further, U.S. oil storage data showed a larger-than-expected draw in crude stockpiles as refiners ramped up output ahead of the summer driving season. With OPEC+ curbing supply by means of Saudi Arabia’s and Russia’s voluntary production cuts, the end of refinery maintenance in Europe and Asia, and better-perceived manufacturing activity globally, demand is also expected to rise. Finally, Saudi Aramco raised its official selling prices for June, which analysts saw as a possible indicator of maintaining production cuts beyond Q2. Copper is higher on the week, pushing to new recent highs before pulling back, with China’s trade data supporting a more sustained recovery there. Gold and silver were also higher on the week, supported by a more reflationary pulse in commodities. The agg complex was higher on the week, with still high and rising prices and volatility in softs, while grains, corn, and bean futures were also up. Finally, the dollar was slightly higher on the week, with the $DXY near 105.3, but trending lower with yields. The Yen weakened back to nearly 156, while the Euro was little changed.

Headlines:

Deeper Dive:

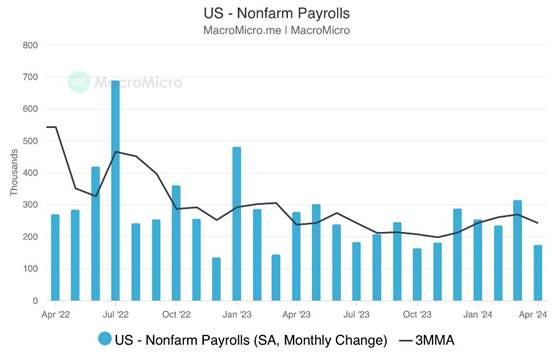

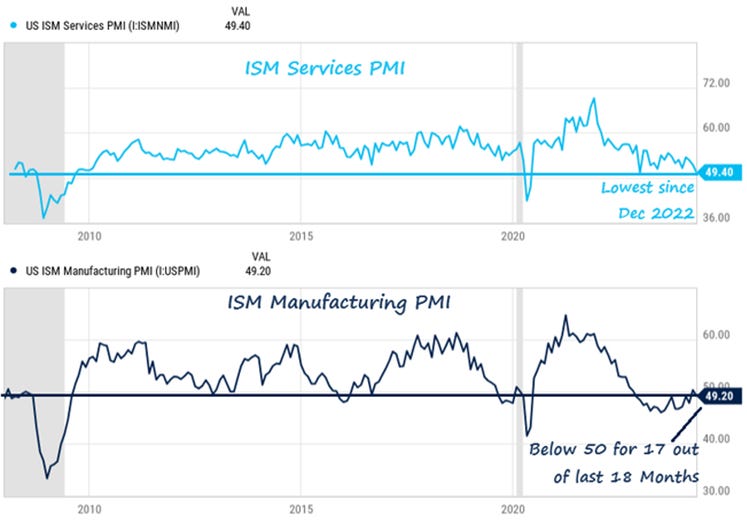

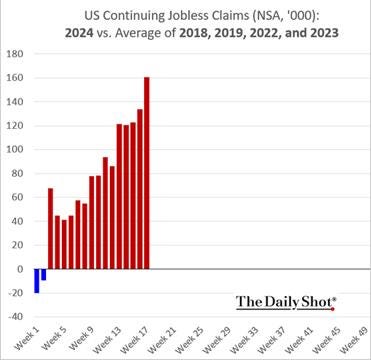

The narrative in the second half of last year was that disinflationary progress was occurring alongside a soft landing in economic activity, allowing for rates to fall without labor markets having to contract. Effectively, supply-side improvements helped the Fed’s crusade against inflation while allowing the economy to run hot. As a result, stocks and risk assets, more generally, could rise as sentiment and earnings improved. The story changed in the first four months of this year, with a view that “no landing” was occurring after strong payroll growth, solid final domestic demand in Q1, and disinflation progress stalling. As a result, Fed rate cut expectations were pushed out and diminished, with “higher for longer” being the market's overarching mantra. Now, the question is whether the narrative can pivot again and evolve back into a “soft landing” with rate cuts outlook. With Powell seemingly starting that pivot at the May FOMC, a weaker NFP report, contracting ISM PMI readings, and continued creep higher in continuing claims, it certainly looks like economic activity is cooling. However, increasing worries regarding the health of the U.S. consumer (especially lower-income cohorts) amplified in today’s sharp drop in consumer confidence in conjunction with a pick up in inflation expectations today and stronger price readings in recent PMI surveys, have markets on edge before next week’s Retail Sales, CPI, and PPI releases, with the worry that the U.S. could be entering a more stagflationary environment, despite Powell not seeing it.

*NFP and initial claims have defied cooler hiring intentions so far this year, but that is likely changing

*ISM PMIs are indicating a more neutral level of activity, which should reduce inflationary pressures (despite upticks in sub-index price readings) and help continue to balance labor markets

*Continuing claims continue to grind higher and are now well above their average level for the last few years (excluding 2020 & ’21)

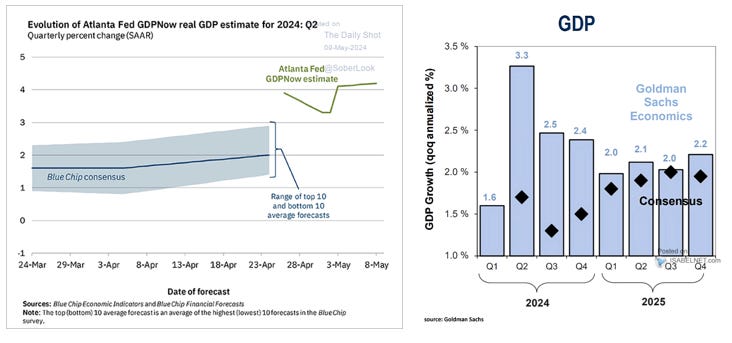

As we have previously expressed, we believe we are entering a below-trend period of growth as a loosening labor market reduces consumer discretionary spending in the second half of the year. In turn, this will give the Fed increased confidence that demand-pull inflation will decline while further progress on the supply side continues to normalize cost-push inflationary pressures. Further, the more balanced labor market squashes any residual wage-spiral inflationary fears. As always, we divide and conquer the current inflationary cycle through these three channels. Regarding economic activity, given our belief that trend growth is higher due to more positive demographics and higher levels of productivity, as well as any coming cooling starting from a stronger place due to the effects of the pandemic (stronger balance sheets, reducing rate sensitivity), a below-trend period doesn’t mean a recession. As a result, we are entering a “goldilocks” setup for markets over the next few months. Optimism over AI, improving global growth, and an easing future Fed policy backdrop will outweigh worries about weaker domestic consumer spending (which so far is concentrated in less impactful lower-income cohorts) and generally normalizing aggregate demand from business investment (outside AI). With earnings forecasts rising as input costs (especially wages) stabilizing while demand has not materially weakened (yet), equities can mount a summer rally. Put another way, we expect equities multiples to expand while earnings remain resilient, with falling real rates driven by changes in expected Fed policy to support risk sentiment. Since Powell told us that the Fed’s next move was “unlikely” to be a hike, we now know the yields are capped. Further, the already high run-rate of second-quarter GDP growth seen in the Atlanta Fed’s GDPNow tracker will come down but not crash, supporting our earnings growth views. This leaves a window to be tactically long equities.

*Cracks are showing, but growth has remained resilient and will likely be above or at trend in Q2

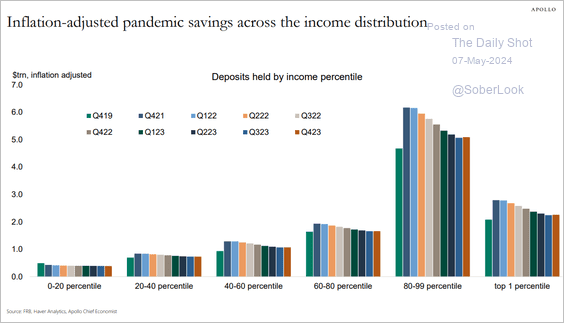

*Lower-income cohorts are increasingly feeling the weight of higher rates (reduced revolving credit), reduced excess savings (normalized), and potentially will have greater job insecurity moving forward

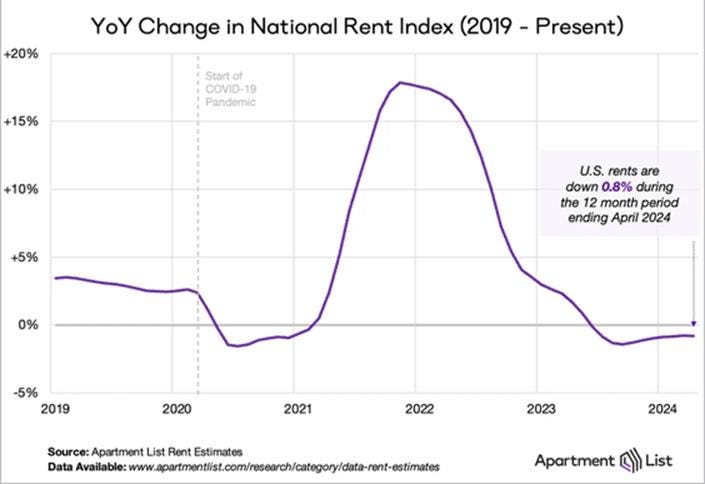

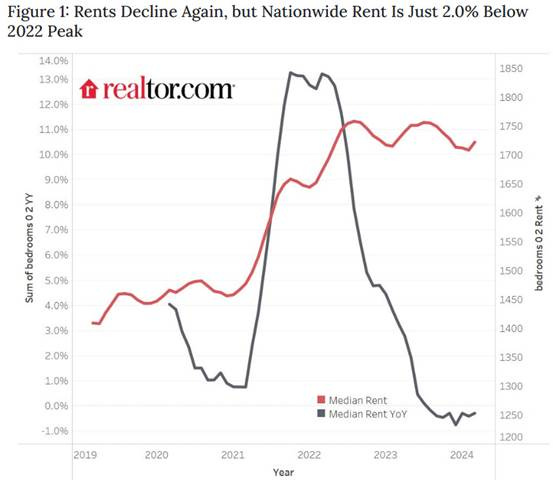

*Will shelter, which usually accounts for around 60% of current inflation growth, finally cool next week?

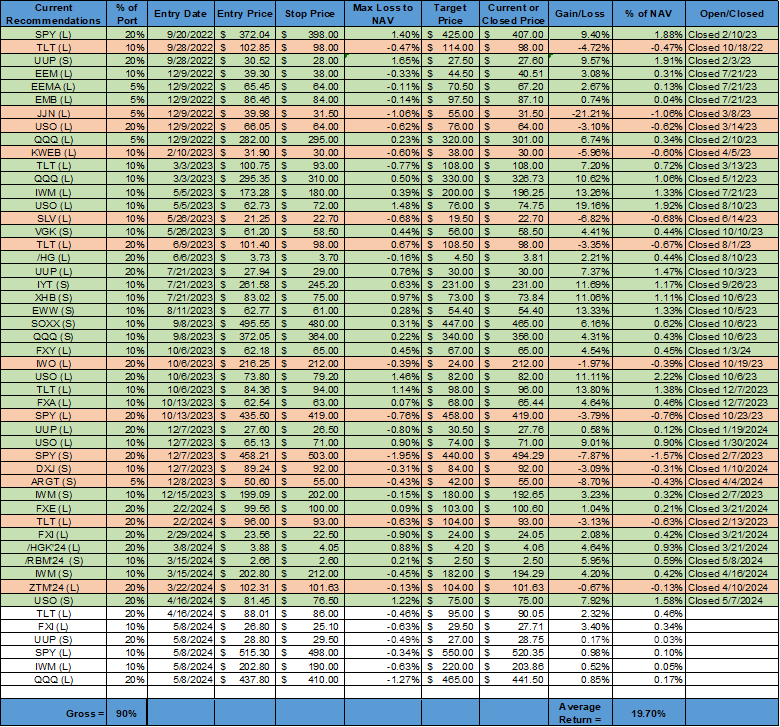

Given the views expressed above, we have entered a number of new positions in our mock portfolio this week. The overarching theme is one where risk sentiment is supported by a more dovish Fed outlook, as labor markets loosen further and disinflationary progress renews, while positive earnings growth momentum and a more positive global backdrop (both from better growth and geopolitically) alleviate fears of a hard landing. We are adding a 10% position in $FXI, the iShare China Large-Cap ETF. We should have never exited our initial position, which we started in late February, and would have been up over 17% if we hadn’t. We believe that Chinese equities still have room to run due to positive domestic economic momentum attracting foreign buying due to cheap valuations and continued home-team support. We are also starting a 20% short dollar position through the $UUP Invesco USD Fund. As we expressed in prior writings, markets are at peak Fed hawkishness, and we see dollar sentiment as overly bullish. We are not looking for a collapse in the dollar; instead, we are targeting a move in the $DXY back to the 103-104 range. Finally, we are entering a 40% long equities position through the $SPY, $QQQ, and $IWM ETFs, looking to capture the entirety of the market but wanting to be overweight tech through a heavier 20% holding in $QQQ versus 10% in the other two. This is a significant position for the portfolio historically as we have strong conviction, looking to capture a 6%-8% move higher in the next few months. We are also closing our short oil and gasoline positions, locking in 8% and 6% gains, respectively. Technicals and fundamentals indicate the sell-off in oil may be stretched, and a tactical relief rally back into the mid-80s could occur (despite price action lower).

With those changes to the portfolio made, we will keep this week’s “Deeper Dive” shorter. It is our hope that next week's inflation data shows renewed disinflationary progress. However, given the uptick in ISM and regional Fed price readings, as well as the uncertainty over when shelter costs may finally reflect more timely private data readings, we certainly are open that another month of sticky inflation readings could persist. With that said, we stand by our above outlook and calls over a longer time horizon and have positional stops placed to limit any drawdown from a change in the macro narrative. We plan to focus our “Deeper Dive” section on the recent slowing of lower-income consumer activity/sentiment next week and determine if it could spread into middle and higher-income cohorts.

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

Technicals, Positioning, and Charts:

The S&P outperformed the Nasdaq and Russell over the last five trading sessions. Utlities, Financials and Materials were the best-performing sectors, while Momentum, High Dvd Yield, and Low Volatility were the best-performing factors. Mid-Cap Growth was the best-performing size/value combo.

@Koyfin

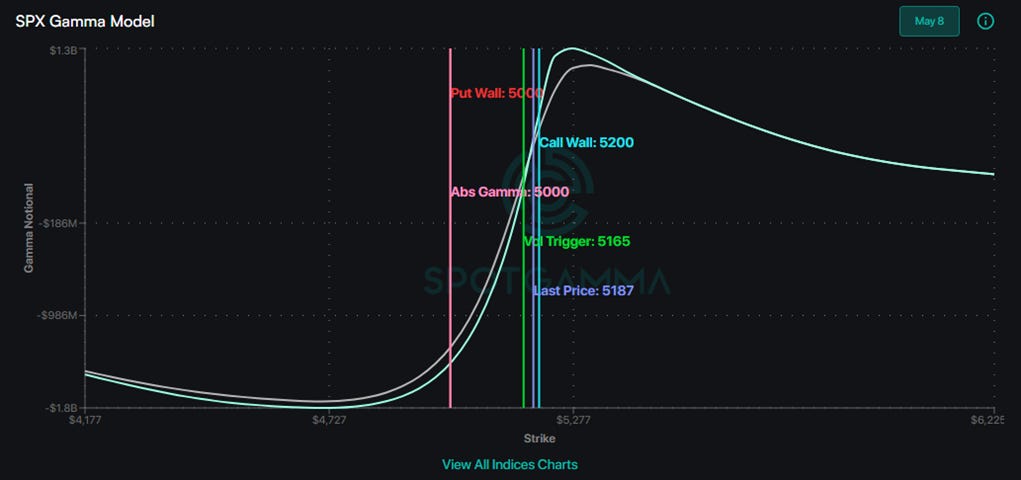

S&P optionality strike levels have the Zero-Gamma Level at 5119 while the Call Wall is 5200 and the Put Wall is 5000.

@spotgamma

Treasuries are lower on the day, with yields higher by 4.7 bps, moving the 10yr yield to around 4.50%, while the 5s30s curve is little changed on the session, moving to around 13 bps.

Other Charts:

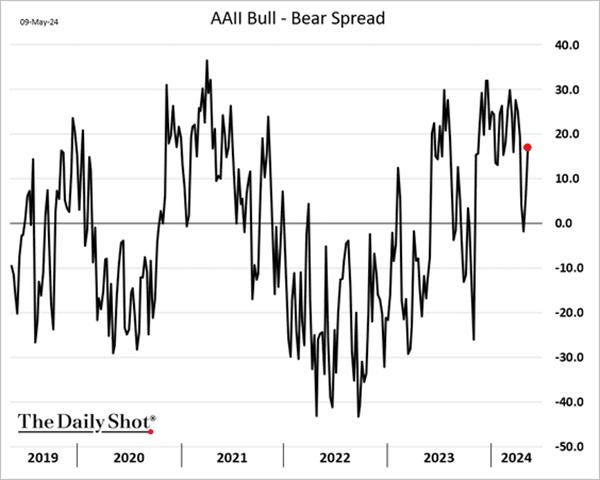

Retail sentiment bounced this week as the market rallied. - @DailyShot

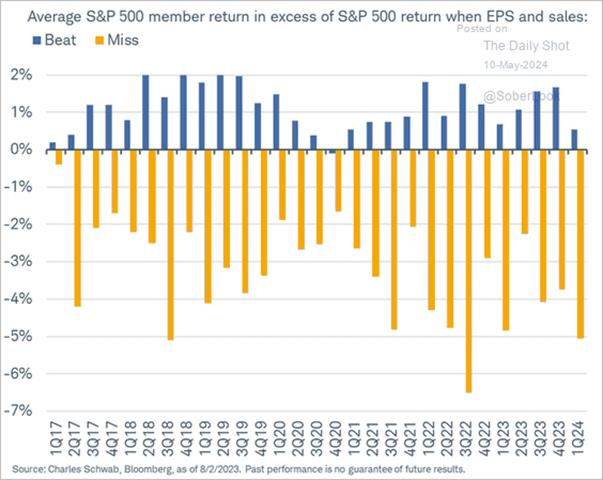

The market has been harsh on companies that missed Q1 earnings estimates, while offering limited rewards to those that exceeded expectations. The chart below illustrates the relative performance for earnings beats and misses. - @KevRGordon

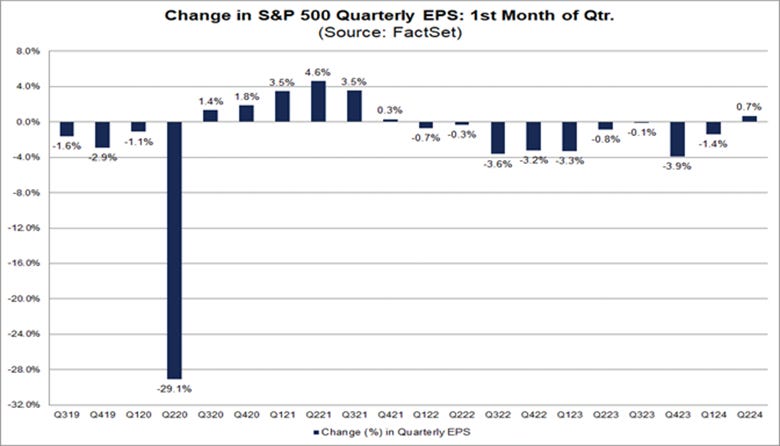

During the month of April, analysts actually increased EPS estimates for the second quarter. The Q2 bottom-up EPS estimate increased by 0.7%, marking the second quarter the first time the bottom-up EPS estimate increased during the first month of a quarter since Q4 2021 (+0.3%).

Buyback plans have risen sharply so far this year.

Sell in May and Go Away? It hasn't worked in the last decade, and it isn't working this year either, with the S&P 500 already up more than 3% this month! - @Barchart

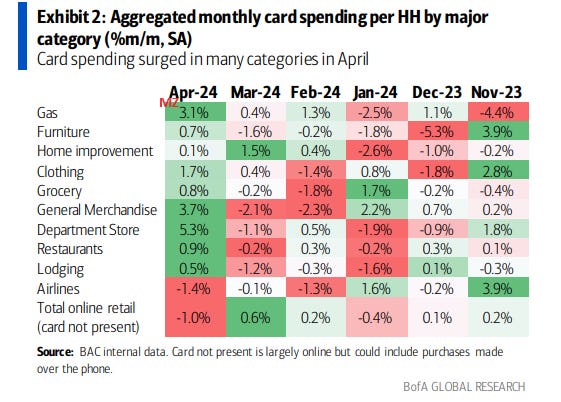

Card spending surged in many categories in April - BofA

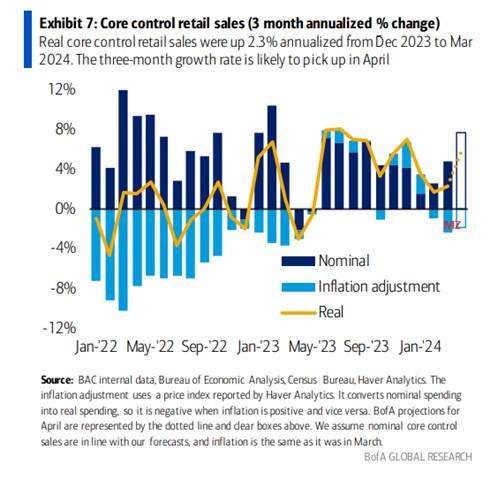

Real core control retail sales were up 2.3% annualized from Dec 2023 to Mar 2024. The three-month growth rate is likely to pick up in April -BofA

In March 2024, the U.S. median rent continued to decline year over year for the eighth month in a row, down -0.3% for 0-2 bedroom properties across the top 50 metros, a pace similar to the -0.4% seen in February 2024. The median asking rent was $1,722, up by $14 from last month following a typical seasonal trend. - @calculatedrisk

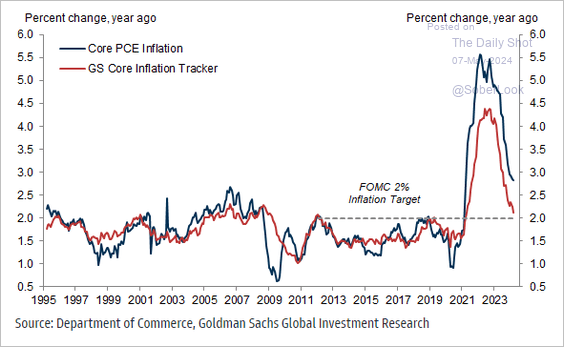

FWIW, Goldman’s U.S. core inflation tracker has declined to almost 2%.

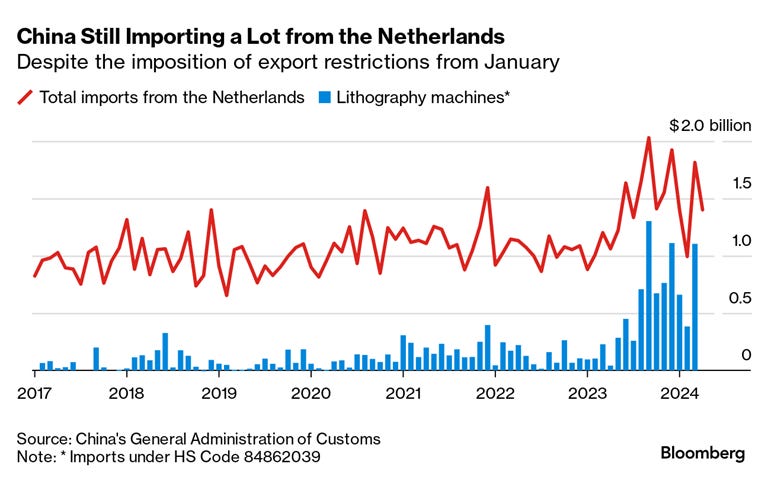

China imported more than a billion dollars of goods from the Netherlands last month, an increase that came despite the recent imposition of controls on the sale of equipment to produce semiconductors. – Bloomberg

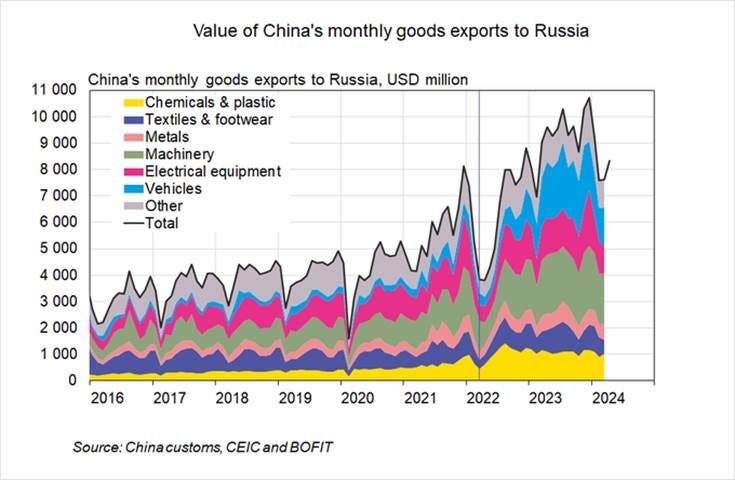

Meanwhile, China’s exports to Russia have cooled slightly in the last two months after a strong start to the year.

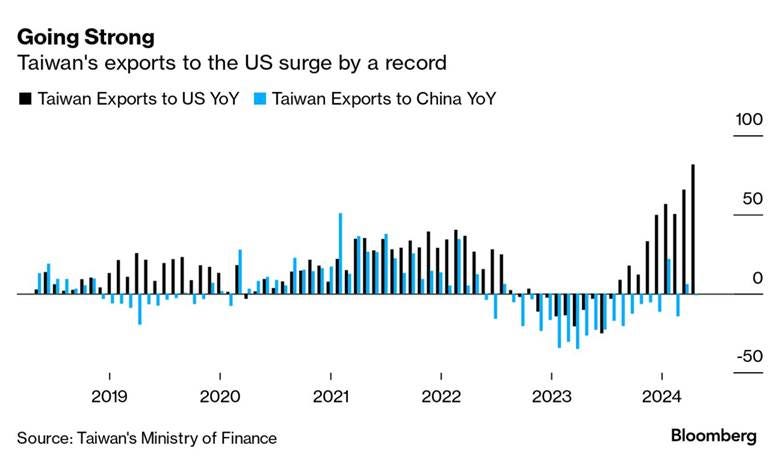

Taiwan’s exports to the US jumped by a record 81.6% year on year to $10.2 billion in April. The island’s shipments to mainland China fell 1.1% to $7.5 billion, underscoring the shift in global tech supply chains. - Bloomberg

Appendix: Policy Talk, U.S. Econ Data Summaries, and Articles by Macro Themes

Policy Talk:

There were numerous Fed speakers since the May FOMC, and the message following the weaker-than-expected NFP report tilted slightly more dovish. Chicago Fed President Goolsebee indicated he had more confidence that the economy would not overheat and reaccelerate inflation given the weaker-than-expected jobs report. He highlighted that higher immigration might have played a role in the higher NFP readings earlier in the year, but the Fed was still analyzing this. As in the past, he indicated worries about keeping policy too restrictive for too long, indicating a need for a more two-sided risk management approach now that labor markets looked to be in better balance.New York President Williams indicated he believed factors driving economic resilience would wane moving forward while speaking at the Milken Institute Conference. When looking at the totality of the data, Williams sees rate cuts coming as job growth moderates and growth cools to a more normal level (something he sees around 2-2.5%) as the economy “gets into better balance.”

Richmond Fed President Barkin gave prepared remarks in South Carolina, where he questioned whether the more uneven data so far this year was a real shift in the path of inflation or just the expected “bumps” along the way. He noted that he had confidence that policy was restrictive enough to bring demand and supply into a balance that would move inflation back to the Fed’s target. Barkin sees the effects of tighter policy as still not fully hitting the economy, and any coming slowdown would likely “bring less dislocation in the labor market.” Minneapolis Fed President Kashkari reiterated his view that policy may not be restrictive enough and rates may stay where they are for longer than expected when speaking at the Milken Institute Conference and in a prepared essay on the Minneapolis Fed’s website this week. He noted that he believes the Fed will likely cut rates one time or not at all this year versus the two cuts he put down in the March FOMC SEPs.

Governor Cook gave prepared remarks on the current state of financial stability at the Brookings Institute in D.C., where she noted banks and businesses were in solid financial shape and able to meet financial obligations such as covering debt payments. She sees the commercial real estate sector as a “sizeable but manageable” risk to smaller banks that own a larger concentration of loans there. Cook noted areas of concern she is watching, including whether a rise in consumer auto and credit card delinquency rates represents "a normalization from recent lows" or reflects outsized stress among some households. Overall, she saw many of the known areas of risk as well identified by firms, markets, and supervisors, reducing the likelihood they become systemic negative risk events in the future. Boston Fed President Collins, in prepared remarks given during a fireside chat, echoed colleagues by signaling that she also sees the need for interest rates to be held higher for longer than previously forecasted but believes cuts are coming. She highlighted that this year's lack of disinflationary progress led her to believe slower economic growth would be needed to move inflation sustainably back to the Fed’s target. She remained optimistic, though, given the moderately restrictive stance of policy, that labor markets would remain “healthy” as inflation fell, but uncertainty remained high. Atlanta Fed President Bostic published a paper focused on labor markets and how the Fed views them, but it did not speak to his current policy views.

Governor Bowman gave prepared remarks on financial stability risks at a Texas Bankers Association meeting, where she highlighted the importance of the Fed’s Financial Stability Report, the role regulators play, and her three principles regarding this role. She also highlighted the growing risk CRE loans posed to the banking system. In Q&A, Bowman expressed a belief that policy would need to be kept steady for a bit longer, given she expected inflation to remain elevated. San Francisco Fed President Daly moderated a discussion at George Mason University, where she also said interest rates are restrictive enough, but it may take “more time” to return inflation to the central bank’s goal than initially thought. “There’s considerable uncertainty now about what the next few months of inflation will be and what we should do in response,” she said. Daly reiterated she didn’t believe a negative growth period was needed to get inflation down further, and if labor markets loosened, it would be enough to start cutting rates. Dallas Fed President Logan, speaking during Q&A at the Louisiana Bankers Association conference, also flagged uncertainties around how restrictive policy is currently and said that it was still too early to talk about cuts. She noted that she needed “to see some of these uncertainties resolved about the path that we’re on and we need to remain very flexible to policy and continue to look at the data that’s coming in and watch how financial conditions are evolving.”

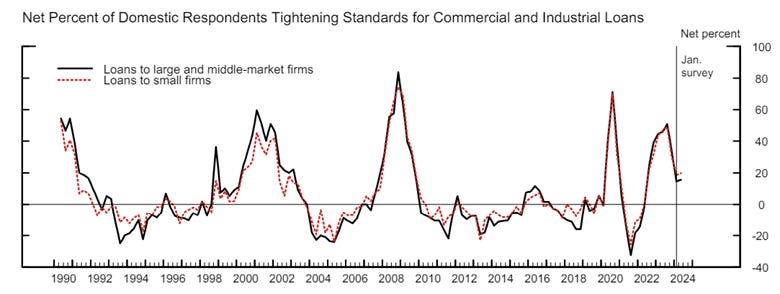

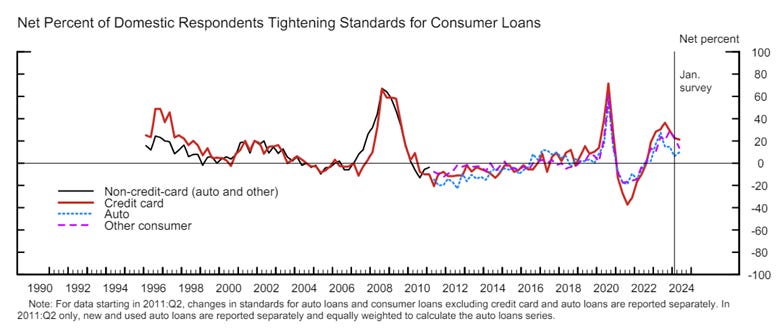

The Board of Governors' April 2024 Senior Loan Officer Opinion Survey showed on balance, banks reported having tighten lending standards further for most loan categories in the first quarter, however, a lower share of banks reported tightening lending standards than in the fourth quarter of last year, with the majority keeping their standards “basically unchanged.” Regarding loans to businesses, banks reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the first quarter, while banks also reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories. Special questions showed that banks reported tightening all lending policies (spread of loan rates over the cost of funds, maximum loan sizes, loan-to-value ratios, debt service coverage ratios, and interest-only payment periods) for CRE loans. Regarding loans to households, banks reported lending standards tightened across some residential real estate (RRE) loans while remaining unchanged for others, while demand weakened for all RRE categories. Further, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Finally, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened.

Total consumer credit increased by $6.27 billion in March, following an upwardly revised $15.02 billion rise in February, missing market forecasts of a $15 billion increase. Revolving credit increased $150 million from a month earlier (vs. $10.7 billion in February) or by 0.1% on an annual basis. Non-Revolving credit increased by $6.1 billion (vs. $4.3 billion) or by 2% from a year earlier. Consumer credit increased at a seasonally adjusted annual rate of 3.2% in the first quarter. Revolving credit increased at an annual rate of 5.7%, while non-revolving credit rose at an annual rate of 2.2%.

Total consumer credit increased by $6.27 billion in March

The New York Fed’s 2024 SCE Housing Survey showed the pace at which households expect home prices to rise by 5.6% over the next year, falling from 2.6% in last year’s survey. That level is slightly above the pre-pandemic average (4.2%) but below the series high in 2022 of 7%. Rents are expected to increase by 9.7%, an increase of 1.5% from last year’s reading and the second-highest level in the series history, following 2022. The outlook for home price and rent appreciation on the five-year horizon was essentially flat. Households expect mortgage rates to rise further to 8.7% a year from now and 9.7% in three years’ time, both of which are series highs. Still, 61% believe that mortgage rates will fall over the next 12 months, which is also a series high. Homeowners’ expectations about the likelihood of refinancing their mortgages over the next 12 months rebounded slightly after falling last year but remain well below pre-pandemic levels. Renters’ views of obtaining a mortgage and buying a house deteriorated substantially, with 74.2% seeing acquiring a mortgage as somewhat or very difficult, with the probability of ever owning a home decreasing to a new series low. Finally, while attitudes toward housing as a financial investment remained strongly positive, they weakened slightly from the previous year.

U.S. Econ Data Summaries:

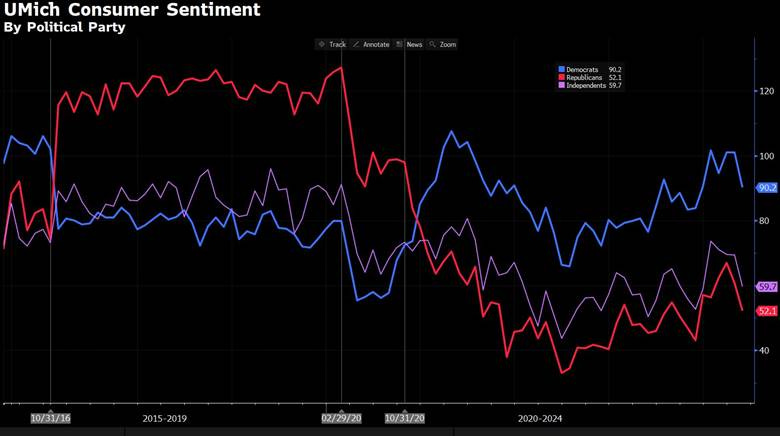

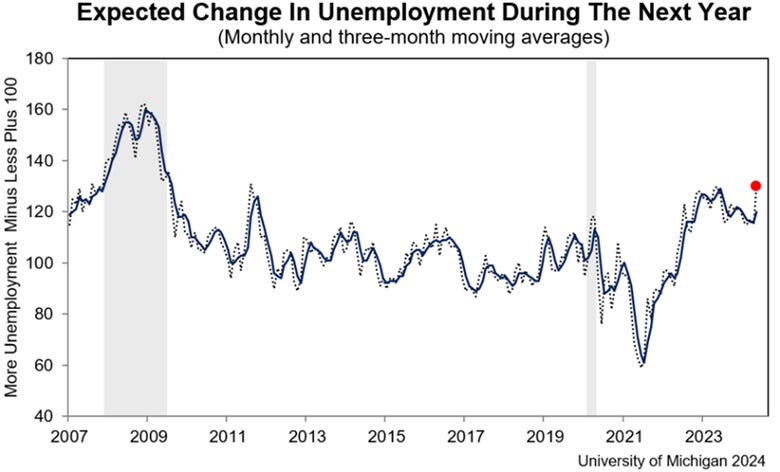

The University of Michigan Consumer Sentiment Index declined to 67.4 in May from 77.2 in April, the lowest in six months and missing market expectations of 76, preliminary estimates showed. The Current Conditions Index fell to 68.8 (vs. 79 in April), while the Expectations Index declined to 66.5 (vs. 76). Inflation expectations increased for the year ahead to 3.5% (vs. 3.2%), the highest in six months, while the five-year outlook increased slightly to 3.1% (vs. 3%) the highest in six months.

Key Takeaways: The notable drop occurred after three months of little change and captured a broad deterioration in sentiment across all consumers by age, education, and income groups. “Consumers in western states exhibited a particularly steep drop. While consumers have been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions. They expressed worries that inflation, unemployment, and interest rates may all be moving in an unfavorable direction in the year ahead,” said the Surveys Director, Joanne Hsu. There was a large jump in unemployment expectations, while all three income groups showed a worsening view of their financial situation versus a year ago. The jump in one-year ahead inflation expectations will not sit well with Fed officials, although five-year ones remained little changed.

*Underlying sentiment readings broadly fell for both current and future outlook

*Sentiment worsened for all age, wealth, education, and political groups

*Views on the future of the labor market notably worsened

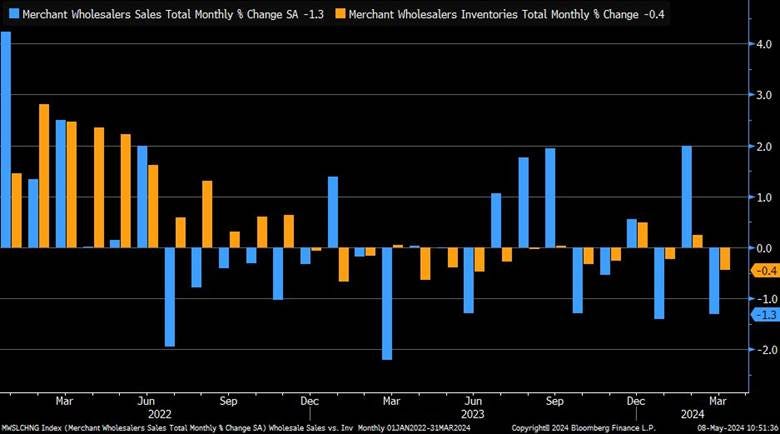

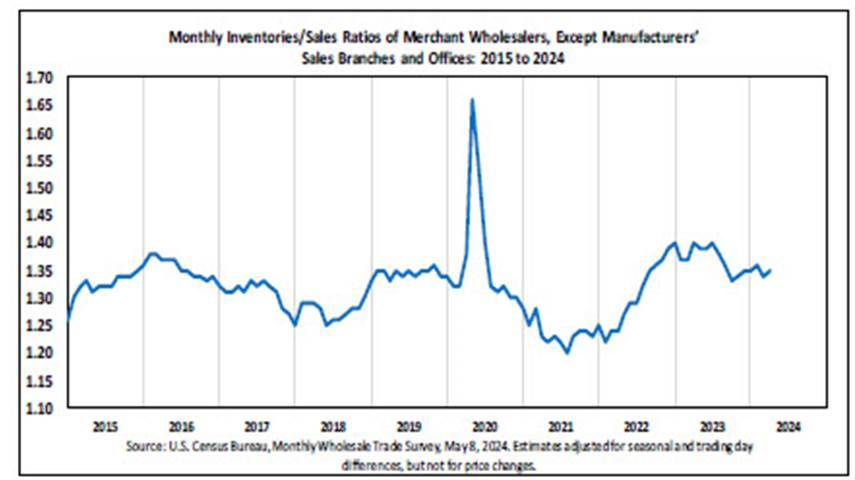

Wholesale inventories decreased by 0.4% month-over-month in March, matching the advance estimate and following a downwardly revised 0.2% rise in the prior month. Nondurables stocks saw a decrease of 1.1% MoM (vs. -0.5% in Feb), mainly on account of farm products (-2.3%). Inventories of durable goods declined by 0.1% MoM, after a 0.7% increase in the prior month, as the increases in stocks of computer equipment (+2.4%), furniture (+1%) and lumber (+0.8%) were not enough to offset a decline in those of metals (-1.6%) and miscellaneous durable products (-1%). On an annual basis, wholesale inventories have declined by -2.3% in March. The inventories/sales ratio moved to 1.35 in March versus 1.34 in February and 1.40 in March 2023. Total SA sales declined by -1.3% MoM in March but are higher by 1.4% YoY.

Key Takeaways: The decline in wholesale inventories was in line with expectations and boosted the Atlanta Fed’s GDPNow Q2 growth rate by 0.1pp to 3.4% and left sell side final domestic sales unchanged (+2.7% Q2 for GS)

*March wholesale sales (blue) declined by -1.3% MoM vs. +0.8% MoM est. and 2% MoM prior, while inventories (orange) declined by -0.4% MoM vs. +0.2% MoM prior

*Inventory/Sales ratio was little changed

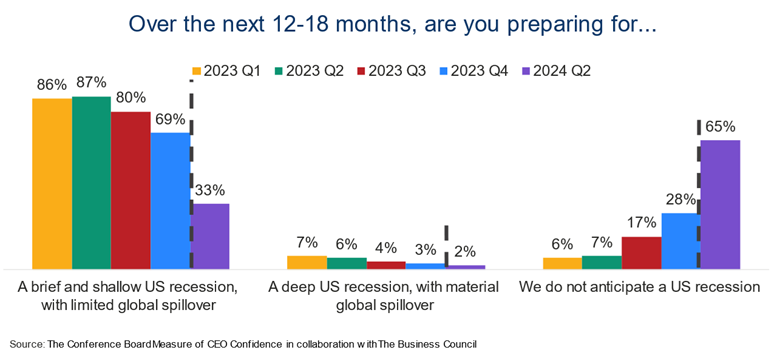

The Conference Board Measure of CEO Confidence increased to 54 in Q2 2024, up from 53 in the previous quarter. Assessments of general economic conditions were more positive, with 16% saying conditions were worse (vs. 22% in Q4 ’23). However, a lower 30% said conditions were better (vs. 32%). The conditions in their own industry were seen to be about the same as last quarter. Future optimism regarding Q2 was higher, with only 15% expecting conditions to worsen (vs. 20% for Q1). 33% (vs.35%) of CEOs expect to expand their workforce over the next year, while 21% (vs. 23%) expect to reduce headcount. 31% (vs. same) report some problems attracting qualified workers, but only in key areas, while only 12% (vs. 15%) report serious and widespread problems attracting qualified workers. 75% of CEOs expect to increase wages by 3% or more over the next year, up from 72% in Q1. The majority of CEOs are not planning to revise capital spending plans (64). However, 21% (vs. 28%) of CEOs expect their capital budgets to increase over the next year.

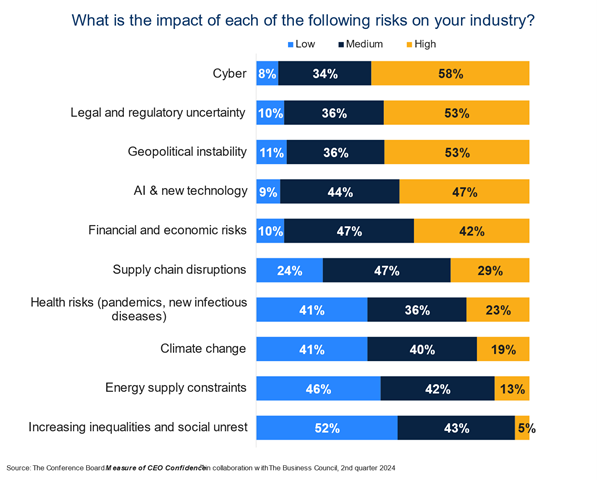

Key Takeaways: CEOs are notably more positive on Q1 ‘24 versus Q1’23, marking the second consecutive quarter in which the measure is above 50. “Recession fears have faded considerably: Only 35% of CEOs surveyed in April anticipate a recession within the next 12 to 18 months, down from 72% in Q4 2023,” said Roger Ferguson, Jr., Vice Chair of the Business Council. However, CEOs on margin are only slightly more optimistic than last quarter, with Q2 expectations slightly worse than Q1, due to fewer CEOs saying conditions will be ‘much better’ or ‘better’ and more saying conditions will be the ‘same.’ “Fewer CEOs say they expect to have difficulty finding qualified workers. Nonetheless, persistent concerns about labor shortages are still prompting many CEOs to anticipate the need to retain workers. This labor hoarding comes at the cost of higher input costs, as most firms anticipate raising wages by more than 3% over the next twelve months,” said Dana Peterson, Chief Economist of Conference Board. Capital expenditure plans were unchanged, indicating no cutback in spending but also no increase in desire to grow capacity or combat labor shortages. Finally, cyber risks were ranked first, followed by geopolitical instability and legal and regulatory uncertainty.

*The CEO Confidence Index was above 50 for a second quarter, signaling more CEOs had a positive than negative outlook

*Recession fears have dramatically fallen

*Cyber risks were the top worry, but economic risks were also notable

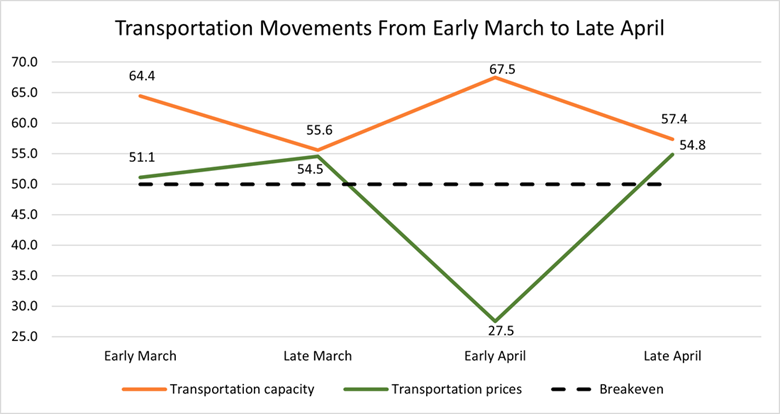

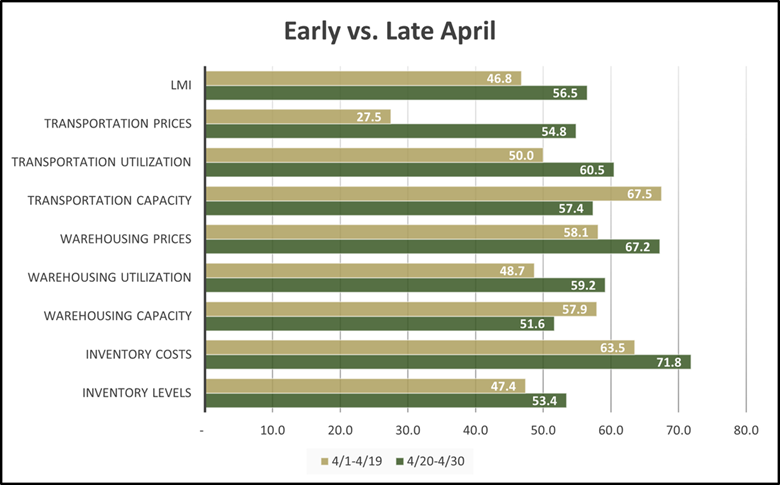

The Logistics Manager’s Index declined to 52.9 in April, down from March's 58.3, marking the slowest growth rate this year. The decline was driven by a significant drop in Inventory Levels expansion (51 vs 63.8 in March), indicating a very slight expansion in inventories. This had a cascading effect across the supply chain, as lower levels of inventory led to a loosening of both warehousing and transportation capacities. There was also a slower expansion for Warehousing Utilization (55.1 vs. 63.4), and most importantly, Transportation Prices (44.1 vs. 53) moved back into contraction. Respondents predicted an overall future growth rate of 62.7 over the next year, which is down very slightly (-0.8) from March’s future prediction of 63.5.

Key Takeaways: Despite the overall decline on the index for April, the second half of the month saw a temporary uptick in transportation and logistics activity, possibly influenced by seasonal restocking or greater future optimism. “Whether this trend persists into May remains uncertain, but the latter part of April better aligns with recent industry trends compared to the sharp contraction observed in the first half of the month,” the official report noted. Respondents continue to be largely optimistic about the future of the logistics industry, and readings suggest respondents expect a healthy, sustainable rate of growth throughout the rest of the year, with little difference in views between upstream and downstream respondents. However, large businesses were more optimistic (and busy at the current readings level) than small ones. An interesting contradiction in the predictions is that inventory levels are expected to grow at a robust level (62), but at the same time, capacity is expected to loosen up (58.2 for Warehousing Capacity and 52.0 for Transportation Capacity). This indicates pricing pressures may not be as strong as when inventory levels rose in past periods. Official commentary in the report also noted that for LMI officials to feel “comfortable calling an end to the freight recession, we would have to see several readings in a row in which prices grow faster than capacity. While we inched close in late April, we are still some distance away from moving back into a boom period.”

*There was a broad bounce back in logistical activity in late April…

*…with early (gold bars) April seeing a notable pullback from March and late (green bars) April recovering much of this

Articles by Macro Themes:

Medium-term Themes:

Half the World (2024 Election News):

Coalition SA: An alliance of South African opposition parties can win a May 29 election and would bring significant change after 30 years of African National Congress (ANC) government, the chairperson of the talks that led to the alliance being formed said on Wednesday. The Multi-Party Charter (MPC) has 11 member parties who have agreed on broad policy priorities including a commitment to a free market economy, and whose ambition is to dislodge the ANC in the most unpredictable election of the post-apartheid era. Polls suggest the ANC will lose its majority while remaining the largest party, opening the possibility of a coalition government. - Opposition alliance can win South African election, says chair - Reuters

Sheinbaum Widens Lead to 30 Points as Time Runs Out for Gálvez – Bloomberg

India's election enters second phase: Four crucial states to watch - NikkeiAsia

Senegal’s Fake News Law Crushed Dissent and Helped Elect a President - Bloomberg

China’s Rebalancing Act:

Better Balance: China’s imports of critical equipment for developing artificial intelligence have surged this year, official data has shown, driving a return to trade growth for the world’s second-biggest economy as the global race for AI supremacy intensifies. The value of China’s imports of automatic data processing equipment — which includes computers and their components — surged 50 per cent year on year in the first four months of 2024, according to official statistics released on Thursday. Imports of computer chips and other high-tech products recorded double-digit gains from the same period last year. - China’s trade returns to growth on back of AI equipment imports - FT

China Moves to Cool Battery Boom Amid Overcapacity Concerns – Bloomberg

China’s Alternative Order – Foreign Affairs

Longer-term Themes:

The Singularity is Near (AI Developments) and Cyber Life (More Generally):

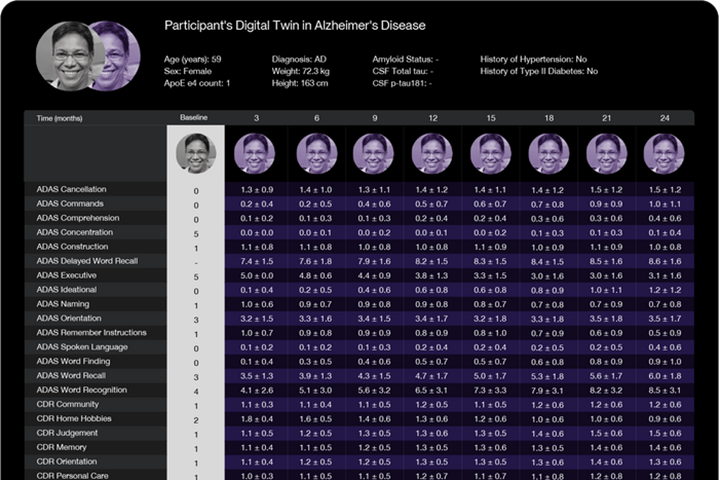

Digital Twin: Artificial intelligence is making it possible for companies to replace humans in tasks that range from modeling sweaters to participating in clinical trials. AI systems can take in data on a person’s individual characteristics—such as appearance, shopping preferences and health profile—then predict how they would look in an item of clothing, how they would answer a question or be affected by a disease. This AI content, sometimes referred to as a person’s digital twin, is already being used for a variety of tasks. While the technology raises questions over the future of the human workforce, these companies say humans continue to play a vital role, and can be compensated for their willingness to share their data for the creation of AI twins. For businesses, the digital people are a way to scale faster and save on costs. - The AI-Generated Population Is Here, and They’re Ready to Work – WSJ

Security above all else—expanding Microsoft’s Secure Future Initiative - Microsoft

Deepfakes of your dead loved ones are a booming Chinese business – MIT Tech Review

OpenAI Releases ‘Deepfake’ Detector to Disinformation Researchers - NYT

The Demise of Unipolarity: A World of Rising Regional Sphere

Three Blocs: With the world now divided among three broad blocs of countries – China-leaning, US-leaning, and nonaligned – both a “significant reversal of the gains from economic integration” and “a broad retreat from global rules of engagement” are on the horizon, said Gita Gopinath, the first deputy managing director of the IMF. Although economic fragmentation is not yet as severe as it was during the Cold War, Gopinath said, it carries a much greater potential cost thanks to higher global reliance on trade. China’s share of US imports fell by 8 percentage points between 2017 and 2023 as trade and overall relations between the two countries fragmented, while the US’ share of China’s exports fell by about 4 percentage points during the same period. - China-West divide threatens ‘reversal’ for global economy, IMF official warns - SCMP

China’s Xi Shouldn’t Expect an Easy Ride in Europe This Time - WSJ

Russia plotting sabotage across Europe, intelligence agencies warn - FT

Saudi Arabia’s $100 Billion AI Fund Will Divest China If US Asks – Bloomberg

Food: Security, Innovations, and Climate Change Implications:

India, the world’s biggest consumer of pulses, removed import duties on some varieties in a fresh bid to curb food inflation with national elections in full swing. The government scrapped the levy on chickpeas and extended tax-free imports of yellow peas just days ahead of the third phase of polling on Tuesday. Pulses are an important part of Indian cuisine and the main source of protein for millions in the world’s most populous nation. - India Scraps Pulses Import Tax to Cool Prices Amid Election - Bloomberg

Scientists are trying to get cows pregnant with synthetic embryos – MIT Tech Review

The Case for U.S.-China Cooperation on Climate-Smart Agriculture - CSIS

Cold Places (Deep Sea, Artic, and Space Capitalization):

Tug-of-War: The National Space Council will reevaluate national security space roles and responsibilities among various players. Speaking at the GEOINT Symposium Wednesday, Chirag Parikh, the council's executive secretary, said the council will examine the ongoing tug-of-war between military leaders concerned with speedy access to imagery and data and intelligence agency leaders who emphasize the need to verify information and gather insights. The National Space Council will consider solutions ranging from policies, authorities and processes to funding, advocacy and communications. - National Space Council will explore military space and intelligence roles and responsibilities - SpaceNews

In the Race for Space Metals, Companies Hope to Cash In - UnDark

Hacking Biology (Medical Innovations):

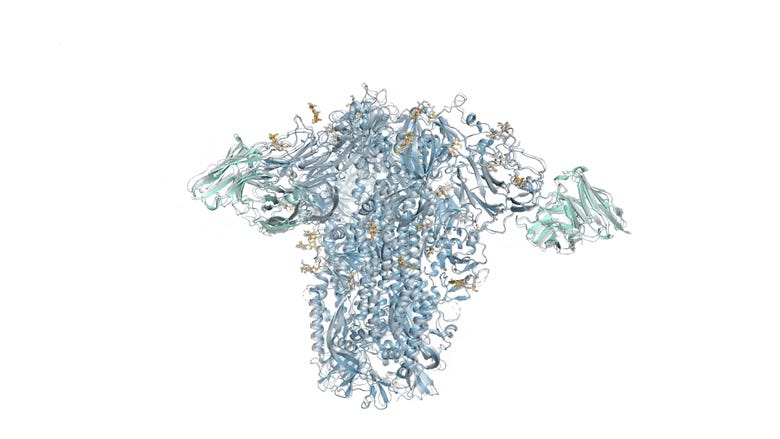

Predict DNA: Google DeepMind has released an improved version of its biology prediction tool, AlphaFold, that can predict the structures not only of proteins but of nearly all the elements of biological life. DeepMind turned to diffusion techniques, which have been steadily improving in recent years and power image and video generators. It works by training a model to start with a noisy image and then reduce that noise bit by bit until an accurate prediction emerges, a method that allows AlphaFold 3 to handle a much larger set of inputs. It’s a development that could help accelerate drug discovery and other scientific research. And the tool is already being used to experiment with identifying everything from more resilient crops to new vaccines. - Google DeepMind’s new AlphaFold can model a much larger slice of biological life – MIT Tech Review

Automated Warfare:

Leveraging: Northrop Grumman’s Manta Ray long-endurance submersible drone demonstrator has recently undergone significant advancements, marked by the release of new imagery during in-water testing off the Southern California coast. Developed under the Manta Ray program for DARPA, this extra-large unmanned underwater vehicle (UUV) aims to showcase critical technologies for a new class of very long-endurance payload-capable UUVs. Dr. Kyle Woerner, DARPA program manager for Manta Ray, emphasized the successful testing as a validation of the vehicle’s readiness for real-world operations. The Navy’s interest in UUVs of various tiers, including the extra-large category represented by Manta Ray, aligns with broader strategic goals for maritime operations. The acquisition of diverse UUV capabilities, such as the Orca extra-large uncrewed underwater vehicle from Boeing, underscores the importance of unmanned platforms in future naval warfare scenarios. - The Manta Ray Underwater Drone Is Even More Enormous Than Everyone Thought – Wonderful Engineering

Robot dogs armed with AI-targeting rifles undergo US Marines Special Ops evaluation – ars Technica

IDF’s Advanced AI Weaponry and Robotics Raises Ethical Questions on Modern Warfare - CCN

Other Articles of Interest:

Quantum Leadership: The world is on the cusp of a second quantum revolution, and it will likely prove as consequential as the first that delivered nuclear weapons and energy, lasers, magnetic resonance imaging (MRI) scanners, and transistors. While the United States once dominated quantum research and development, its lead has since slipped. The United States needs an unclassified national quantum strategy that outlines a plan to promote and protect the United States’s quantum ecosystem and updates the 2018 National Strategic Overview for Quantum Information Science—which came packaged within the now-expired National Quantum Initiative Act. - The U.S. Needs a Strategy for the Second Quantum Revolution - Lawfare

The Science Behind Why the World Is Getting Wetter – WSJ

China's Rare Earth Dominance Faces Challenges As Global Supply Chain Shifts – OilPrice.com

Podcasts and Videos:

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.