Economy Slowing and Fed Still Has Work to Do, Who Cares, Buy Mega-Caps? – Midday Macro - 5/26/2023

Color on Markets, Economy, Policy, and Geopolitics

Economy Slowing and Fed Still Has Work to Do, Who Cares, Buy Mega-Caps? – Midday Macro - 5/26/2023

Daily/Weekly Price Action and Headlines:

Equities are higher on the day and week, with the Nasdaq going parabolic as breadth worsens, while this week’s economic data showed a mixed picture between business and consumer strength

Treasuries are mixed on the day but lower on the week, with hotter PCE price and consumer spending data weighing on the front end while reduced consumer inflation expectations supported the long-end

Oil is higher on the day but little changed on the week, with a surprise drawdown in inventories not supporting earlier gains, while an abundance of diesel due to no shortage of Russia exports and only limited threats from OPEC+ lead speculators to reduce longs

Market’s Weekly Narrative:

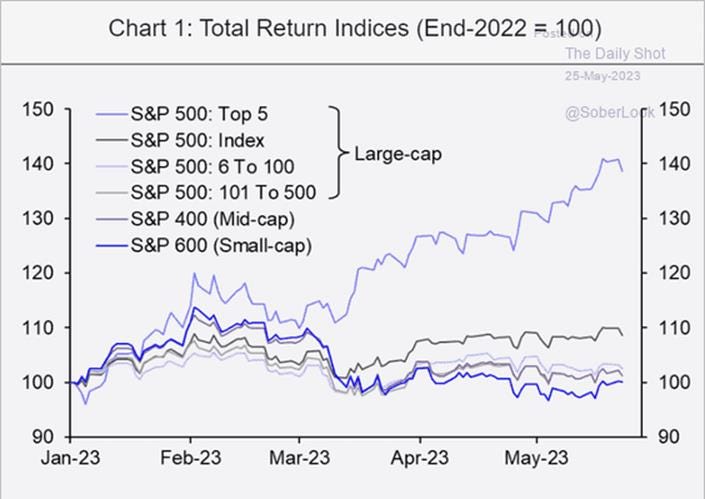

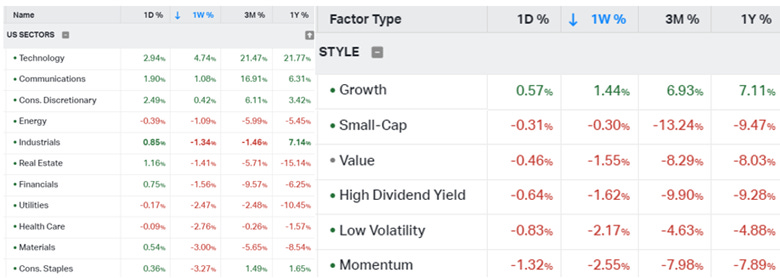

It was a tale of two cities this week regarding markets, economic data, and Fed speakers. Turning to markets, the Nasdaq continues to leave the S&P, Dow, and Russell in the dirt due to the outperfromance of a few mega-cap, with Nvidia now joining the trillion-dollar club due to AI dreams. Sectorial performance outside of tech, discretionaries, and communication was down on the week; however, the S&P ended today’s session above its post-April range. Given the limited breadth of the current rally, it is hard to get too excited. Turning to the economic front and it is clear the consumer remains healthy, keeping inflation sticky, while manufacturing measures cooled further. Although the Fed can’t take comfort from today’s PCE price readings, the decline in inflation expectation seen in the Univ. of Michigan Survey should at least calm nerves a little. There was a full gambit of Fed speakers this week, and the mosaic-painted picture skewed towards a further rate hike in June. Next week’s job report is looking increasingly important to seal the deal. As a result, Treasury yields moved higher on the week, breaking out of their recent post-SVB bank failure ranges. Oil had a somewhat bumpy week as headlines took attention away from fundamentals, with drawdowns not eliciting expected prices. Industrial metals continue to be at the mercy of Chinese data, with copper recovering from midweek recent lows but still trending lower. The agg complex was little changed on aggregate but corn did have a solid week. Finally, “King Dollar” is starting to reassert itself, with the $DXY ending the week above 104 due to broad weakness across crosses outside of the peso.

Deeper Dive:

A further increase of 25bps at the June FOMC meeting now looks all but certain following today’s stronger-than-expected PCE price and consumer spending data. Of course, no one is telling stocks, with the Nasdaq’s chart now looking like a meme stock despite the move higher in Treasury yields. Whether this is simply a short covering and speculative-driven rally due to the perceived higher probability of a debt ceiling deal being reached or investors are genuinely convinced the earnings will rise (to justify rising valuations) is unclear. We are not buying into this rally, as we see higher real rates weighing on multiple expansions. Further, despite today’s consumer data, we expect softer sales trends over the second quarter, something that started towards the end of Q1 in core retail and should spread elsewhere. We do regret closing our Nasdaq longs in favor of small-caps last week, but given this rally is still primarily driven by a handful of stocks, see a more mixed picture underneath the hood than bullish index price action indicates. In the end, the cumulative effects of the tighter Fed policy over the last year are only now hitting the real economy, and the Fed still intends to raise rates one more time by 25 bps, if not two more times. The abundance of Q1 earnings beats was due to low expectations, and this will likely not be the case moving forward. Also, any debt deal means less fiscal stimulus at a time when it is already notably tightening.

*The lack of breadth in the current rally is increasingly becoming worrisome to us, and we believe valuations are now unrealistic for mega-caps, making cheaper, smaller caps more attractive

*Earning estimates will begin to fall again as the real economy slows into the second half of this year

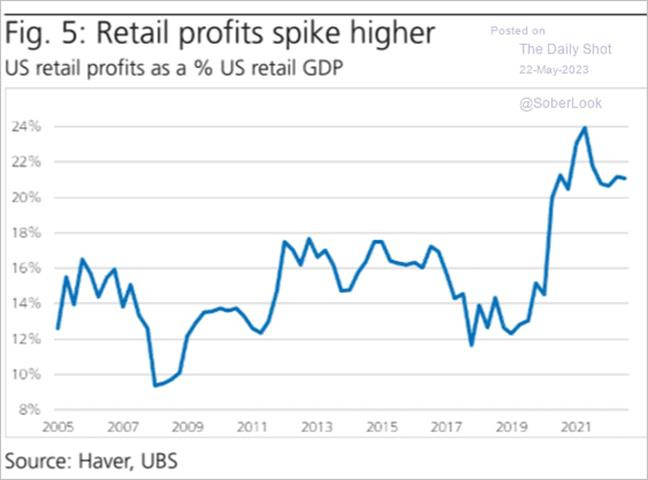

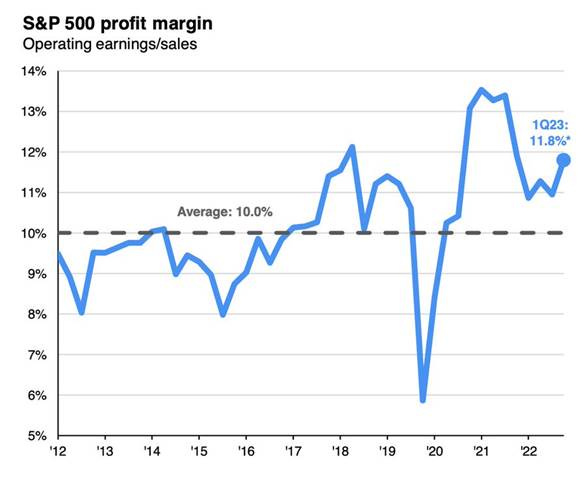

*We think profits, which have occurred due to the ability to pass cost increases on, will reverse to more normal levels as the elasticity of demand becomes more sensitive

“Sales trends softened over the course of the first quarter. More specifically, we began the quarter with positive comp growth in the month of February and then saw the trends soften into low single-digit declines by the end of April and so far into May." - Target CFO Michael Fiddelke

“...we saw moderation as we went through the quarter. February was stronger and March and April were a bit of a tick down, and that follows some of the trends that we saw and other consumer behavior related to SNAP benefits, tax refunds, and such. This quarter has started off basically how the last quarter ended." - Walmart CFO John Rainey

*Recent comments from retailers indicate a slowing in activity heading into Q2

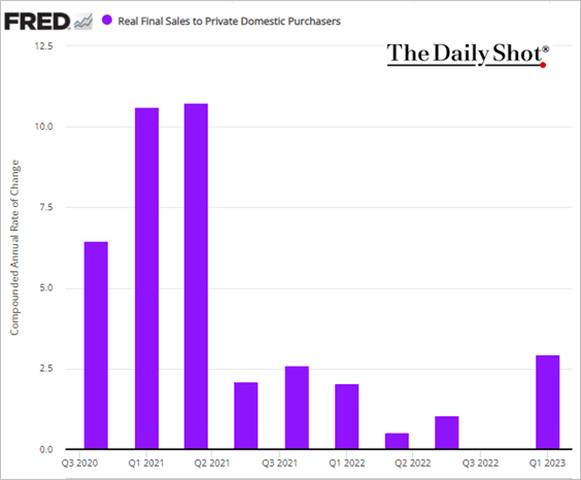

*Real final sales increased at an impressive clip in Q1, but again, we do not see that as sustainable in the face of weaker investment and a less confident and cash-rich consumer

We are adding two new shorts to our mock portfolio. We are shorting silver through the $SLV ETF, which has already moved notably off recent highs. We see inflation falling faster than expected over the next two quarters due to declines in shelter costs and reduced stickiness in core goods, leading to higher real rates and hurting precious metals. We also think a debt ceiling deal will reduce the fear premium gold and silver currently have. We are also starting a short position in European stocks through the $VGK ETF, which have performed well year to date. We see a stronger dollar coming, and although this will be negative to our EM long positions, we still believe China’s growth pulse will support those positions, while our short silver and European stock positions will provide a hedge. Optimism over European growth seems overdone and misplaced. We believe that stocks are not reflecting the coming effects of tighter policy and credit conditions there, as well as the potential for renewed increases in energy costs. We maintain our long in copper, EM, small caps, and oil.

*We expect the hard data to increasingly reflect weaker demand that has been showing in the soft data for some time, as business and consumer entrench in the second half of the year

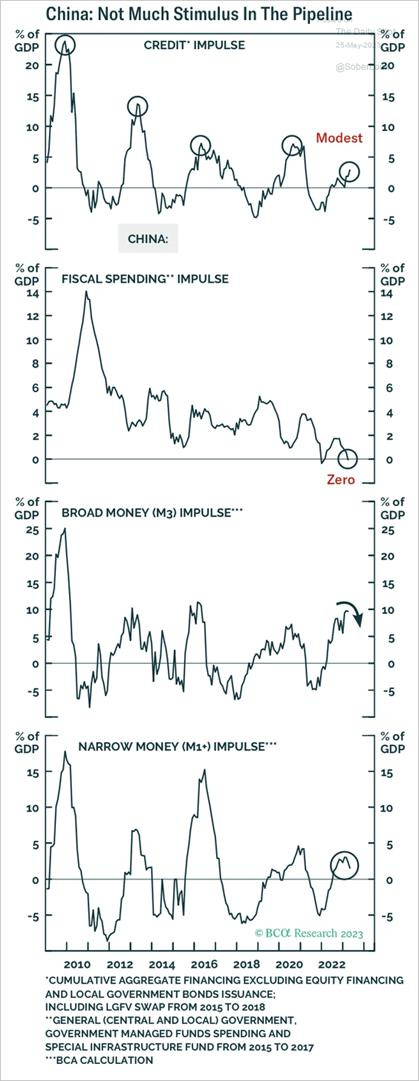

*With low inflation and a weakening job market, Beijing is likely to become more aggressive in stimulating the economy just as business and consumer confidence normalizes to pre-lock-down levels

*We moved some stops lower on our EM positions but maintain our conviction levels there and other longs. We are looking for gains of 8-10% in our new shorts on SLV and VGK

Policy Talk:

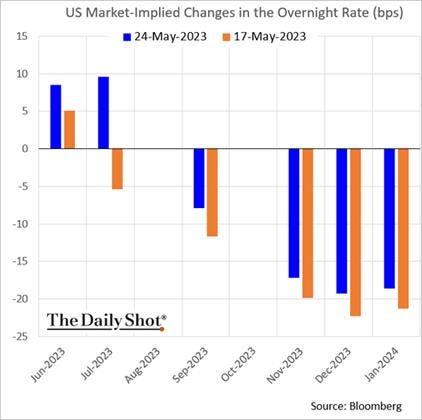

Numerous Fed officials spoke this week, and due to the strength of the data and stronger-than-expected inflationary data in today's PCE report, it looks like the Hawks continue to outnumber the Doves. Some Fed officials, though, including Atlanta Fed’s Bostic and Philadelphia’s Harker, have stressed that the impact of banking failures on credit has yet to be felt, while Governor Jefferson highlighted that monetary policy works with a lag so that much of the pain from higher rates has yet to be seen in official data. However, Bullard, Waller, Bowman, Mester, and Logan indicated they had not seen enough progress on the inflation front while the economy's strength allowed further tightening. As a result, it does look like a case for a further rate hike in June was successfully made through the mosaic of speeches and comments since the May FOMC meeting so far, although next week's jobs report will be an essential factor. Wall St. is still split, with the odds of a June hike rising after today’s data, but many think a pause may still be in the cards. “It’s going to take a bit more to unlodge them from a June pause, but it does raise the chance of another hike thereafter,” said Derek Tang, an economist at LH Meyer/Monetary Policy Analytics in Washington. “The stronger the data flow, the more likely that the next hike is in July rather than September.” “Patience has limits, and it will start to wear thin if the economy keeps roaring and bank stress doesn’t worsen,” he added.

Fed Governor Jefferson gave prepared remarks titled “Implementation and Transmission of Monetary Policy” at Washington and Lee University. All the appearance was a lecture on how the Federal Reserve used its tools to implement monetary policy; several comments did come out. Jefferson acknowledged inflation remained too high but was patiently watching to see the impact of the cumulative policy tightening on the economy before deciding on future moves, indicating he wanted to pause rate hikes at the June FOMC meeting. He noted that economic activity was slowing, and he expected it to cool further this year. Jefferson, who was nominated last week by President Biden to serve as the Fed’s vice chair, looks to be a good replacement for the more dovish and patient nature of now departed Brainard.

“History shows that monetary policy works with long and variable lags and that a year is not a long enough period for demand to feel the full effect of higher interest rates.”

Boston Fed President Collins gave a speech this week titled “Creating a Vibrant, Inclusive Economy” at the Community College of Rhode Island. Collins noted that there were some signs that inflation pressures were moderating. She believes that policy is at or near a point where the FOMC can pause raising interest rates. She wants to more fully assess the impact of the cumulative actions taken to date and the expected further tightening of credit conditions on economic activity. Collins, who doesn’t vote on the Federal Open Market Committee this year, said officials should approach policy on a meeting-by-meeting basis and take a comprehensive assessment of the information available at the time.

"I believe we may be at, or near, the point where monetary policy can pause raising interest rates.”

“I do think it’s going to take some time, some of the declines we’ve seen so far in inflation have been a little slower than I might have anticipated, but we are starting to see some positive movements.”

“Each policy decision moving forward will be based on a wholistic assessment of the information available at the time.”

Atlanta Fed President Bostic and Richmond Fed President Barkin answered questions at the Southwest Virginia Economic Forum at the University of Virginia. Both took a more cautious tone towards further rate hikes. However, Bostic was the most dovish in his views. “Our policy works with a lag. And we’re just at the very beginning of this time when that lag is starting to play out, and you’re starting to see tightness emerge,” Bostic said on Monday. “Right now, absent a big change, I think I will be comfortable saying, let’s just look and see how things play out.” On the other side, Barkin said, “I’m not going to prejudge June,” noting there was a plausible narrative whereby the Fed’s previous rate hikes, plus tighter credit standards amid strains in the banking sector, will cool demand and prices. However, he was still unconvinced about how quickly that could happen and move inflation back to target.

St. Louis Fed President Bullard spoke during a moderated discussion at an event in Fort Lauderdale this last Monday. He expects the central bank will need to raise interest rates twice more this year to quell inflation. Bullard said the March SEPs forecast was based on a low growth outlook with inflation falling fast. Instead, growth had been stronger and more robust than expected, and price pressures have not cooled quickly. This is why he believes the committee needs to move rates higher, and the current environment, with unemployment at the lowest levels since the 1960s, was a good time to act.

“I think we’re going to have to grind higher with the policy rate in order to put enough downward pressure on inflation and to return inflation to target in a timely manner.”

“As long as the labor market is so good, it’s a great time to fight inflation, get it back to target, and get this problem behind us and not replay the 1970s.”

Dallas Fed President Logan gave remarks at a Technology-Enabled Disruption Conference in Richmond this week. She suggested she would be prepared to hike rates by a quarter percentage point at the June FOMC meeting barring no material change in the data. While noting some progress in bringing down inflation and cooling in the labor market, she said the Fed still has work to do. Logan emphasized that the decision ultimately will be based on inflation and employment data still to come before the next meeting. Logan is a voting member and, given her NY Fed Markets experience, should command some attention in any coming policy debates.

“The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.”

“We haven’t yet made the progress we need to make. And it’s a long way from here to 2% inflation.”

Governor Waller delivered a speech titled “Hike, Skip, or Pause?” at the 2023 Santa Barbara County Economic Summit this week. He highlighted that he was still uncertain about the right Fed policy action but was leaning toward further rate hikes. The economy has slowed, but he still sees a very tight labor market and high inflation. He also noted that we are in a higher-than-usual period of uncertainty about how credit conditions will evolve in response to the recent bank failures and stress among some other midsize banks. He viewed inflation as not materially improving, going as far as to highlight areas it had worsened, such as in core goods. He also shared concerns that recent housing strength would renew upward pressures on inflation through that channel. He downplayed any increase in tightening of lending standards and loan growth, noting that a longer-term trend of tighter conditions was still intact. He concluded by laying out all the ways one could interpret the current situation in regard to how to proceed with policy. However, in his opinion, further rate hikes were still warranted, giving the caveat that incoming data would determine the ultimate decision.

“Let me cut to the chase, in my view, data since the last meeting of the Federal Open Market Committee has not provided sufficient clarity as to what we should do with our policy rate at the next meeting.”

“Core goods prices, which were among the biggest factors that drove the escalation in inflation the past two years, aren't slowing or retreating as much as we need to get inflation down closer to our 2 percent target.”

“In addition to the Fed survey, a variety of financial market participants over the past few weeks have also reported that credit tightening is expected to continue. They are not suggesting a credit crunch but are concerned that it could happen, and they say it isn't yet clear how banking terms and conditions will evolve.”

“I do not expect the data coming in over the next couple of months will make it clear that we have reached the terminal rate. And I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2 percent objective.”

The FOMC’s May meetings minutes generally indicated there is likely more tightening if the data remains where it has been. However, policymakers said they were uncertain about how much additional policy tightening might be needed and weighed the slower-than-expected progress on inflation and resilient labor market against the likelihood of a credit crunch following recent banking turmoil.

“Recent measures of nominal wage growth continued to ease from their peaks recorded last year but were still elevated.”

“Market sentiment improved over the intermeeting period, with concerns about a sharp near-term deceleration in economic activity appearing to recede as stress in the banking sector declined.”

“The staff’s core inflation forecast was revised up a little relative to the previous projection. Recent data for core PCE goods prices and the ECI measure of wage growth—the latter of which importantly influences the staff’s projection of core nonhousing services inflation—came in above expectations, and the staff judged that supply–demand imbalances in both goods markets and labor markets were easing a bit more slowly than anticipated.”

“Participants noted that the labor market remained very tight, with robust payroll gains in March and an unemployment rate near historically low levels. Nevertheless, they noted some signs that the imbalance of supply and demand in the labor market was easing, with prime-age labor force participation returning to its pre-pandemic level and further reductions in the rates of job openings and quits.”

“In discussing the policy outlook, participants generally agreed that in light of the lagged effects of cumulative tightening in monetary policy and the potential effects on the economy of a further tightening in credit conditions, the extent to which additional increases in the target range may be appropriate after this meeting had become less certain.”

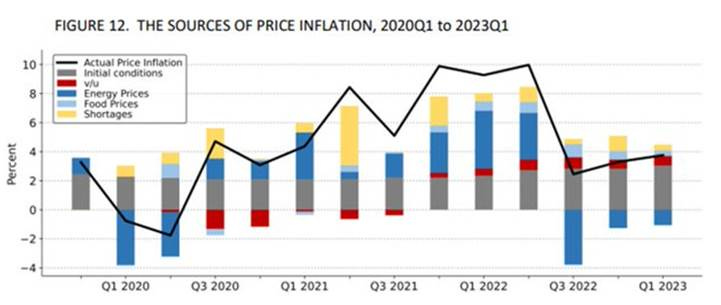

Ben Bernake and Olivier Blanchard released a research paper titled “What Caused the U.S. Pandemic-Era Inflation?” which attempts to use a simple dynamic model of prices, wages, and short-run and long-run inflation expectations to determine why inflation rose much higher than expected. They find that most of the inflation surge that began in 2021 was the result of shocks to prices that came from sharp increases in commodity prices and shortages of input materials. However, the current pandemic-era inflation dynamics are complex, and tight labor markets are now keeping nominal wage growth and inflation more persistent as opposed to the supply-side shortages at the beginning of the pandemic. The paper concludes that the “good news for policymakers is that the indirect effects of the price shocks were smaller than they might have been.” Although higher inflation expectations did put upward pressure on wages, they remain anchored enough to avoid a wage-spiral feedback loop. As a result, tight labor market conditions still accounted for a minority share of excess inflation in 2023, and that share is likely to grow and will not subside on its own. Controlling inflation will thus ultimately require achieving a better balance between labor demand and labor supply. Finally, they don’t believe there has been a structural change in inflation that requires a new modeling approach. They conclude in their summary that “policymakers must be alert to the possibility that inflationary pressures can come from product markets as well as labor markets, for example, through unexpected changes in input costs or shifts in demand that collide with inelastic sectoral supply curves. Moreover, through various mechanisms, inflationary pressures from product and labor markets can interact and be mutually reinforcing.”

*The paper concludes that a loosening in labor markets is necessary, but the majority of the recent inflation pulse was supply-side driven

Econ Data:

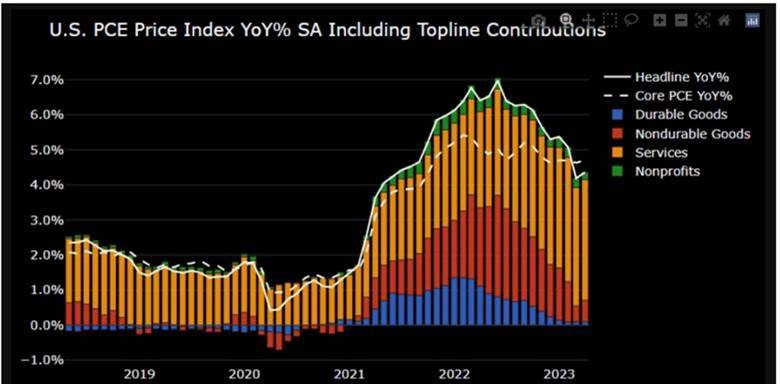

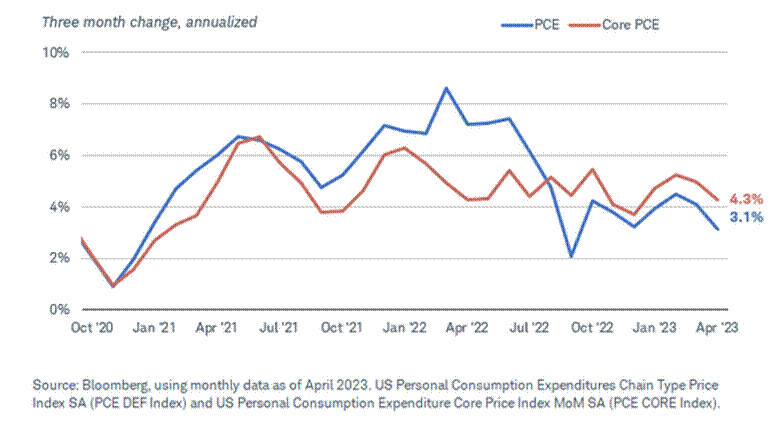

The personal consumption expenditure price index rose by 0.4% MoM in April, following a 0.1% increase in March and above market expectations of a 0.2% MoM increase. This moved the headline annual rate to 4.4%, an acceleration from 4.2% in the prior month. Core PCE also increased by 0.4% MoM in April, above market expectations of a 0.3% MoM gain and moving the annual rate to 4.7%, compared with market expectations of 4.5% and the prior month’s annual reading of 4.6%. Prices for goods increased 0.3% MoM, rebounding from a -0.2% fall in the previous month. Services inflation accelerated to 0.4% MoM from 0.3% MoM. Food prices were flat on the month, and energy prices increased 0.7% MoM after a -3.7% decline in March.

Why it Matters: Fed officials would not see meaningful progress that underlying inflation is falling in April’s report. Core services, excluding housing prices, rose at the fastest rate in three months and underscoring that the CPI version of this measure is a poor guide to the Fed’s more favored PCE inflation indicator. In searching for some good news, headline inflation readings tend to lead core, and three-month annualized averages for food and energy continue to trend in the right direction.

*The current stickiness in inflation continues to be due to the service side, with a 0.4% MoM gain in April

*Although three-month averages did move lower, core ex-shelter picked up, and things remain generally range-bound, showing little real progress from the Fed’s perspective.

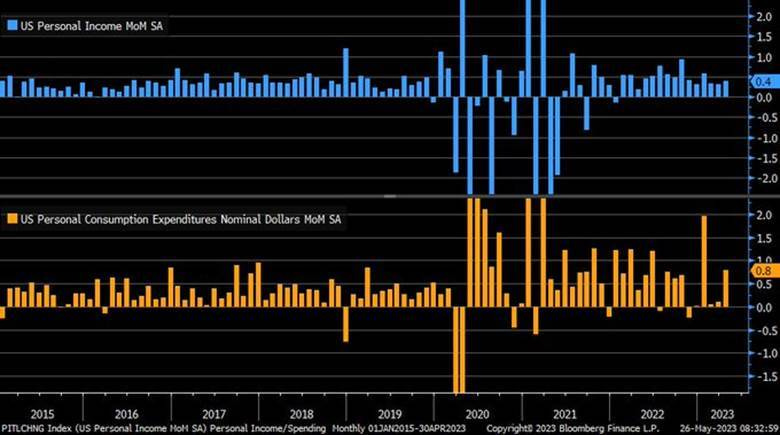

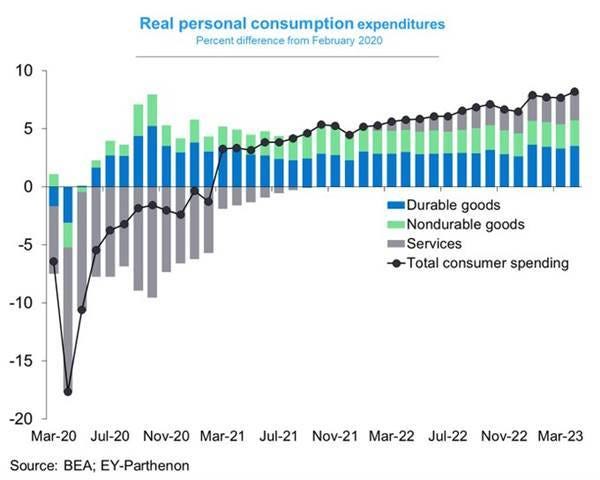

Personal spending rose by 0.8% MoM in April, the most in three months, and well above market forecasts of a 0.4% MoM gain. Real PCE, which is adjusted for changes in prices, rose by 0.5% MoM, reflecting an increase of 0.8% MoM in spending on goods and a 0.3% MoM gain in spending on services. March figures were revised higher to show a 0.1% increase instead of the flat reading initially estimated. Personal income rose by 0.4% MoM in April, compared to a 0.3% MoM rise in March and matching market forecasts. The increase primarily reflects increases in compensation, namely private wages and salaries and personal income receipts on assets. On the other hand, personal current transfer receipts decreased due to lower “other” government social benefits. The personal saving rate fell to 4.1% in April from 4.5% in March.

Why it Matters: Consumer spending and income are off to a strong start at the beginning of the second quarter. However, the sharp fall in the savings rate puts into question the sustainability of the current momentum. However, as of now, there is still no sign of a meaningful slowdown in consumer spending, something yesterday’s upward revisions to Q1 GDP also showed. The most recent retail sales report also showed Americans increased spending at stores, restaurants, and online in April for the first time in three months. “We are not in an economy that’s retrenching,” said Gregory Daco, chief economist at the consulting firm EY-Parthenon. “Neither are we in an economy that is very strong. We’re somewhere in the middle, and the momentum appears to be tilted to the downside.”

*PCE and Personal Income both hit three-month highs, with real PCE rising 0.5% MoM in April

*Consumer spending increased for all three major categories in April

*There was a broad increase in most measures in April’s report, although real disposable income was flat on the month

*Personal expenditures remain well above pre-pandemic trends while disposable income has returned, although it would be much lower in real terms

Technicals, Positioning, and Charts:

The Nasdaq is outperforming the S&P and Russell, with Growth outperforming, as well as Technology, Consumer Discretionary, and Communication sectors all outperforming on the day. There was a clear tilt to sector performance this week as technology, communication, and discretionaries were the only sectors higher. Defensive sectors did poorly. Growth was the only factor higher on the week, with large-cap growth the best-performing size/factor. This is not a positive picture for the sustainability of the rally.

@KoyfinCharts

S&P optionality strike levels have the Zero-Gamma Level at 4127 while the Call Wall is 4200 and Put Wall is 4000. The SPX Call Wall has retracted to 4,200 (from 4,300), which we generally consider bearish. However, that is counteracted by the QQQ Call Wall, which has remarkably rolled higher to 350 (from 340). In rallies, correlation generally declines, as is happening now. It's quite apparent in this environment as select technology stocks launch higher while nearly all other sectors are flat to lower.This outperformance is heavily reflected in implied volatilities. Consider the difference in skew between QQQ & SPY, which implies there is more of a long call grab in tech, which is stating the obvious.

@spotgamma

S&P technical levels have support at 4205, then 4175, with resistance at 4225, then 4245. We have remained in an objective, textbook uptrend since October, and for this reason, the tendency will be for dips to get bought until that changes. That has been clearly occurring, and until today, we remained stuck in that same range we have been in since the beginning of April between 4200 and 4116. However, with this second attempt of the week above 4200 likely sticking, a new range may be forming. Things look extended now, with various time-framed RSIs indicating overbought conditions.

@AdamMancini4

Treasuries are mixed, with the 10yr yield at 3.81%, lower by around -1.3 bps on the session, while the 5s30s curve is flatter by 5 bps on the session, moving to 3 bps.

Four Key Macro House Charts:

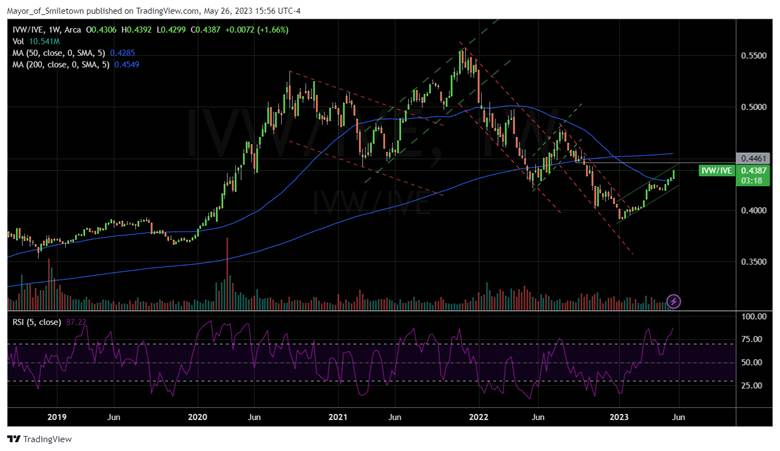

Growth/Value Ratio: Growth is higher on the day and week, with Large-Cap Growth the best-performing size/factor on the week.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and lower on the week.

5yr-30yr Treasury Spread: The curve is flatter on the day and the week.

EUR/JPY FX Cross: The Euro was stronger on the day and the week.

Other Charts:

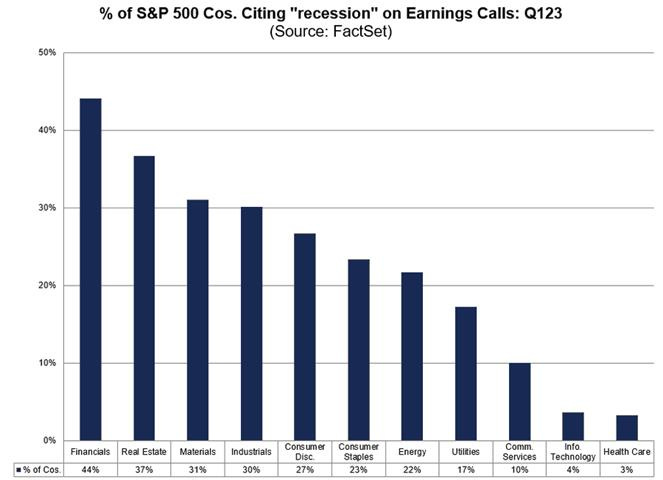

44% of the S&P Financials sector companies have cited "recession" on earnings calls for Q1 2023, the highest percentage out of any sector.

With over 90% of the S&P 500’s market cap having been reported, profit margins currently stand at 11.8%, a level of profitability that had only been eclipsed once in the pre-pandemic period. - @JPMorgan

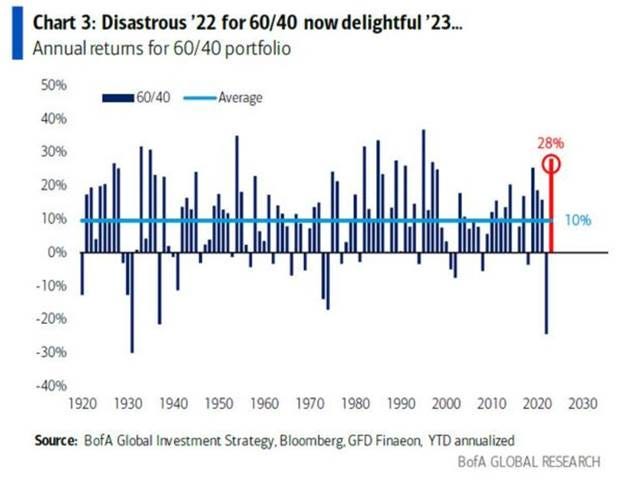

The 60 stocks/40 bonds portfolio is reversing historically huge losses last and is so far having a great year.

Looking at a view of the blended U.S. money supply going back nearly 200 years: this is the fastest contraction since the 1930s. Sharp slowdowns and contractions in the economy have always followed such moves. - @DeutscheBank

Mutual funds are increasingly deploying their cash

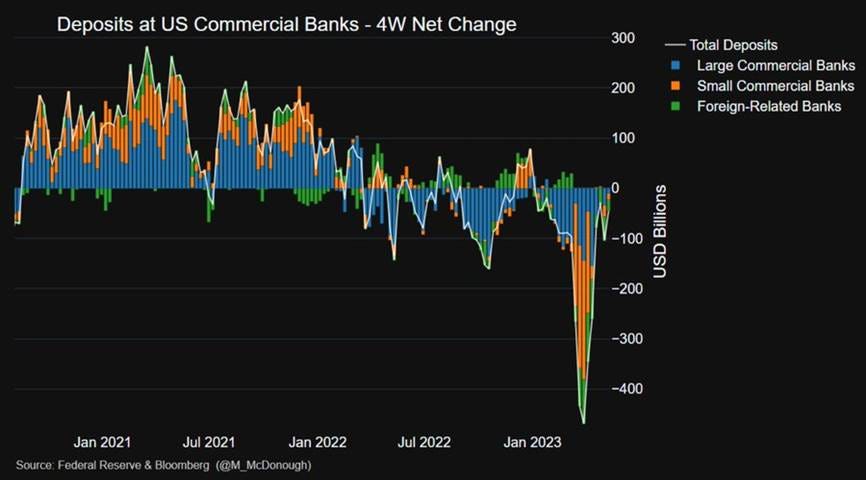

The Fed’s H8 Data which shows changes in deposits at commercial banks, continues to show a reduced outflow

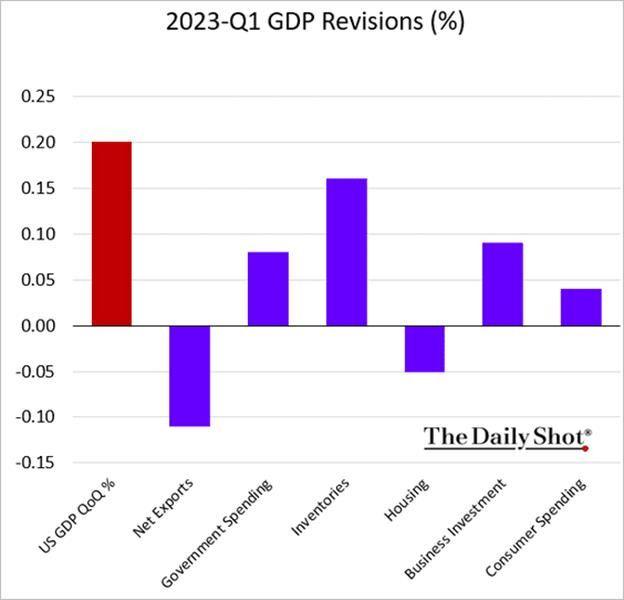

Q1 GDP was revised higher, with the inventory drag reduced while business investment, government, and consumer spending rose.

Articles by Macro Themes:

Medium-term Themes:

China’s Post-Pandemic Life:

Medicaid in China: China has issued guidance to all provinces to build a basic elderly care system by 2025, the state-run Xinhua news agency said on Sunday, in the latest step to prevent a demographic crisis. China's National Health Commission projects the number of people 60 and older will grow to 400 million by 2035 from 280 million now. There will most likely be a need for about 40 million beds in community facilities and nursing homes, up from 8 million now, analysts say. Services included material assistance, nursing, and caregiving, while all provinces must provide visiting and caring services for the elderly living alone and for families with financial difficulties. - China Issues Guidance for Basic Elderly Care System by 2025 - Reuters

Longer-term Themes:

Cyber Life and Digital Rights:

Cut Off?: On Monday, the European Union slapped Meta with a record $1.3 billion privacy fine and ordered it to stop transferring users’ personal information across the Atlantic by October, the latest salvo in a decadelong case sparked by U.S. cyber-snooping fears. The penalty of 1.2 billion euros is the biggest since the EU’s strict data privacy regime took effect five years ago, surpassing Amazon’s 746 million euro fine in 2021 for data protection violations. Meta, which had previously warned that services for its users in Europe could be cut off, vowed to appeal and ask courts to immediately put the decision on hold. - Meta fined record $1.3 billion and ordered to stop sending European user data to US – AP News

Energy’s Midlife Crisis:

Winding Up: Japanese companies have committed to invest more than $22bn in the UK, including funding for offshore wind, low-carbon hydrogen, and other clean energy projects. Trading house Marubeni had announced its intention to sign an agreement with the government which envisaged close to $12.5bn of investment in Britain with partners over the next ten years. This includes offshore wind in Scotland and green hydrogen projects in Wales and Scotland. The announcement came ahead of a Group of Seven leaders’ (G7) summit and followed a report showing that Japan has the lowest share of clean electricity of any G7 country, with the offshore wind being “the biggest gap” to its current electricity plan. G7 Climate, Energy, and Environment Ministers laid out that they would build 150 GW of new offshore wind by 2030. Meanwhile, Japan is targeting 10 GW of offshore wind capacity approved by 2030, with at least 5.7 GW online by then - Japanese pledge to plow billions into UK offshore wind sector – Splash247

Moving Fast: Clean energy technology manufacturing is expanding rapidly, driven by supportive policies, ambitious corporate strategies, and consumer demand, according to the IEA’s most recent Energy Technology Perspectives (ETP) Special Briefing. The global energy crisis has instilled further impetus to develop manufacturing capacity to strengthen energy security and diversify supply chains. Manufacturing capacity year-on-year grew for batteries (72%), solar (39%), electrolyzers (26%) & heat pumps (13%). If all announced Solar PV projects were to come to fruition, capacity would comfortably exceed the deployment needs of the IEA’s Net Zero Emissions by 2050 (NZE) Scenario in 2030. Further, announced projects for battery manufacturing capacity may cover virtually all of the 2030 global deployment needs of the NZE Scenario. However, other areas, such as wind, are lagging goals, and the geographic dispersion is still highly concentrated in a few places. The report looks deeper into current trends - The State of Clean Technology Manufacturing - IEA

Other Articles of Interest:

Above 2022: Companies in the Russell 3000 have unveiled plans to buy back more than $600 billion in shares this year, in line with last year’s record pace, according to data from research firm Birinyi Associates. In all, they announced $1.27 trillion of share repurchases and completed $1.05 trillion in buybacks in 2022, both all-time highs. A handful of the biggest companies are responsible for a disproportionate share of total buybacks. Apple, Alphabet, Meta Platforms, and Microsoft were the biggest buyers of their own shares in the first quarter. That activity has offered an important source of support for the stock market. Data on fund flows show many of the traditional buyers of stocks have been net sellers of late. - Share Buybacks Continue at Torrid Pace While Investors Sit on Sidelines – WSJ

Soaring Imports: The European Union is managing to replace shipments of diesel from Russia as deliveries from other nations have soared. Total arrivals of diesel and gasoil are expected to surge to a four-month high of about 1.25 million barrels a day in May, according to data compiled by Bloomberg from shipping analytics firm Vortexa Ltd. Flows from Saudi Arabia are expected to reach a new high of about 324,000 barrels a day, while cargoes from the US are set to be the highest since August 2020. Shipments from Asia are set to decline this month due to lower flows from China and Singapore, although diesel-type cargoes from India are expected to climb. - Europe Is Successfully Replacing Its Lost Russian Diesel Supply - Bloomberg

Podcasts:

For Fun:

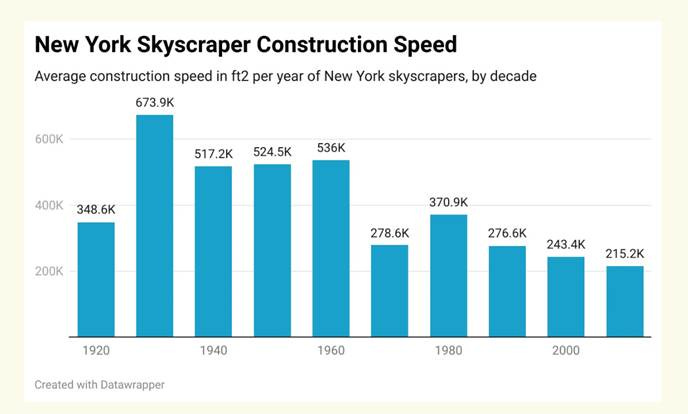

Average skyscraper construction speed in New York declined from over 500,000 square feet per year from the 1930s through the 60s to less than half that post-2000.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION