Fed Officials Jawbone Yields Higher, Causing Stock Market Rally to Take a Breather - MIDDAY MACRO WEEKEND READ – 2/10/2023

Color on Markets, Economy, Policy, and Geopolitics

Fed Officials Jawbone Yields Higher, Causing Stock Market Rally to Take a Breather - MIDDAY MACRO WEEKEND READ – 2/10/2023

Overnight and Morning Recap / Market Wrap:

Price Action and Headlines:

Equities are lower, with the Nasdaq the worst performer on the day and week as little new economic data, hawkish Fed speakers, and higher yields increasingly weighed on sentiment throughout the week

Treasuries are lower, with yields notably higher on the week both in nominal and real terms as last week’s stronger-than-expected jobs report recalibrated higher for longer Fed policy views

WTI is higher, up almost 10% on the week as tighter future supply, better outlook on China’s reopening, and reduced inventory glut worries reversed recent weakness

Narrative Analysis:

It looks like the January rally has finally hit some real resistance, with the S&P unable to breach 4200 as worries (check notes) the economy is too strong, and as a result, deflation would be “transitory” grew over the week, helped by a chorus of hawkish Fed officials upping their terminal rate predictions. As a result of increased “higher for longer” Fed expectations, nominal and real rates rose notably on the week, effectively killing the P/E multiple expansion growth/tech-driven January rally. All eyes now turn to next week's January CPI report, which is expected to be hotter than a revised higher December report. A rise in today’s University of Michigan one-year forward inflation expectations didn’t help either, showing a renewed sensitivity to inflation data due to reduced recessionary fears. Oil was up notably on the week, helped by renewed geopolitical concerns as Russia cut output and OPEC said don’t look at us for help. China’s reopening continues to be a little bit of a quagmire, but rising or at least more stable industrial metal prices countered drops in equity indexes there as a gauge of progress. Finally, the dollar was higher on the week, as higher yields helped the $DXY end the week around 103.6, building a bit of a technical base.

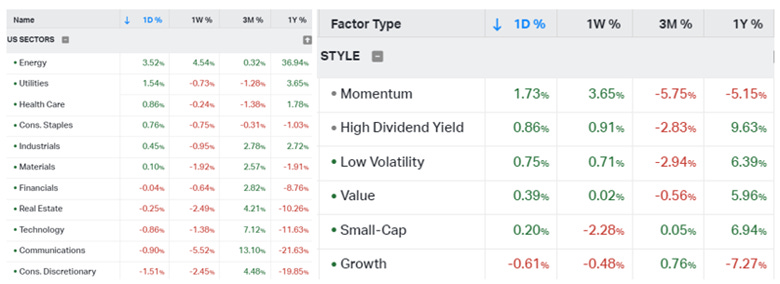

The Russell is outperforming the S&P and Nasdaq with Momentum, High Dividend Yield, and low volatility factors, as well as Energy, Utilities, and Healthcare sectors are all outperforming on the day. The week had a clear defensive tilt and favored yield enhancement/low volatility but also saw energy/momentum outperform.

@KoyfinCharts

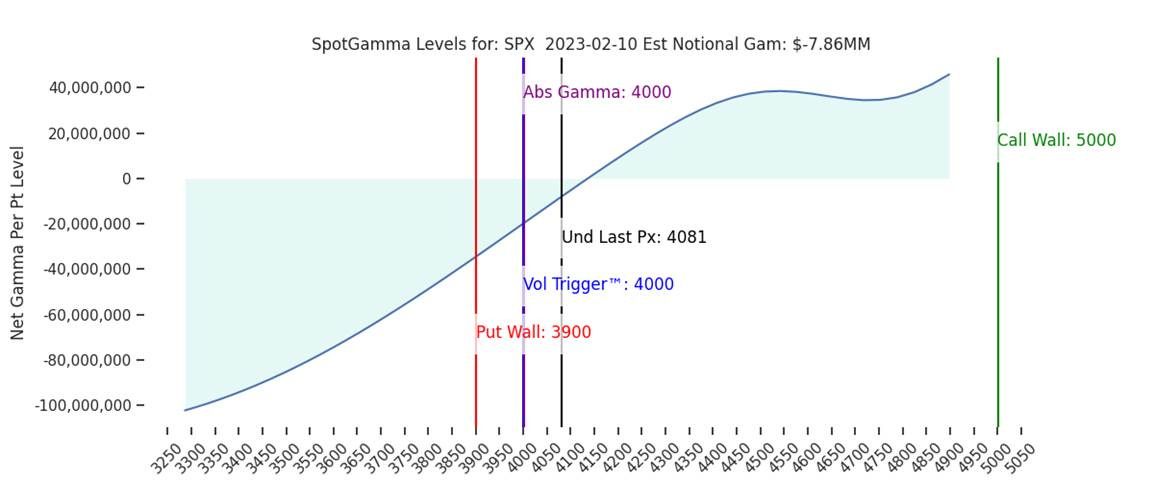

S&P optionality strike levels have the Zero-Gamma Level at 4098 while the Call Wall is 4200 and Put Wall is 3900. 4000 is a very large support strike. Resistance above shows at 4100-4115. While 4100-4200 was a positive gamma range drawing mean reversion flows, the 4000-4100 range is predominantly a negative gamma area which should elicit higher volatility. Long downside hedge positions have recently come into the market, and they are being energized not only by lower market prices but also the shift higher in implied vol. However, for downside momentum to continue, fresh hedging/selling to come into the market. This is because IV is now up rather sharply, and so a pause in downside price action immediately starts to decay highly energized short-dated puts.

@spotgamma

S&P technical levels have support at 4065 (major), then 4025 (major), with resistance at 4105, then 4130(major). The S&P made the full round trip in its 4170 to 4090 range four times this week: rallying to 4170s resistance, trapping breakout chasers, selling to 4128-4130 or 4090s, trapping breakdown chasers, until finally breaking lower last night. Once 4085 failed, the bull flag support was broken a path lower became more probable, with today’s close above that level being key to keeping a more bullish technical picture alive.

@AdamMancini4

Treasuries are lower, with the 10yr yield at 3.74%, higher by 7 bps on the session, while the 5s30s curve is steeper by 4 bps, moving to -9 bps.

