Inflation Readings Cool Further, Leading Markets to Question Fed’s Resolve- MIDDAY MACRO WEEKEND READ– 1/13/2023

Color on Markets, Economy, Policy, and Geopolitics

MIDDAY MACRO WEEKEND READ – 1/13/2023

Overnight and Morning Recap / Market Wrap:

Price Action and Headlines:

Equities are higher, with a further drop in inflation expectations in this mornings data turning overnight/morning weakness around, with financials now higher after initially negative earnings reception

Treasuries are lower, with the curve slightly steeper due to the more risk-on-tone leading yields to retrace yesterday’s drop but still well below pre-CPI levels

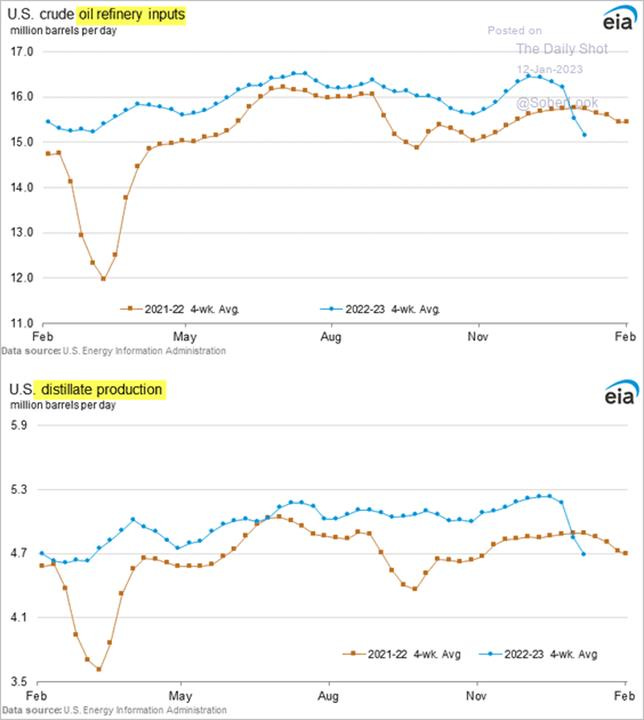

WTI is higher, nearing $80, and having the strongest weekly gains in a month as China reopening/demand fears fall while distillate shortages worries increase

Narrative Analysis:

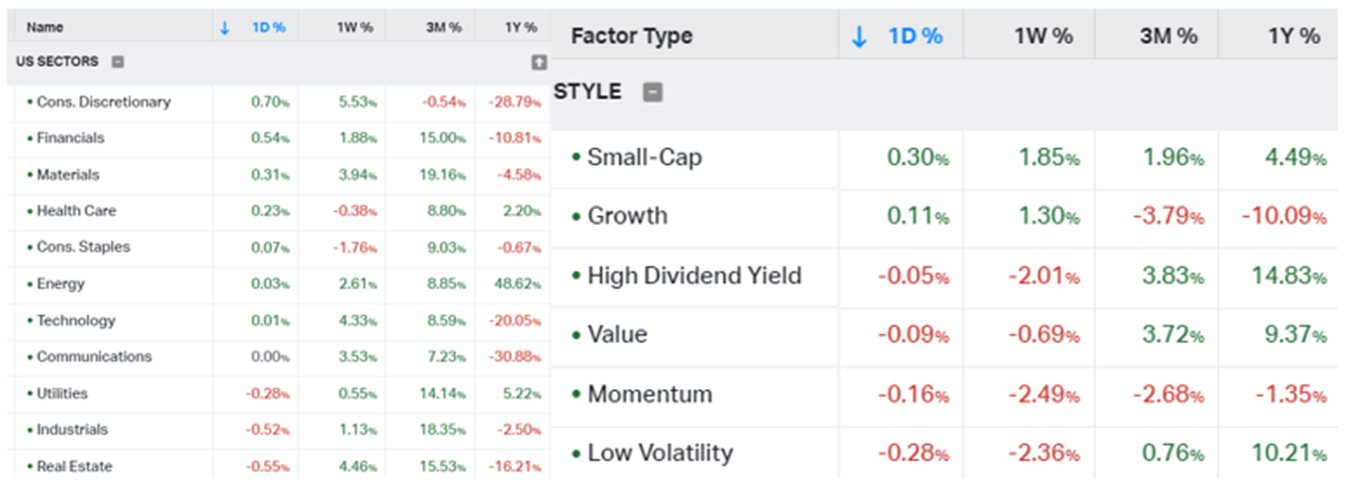

The week looks to be ending on a positive note, with this morning's earnings and consumer confidence data keeping the post-CPI positive momentum going, albeit at a reduced rate. Small-Caps/Growth and Consumer Discretionary/Technology were the clear outperformers on the week, helped by falling yields and reduced Fed tightening fears, although recessionary worries continue to weigh on earnings estimates. All eyes are now turning to changes in forward guidance as Q4 earnings season kicked off today with the large banks, which initially sold off but are ending the session in the green, delivering solid earnings despite further warnings of tough times coming. Treasuries are giving back yesterday’s gains but ending the week well in the green thanks to their post-CPI rally, which saw 10yr yields hit their lowest level in a month. Oil also posted a solid positive week with the recent sell-off in energy retracing more generally. Copper continues to rally notably, as China's reopening has much of the industrial metal complex at multi-month highs. Finally, the dollar continues to drop, with the $DXY near 102 and falling through recent support due to gains in the Yen, as YCC is increasingly being questioned there.

The Russell is outperforming the Nasdaq and S&P with Small-Cap, Growth, and High Dvd Yield factors, as well as Cons. Discretionary, Financials, and Materials sectors all outperforming on the day. The week, again, had a more pro-cyclical growth feel. However, Discretionaries and Tech were the clear leaders due to lower real rates and short covering, which also helped small caps and growth factors outperform on the week.

@KoyfinCharts

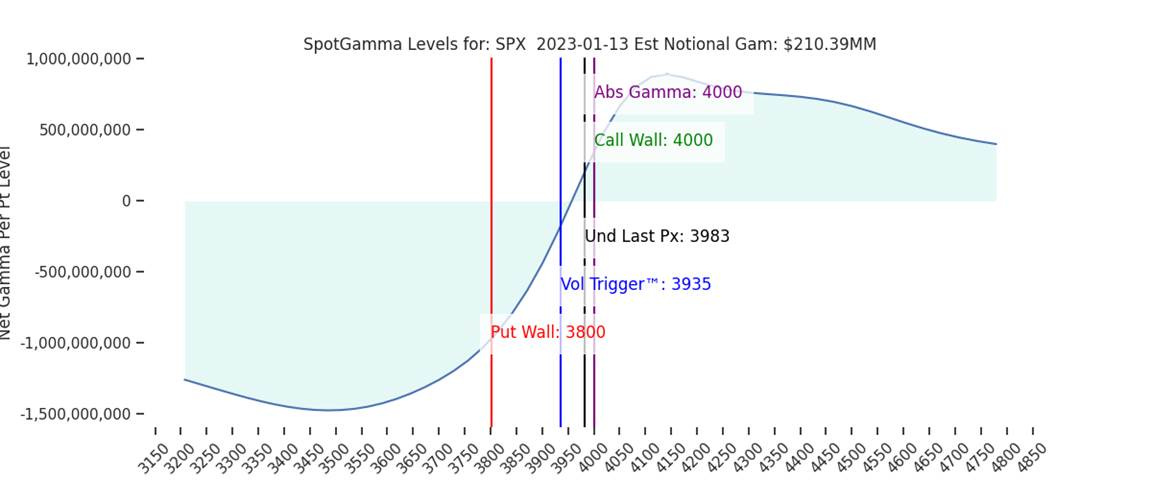

S&P optionality strike levels have the Zero-Gamma Level at 3955 while the Call Wall is 4000 and Put Wall is 3800. There remains a lot of call buying/strikes at 4000, but there was low demand for calls yesterday following the CPI print. Further, skew readings seen through risk reversals all remain low, which suggests a lack of long-put demand. The VIX closed under 20 for the first time since early December, and implied volatility is now under 30-day realized volatility. This indicates risk has come off, usually associated with an event passing/policy change, or traders have “oversold” volatility.

@spotgamma

S&P technical levels have support at 3995, then 3860 (major), with resistance at 4020, then 4050 (major). The S&P is back in a sideways channel structure. The bottom was a major support level in early December, which eventually broke around December 15th. We backtested it Monday from below, re-tested it, broke through, and then yesterday backtested it from above. Until the 200 DMA is recaptured and 4050 is meaningfully broken and backtested, the longer-term downtrend remains intact.

@AdamMancini4

Treasuries are lower, with the 10yr yield at 3.50%, higher by 6 bps on the session, while the 5s30s curve is flatter by 2 bps, moving to -2 bps.

Deeper Dive:

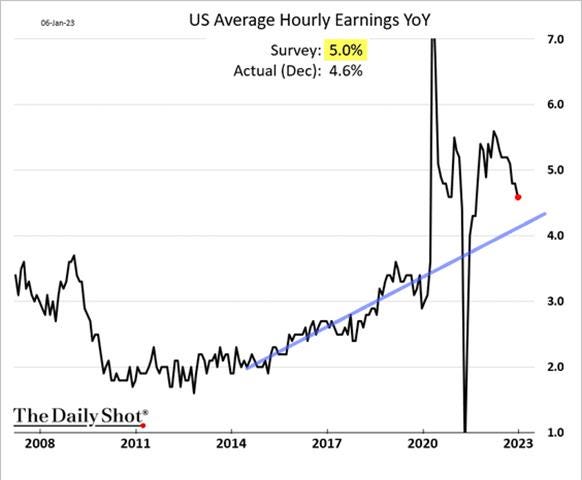

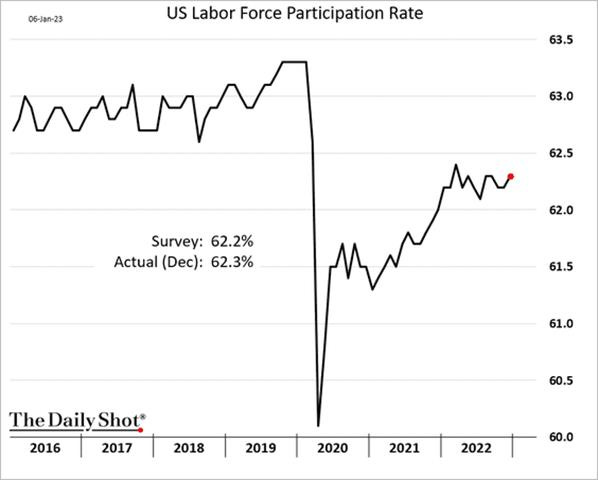

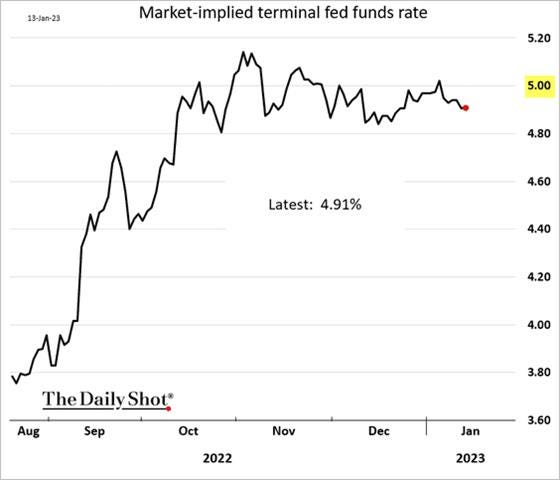

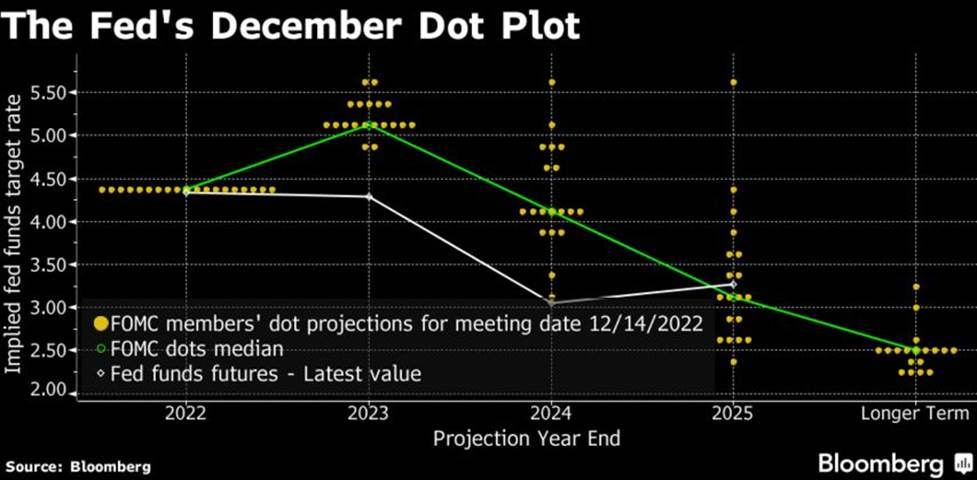

Despite last week's “cooler” jobs report (with declines in AHE) and this week’s improving inflation data (both CPI and expectation readings), the song remains mainly the same. Fed speakers continued to indicate a desire to reach a terminal rate above 5% and hold there for “some time,” although an increasing chorus (Bostic, Harker, Barkin) called for a more gradual/normal pace of 25 bps hikes moving forward. As a result, a further loosening in financial conditions still remains challenging, and the current rally in equities remains capped, with little incentive to chase at current levels. This is due to two major headwinds, the continuation of tight labor markets (muddling the future inflation picture) and the persistence of recessionary and subsequently earning growth fears (which change daily), as well as the now always lurking significant geopolitical tail risks regarding China and Russia. With that said, we remain comfortable with the holding in our current mock portfolio. We see Q4 earning expectations as overly pessimistic, given how the actual domestic economy performed. We see China’s reopening as ultimately being a highly risk-positive thing, despite the general messiness of how it's proceeding. Finally, we see recent rises in consumer sentiment due to falling inflationary fears and expectations of improving real disposable incomes as supporting aggregate demand and leading to improvements in business sentiment, which will floor any cooling in the labor market. As a result, we continue to advocate tactical trading and risk discipline but look for the current rally to have another leg higher, leading us to raise our tactical price targets for the S&P and other holdings.

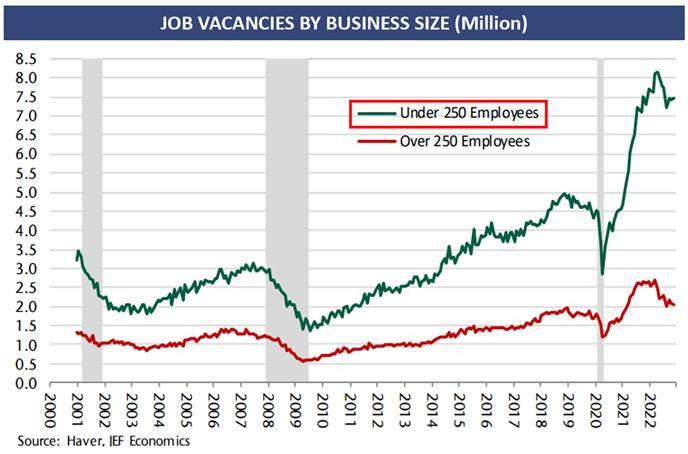

Looking at headwind number one more closely, the need to see labor markets loosen, giving the Fed its final piece of the puzzle to have confidence inflation is trending back to target as forecasted (or faster), may prove elusive. Given the massive supply-side shock the pandemic caused and the structural change to labor markets (reduced EPOP and a weaker relationship/bargaining power with capital/production) that occurred, we continue to see no need for a significantly higher unemployment rate to move the supply and demand balance further and inflation back to the 2% target. That shift is already occurring meaningfully enough as seen in reduced backlogs, workweeks, and falling logistical costs, as well as interest-rate sensitive demand plunging. As the lagged effects of tighter policy further weigh on real activity and continue to push down the current inflationary wave, which we still attribute mainly to supply-side factors, the real risk for the Fed will be overshooting (its 2% target) to the downside in 2024.

*Markets took comfort in the decline in AHE, with wage-spiral worries falling, supported further by declines in consumer inflation expectations this week (reducing labor bargaining expectations)

*We expect EPOP level to have structurally fallen but wage pressures to subside still as firms have found ways to do more with less, reducing future labor demand

*Markets have reduced their rate hiking expectations for the next FOMC meeting as the worry of overtightening grows

*The terminal rate has been in a tight range since last fall when inflation peaked, and recessionary fears really began to grow

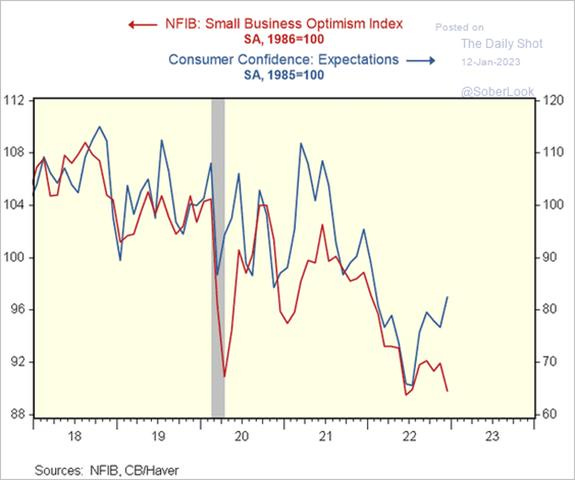

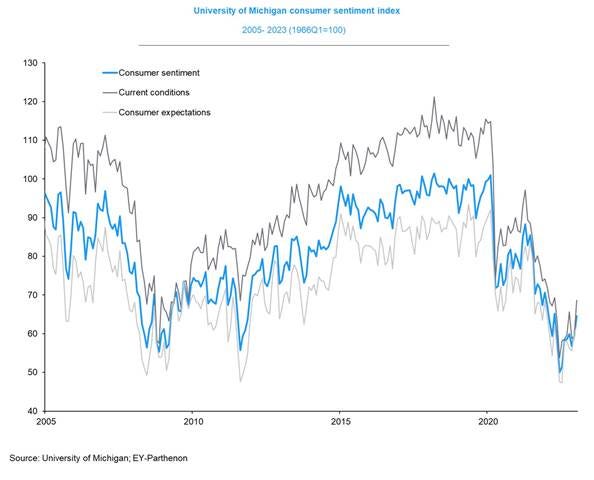

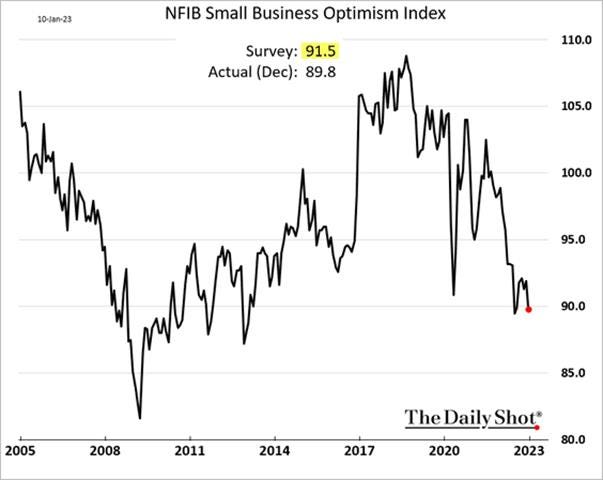

It was long our expectation that falling prices, especially at the pump, would lead to consumer confidence rebounding around year-end as labor markets remained healthy. We also expected a cooling in harder data, such as retail sales and industrial production, as demand fell due to falling new and backlog of orders, general overstocking in prior periods, and more service-focused consumers. As a result, there should be a growing divergence between current sentiment (▼) and future expectations (▲) as businesses deal with greater future sales uncertainty but continue to hire needed positions. Regional Fed business surveys are beginning to show this increasingly. This divergence was also seen in this week's NFIB Small Business survey, which showed confidence weakening, mainly due to views on inflation still being highly negative and sales expectations falling, but there was still a historically high desire to hire and raise compensation. As a result, we expect negative business sentiment to follow consumer sentiment higher as reduced input costs and less loss of sales than expected materialize in Q1 ‘23. As we saw in Q4 ‘22, there is still a lot of momentum in real activity (it just changed form), and despite the drag that tighter policy is increasingly having on rate-sensitive areas of the economy, consumer activity and hence growth will likely remain near trend for a few quarters more.

*The divergence between consumer confidence and business optimism grew further in Q4

*However, with businesses still citing inflation as a top worry and inflation falling, will optimism bottom and increase in Q1?

*Despite our expectation for business confidence to base, mainly due to falling inflation, it is still likely the pace of hiring will stabilize and job openings will fall as the need/urgency to increase capacity drops

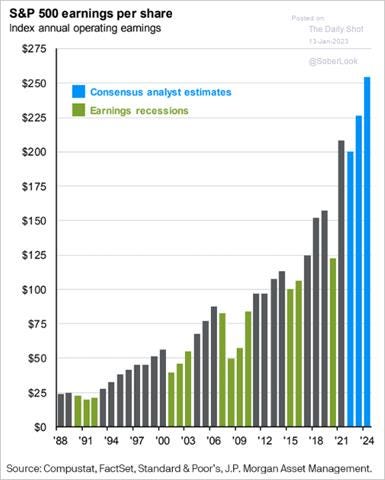

Finally, recession fears and earning expectations will continue to be very volatile. Currently, bad data is good, given markets want to see a cooling in economic activity, reducing inflation expectations and hence Fed tightening worries. No one really knows what tightening policy this “fast and furious” really means, as we don’t have good historical comparisons and well models drive this world, and they are built in a backward-looking fashion. However, eventually, as the trend lower in inflation becomes more pronounced, markets will again need to see that growth is not materially dropping and hence tighten the now wide dispersion in ’23 earning expectations. The stronger-than-expected growth level in Q4, as seen through the Atlanta Fed’s GDPNow, makes this earnings season more critical in setting investor sentiment and trading ranges moving forward. If the economy can maintain momentum around trend growth, earning estimates may be fair currently, reducing downward pressure on prices. Coupled with reduced Fed tightening fears and hence further easing in financial conditions (due to that), multiples could expand again, driving price gains into the summer. This is our modal expectation and why we see a further rise of 10% at the index level as very possible in Q1. We acknowledge a simplification in thinking here, and there are many other variables at play here but given our mock portfolio’s positioning want to elaborate on why we are long U.S. equities.

*Many feel earning estimates are still too high, and historically they usually are, but earnings can also have poor predictive power on where stock prices go

*The dispersion in Q4 ‘22 earning estimates is unsurprisingly historically high

*The mock portfolio has benefited from the strong start to January, with our largest positions in long S&P and Copper and short dollar position all rising notably. We moved higher our S&P target to the 4250 area

Econ Data:

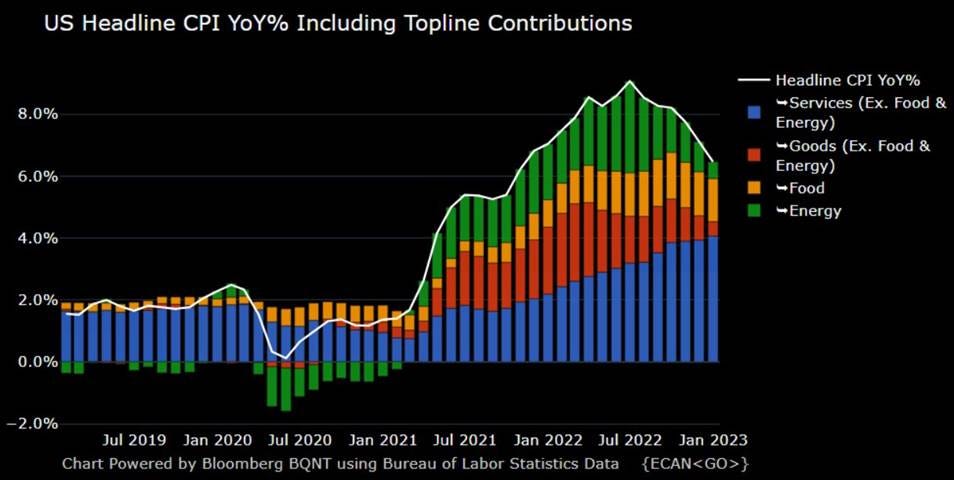

The Headline Consumer Price Index decreased by -0.1% in December, the first decline since May 2020, moving the annual headline inflation rate to 6.5%, the lowest since October of 2021, falling from a 7.1% reading in November. Core consumer prices increased by 0.3% MoM, compared to a 0.2% rise in the prior month, in line with market expectations. Year-on-year, core consumer prices fell to 5.7% from 6% in November. The headline rate was driven down by a -4.5% decline in energy costs, mainly due to a -9.4% drop in gasoline, while food moderated to a 0.3% MoM gain from 0.5% in the previous month. Shelter costs rose by 0.8% MoM while medical care prices edged up by 0.1%, used car prices dropped by -2.5%, and new car prices slipped by -0.1%. Transportation rose by 0.2% on the month, despite a -3.1% decrease in airfares.

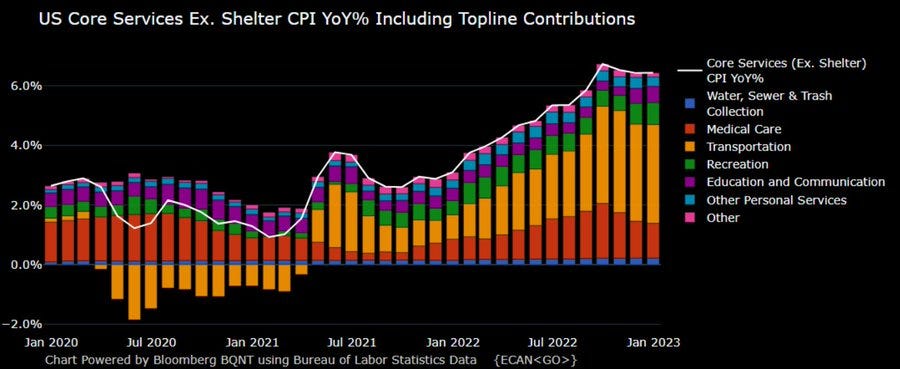

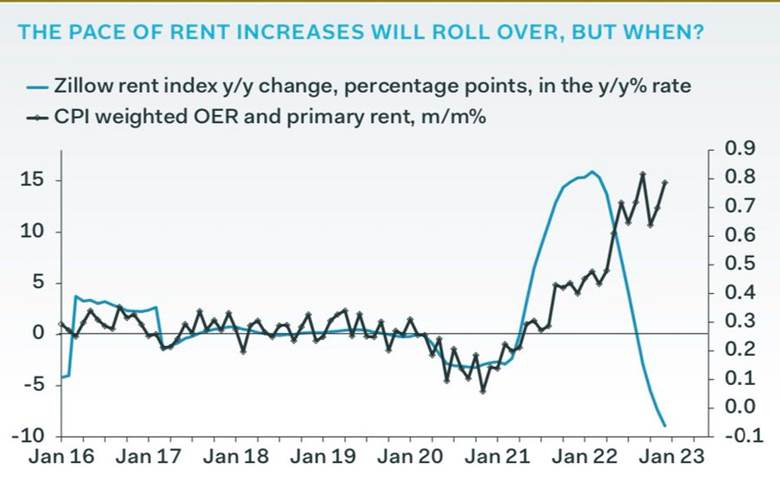

Why it Matters: Both the headline and core CPI measure were exactly in line with expectations, a rare occurrence these days. The breadth of rapid price increases (components that rose at a rate of at least 5%) narrowed to 36% versus 50% in November. Shelter costs continue to rise at an elevated rate, but services prices, excluding energy and rents, rose by 0.3%, and excluding energy, food, and shelter, were lower by -0.1% MoM for the third month in a row. The December CPI shows that inflation is beginning to slow more meaningfully and gives the Fed enough “data” to move to a more traditional 25 bp hiking pace. It is still being helped by falling health insurance prices (on the CPI’s arcane method, health insurance prices fell a further -3.4% in December and have dropped -11.3% since September) and used car prices (down -2.5% in December), both of which are not sustainable. Stepping back, underlying inflation is still running significantly faster than is consistent with the Fed’s 2% PCE price inflation target. The question now is how much the Fed will discount what looks to be a significantly lagged shelter cost index to the reality of falling home and leases prices and how they see core service inflation x-shelter, something that has stopped rising but is not yet falling.

*The service side, with large increases in shelter and more stability than goods outside of that, continues to be the main driver of inflationary pressures

*Transportation and Education & Communication services increased, keeping core service ex. shelter stable

*The FOMC more used Cleveland Fed’s Trimmed Mean CPI measures may be peaking

*Further, The Atlanta Fed’s “sticky” price inflation index 3-month average is falling as the breadth of inflation falls

The University of Michigan consumer sentiment rose to 64.6 in January from 59.7 in December, the highest since April and beating market forecasts of 60.5, preliminary estimates showed. Both current conditions (68.6 vs. 59.4) and expectations (62 vs. 59.9) improved to their highest since April. Year-ahead inflation expectations receded for the fourth straight month, falling to 4.0% from 4.4% in December, the lowest since April 2021. Long-run inflation expectations were little changed from December at 3.0%, again staying within the narrow 2.9-3.1% range for 17 of the last 18 months.

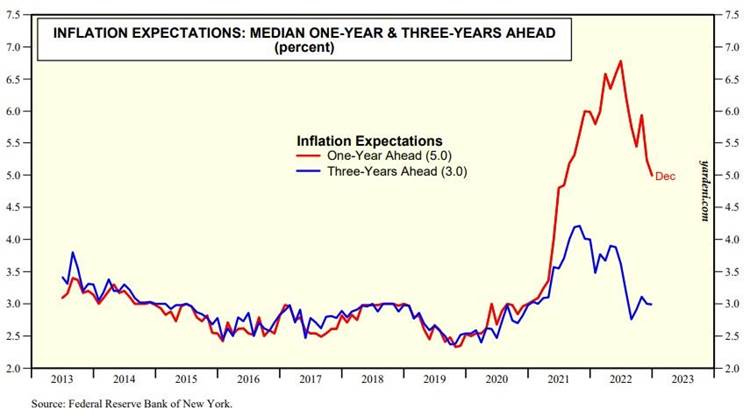

Why it Matters: Consumer sentiment remains low historically but rose for a consecutive month, rising 8% from December. Consumer's current assessments of personal finances improved to its highest reading in eight months due to higher incomes and easing inflation. While the consumer’s short-run economic outlook fell modestly, their long-run outlook rose to its highest level in nine months and is starting to approach a more normal level. Year-ahead inflation expectations receded for the fourth straight month, with the current reading the lowest since April 2021 but still well above the 2.3-3.0% range seen in the two years before the pandemic. Uncertainty over both inflation expectations measures remains high. The decline in inflation expectations seen in this report and data seen in Monday’s NY Fed report will further reassure policymakers that inflation expectations are not becoming unanchored. When coupled with market-implied inflation expectations, there is an increasing decline in future expected levels, which makes sense, given declines in gasoline and inflation peaking more broadly.

*Univ. of Michigan Consumer sentiment readings look to have bottomed due to decreases in inflation (particularly gas prices)

*Declines in one-year ahead inflation expectations picked up speed in January’s initial reading

*Independents and Republicans saw the largest increases in sentiment readings, while Democrat's views on the future fell notably

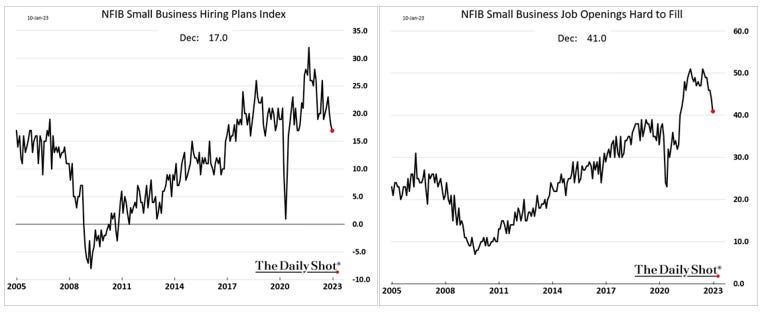

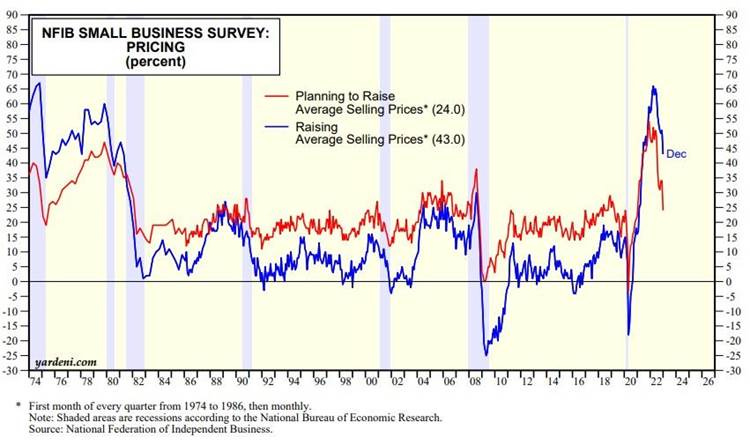

The NFIB Small Business Optimism Index declined to a six-month low of 89.8 in December. Expectations for better business conditions over the next six months worsened by 8 points to -51%. Inflation remains the most serious business problem, with 32% of owners reporting it as their top problem. The percentage of owners reporting labor quality as their top problem remains elevated at 23%, up 2 points from November. Labor costs reported as the single most important problem decreased by 1 point to 8%, which is historically high.

-10% of owners expect real sales to be higher, worsening by 2 points.

55% reported hiring or trying to hire in December, down 4 points from November

41% of owners reported job openings that were hard to fill, down 3 points but historically very high.

44% reported raising compensation, up 4 points and 6 points below the 49-year record high set in January last year.

43% of owners reported raising average selling prices, decreasing by 8 points, but historically high.

Why it Matters: The labor situation remains frustrating for small business owners. The staffing shortage has limited small business owners’ ability to expand production capacity, but the need to expand is starting to fade. Consumer sentiment is depressed, but spending is still holding, just softer. Inflation is still eating away at compensation gains. Owner optimism has been fading (October and November were the lowest readings in 2022), with lower readings held off by solid labor market components, but that is likely to change moving forward. “Small business owners remain frustrated with the current labor situation,” said NFIB Chief Economist Bill Dunkelberg. “The trend in planned hiring eased slightly as labor quality and labor cost are two top issues for owners. Owners raised compensation again in December to attract and retain employees.”

*Small business owner’s optimism has fallen back to recent lows after a slight rebound at the end of ‘22

*Openings and hiring plans are beginning to fall at a faster pace

*Actual increases and plans to increase selling prices are also falling fast

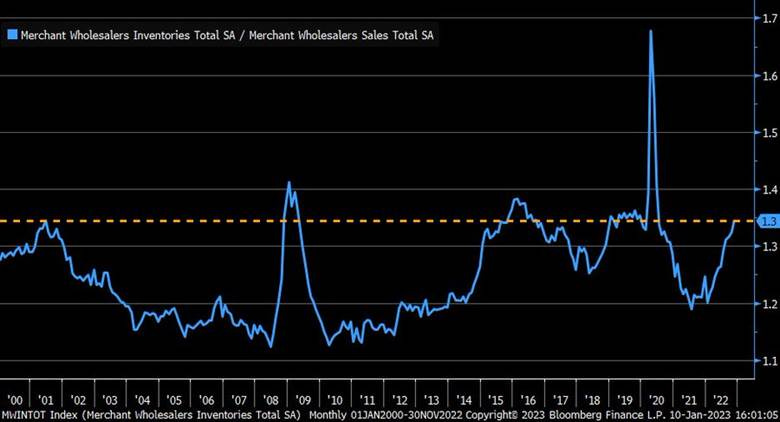

Wholesale inventories rose by 1% to $933.1 billion in November, in line with preliminary estimates and picking up from the 0.6% increase in the previous month. Inventories accumulated at a faster pace for durable goods (1.1% vs. 0.8% in October) amid a rebound for inventory changes of furniture (1.4% vs. -2.2%) and professional equipment (1% vs. -0.2%), while growth continued at a high pace for machinery (2.2% vs. 2.9%). Inventories levels also accelerated for non-durable goods (0.7% vs. 0.3%), largely due to rebounds in stocks of drugs (2.7% vs. -0.7%) and apparel (2.3% vs. -0.5%). On an annual basis, wholesale inventories rose by 20.9%, slightly below the 21.9% increase from the prior month. The November inventories/sales ratio was 1.35, compared to a ratio of 1.21 in November ‘21.

Why it Matters: On the aggregate, firms continue to grow their inventories even as future demand looks to be weakening. We have already seen backlogs increasingly normalize and the desire to expand capacity fall (shorter average work weeks and reduced logistical pressures). The desire to hold higher inventory levels due to the pandemic experience will likely reverse, and firms will return to a more historical level. This will reduce inflationary pressures as buyers regain more bargaining power.

Inventory/Sales Ratio continues to rise as wholesalers are increasingly finding themselves overstocked

U.S. consumer inflation expectations for the year ahead declined for a second month to 5% in December, the lowest level since July of 2021 and compared to 5.2% in November. Expectations declined by 0.7 percentage points for gas (to 4.1%) and food (to 7.6%) and 0.2 percentage points for rent (to 9.6%). The medium-term inflation expectations remained at 3%, while the five-year-ahead measure increased to 2.4% from 2.3%. Household spending expectations fell sharply to 5.9% from 6.9%, while income growth expectations rose to a new series high of 4.6%. Unemployment expectations decreased by 1.4 percentage points to 40.8%, while the perceived probability of losing one's job in the next 12 months increased by 0.9 percentage points to 12.6%, its highest reading since November 2021. Similarly, the mean probability of leaving one's job voluntarily in the next 12 months increased by 0.7 percentage points to 19.3%.

Why it Matters: Further declines in inflation expectations show that consumers continue to believe the worst is behind us, with one year still highly elevated but falling quickly. This bodes well for the Fed and is reinforced by the large decrease in spending expectations, which indicates a more defensive consumer mentality is emerging. However, views around the labor market continue to be very strong, with expectations for increases in income/earnings and voluntarily quitting continuing to rise. In aggregate, this report shows that inflation expectations and future spending drivers are falling while the consumer still expects to be employed and has a rising cash flow level.

*Inflation expectations are falling fast thanks to drops in gasoline, but expectations for future rises in food and rents are still very high

Consumer credit increased at a rate of 7.1% in December. Revolving credit increased at an annual rate of 16.9%, increasing from 10.3% in October, while nonrevolving credit increased at an annual rate of 3.9%, falling from 6.5%.

Why it Matters: Total consumer credit is now above its long-run trend after falling sharply at the onset of the pandemic. As expected, growth in nonrevolving credit, as seen mainly from mortgages, is slowing due to housing affordability still being punitive, while revolving credit, or the use of credit cards, is growing due to consumers losing real disposable income due to the high level of inflation. This trend will likely continue throughout the first half, but a strong labor market and a falling inflation tax, as well as mortgage rates likely having peaked and housing affordability stabilizing, should see the trend eventually break.

*Total Consumer Credit was higher by $28 billion, although the annual percentage growth fell to 7.1% due to tough comparables in nonrevolving credit

*The middle class is increasingly turning to their credit card, and the cost to do so has risen, but revolving credit is only now approaching its long-run trend

Policy Talk:

Chairman Powell attended the Symposium on Central Bank Independence in Stockholm, Sweden, where he gave prepared remarks titled "Central Bank Independence and the Mandate—Evolving Views." He emphasized three main points; Federal Reserve's monetary policy independence is important and serves the American public well. Second, the Fed must stick to its goals of achieving maximum employment and price stability through transparent policy. Third, the Fed should not pursue perceived social benefits that are not tightly linked to our statutory goals and authorities. Powell did, however, acknowledge the Fed does have responsibilities as a regulator to make sure banks know and "appropriately manage" financial risks associated with global warming. We applaud Powell for his comments and commitment, but before the pandemic saw a significant creep in the Fed’s focus/culture that was increasingly focusing on more ESG issues. As a result, it seems Powell said what was expected of him, but as inflation returns to a more normal level, it is likely corners of the Fed will continue to make a case for addressing/opining ESG topics.

"We should 'stick to our knitting’ and not wander off to pursue perceived social benefits that are not tightly linked to our statutory goals and authorities."

The Fed should "resist the temptation to broaden our scope to address other important social issues of the day."

"Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals. We are not, and will not be, a 'climate policymaker.'"

Governor Bowman gave similar remarks on bank supervision and the economy twice this week in front of two Florida Bankers Association Leadership luncheons in Miami and Tampa. She noted some progress on inflation, but more work was needed, given the importance price stability played in promoting a strong labor market. As we are commonly hearing from Fed officials, her future decision on policy would be crafted by incoming data, and she still believes it is important the labor market cools for inflation to return to target. She remains somewhat optimistic that a soft landing can still be orchestrated due to the strong labor market, solid household balance sheets, and the current strength of the U.S. banking system. She finished her speech by talking about recent events in the crypto market, CBDC's future in the payment system, climate supervision responsibilities, and updates to the Community Reinvestment Act.

“My views on the appropriate size of future rate increases and on the ultimate level of the federal funds rate will continue to be guided by the incoming data and its implications for the outlook for inflation and economic activity.”

“I expect that once we achieve a sufficiently restrictive federal funds rate, it will need to remain at that level for some time in order to restore price stability.”

“We have also been studying the concept of a central bank digital currency (CBDC). Several foreign governments and central banks are exploring digital currency, and there are many competing proposals suggesting a need to create a digital currency.”

Atlanta Fed President Bostic gave a number of interviews this week and a prepared speech last week. He most recently said he is leaning toward supporting a smaller interest-rate hike at the Fed’s next meeting following this week’s CPI report. However, he has continually noted the need to stay the course and that the Fed can’t “claim victory prematurely” and needs not only to keep pushing rates higher but to keep them there. Bostic is a nonvoter this year but has a high level of public rhetoric, giving him some perceived committee table juice.

“This report was really welcome news. It really suggests that inflation is moderating, and it gives me some comfort that we might be able to move more slowly now that we are in restrictive territory.”

“What I think is the important point is just to hold there and stay there and let that policy stance really grip the economy and just make sure that the momentum is fully arrested so that we get to a place where demand and supply start to become more interbalanced, and we start to see those pressures on inflation really start to come down.”

Richmond Fed President Barkin gave prepared remarks on his 2023 economic outlook in front of the Virginia Bankers Association and Virginia Chamber of Commerce. He started his remarks by reviewing the actions the Fed took last year and why they were needed. He noted the effects have been “substantial,” with investment slowing and asset prices lower. However, he also highlighted how demand destruction in less interest-rate-sensitive areas had taken longer due to many of the tailwinds inflation received due to factors caused by the pandemic. Barkin sees notable progress being made on the inflation front and stated policy is now clearly in restrictive territory, allowing the Fed to reduce the size of future rate hikes. His outlook for the economy pushed back on what he called the most predicted recession, noting that more work was needed to stem inflation but eluding that a recession was not necessary to return inflation back to target.

“Excess savings and the return of consumer borrowing to pre-pandemic levels are funding continued strong consumption, especially for services like travel. Billions in fiscal appropriations are still being distributed. Strong pandemic-era order pipelines and the need for inventory replenishment are sustaining businesses. Employers who fought hard to hire scarce workers are reluctant to fire them.”

“Now, with forward-looking real rates positive across the curve and, therefore, our foot unequivocally on the brake, it makes sense to steer more deliberately as we work to bring inflation down in the context of the lags I just discussed.”

“This has been the most predicted potential recession in memory. But, despite some scares earlier in the year, the data we’ve seen on spending, investment, and employment keep pushing the timeline out —unless you are in housing or sell into a low-income customer base, or are a deal maker, or are dependent on digital advertising.”

Philadelphia Fed President Harker gave prepared remarks titled “The Local and National Economic Outlook” at an event at the Main Line Chamber of Commerce in Malvern, PA. Like Barkin, he gave a recap of how the economy and policy had arrived at its current state, noting the unique effects of the pandemic and the subsequent policy response have led to a phenomenon known colloquially as “too much money chasing too few goods.” He noted that demand in interest-rate-sensitive areas was now clearly falling and there were increasing signs inflation was cooling from that and improvements in supply chains. Harker said he was “pleased” that labor markets were strong. He went on to highlight a few regional concerns. He concluded by saying he expects inflation to continue to fall, labor markets will cool, but no recession is coming.

“I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed. In my view, hikes of 25 basis points will be appropriate going forward.”

I’ve been in the camp that we need to get rates above 5%. How far above? We’ll let the data dictate that. But I don’t think we need to get much further than 5% at this point. And then sit for a while so that we’re not causing undo harm to the labor market.”

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Value is flat on the day and on the week, and Small-Cap Core is the best-performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and the week.

5yr-30yr Treasury Spread: The curve is flatter on the day but steeper on the week.

EUR/JPY FX Cross: The Yen is stronger on the day and the week.

Other Charts:

Its do or die time for the current rally, with the S&P just below its longer-term downtrend resistance and floating between its 50 and 200 day-moving averages as optionality is heavily positioned at the 4000 strike level.

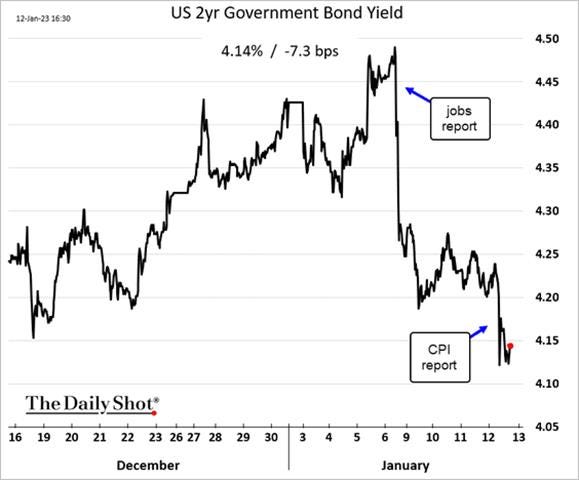

Front-end Treasuries have benefited from the drop in hourly earnings and inline CPI report, with two-year yields falling over 30 bps in a week.

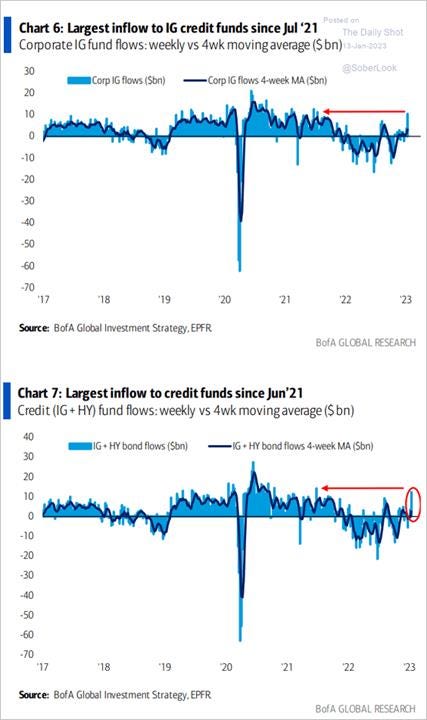

Credit funds saw large inflows last week, with one-month moving averages back in positive territory.

Copper, along with other industrial metals, has been rallying due to sentiment driven by China’s reopening and longer-term supply worries.

Diesel production is falling, and future shortage worries are increasing again due to an embargo on Russian diesel looming, demand for heating oil set to climb, and travel increases. As a result, middle distillate markets could tighten further.

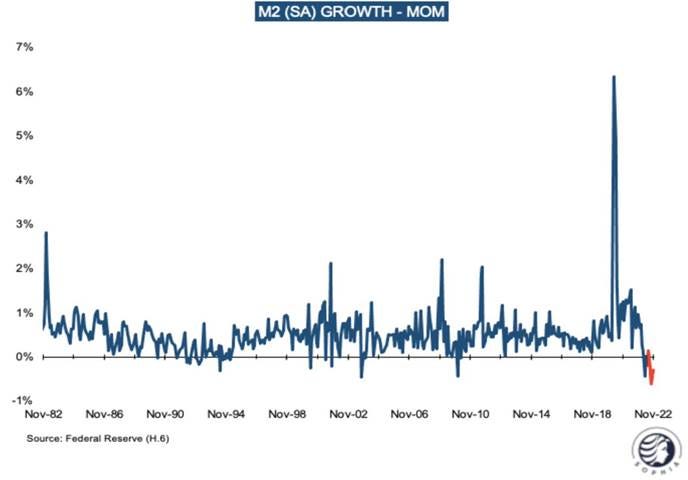

M2 growth continues to be highly negative despite lending activity holding up as QT continues to remove excess liquidity from the system.

There is bifurcated Fed liquidity occurring. QT is trimming liquidity by $95bn a month, or equivalently U.S. equities by -6% over 1Q23. However, debt ceiling-led TGA injections to fuel Fed liquidity by $300bn over 1Q23, or equivalently US equities by +6%. As a result, U.S. equities are likely to seesaw for months based solely on liquidity conditions. - @steve_donze

When adjusting for shelter with a more current reading on rentals or housing prices, a deflationary pulse is emerging.

Mortgage applications remain depressed and are at lows last seen during the GFC when seasonally adjusted

Article by Macro Themes:

Medium-term Themes:

Labor Markets Loosening:

Temp Leads Perm: “The ETI declined for the third consecutive month in December 2022, a signal that further deceleration in job growth is likely over the coming months,” said Frank Steemers, senior economist at The Conference Board. However, the ETI remains at a high level, and job gains are currently still robust. “On the other hand, the number of employees working in temporary help services, a component of the ETI and an important leading indicator for hiring, has fallen for five consecutive months and may foreshadow weaker job gains or even job losses in other industries,” Steemers said. “In addition, wage growth seems to be gradually slowing compared to early 2022, although it is still significantly higher than its pre-pandemic rate.” - Employment Trends Index Falls: Temp Job Losses May Portend Declines in Other Industries - SIA

China’s Pandemic:

The Real Pivot: The costs of China’s chaotic exit from its zero-Covid strategy are surging, with unofficial projections putting the number of people that could die in China’s exit wave at about one million. This is damaging the image of Xi Jinping, China’s most powerful leader since Mao Zedong. As a result, a fundamental reset is taking place in Xi’s foreign and economic policies. Beijing is putting together policies to improve diplomatic ties that have soured badly and boost a deeply strained economy. - Xi Jinping’s plan to reset China’s economy and win back friends - FT

Responsible for Your Own Health: The drastic COVID-19 U-turn is highly uncharacteristic of the CCP. Although it could never be described as democratic, the party does care a great deal about how citizens perceive it. However, three years of zero COVID and no significant push to vaccinate the population have left China grossly unprepared for what is to come, with millions of people vulnerable to the rampaging virus. Xi is taking China down an unknown path, one that may cost the party dearly in its ability to govern. - China’s Epidemic of Mistrust – Foreign Affairs

Longer-term Themes:

Energy’s Midlife Crisis:

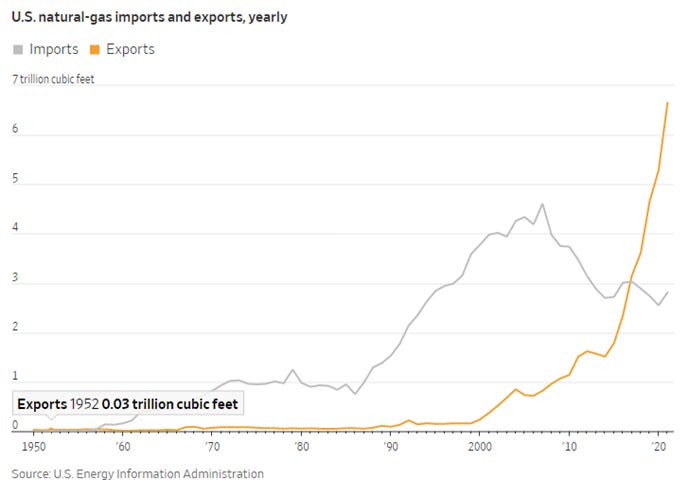

Gassed Up: Europe was the largest LNG customer in 2022, with the region importing substantially higher volumes than rival buyers as it seeks to replace Russian supplies. With Europe’s need to import greater volumes to fill up its storage facilities in 2023, the global LNG market is set to remain tight, potentially pushing up prices for gas users worldwide. - Europe leads pack on LNG imports as global competition for fuel heats up - FT

Back and Booming: Thanks to a mix of events, from the Russian invasion of Ukraine to the U.S. economic recovery, fossil fuels are showing surprising resilience, despite President Biden’s push to transition to clean energy and the industry’s own history of boom-bust investing and heavy reliance on debt. U.S. production of natural gas has hit record levels. The country’s crude oil production remains shy of the 2019 level but is otherwise at a peak. Exports of both gas and crude are hitting new highs - Oil and Gas Are Back and Booming – WSJ

Electrolyzer Domination: The U.S. and Europe are determined not to let China dominate hydrogen manufacturing, as they did with solar a decade ago.Companies around the world are already revving up electrolyzer production, green hydrogen plants are under construction, and the industry is finally making the leap from pilot projects to industrial scale. BloombergNEF estimates worldwide electrolyzer production will need to grow 91 times by 2030 to meet demand. But many Western clean tech veterans eye the emerging competition with a queasy feeling of déjà vu. More than 40% of all electrolyzers made today come from China. - China Has Set Its Sights on Cornering Another Green Energy Market: Hydrogen - Hydrogen

Cyber Life and Digital Rights:

AI Ate My Homework: New York City public schools banned access to ChatGPT, an artificial intelligence chatbot, on its internet networks and school devices after officials raised concerns that students could use the AI program to answer questions, do homework or write essays. ChatGPT could upend entire industries and schools by automating certain jobs or offering intelligent answers to almost any question. - ChatGPT Banned in New York City Public Schools Over Concerns About Cheating, Learning Development – WSJ

New Risks, New Costs: Insurers significantly increased premiums for cyber coverage in 2021, as a string of high-profile attacks and government regulations boosted demand for products. The drastic rate increases reflect a realignment of a relatively new market that is maturing quickly, executives say, indicating that the insurance industry is getting to grips with pricing cyber risk. - Cyber Insurers Raise Rates Amid a Surge in Costly Hacks – WSJ

DeepReg: China is implementing new rules to restrict the production of ‘deepfakes,’ media generated or edited by artificial intelligence software that can make people appear to say and do things they never did. Beijing’s internet regulator, the Cyberspace Administration of China, began enforcing the regulation on what it calls “deep synthesis” technology, including AI-powered image, audio, and text-generation software, marking the world’s first comprehensive attempt by a major regulatory agency to curb one of the most explosive and controversial areas of AI advancement. - China, a Pioneer in Regulating Algorithms, Turns Its Focus to Deepfakes – WSJ

Food: Security, Innovations, and Climate Change Implications:

80%: A biotech company in Georgia has received conditional approval from the U.S. Department of Agriculture for the first vaccine for honeybees, a move scientists say could help pave the way for controlling a range of viruses and pests that have decimated the global population. It is the first vaccine approved for any insect in the United States.Honey bees alone pollinate 80 percent of all flowering plants, including more than 130 types of fruits and vegetables. - U.S.D.A. Approves First Vaccine for Honeybees - NYT

More Chicken Problems: Service problems at Union Pacific have sparked a dispute between the railroad and one of the country’s biggest chicken processors, which says the lives of millions of birds are endangered by repeated delays in the delivery of corn. California-based Foster Farms has asked for regulatory intervention for the second time in six months, saying it has diverted feed from dairy cattle to chickens, which are susceptible to a quicker death. - Poultry Farm Says Millions of Chickens Could Starve From Rail Delays -WSJ

Authoritarianism in Trouble?:

An Explosion of Violence: In Peru's south, a mining region that has been roiled by deadly protests over the ouster of former leftist President Pedro Castillo, protest leaders say they are ready for an "endless battle" against the government, threatening to destabilize the deeply divided Andean nation. Seventeen protesters were killed this week in the southern province of Puno in the worst day of violence since Castillo's Dec. 7 dramatic removal, which has seen a total of 39 people killed in protests and seven more in related accidents. - Peru's mining south, rocked by violence, braces for 'endless battle' - Reuters

Exporting MisInformation: For months, researchers and advocates warned that Brazil was poised for its own version of the January 6 attack should the now-former President Bolsonaro lose his reelection bid. Now that an attack on Brazil’s Congress has come to pass, those same researchers are accusing tech platforms, especially YouTube and Meta, of failing to stem the flow of dangerous disinformation. Those platforms are propagating extreme views held by the U.S. far right across the globe, people tracking developments in Brazil say. - The US Far Right Helped Stoke the Attack on Brazil’s Congress - Wired

Asian Tigers 2.0:

Almost Done: Southeast Asian central banks look like they are close to done fighting inflation using interest rates, with economists seeing the tightening cycle ending after 25- to 50-basis points of moves this quarter. According to median forecasts in a Bloomberg survey, policymakers in Indonesia, the Philippines, and Thailand will each raise borrowing costs by a total half-point in the coming months before reaching their peak rates. Malaysia, meanwhile, will cap the rate hike cycle with one more quarter-point increase, the survey showed. - Central Bank Rates Peaking Soon in Southeast Asia, Survey Shows - Bloomberg

Winners and Losers: India’s central bank governor has expressed concern over growing debt distress among regional trade partners and said he is alert to possible risks to his country’s economy from a global slowdown. Shaktikanta Das said in an interview with the Financial Times that he was optimistic about India’s growth and financial stability despite the deteriorating global economic outlook. Das attributed India’s resilience partly to the government's government’s “calibrated, prudent” fiscal response to the Covid-19 pandemic and partly to the RBI’s monetary policy response. Many economists expect New Delhi to increase spending in next month’s annual budget ahead of 2024’s general election. - India’s central bank governor warns of South Asian debt distress – FT

Cold Places (Deep Sea, Artic, and Space Colonization):

SpaceReg: The FCC is one step closer to creating a Space Bureau. The commission released an order Monday adopting the proposal announced two months ago by Chairwoman Rosenworcel to replace the International Bureau, which has handled space activities, with a Space Bureau and a separate Office of International Affairs. The new bureau would provide more resources for and attention to space regulatory issues. The bureau still requires congressional and other approvals. – FCC Press Release

Secure Funding Priority: The new chairman of the House Science Committee, Rep. Frank Lucas (R-Okla.), says a "comprehensive" NASA authorization act is a priority for him, along with legislation to streamline commercial space regulations and an "organic act" for NOAA that would formally authorize the agency for the first time. He said it would be vital to fully justify NASA programs to ensure the agency's budget is not cut by members seeking broader spending reductions across the federal government. - New House Science, Space, and Technology Committee Chairman Optimistic, Enthusiastic about NASA – Space Policy Online

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION