Fed Likely To Dial It Back With Disinflation Back On Track and Labor Markets Loosening

Color on Markets, Economy, Policy, and Geopolitics

Despite the shift in U.S. political expectations, continued weakening growth, loosening labor markets, and renewed disinflationary progress still support lower yields, while risk asset performances will become more nuanced

Fed officials are increasingly noticing the shift in the data, which will cause them to convey a more neutral to dovish tone moving forward

Given the greater uncertainty over November’s election results versus where economic data is trending, chasing “Trump” trades given the coming data and seasonals may provide a poor risk-reward

The higher probability of a second Trump presidency and the GOP taking Congress following last week’s presidential debate has increased term premium across the Treasury curve, steepening the curve due to higher inflation expectations (increased tariffs and less immigration) and increased fiscal deficit worries (lower tax revenue).

How long will this political narrative drive cross-asset performance last?

The U.S. economy was more resilient than expected in the year's first half, with consumers supported by a solid labor market and healthy balance sheets. Businesses saw reduced cost pressures and generated good earnings growth.

With the year's second half starting, the macro narrative has shifted over the last weeks from “no-landing reflationary” worries to slower growth but further disinflationary progress, supported by a change in data trends domestically. However, a Trump 2.0 presidency (coupled with a Republican Congress) is now increasing stagflationary worries.

Although this initial interpretation seems correct, it is still too soon in the election cycle to have enough conviction to see recent moves in rates as indicative of a structural change that will have further follow-through. As a result, we are willing to maintain our long-end Treasury long position (through the $TLT ETF) despite the surge in steepener trades that have been put on.

Looking forward, the setup is still likely supportive of rates:

Weakening manufacturing and investment data, and a now softening service sector ISM PMI reading.

A still balanced but softening labor picture

A household picture that is under increased pressure with cooling consumer spending and weaker confidence

CPI/PPI looking set to be weaker for a second month with improving disinflationary breadth

A more balanced-sounding Fed is beginning to form

A break in auction supply and continued foreign buying support

Headwinds certainly still remain:

Oil prices are near a two-month high amid escalating tensions in the Middle East and hurricanes in the Atlantic

European political results increasing deficit worries globally and support a greater term premium there

Inflationary prints abroad have been mixed, while growth has skewed better

Overall, the balance of variables skew more supportively for rates, leaving us still seeing rates as rangebound at worst (with yields near the highs currently) but more likely channeling lower as the Fed confirms it will begin its cutting cycle in September in the coming months. Using the ten-year yield chart, we believe we are in the C wave of an ultimate move back towards a 3.50% target by year-end.

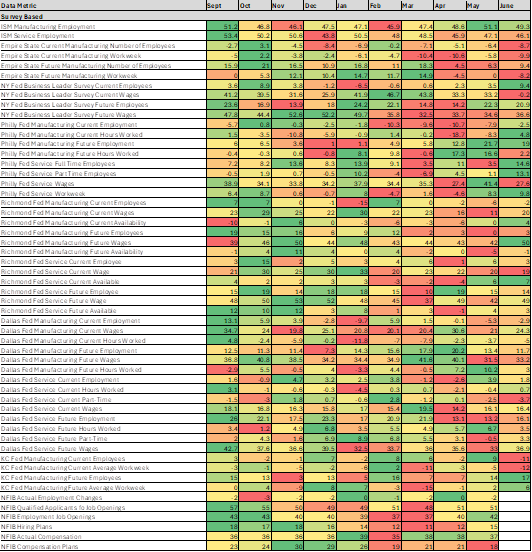

Since it is labor data week and Friday’s payroll will likely make or break the current cross-asset price trends, it's worth quickly reviewing how the recent data for May and June has looked going into Friday’s job report:

Initial claims have moved higher into the 230K range, while continued claims have trended higher for almost three months

June’s ISM and regional PMI survey results were mixed but still skewed towards contractionary, while May’s NFIB report showed a divergence between actual employment changes and hiring intentions, with the first falling and the latter increasing

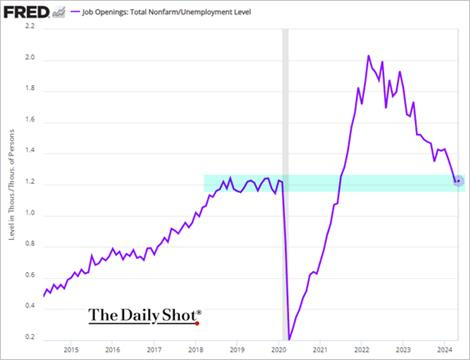

The vacancy-to-unemployed ratio (1.22) is at its lowest level since before the pandemic, while the last time the hiring rate was this low, the UER was 5.5%

Although the level of job openings rose, there are increasing reports of a rise in fake job postings, while the JOLTs report response rate is near historic lows, and May’s gains were primarily driven by openings for government jobs

Temporary workers and consultancy hiring continues to decline, a historic leading indicator

With the non-inflation accelerating monthly NFP level now higher (likely around 200Kish) due to the rise in the country’s population/immigration level and a notable (positive) change in the availability of skilled labor and turnover, it is safe to say the labor market is cooling. The Fed has no reason to suspect wage-spiral inflation is occurring despite ECI and AHEs being above historical averages.

A more two-sided risk management approach to policy will be the theme of Fed speakers moving into year-end, expanding from the more dovish members currently (Goolsbee, Jeferson, Kugler, Cook) to the more centralist camp (Daly, Collins, Bostic, Harker, Barkin).

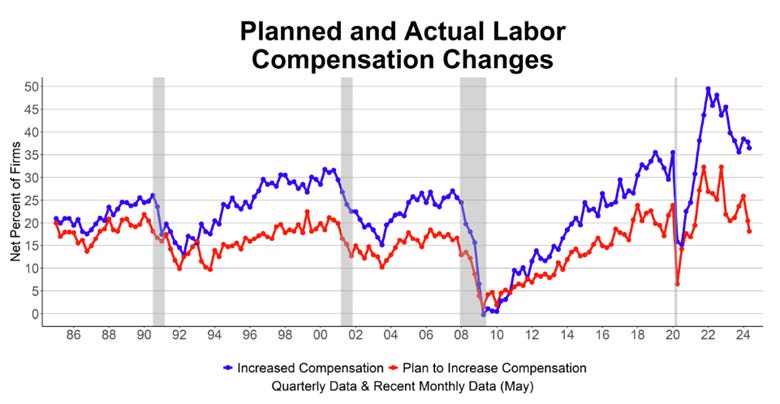

Small business confidence drives hiring, and even though a higher probability of a Trump victory is now more likely to drive PMI readings higher on better optimism, end demand is still weakening and more price sensitive, pressuring profit margins as prices paid have become more sticky than the price received.

As a result, we expect a divergence in soft and hard data to increasingly show, with the latter continuing to weaken, while business surveys indicate a more positive outlook and reduced uncertainty. We believe this will not change the weaker trend in hiring, best seen in small-business compensation plans at their lowest level since 2021.

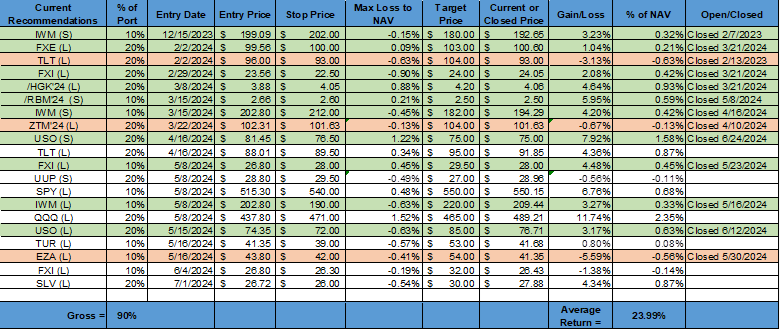

Putting it all together, we still want to be long U.S. equities with a growth/large cap bias into this seasonally strong period of the year. However, we expect this July period to deliver a milder 2-3% return versus the more robust performance last year, given gains YTD so far.

We are staying long Turkish and Chinese equities, seeing EM generally rising into a five-wave pattern in Q3.

Turkey continues to be a mixed bag, and we expect more Lira appreciation than is occurring while investor risk appetite has supported bonds over equities. However, given the technicals and our belief in improving fundamentals on the inflation front, we are willing to be patient here.

With the July CCP Third Plenum likely to indicate further support for the economy (hopefully more focused on the property sector), we think the pullback in Chinese equities has run its course. We also find it interesting that Beijing has begun to borrow government bonds to keep yields where they are (and stop the trend lower), potentially driving risk taking into corporates and equities while supporting the currency.

We are adding a long silver position, with the metal complex more generally looking like it's ending its consolidation wave. Silver still looks to be in a bullish pattern, benefitting from greater geo-political uncertainty, lower real rates, and higher demand from Asia for personal and industrial use.

Finally, we are also maintaining our short-dollar position. With household spending cooling, investment expenditures contracting in many places, and labor markets now in a non-inflationary accelerating place, additional Fed cuts will start to be priced into the end of 2025 through the beginning of the 2026 period, eroding rate differentials and changing the dollar strength theme.

As a final thought, the odds of a Fed policy “mistake” are rising. The current signaled one rate cut through the end of the year runs counter to the renewed disinflationary progress, consumers losing momentum, housing activity contracting, and the labor market trending looser. This means the current market narrative of a soft landing goldilocks scenario throughout the rest of the year can quickly change. As a result, we have moved up our trailing stops on our U.S. equity long positions to lock in profits.

For our U.S. readers, have a happy Fourth of July Holiday!

As always, thank you for reading, and please share our newsletter if you like it and know others who may enjoy it. Please feel free to reach out with any questions or comments. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.