Deeper Dive:

This week showed that “good” remains “bad,” with last week’s significantly stronger-than-expected jobs report giving Fed officials second thoughts on how high the terminal rate will need to be and how long they would need to stay there. With little new economic data and plenty of hawkish Fed speakers, yields moved notably higher on the week, especially in the front end, sending stocks, especially growth-orientated sectors, lower. In the end, trends in real rates continue to drive markets, and as they rise, P/E multiples contract, reversing the primary driver of the January rally. This wouldn’t be so problematic if earning estimates were also rising on the back of better data, but markets continue to put more weight on the Fed tightening policy further for longer over reduced recessionary fears. When coupled with a more neutral positioning by market participants in risk assets due to improved sentiment, a heavier skew in bullish optionality, and a less inspiring technical picture and the January rally has finally notably faded with the Nasdaq, the primary outperformer at the index level, now -5% off its recent highs. Where does this leave us? With no signs of labor markets meaningfully cooling and next week’s January CPI report likely showing an increase in headline inflation without any meaningful change in core services, X-shelter, the setup bodes poorly for risk assets. As a result, we are closing our S&P and Nasdaq longs, capturing a 9.5% and 6.75% return, respectively, over two months. Although we remain constructive on risk assets on the year, we see February as likely leading to a further pullback as the economy remains strong enough to increase inflationary and subsequently more than expected policy tightening fears, and we would look to reenter domestic equity longs in March if things go as expected. Finally, we are starting a long position in $KWEB, the China Internet ETF. We expect Chinese equities to recover from their recent pullback as the domestic consumer continues to gain confidence and increase spending activity. At the same time, the effects of the more supportive policy environment (monetary, fiscal, and regulatory) should increasingly support growth moving forward. We are also increasing our long oil position to 20% based on this view on China as well as recent cuts to supply by Russia in an already tight market.

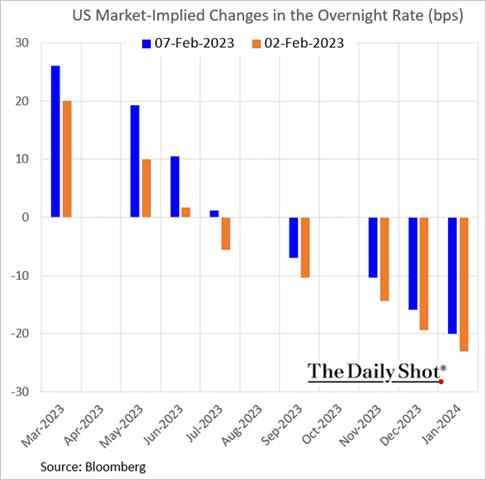

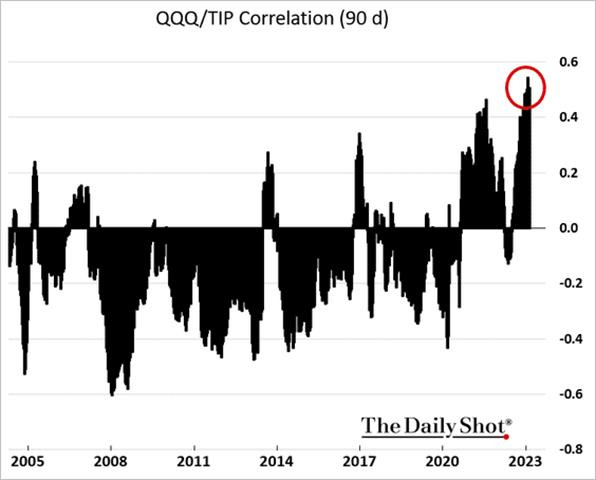

It has become notably harder for the current stock market rally to keep going as long as Fed officials threaten the economy and financial markets with higher rates. There has been a notable repricing in yields following the January jobs report, with the terminal rate moving towards resistance at 5.15% and two-year Treasury yields higher by over 40bps. Cuts later in the year have also come out, with the Dec '23 pricing now around 4.75%, all of which presents a tougher backdrop for risk assets. This rise in yields (and real rates) has resulted in a more positive correlation between stocks and bonds, an increasing headwind after falling yields supported the January rally. As a result, bearish views have “pivoted” their own narrative, no longer talking about a “hard landing” but focusing now on the economy being too strong for disinflation to continue.

*Markets moved the terminal rate higher and reduced cuts in the second half of the year following the jobs report

*Real rates moving higher have weighed heaviest on the Nasdaq, with the positive correlation at highs

*Next week’s CPI is a notable event regarding vol term structure

To be clear, we believe the bear market is over, and a new bull phase has begun, but a correction in the S&P 500 down to the October ‘22 uptrend line is still plausible in the short term. This is because despite the positive global expansion of breadth, and top-down tops across the dollar, interest rates, credit spreads, inflation, and the pace of policy itself, the economy remains too strong, increasing inflation uncertainty and hence the tail risk that central banks will make a policy error by over-tightening, moving real-rates high enough to finally drive what has so far been a very rate-insensitive real economy into a prolonged recession. With the lagged effects of cumulative policy still uncertain and earnings forecasts not yet bottoming, the “good is bad” narrative caps sentiment and, with positioning more neutral, reduces upside potential.

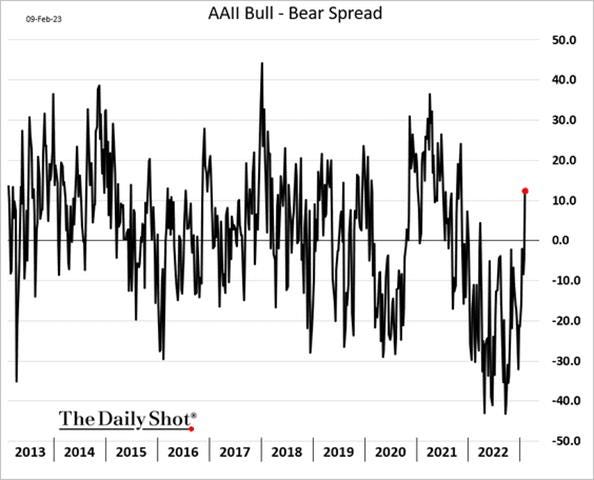

*Sentiment became more bullish in January but institutional investors are still likely positioned defensively, with retail picking up much of the recent rally

We do believe inflation will continue to fall, but we retreat from our view that it will do so in a surprising manner. This is mainly due to the resilience of the consumer due to the strong labor market, allowing firms to maintain greater pricing power, especially in the core service sector, than we expected at this stage of the tightening cycle. Even with forward guidance, a historical rise in the Fed funds rate, and ongoing QT, the economy is much less interest rate sensitive than initially thought. Interestingly, research out of J.P. Morgan suggested that, rather than a recession, an inverted yield curve might instead indicate a sharp decline in inflation is coming. That would mean the Fed could stop hiking (and maybe even start cutting) interest rates soon. "We are respectful that the Treasury yield curve has a successful history of forecasting recessions," they wrote. "So why do we think it is sending a different message this time?" The answer: "Rarely, if ever, have markets expected this much disinflation." Meanwhile, Goldman Sachs' take is a little different. Their analysts argue that rather than a swift pullback in inflation, investors are pricing in return to the secular stagnation of the pre-COVID economy. Markets appear to be pricing in a scenario where the Fed cuts interest rates sharply over the long term, indicating a return to a low-growth and low-interest rate environment. As a result, yield curves would need to steepen if inflation is more sticky, despite increased recessionary fears due to tighter policy. Not our base case belief, just food for thought.

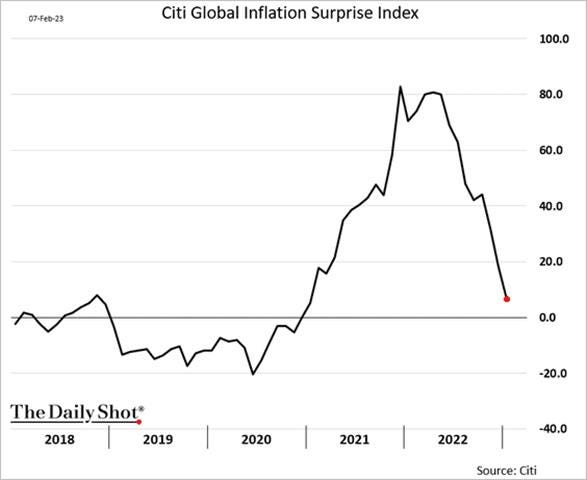

*Inflation is a global phenomenon that is increasingly coming down faster than expected if one uses the Citi Global Inflation Surprise Index

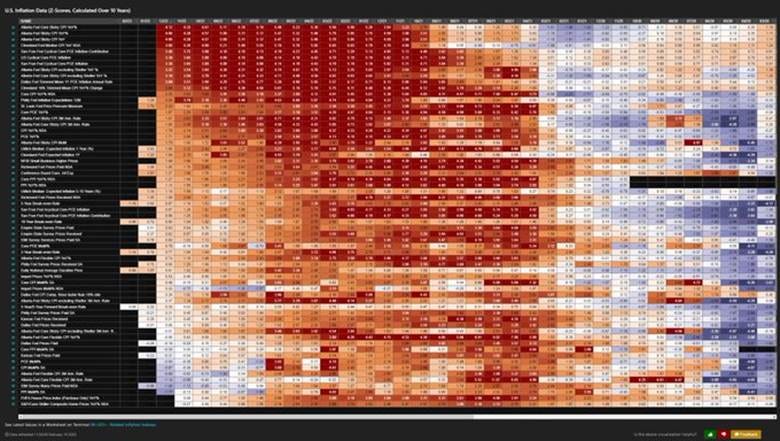

*Although the heat map is still rather red, some of the first areas to signal inflation was rising are now the first to show it is falling

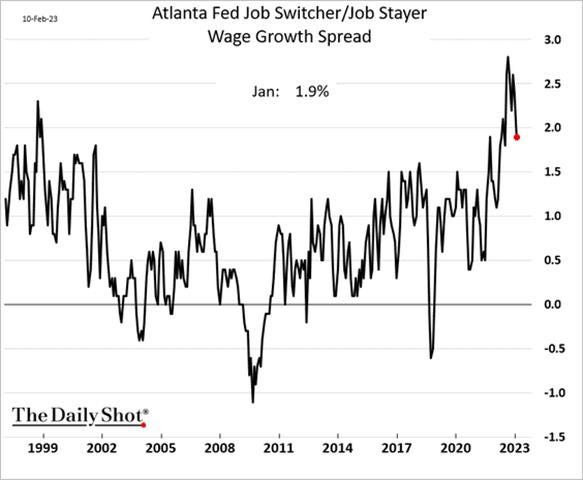

*Job switchers are receiving reduced increases in wages, reducing wage-spiral fears and indicating the labor market, despite hot headline numbers, is loosening slightly

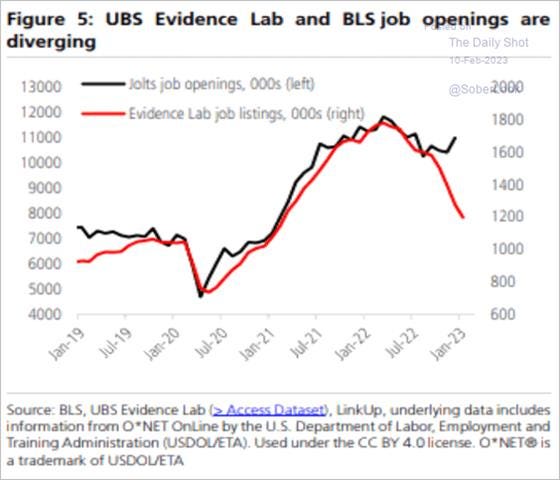

*We expect January’s JOLTs report to show a significant drop in openings as firms waited till the end of the year to report closures officially

Finally, although we remain constructive on U.S. growth, continuing to believe in the softer landing scenario, we now see the market's current narrative leading to reduce risk appetite on positive economic data continuing at least until the terminal Fed funds rate is reached. As a result, we are increasing our exposure to China, something we already have most of the portfolio geared towards through general EM, copper, and oil longs. The new 10% long in the Chinese internet sector is not only a play on a return to normal for consumers and hence business profitability but also a break in the common prosperity policy/regulation clampdown that Beijing used to punish Shanghai. There is a lot to say about China, and we encourage readers to watch the articles we highlight in the “China’s Pandemic” section in our “Macro Themes” to get a sense of how their reopening is going. We still see attractive value in equities there, given an improving growth outlook. We also don’t see a further meaningful deterioration in U.S.-Sino relations despite the recent “Balloongate” fiasco. To be clear, the relationship is at a geopolitically historical low, but economically, trade has never been as high, and our two economies are very much still in tune with each other, being both, again, the main drivers of global growth. It took four decades to get in bed with each other, and it will take time to break up, something that is happening and will weigh on risk assets but is not imminent. As a result, we want to be invested there currently, and in time, again, in U.S. equities after the Fed eventually moves on to the next phase of the cycle.

*Economic growth in China will lead to earnings growth, given no interference from Beijing, with much of the world still underweight the country due to geopolitics and zero-Covid worries

*Closing our U.S. equity longs and now overweight China with the overall mock portfolio up 6% since inception

Econ Data:

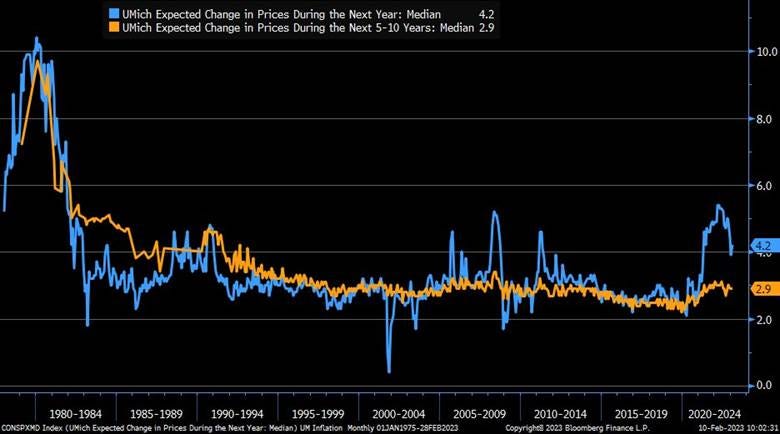

The University of Michigan consumer sentiment rose to 66.4 in February from 64.9 in January, beating market forecasts of 65, preliminary estimates showed. Views on current economic conditions improved to 72.6 from 68.4, while the expectations subindex fell to 62.3 from 62.7. Meanwhile, inflation expectations for the year ahead went up to 4.2% from 3.9%, while the five-year inflation outlook remained steady at 2.9%.

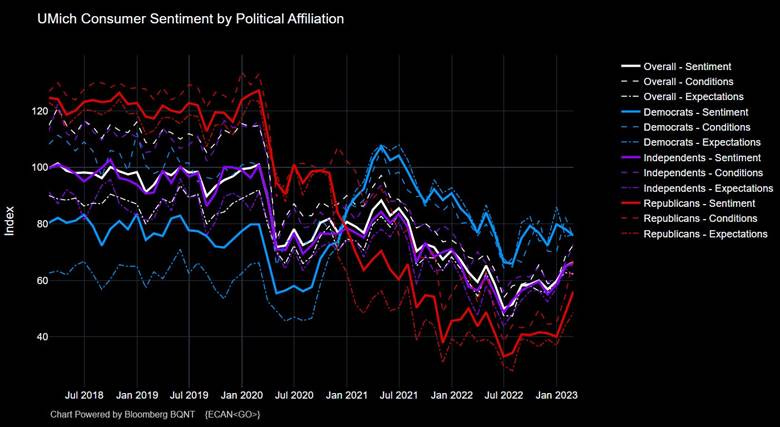

Why it Matters: The overall index is now at a thirteen-month high, following three consecutive months of increases, with sentiment now 6% above year-ago levels but still 14% below two years ago. “Overall, high prices continue to weigh on consumers despite the recent moderation in inflation, and sentiment remains more than 22% below its historical average since 1978. Combined with concerns over rising unemployment on the horizon, consumers are poised to exercise greater caution with their spending in the months ahead,” the report noted. Longer-term inflation expectations, something the Fed is more focused on, were unchanged but still somewhat elevated compared to pre-Covid readings. Meanwhile, short-term inflation expectations ticked higher in February, likely due to increases at the pump. One-year-ahead inflation uncertainty rose and remains at a highly elevated level, while longer-term inflation uncertainty remains well anchored. Finally, Republican respondents recorded the largest increase in sentiment, likely due to their party now being in the majority in the House.

*Gains to the overall confidence index came solely from current condition readings

*There was a slight tick higher in the preliminary reading of one-year ahead inflation expectations in February, with the price of the pump rising in January but starting to fall now

*Republican sentiment jumped higher while Independents rose and Democrats fell

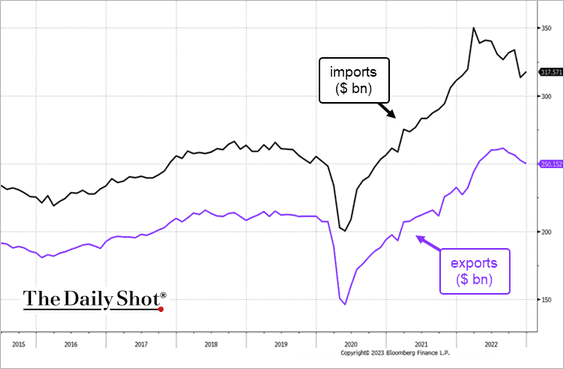

The trade deficit widened to -$67.4 billion in December from a downwardly revised -$61 billion in November and compared with forecasts of a -$68.5 billion gap. Exports fell by -0.9% to $250.2 billion, while imports rose by 1.3% to $317.6 billion. The U.S. trade deficit went up to a record high of $948.1 billion in 2022 from $845 billion in 2021, equivalent to 3.7% of the GDP. The goods gap widening 9.3% to $1,191.8 billion, while the services surplus narrowed by -0.6% to $243.7 billion. Exports of goods increased 17.7% to $2,085.6 billion, and imports jumped 16.3% to $3,277.3 billion, both led by crude oil. The deficit with China widened to -$382.9 billion, and the deficit with Canada grew to -$81.6 billion.

Why it Matters: Despite U.S. imports of goods and services falling in the second half of last year,the U.S. posted its largest trade deficit on record in 2022. Exports fell in the fourth quarter, as commerce slowed around the world and the stronger dollar likely weighed on demand. Specific to December, imports of goods and services rose 1.3% from the prior month as Americans bought more foreign-made products such as cell phones and vehicles. Weaker demand for U.S. goods, such as industrial supplies and consumer products, contributed to a -0.9% decline in exports from the prior month.

*It keeps growing, with inflation helping exacerbate the reading, as the 2022 deficit was the largest on record

*Imports ticked higher at the end of last year while exports fell, with U.S. growth looking to be better than RoW in December

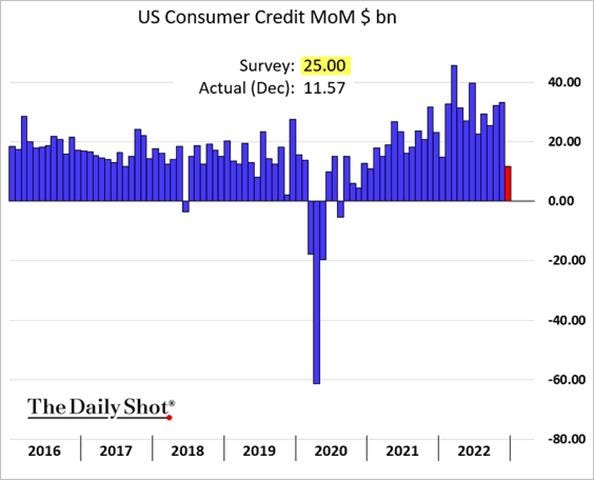

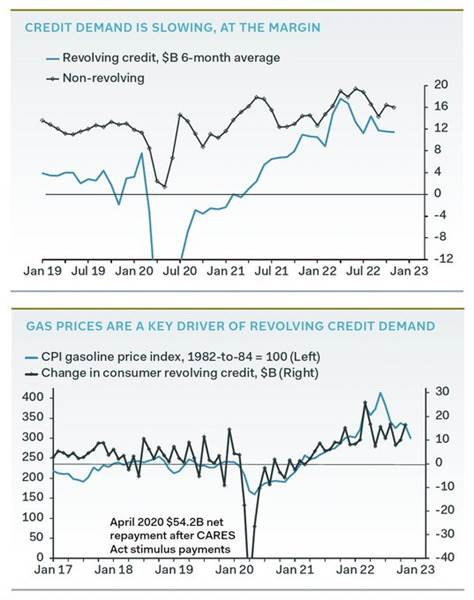

Total consumer credit went up $11.65 billion in December, after a $27.96 billion rise in the previous month and missing market expectations of a $25 billion rise. On an annual basis, consumer credit was up by 2.9% in December after a 7.1% gain in the prior month. Revolving credit (credit cards) increased by 7.3% MoM, compared to a 16.9% rise in the prior month. Nonrevolving credit (auto and student loans) increased by 1.5%, following a 3.9% gain in the prior month.

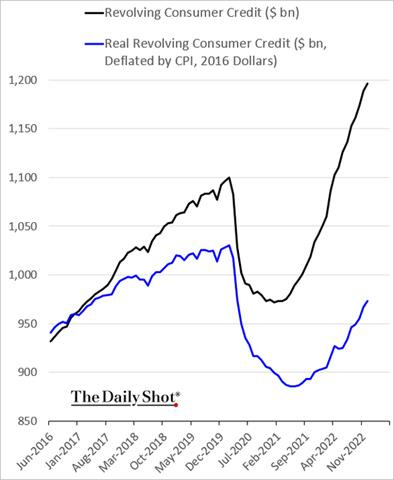

Why it Matters: Total consumer credit increased at the lowest monthly level since early 2021 in December. Although this is only one month, it may be the start of a lower level of credit use as higher rates (and greater uncertainty) reduce demand for larger ticket items and education that use nonrevolving borrowing while credit card debt returns to a more historically normal level after falling well below that during the pandemic. This is best seen in the revolving credit to disposable income ratio, which is almost back to a level it held for almost a decade before the pandemic. However, it's also important to note that in real terms, when adjusting for inflation, revolving credit levels are still well below their pre-pandemic levels, adding to the debate about how much real purchasing power consumers have going forward.

*The actual increase in total credit in December was much lower than expected, making a case that the consumer is slowing their aggregate demand

*Revolving debt levels are returning to a longer-term linear growth trend, while debt-to-income ratios are also normalizing

*However, when adjusting for inflation, revolving debt levels are still below prior highs

Policy Talk:

Chairman Powell spoke with David Rubenstein in a “fireside chat” setting at the Economic Club of Washington D.C. Although giving little new information since his FOMC press conference last week, he did note that if the labor market data continue to come in stronger than officials expected, the Fed may need to raise rates to higher than previously forecasted. He repeated that his main focus was on core services, excluding-shelter. He maintained the view that getting inflation down will likely be a difficult process and one that isn’t necessarily smooth. He didn’t put too much emphasis on the stronger-than-expected January jobs report, noting the Fed was always looking at an array of data. He again didn’t push back on loosening financial conditions or the market-derived path of Fed funds moving forward. It indicated that he was in tune with the FOMC deliberation process that is now more data-dependent and that there was a significant amount of time between now and the March FOMC meeting. Finally, as a non-important piece of information, Powell enjoys bike riding and playing guitar in his free time.

“…ongoing rate increases will be appropriate, and the reason is we're trying to achieve a stance of policy that is sufficiently restrictive to bring inflation down to 2% over time, and we don't think we've achieved that yet. So we said that, and I, and you know, now you see the labor market report, and I think again, financial conditions are, are, now more well aligned with that than they were before."

"The labor market's extraordinarily strong, and by the way, it's good. It's a good thing that inflation has started to come down without it happening at the cost of the strong labor market.”

New York Fed President Williams spoke to WSJ’s Nick Timiraos at a WSJ CFO Network Summit in New York on Wednesday. The interview was rather lengthy and covered the gambit of relative topics being discussed by policymakers today. Williams continues to believe that the most recent SEPs projections still provide “a very reasonable view of what we’ll need to do this year in order to get…inflation down.” He sees policy as restrictive, citing that the real Fed funds level is now positive, but believes it is appropriate to raise it further to ensure that inflation falls to target. He noted that financial conditions have tightened and are a broad concept, not necessarily a specific number from an index. Overall the interview came across neutral as Williams indicated an alignment with the current plan to slow the size of future rate rises but still sees scenarios where inflation is stickier and may warrant a tighter policy stand.

“the vast majority of my colleagues put in the funds' rate ending this year between 5 and 5 ½ percent, with quite a few at 5 to 5 ¼ – 5 ¼ to 5 ½. I mean, my view is that still seems a very reasonable view of what we’ll need to do this year in order to get the supply and demand in balance and bring inflation down.”

“We need a sufficiently restrictive stance, and we’re going to need to maintain that for a few years to make sure we get inflation to 2%.”

“But that’s around 3 ¾ percent right now (NY Fed's inflation model), and it’s been running that for the last few months. So if you think that’s kind of the – kind of basic underlying inflation, currently we’ve got the funds rate a little less – oh, about a percentage point above that, and that’s definitely a real rate that’s slightly above, you know, kind of a – most people’s estimates of an equilibrium or neutral real interest rate. So I think to me, to get sufficiently restrictive, you know, you would want to get it higher than that because we’re barely in this restrictive, and I think we need a sufficient restrictive to bring inflation down.”

“I mean, financial conditions – it’s hard to summarize in one number but, you know, what we have seen is the financial conditions broadly have tightened a lot in the last year in a way that I think is consistent with moving to a restrictive stance overall.”

Governor Waller gave prepared remarks titled “The Inflation Rate for Necessities: A Look at Food, Energy and Shelter Inflation” at the 2023 Arkansas State University Agribusiness Conference. As the title would suggest, Waller meticulously went through his views on the various parts of inflation. Overall he signaled that progress towards getting inflation back to the Fed’s target had been made, often citing 3-month averages falling back to more normal levels for food and energy, but the job was far from over. Interestingly he noted how important headline inflation, which rose first, had been in signaling that the Fed had to move, negating the normally more heavy focus on the core rate. He remained somewhat cautious on the future path, noting that the “ebb and flows” of inflation meant it would not be a smooth path back to target, and the Fed may need to do more than what was currently forecasted.

“The big picture is that the U.S. economy is adjusting well so far to the higher interest rates that are necessary to rein in inflation. But inflation remains quite elevated, and so more needs to be done… and I am prepared for a longer fight to get inflation down to our target.”

“I expect the U.S. economy to continue growing at a modest pace this year, supported by a strong labor market and by encouraging progress in lowering inflation.”

“Such employment gains mean labor income will also be robust and buoy consumer spending, which could maintain upward pressure on inflation in the months ahead.”

“There is good reason to believe rents will moderate significantly over this year, and so some people have suggested that the focus should be on a "super core" measure of inflation that excludes food, energy, and housing. That would make inflation look not nearly as bad over the last year or two and also likely not show much improvement in the coming months.”

Federal Reserve Bank of Atlanta President Raphael Bostic, in an interview on Bloomberg TV, said the stronger-than-expected January jobs report raises the possibility the Fed will need to raise rates further than expected. Bostic reiterated that his base case remains for rates to reach 5.1%, in line with the median of policymakers’ December forecasts, and stay there throughout 2024. A higher peak could come through an additional quarter-point hike beyond the two currently envisioned, he said, while not ruling out a half-point increase.

“It’ll probably mean we have to do a little more work, and I would expect that that would translate into us raising interest rates more than I have projected right now.”

“I like optionality, so I never want to foreclose any action, but I do think that a lot of this will depend on how the economy evolves relative to my expectations. We understand what data dependence means, and we’re going to try to avoid getting too locked into just one approach.”

“I’ve said for a long time that I thought there’s a lot of momentum in the economy and that there was a good chance that that momentum was going to be sufficient to absorb our policy tightening in ways that could help us avoid a recession.”

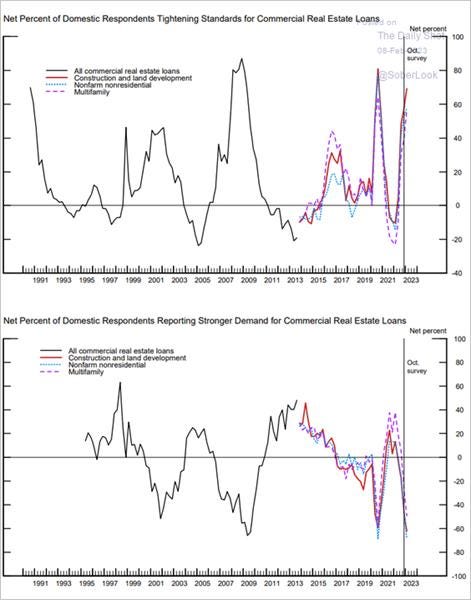

The January 2023 Senior Loan Officer Opinion Survey (SLOOS) showed banks, on balance, reported tighter standards and weaker demand for commercial and industrial loans to large, middle-market, and small firms over the fourth quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate loan categories. For loans to households, banks reported that lending standards tightened or remained basically unchanged across all categories of residential real estate loans, and demand for these loans weakened. In addition, banks reported tighter standards and weaker demand for home equity lines of credit. Standards tightened, and demand weakened, on balance, for credit card, auto, and other consumer loans. The January SLOOS survey also included a set of special questions inquiring about banks' expectations for changes in lending standards, borrower demand, and loan performance over 2023. Banks, on balance, reported they expect lending standards to tighten, demand to weaken, and loan quality to deteriorate across all loan types.

*Lending standards are tightening and demand is falling

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth was little changed on the day but higher on the week, and Small-Cap Value is the best-performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and the week.

5yr-30yr Treasury Spread: The curve is flatter on the day and the week.

EUR/JPY FX Cross: The Yen is stronger on the day and the week.

Other Charts:

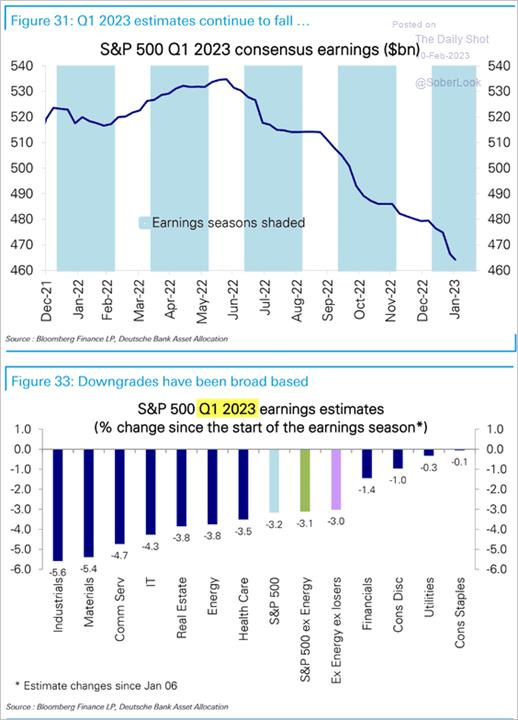

Q1 earnings estimates continue to trend lower, with the current earnings season re-estimates hitting industrials and materials the worse

Benchmark 10-year yields have plied a 60-basis point range or so since the start of 2023 to oscillate around 3.5%. While 60 basis points is admittedly a rather wide road, it’s small compared to 2022’s about 285 basis point gyration. Rate volatility has cooled as a result, with the MOVE Index dipping below the average of the past year.

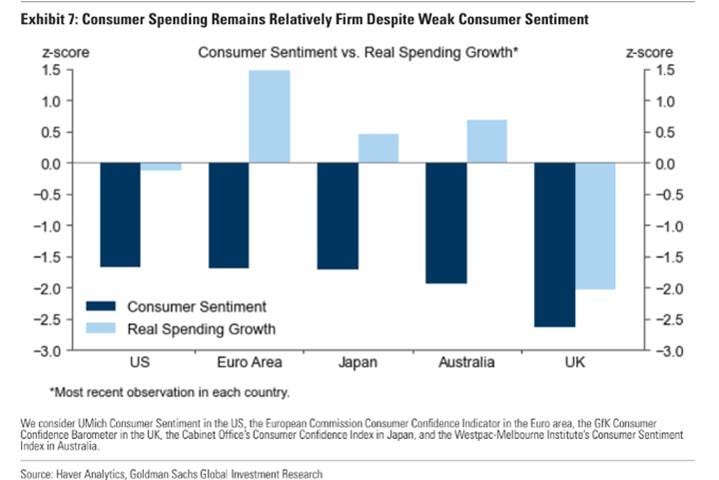

Consumer spending remains relatively firm despite consumer sentiment still being well below pandemic highs

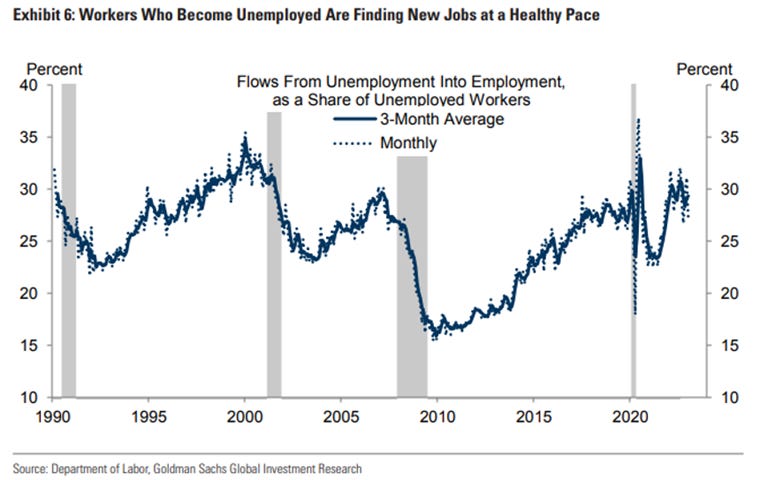

Evidence suggests that people getting laid off are finding new jobs at a historically high rate. Job openings remain plentiful, with the number of available positions climbing to a five-month high of just over 11 million in December. The dynamic of companies wanting to hold onto workers they fought so hard to hire during the labor shortages experienced during the pandemic could also keep the broader job market healthy. – Goldman Sachs

“Worried about credit card/revolving debt? The biggest contributors to this variable in 2022 were gas and grocery prices. Revolving credit well off its highs as gas prices have moved sharply off-peak. A lot of hyperbole around debt, but #consumer is managing well.” - @SethCL

Credit card delinquencies are rising, especially for the youngest cohort, despite the strong labor market backdrop

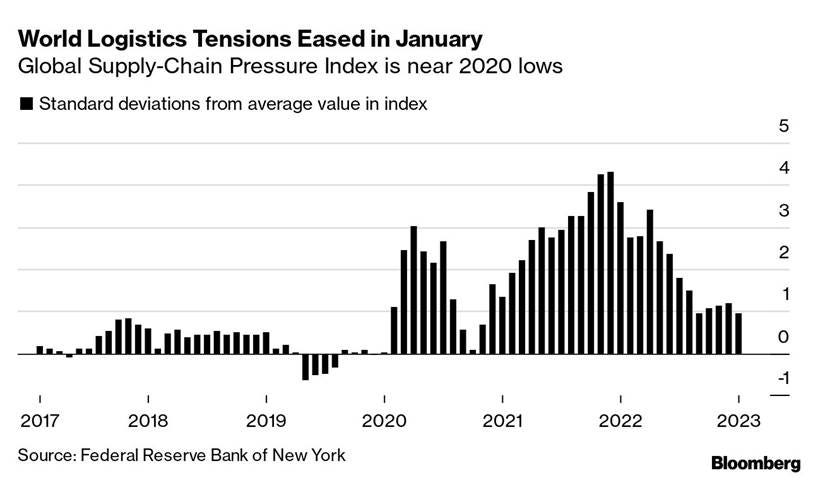

Global logistics tensions moderated in January, falling near to the levels last seen in 2020, according to the NY Fed’s Global Supply Chain Pressure Index. The largest contributing factors to the easing were declines in Korean and Chinese delivery times and smaller euro-area backlogs. The gauge brings together 27 variables that take the temperature of everything from cross-border transportation costs to country-level manufacturing data in the euro area, China, Japan, South Korea, Taiwan, the UK, and the US.

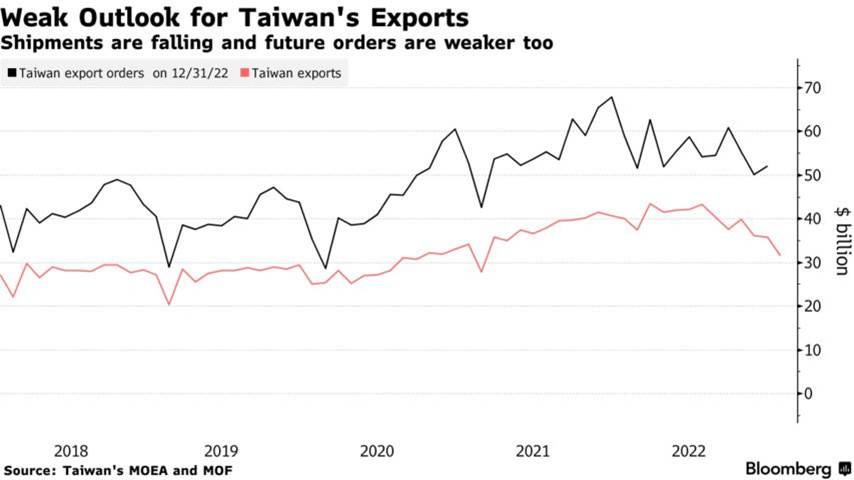

Taiwan’s exports fell by the most since 2009 last month as waning global demand for technology products and the Lunar New Year holiday weighed on international trade. Overseas shipments declined 21.2% in January from a year ago to $31.5 billion, the lowest since February 2021, while semiconductor exports fell 18.3%, the most in 14 years.

Trade in goods between the US and China climbed to a record in 2022, with total merchandise trade between the two countries rising to $690.6 billion last year, exceeding the record set in 2018. The annual goods-trade deficit with China widened 8% to $382.9 billion, the biggest on record after the $419.4 billion shortfall in 2018. The shortfall in trade in goods and services with all countries climbed 12.2% to almost $1 trillion.

Articles by Macro Themes:

Medium-term Themes:

China’s Pandemic:

Cashing Out: Macau’s casinos saw gaming revenue surge in January as China’s reopening and the week-long Lunar New Year break sparked an influx of visitors to the gambling hub, fueling optimism the enclave is finally shaking off its Covid Zero doldrums.The Gaming Inspection and Coordination Bureau said that gross gaming revenue climbed 82.5% last month from a year earlier, beating the median estimate of a 36.5% increase, according to analysts surveyed by Bloomberg. That’s the first rise since February last year and the highest monthly revenue since January 2020. - Macau’s Gaming Revenue Jumps 82.5% as China Travel Reignited - Bloomberg

Slight Thawing: Dollar debt issuance by Chinese real estate firms fell 60% to $18 billion last year, the lowest since 2016. A turnaround has emerged since November when Beijing stepped up efforts to salvage the ailing housing market as economic growth overtook Covid controls as policymakers’ top priority. Chinese junk dollar bonds, dominated by those from developers, have rallied for a record 13 straight weeks since then, pushing average yields down to around 15% from a record 31%. Investment banks are urging the borrowers to seize the issuance window given the uncertainties over how sustainable the recent secondary-market rally and Beijing’s policy support may be. However, many developers approached by bankers so far remain cost sensitive and prefer to wait until yields drop further. - Global Banks Seek to End Drought in China Property Debt Sales - Bloomberg

Longer-term Themes:

Energy’s Midlife Crisis:

End to End in the USA: Car makers are forging joint ventures with battery producers to take advantage of federal incentives and gain firmer control over their supply chains. Plans call for more than a dozen battery factories to be built in the next five years, with most located in the Midwest and South near existing assembly plants. While the projects represent a significant step forward in the U.S. effort to bring battery production stateside, these plants would still rely on materials sourced abroad. To counter this, the recently passed Inflation Reduction Act, which provides incentives for North American-built batteries and penalizes car companies that source batteries abroad, is spurring a wave of new projects in the U.S., from cell-making factories to new ventures to mine the raw materials. – U.S. Car Makers’ EV Plans Hinge on Made-in-America Batteries – WSJ

Reversing Course: Some in the shipping industry are betting that methanol produced from renewable sources could play a key role in helping the industry reduce its greenhouse-gas emissions, which account for about 3% of the world’s total annually. While ship engines that can burn hydrogen and ammonia are still being developed, about 100 ships that can burn methanol have been ordered by some of the industry’s biggest names. But for methanol to become a viable replacement for bunker oil, it needs to be cheaper and more available, and refueling infrastructure must be put in place at ports around the world. As a result, any transition to methanol will depend on how committed the largest industry players are to cutting their carbon-emissions profiles and government policies that could support the build-out of new fuel-supply networks. - Methanol Takes Lead in Shipping’s Quest for Green Fuel – WSJ

Coming Up: Thanks to booming investment in green technology, electrochemistry, the branch of science that explains how chemical reactions create electricity and electricity spurs chemical reactions, is an increasingly hot field. Electrochemical systems have been around for centuries. But electrochemists say their field has long been seen as something of a backwater. Now, aided by advances in materials science, that is changing. People working in electrochemistry say there is a birth-of-the-internet feeling in their field, with investors paying closer attention and colleges building stronger links with various industries. - What Is Electrochemistry, and Why Is It So Important to a Green-Energy Future? – WSJ

Cyber Life and Digital Rights:

Community Moderation?: A legal provision tucked into the Communications Decency Act, Section 230 has provided the foundation for Big Tech’s explosive growth, protecting social platforms from lawsuits over harmful user-generated content while giving them leeway to remove posts at their discretion. As a result, this case might have a range of outcomes; if Section 230 is repealed or reinterpreted, these companies may be forced to transform their approach to moderating content and overhaul their platform architectures in the process. But another big issue is at stake that has received much less attention: depending on the outcome of the case, individual users of sites may suddenly be liable for run-of-the-mill content moderation. - How the Supreme Court ruling on Section 230 could end Reddit as we know it – MIT Tech Review

Sour Sauce: TikTok says it has devised a plan that would allow U.S. officials to check whether its proprietary algorithm, which recommends videos to users, was being influenced by Beijing. TikTok, owned by Beijing-based ByteDance, says it wouldn’t allow Chinese government meddling but has offered to give a U.S. company Oracle the ability to access the algorithm’s code and flag issues for government inspectors, part of a $1.5 billion plan to wall off aspects of its U.S. operations. But that arrangement faces practical difficulties, according to some U.S. officials and independent researchers, who say that determining why the algorithm promotes or demotes content is a complex task that often doesn’t yield clear answers. - TikTok’s Secret Sauce Poses Challenge for U.S. Oversight, Researchers Say - WSJ

Food: Security, Innovations, and Climate Change Implications:

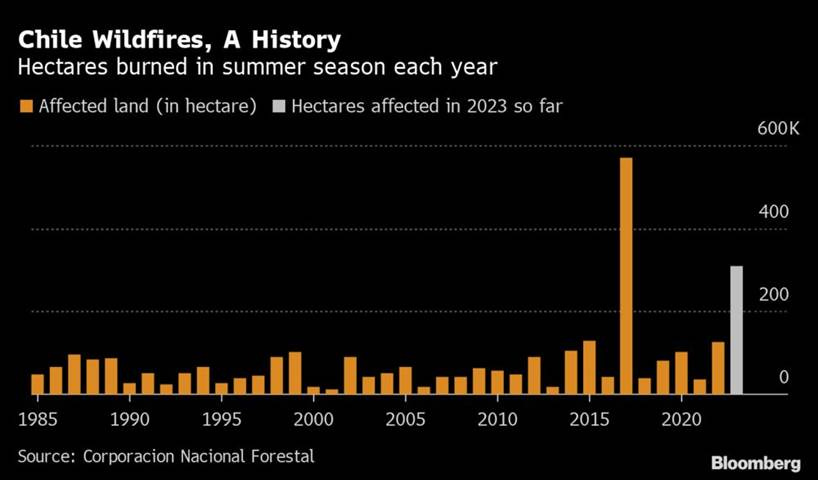

Scorched Berries: Chile’s worst forest fires in six years are starting to impact the country’s cherry and blueberry industries, destroying orchards in a fresh threat to global fruit supplies. In the southern region, some producers of cherries and lemons “have lost their land and all their years of work,” the growers association Fedefruta said in a statement. Warm temperatures have caused blueberry growers there to lose hundreds of tons of fresh fruit, it added. At last count, there were 301 active fires in central-southern Chile, fanned by hot and dry conditions, adding to disruptions in neighboring Peru’s fruit industry from a wave of anti-government protests. - Wildfires Scorch Chilean Cherry Orchards in Threat to Exports – Bloomberg

ESG versus the World:

Sensitive: Individual-investor demand for socially responsible investing “is highly sensitive to income shocks” and economic stress, a recently published academic study finds. The conclusions are a reminder that when times become tough for individual investors, not even the idea that they might be helping to save the planet from society’s excesses can persuade them not to sell investment products that they worry may suffer more in a downturn. In contrast, the study found that demand for ESG investments from institutions like pension funds and asset-management firms remained more robust as they are usually slower to respond to market shocks and don’t face the same kind of pressures that individual households have had to grapple with during the Covid lockdowns and job losses. - Investors Are All for ESG. Except, That Is, When Times Are Tough. – WSJ

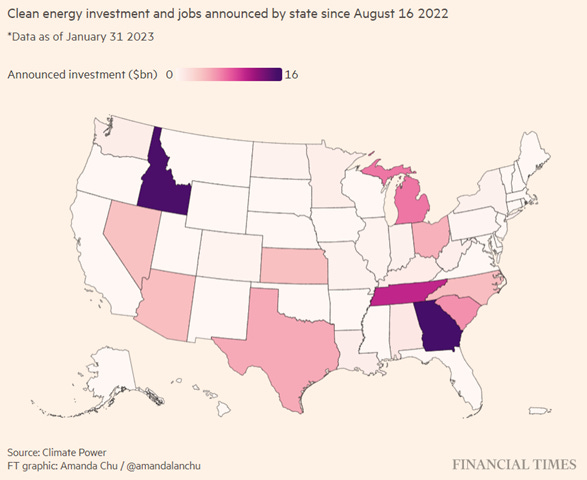

Jobs > Political Noise: Developers of projects from electric car plants to green hydrogen refineries are getting red-carpet treatment from state and local officials. Long vying with one another for inbound investment, some states have revamped subsidy schemes in response to last year’s passage of the landmark US Inflation Reduction Act climate law. Among the states dangling incentives before clean energy developers are those led by governors who opposed the bill that became the IRA. - U.S. states offer their own green subsidies in a bid to lure investment - FT

Cold Places (Deep Sea, Artic, and Space Colonization):

Increasingly Concerned: Heavyweight investors are hungrily looking at deep-sea mining, including the Danish logistics giant Maersk and the multinational commodity Glencore, underscoring the hopes that the industry has enabled the extraction of new sources of critical metals, such as copper, cobalt, and nickel. However, as the push for deep-sea mining intensifies, experts are increasingly concerned that companies will kick up clouds of sediment, which could be laden with toxic heavy metals that may harm marine life. At least 700 scientists, along with France, Germany, and Chile, call for a moratorium on deep-sea mining. The article discusses the debate surrounding a deep-sea mining test that showed sediment discharging into the ocean. - Leaked video footage of ocean pollution shines light on deep-sea mining – The Guardian

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION