Changing Tides on the Data and Policy Front - MIDDAY MACRO - 12/1/2022

Color on Markets, Economy, Policy, and Geopolitics

Midday Macro – 12/1/2022

Overnight and Morning Recap / Market Wrap:

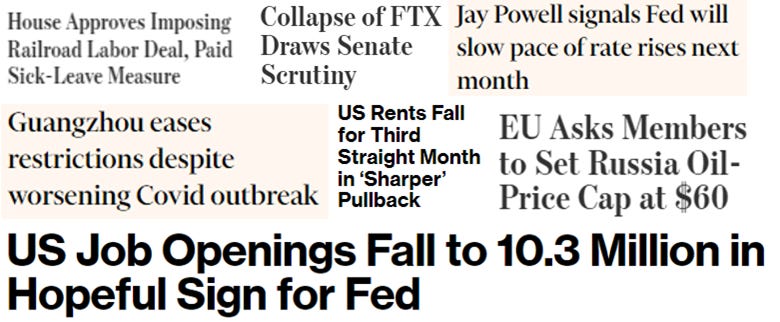

Price Action and Headlines:

Equities are mixed, with yesterday’s gains holding despite weaker-than-expected ISM manufacturing survey results and a history of Powell-driven rallies reversing quickly

Treasuries are higher, with the curve flattening despite further drops in yields following massive moves lower yesterday due to Powell’s dovishly perceived speech, with the 10yr Treasury yield back near 3.5%

WTI is higher, around $81, as further news that zero-Covid policy was changing and OPEC is likely to defend prices further have prices rebounding $10 higher from last week’s lows

Narrative Analysis:

Equities are flat and consolidating yesterday’s historically sizeable daily gains, with the Nasdaq (growth/tech) outperforming, but all indices are generally little changed following weaker-than-expected manufacturing data this morning, which overshadowed better-than-expected core PCE readings and consumer spending data. This is helping Treasuries to continue to rally following a sizeable gap lower in yields due to Powell’s more dovish-than-expected speech yesterday. Oil has recovered much of its recent losses due to expectations that demand in China may improve while energy markets are generally bracing for colder weather. Industrial metals are also better bid on the news China is reducing zero-Covid restrictions and embarking on a massive vaccination campaign. The dollar is weaker as real rates continue to fall sharply, reducing yield differentials as well as reflecting lower levels of growth worries due to a perceived lower terminal Fed funds level. The $DXY has fallen to 104.7, as the Yen, Euro, and Pound are up notably on the day.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and Small-Cap factors, and Communication, Health Care, and Technology sectors all outperforming on the day. Factor and sector leadership on the week favored Consumer Discr., Communication, and Tech, while Growth and Low Vol notably outperformed, indicating no apparent cyclical/defensive tilt.

@KoyfinCharts

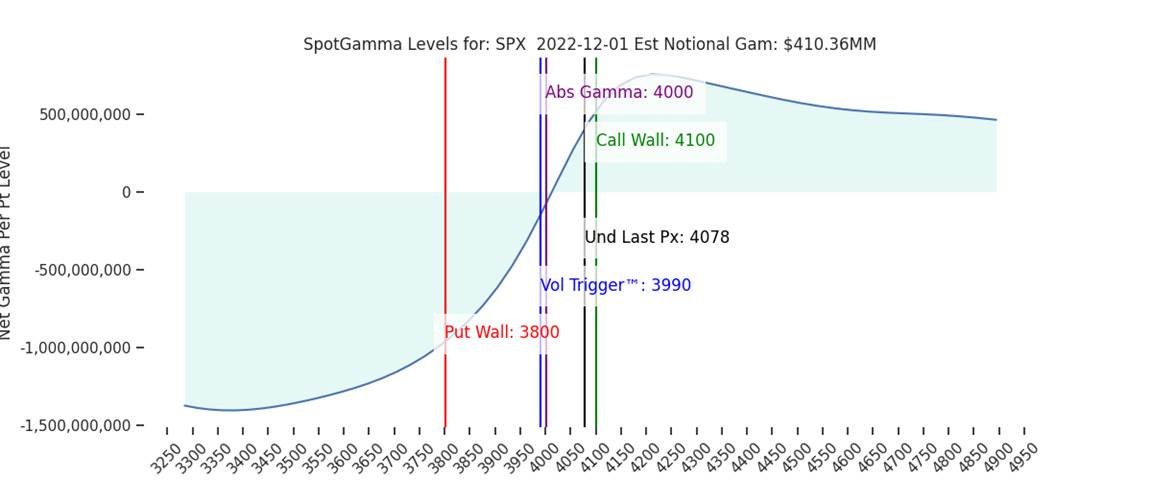

S&P optionality strike levels have the Zero-Gamma Level at 4002 while the Call Wall is 4100. Expectations are for volatility to fall further, implying a <=1% daily move. Yesterday’s dovish Powell presentation crushed implied vol, unlocking positive gamma, and created a vanna tailwind that, when coupled with the large amount of 0DTE call positions, caused a positive feedback loop of buying.

@spotgamma

S&P technical levels have support at 4075, then 4045, with resistance at 4095, then 4130. The S&P has now cleared its 200-day moving average for the 1st time of this bear market, as well as broken its November highs. After yesterday’s break out, bulls are obviously in control as long as they are above the prior resistance, which is now 4045-50, and the lowest bulls would want to see on any sell-off is 4010-20. However, it is not uncommon for these euphoric Powell-driven moves to retrace the next day. While the technical setup is good, a move is always confirmed after the fact by whether it “survives” the 1st breakout pullback.

@AdamMancini4

Treasuries are higher, with the 10yr yield at 3.54%, lower by 7.5 bps on the session, while the 5s30s curve is flatter by -3.7 bps, moving to -3.7 bps.

Deeper Dive:

Was that actually Powell yesterday or a dovish doppelganger? All kidding aside, and as seen following last month's better-than-expected CPI report, this market continues to be poorly positioned for what we believe is a changing tide on both the economic data front and, in accordance, the policy front. With inflation having now clearly peaked and indications of demand falling fast, as seen in today’s ISM manufacturing survey and a slew of weaker-than-expected regional Fed business surveys, the need for a more two-sided risk management approach to monetary policy is quickly emerging. While we certainly still have a long way to go to get inflation back down to target, as seen in today's 5% core PCE reading, we may not have that much further to go in regards to tightening policy further, at least on the Fed funds rate front, given the increasingly not-so-lagged effects that forward guidance, cumulative rate hikes, and increasingly QT are having on Main Street. As a result, it's not too surprising that Powell (and others) have signaled that caution is now warranted as the Fed enters the next phase of the tightening cycle. Interestingly, weaker employment data (but not crashing) will likely be the new catalyst (alongside CPI prints) that drive risk assets higher. Well, at least until consumer activity is clearly below trend, something that still looks a few quarters away.

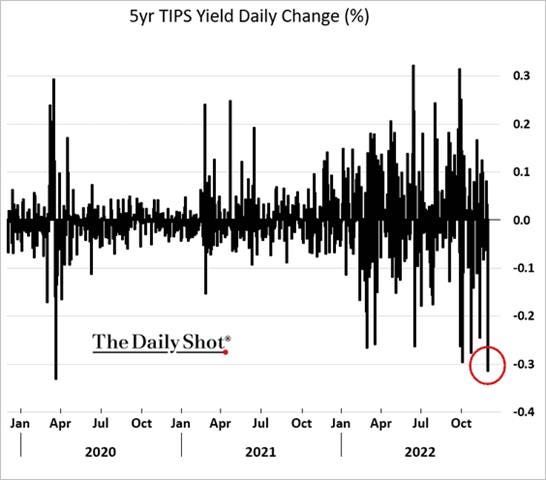

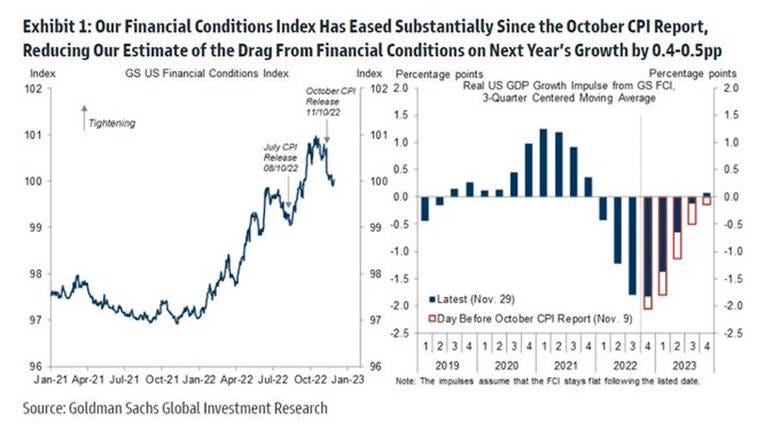

After consolidating post-CPI gains for two weeks, the much-hated October “bear-market” rally got a much-needed boost from Powell yesterday. It looks like macro and systematic positioning again drove the outsized moves as markets were caught offside and generally defensive into what was expected to be a hawkish rebuttal on the recent loosening of financial conditions. Optionality and technicals also increasingly became more supportive following Powell’s speech thanks to the continued large amounts of 0DTE calls driving dealer buying, the recapturing of the 200-day moving average, and a challenge of the longer-term downtrend resistance. Add in the massive drop in yields, particularly real rates, as well as notable dollar weakness, and already trending lower financial conditions loosened even further.

*Its make or break time for the S&P, which closed above its 200-day moving average and is now on at its downtrend resistance

*Yields across the curve fell between 20 to 30 bps, with 5yr real rates falling by the most since the onset of the pandemic

*The October CPI report had knocked the GS Financial Conditions Index out of its uptrend, with yesterday's price action now likely moving it closer to 99, reducing expected rag on economic growth

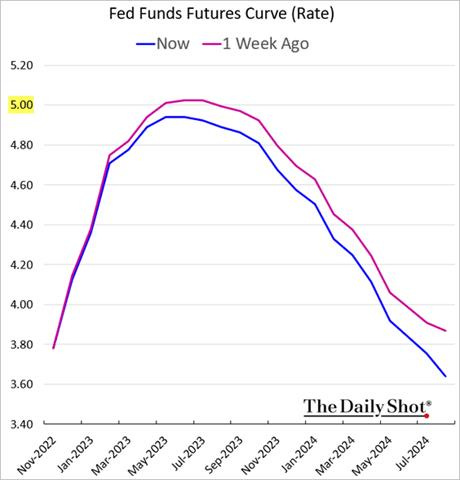

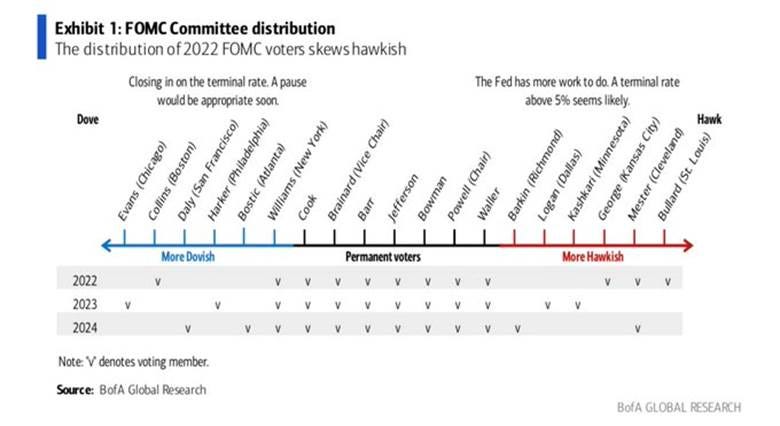

What now? At this point, the hawkish members of the committee have generally played out their hand, with Bullard and Waller throwing out projections for terminal Fed funds rates as high as 7%, something we don’t believe is remotely necessary (or even achievable given the number of things that would break). On the other side, dovish members have generally only started to chime in lately, and we suspect that if inflation falls further in the coming months, a growing chorus of restraint and caution will emerge from the middle members. Powell’s main goal yesterday was to solidify that the Fed is moving into the next stage of its tightening cycle, which embraces a more two-sided risk management approach. Given the weakening data (inflation, demand, and employment) and the fact markets already expect step-downs in rate hike sizes, he needed to solidify that there would likely be no easing in 2023, keeping policy at (a now reduced) restricitve level for longer. Any indications of further large rate hikes would bring into question creditability (as, again, in our opinion, it is not needed) and bring on more “policy error” fears. The market rallied as much as it did because a longer-hold strategy meant not hiking too much more in the immediate (now potentially below a 5% level) and deciding the ultimate length of holding rates there later (into falling inflation). Finally, Powell's posture/demeanor was more dovish, and he seemed more optimistic about achieving a soft landing.

*There was a slight decrease in the expected terminal Fed funds level and, interestingly, a faster reduction in rates despite Powell’s intended message of staying at the terminal level longer

*We fully expect to see a mass migration to the dovish camp by Q2 next year as the Fed tries to have its cake and eat it too, meaning the focus will shift back to the labor/growth side of the dual-mandate after a quarter of lower trending inflation

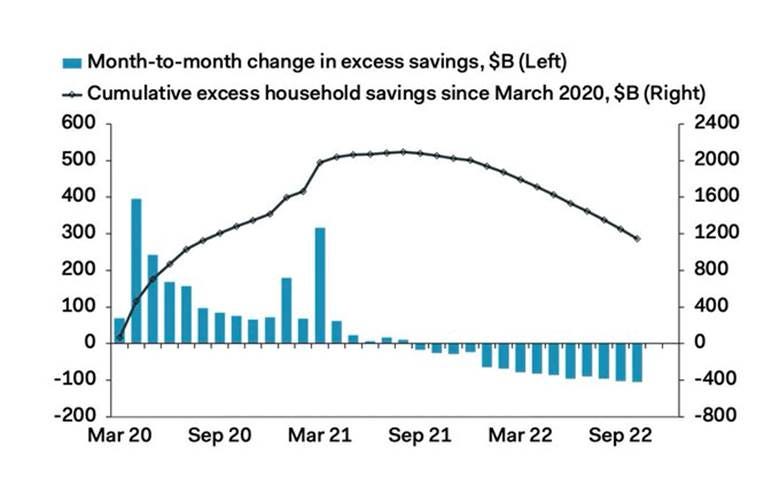

Switching gears, on the whole, Q3 earnings were not as bad as many feared. The S&P 500 earned $44.79 per share last quarter, down by -9.7% from Q3 ‘21 but 4.8% higher than in Q2 ‘22. The main takeaway is that things are weaker than last year, but the consumer is still stronger than they were pre-pandemic and has been able to weather the higher inflation levels better than expected. Will this change? It sure will. With savings and net wealth falling and credit card debt and HELOC usage rising, the consumer is entering its final innings of keeping up with the

JonesKardashians. Expectations are that excess deposits/savings will be fully depleted by the middle of next year. However, with that said, there's still some gas left in the tank, and with the job market only now starting to waiver, the true consumer recession still looks several quarters off (and we aren’t in the business of forecasting more than six months ahead). Recent comments and data show that the holiday season will likely be the last hurrah, potentially beating expectations but taking away from activity next year:"...what we continue to see is a very strong consumer. Consumer spending is healthy -- for what we've seen from our operating metrics through the first week of November, what we're seeing is generally consistent with our expectations as we had laid out in Q3." - Mastercard CFO Sachin Mehra

"The consumer is healthy. The consumer is healthy. I don't see it necessarily taking off, but if there's any pullback, it's very, very, very small, if there is any. So I think the consumer is still out in force." - Fiserv CEO Frank Bisignano

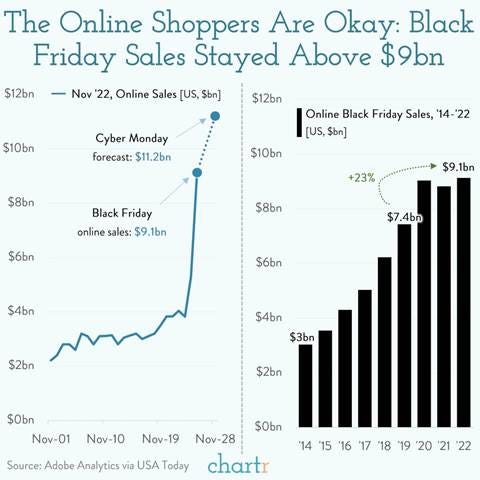

Black Friday and Cyber Monday sales beat expectations, although mainly due to more thrifty buying, showing that the time of price-insensitive shopping has ended, but the holiday season won’t be as weak as feared.

TSA screened 2.56 million air travelers last Sunday, the highest number since December 2019, as the demand for travel and leisure & hospitality, more generally, continues to be strong.

"Cities are reopening; travel is booming and more broadly, a continued shift of consumer spending from retail back to services. We've seen these trends continue into the fourth quarter with October tracking to be our best month ever for mobility and total company gross bookings." - Uber Technologies CEO Dara Khosrowshahi

We highlight these more positive consumer views in an attempt to push back on any dire imminent recessionary fears. Timing what seems like the most predicted recession ever will be tricky and ultimately depend on how healthy the labor market remains, even as various cohorts of consumers reduce activity next year. The abundance of jobs will depend on a lot of other things not yet known/seen (such as the Fed, inflation, global growth, and no new shocks), and, as a result, we have a high level of uncertainty over where growth, earnings, and risk-asset valuations will go. You simply can’t look too far ahead currently, hence our cautious but still more optimistic outlook than most.

*Initial data showed a positive buying pulse on Black Friday and Cyber Monday, even when adjusted for inflation, with consumers increasingly looking for deals/discounts

*“People are still running down their pandemic savings and have about $1.15 trillion left. .. Looking into next year, however, we expect spending growth to slow .. people will be less willing to run down savings in the face of a deteriorating labor market.” @PantheonMacro

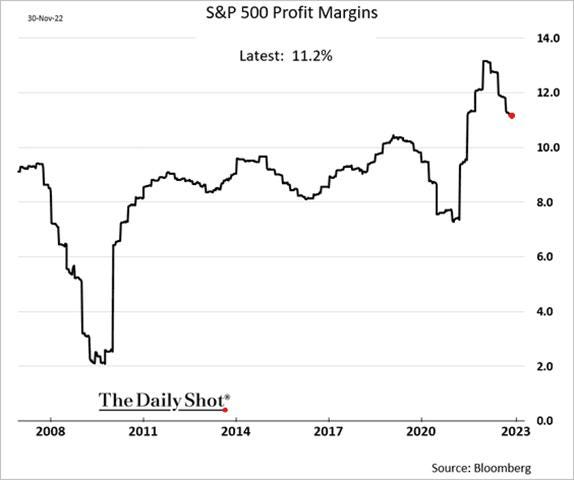

*In theory, costs should begin to stabilize right when top-line demand begins to fall, likely moving back toward the 10%-8% range as the economy slows further in 2023.

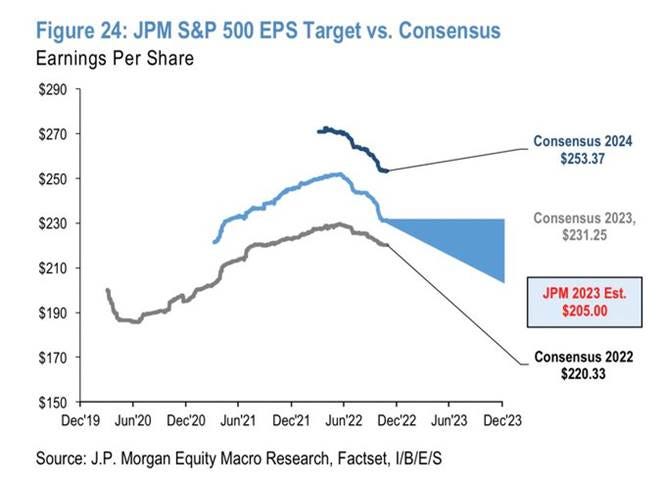

*As a result of expectations for margins to keep falling, earnings estimates have yet to bottom, with JPM reducing their 2023 S&P EPS forecast to $205 today.

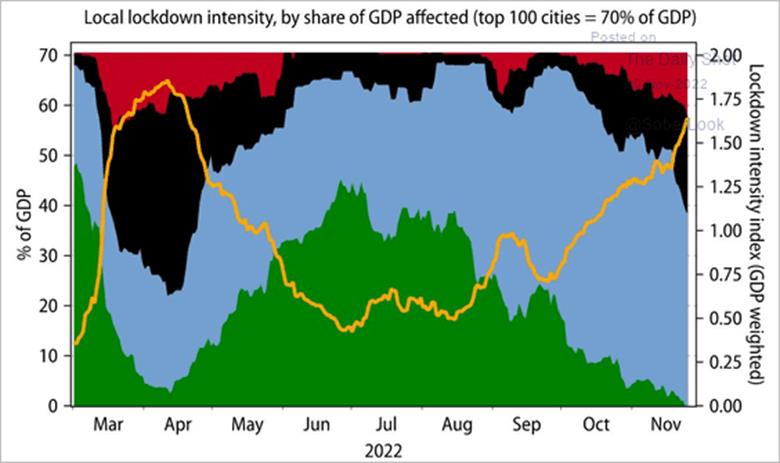

Finally, it is worth highlighting the recent zero-Covid developments in China. Beijing is now allowing some virus-infected people to isolate at home, starting with residents of its most-populous district, a significant shift that reflects the pressure officials are under following historical public opposition/unrest. On Wednesday, China’s top Covid official said the country’s efforts to combat the virus are entering a new phase, with the omicron variant weakening and more people getting vaccinated. State-backed media, which have spent years demonizing the virus and showcasing the devastation and death toll in Western countries, are now playing up stories of Covid-19 survivors in a bid to reassure the same people they’ve frightened. The Global Times tabloid ran an article Thursday morning citing Chinese experts that people don’t need to panic over omicron, as it’s much less deadly. Further, Caixin reported that Beijing had set hard KPIs for local governments. They are expected to have 90% of the people aged over 80 (who meet the health criteria) to be fully vaccinated and receive booster shots by the end of January 2023. The current number is 66%. China is about to start a massive vaccination campaign (better late than never?).

*Very high level of lockdowns currently occurring despite changing rhetoric, leaving Q4 economic activity under pressure again

*Recent rises in equities and copper, as well as further dollar weakness, has the mock portfolio's performance near 3%. We have moved stops higher to protect gains. We are remaining patient and not chasing further equity, credit, and EM exposure, something we wish we had more of on since October

Econ Data:

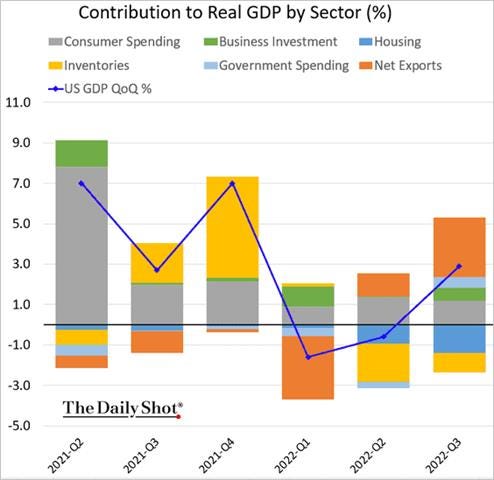

Third-quarter real GDP was revised higher to 2.9% from 2.6% on an annualized basis. Increases in exports (15.3%), consumer spending (1.7%), business fixed investment (5.1%), and government spending (3%) made positive contributions, while decreases in residential fixed investment (-26.8%) and private inventory investment subtracted from the headline figure. Within consumer spending, increases in services (2.7%) offset decreases in goods (-0.2%), but service spending cooled notably from last quarter. Inventory investment continued to be a drag on growth, while a narrower trade gap positively contributed for the second quarter in a row. The GDP deflator was revised higher to 4.3% from 4.1%, with nominal GDP growth moving to 7.3% from 6.7%. The annualized change in real private domestic final sales (private-sector GDP less inventories and trade) was revised to 0.5% from 0.1%. Corporate profits fell -1.1% (non-annualized) in the third quarter but were up 4.4% year-over-year. Real disposable personal income increased by 0.9%, while the personal savings rate fell to 2.8%.

Why it Matters: Both growth and inflation were revised higher by more than expected. The trade balance, for a second quarter in a row, was a significant contributor, with the U.S. exports of energy to Europe (and elsewhere) adding 1.7% to the headline total. Personal consumption expenditures cooled mainly due to a drop in spending on services (2.7% vs. 4.6% Q2), although purchases of goods remained negative for the third quarter in a row. Fixed investment remained negative due to a growing contraction in residential (-26.8% vs. -17.8%), although there was a large increase in equipment spending (10.7% vs. -2%). Corporate profits notably fell, although a core measure of that did slightly increase. The weaker profits were a drag on the income estimate of GDP, which rose 0.3% at an annual rate compared to the 2.9% increase in the expenditure estimate of GDP. With the effects of tighter monetary policy yet to fully weigh on the economy, reducing PCE and investment further, and still challenging international picture, hurting export demand, it is likely the very rosy Q4 GDP by the Atlanta FedGDPNow model will trend lower from its now 2.8% estimate.

*Business fixed investment, government, and trade balance all increased in Q3, while PCE, inventories, and residential investment fell

*Housing construction (-1.4%) and inventories (-0.97%) were the main detractors of the Q3 2.3% GDP growth level

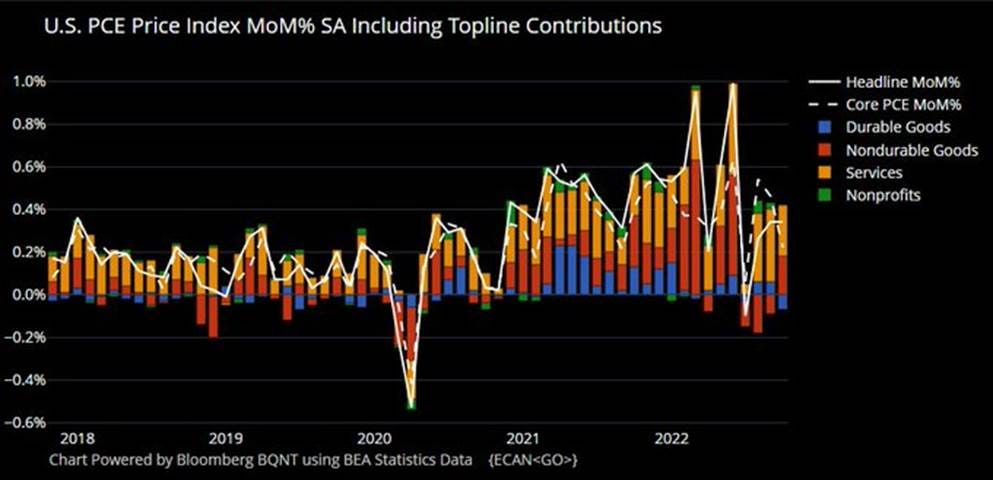

Personal spending increased by 0.8% in October, following a 0.6% rise in September and matching market forecasts. Personal income rose by 0.7% on the month, up from a 0.4% rise in September and above market expectations of a 0.4% gain. It was the strongest reading since October 2021. The Headline PCE price index rose by 0.3% MoM, while core PCE increased by 0.2% (lower than 0.3% expected), bringing their annual increases to 6% and 5%, respectively. In terms of inflation trends in core PCE prices, the rate of increase over the last three months was 5.0% at an annual rate, which is in line with the 12-month increase.

Why it Matters: Figures continue to point to solid consumer spending, helped by a tight labor market and high savings/net wealth, despite rising prices and borrowing costs. Within goods, the leading contributors were new motor vehicles (namely light trucks) and gasoline. Within services, the largest contributor to the increase was spending on food services and accommodations. The lower-than-expected monthly increase in Core PCE also bodes well for the Fed and highlights the difference in accounting for shelter between PCE and CPI. With Powell potentially indicating the Fed is looking through current shelter inflation, it is likely to be less impactful, but never the less shows a deceleration in monthly gains is occurring.

*Real personal consumption expenditures continue to grow, increasing from last month, while the price indexes for headline were in line while core came in lower than expected.

*The annual core rate has fallen again after picking up last month. With slowing demand, excess inventory, and harder comps coming, it is very likely the peak is in

*Gasoline was a top contributor to the headline reading, while food service and accommodations and housing and utilities drove core higher

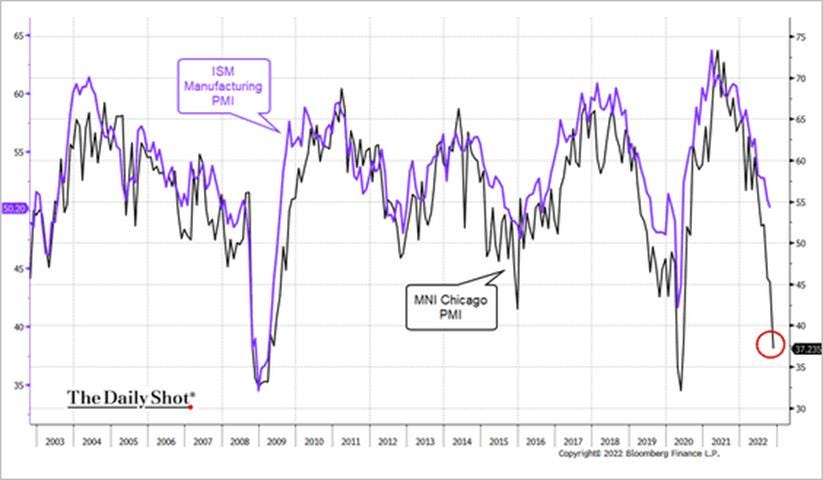

The ISM Manufacturing PMI declined to 49 in November from 50.2 in October and more than market forecasts of 49.8. Only Production (51.5 vs. 52.3 in Oct) and Inventories (50.9 vs. 52.5) remain in expansionary territory (above 50), but both weakened. New Orders (47.2 vs. 49.2), Backlog of Orders (40 vs. 45.3), and Imports (46.6 vs. 50,8) showed demand is contracting faster, although New Export Orders (48.4 vs. 46.5) slightly improved. Employment (48.4 vs. 50) finally fell into contractionary territory. Inventories measures were more stable while Prices (43 vs. 46.6) fell further. Finally, Supplier Deliveries (47.2 vs. 46.8) rose slightly but still are in contractionary territory, showing the persistence in better logistics since summer's end.

Why it Matters: November’s ISM report showed the first contraction in factory activity since May 2020. Drops in demand and inventory being at a more normal level show firms are preparing for lower production moving forward. On the employment front, “companies confirming that they are continuing to manage headcounts through a combination of hiring freezes, employee attrition, and now layoffs.” There was an increase in the number of commodities that had decreasing prices over the month, while the list of those in short supply continued to contain electronic components and semiconductors. One survey respondent said it best, noting that the “general economic uncertainty has created a slowdown in orders as we approach the end of the year, and many of our key customers are reducing their capital expenditures spend.”

*Only two of the survey’s sub-indexes were in expansionary territory, while only three moved higher on the month

*Some respondents still note a stable environment but many expressed concerns regarding future demand, as expected

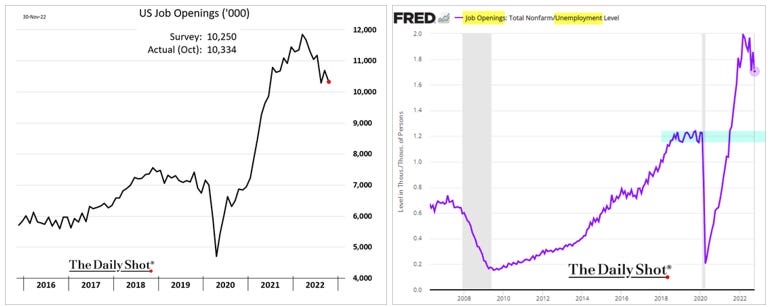

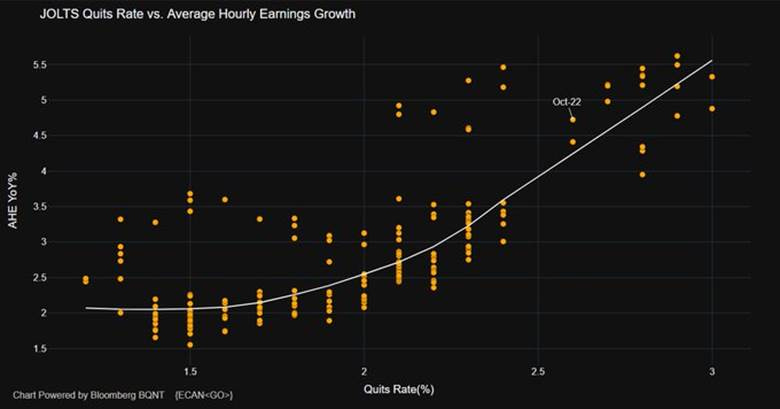

The number of job openings dropped by 353K to 10.3 million in October, roughly in line with market expectations. Job openings decreased in state and local government, excluding education (-101K), nondurable goods manufacturing (-95K), and federal government (-61K). The number of job openings increased in other services (+76K) and in finance and insurance (+70K). Over the month, the number of hires and total separations changed very little, remaining at 6.0 million and 5.7 million, respectively. The hires rate and quits rate (quits level as a percentage of payrolls) both edged 0.1% point lower to 3.9% and 2.6% (quits rate was 2.3% pre-Covid in February 2020), respectively, while the layoffs rate was unchanged at 0.9%. The job openings rate (job openings level as a percentage of payrolls plus job openings) declined to 6.3% from 6.5%.

Why it Matters: The report represents a slight easing in the labor market, but there is still a long way to go before Fed officials see a more historical supply and demand balance. The job opening rate has fallen from a peak of 6.8% in July to 6.3%, while the UER has also risen during that time. The number of vacancies is off its high of 2 to now 1.7, but again is still very elevated and was at 1.2 prior to the pandemic. Since May, the quits rate has declined to 2.6% from 2.9%, but this is also still historically very high. There has been no real pick-up in layoffs despite the growing barrage of headlines. Anecdotally, we continue to hear that businesses are more reluctant to lay off workers, given the difficulty in finding them initially. Other firms say they plan layoffs at the beginning of next year.

*JOLTs data is slowly trending towards a less tight labor market but has a long way to go to get back to more historical average levels

*The quits rate is likely the best indicator of labors confidence and is starting to show a greater uncertainty over future job prospects

*JOLTS Quits Rate vs. Average Hourly Earnings Growth, as quits fall, so does wage growth

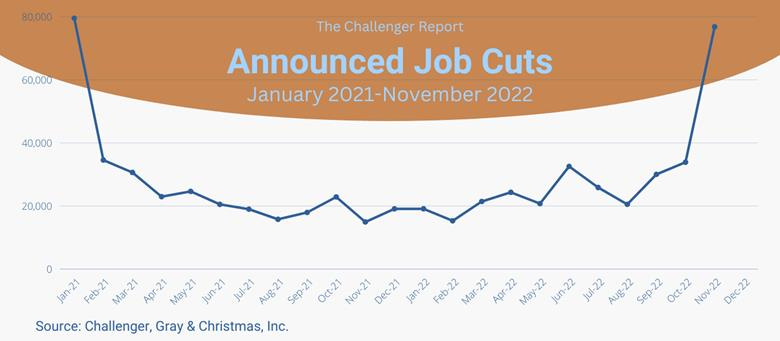

The Challenger Job Cut report showed that employers announced 76,835 job cuts in November, the highest since January of 2021, and compared to 33,835 in October. The tech sector announced 53K cuts, the highest monthly total for the sector since detailed industry data started being collected in 2000. Other big job cuts were recorded in the consumer products sector (4K), health care (3K), construction (2.6K) and transportation (2.1K). So far this year, employers announced plans to cut 320K jobs, a 6% increase from the first eleven months of 2021, with the tech sector cutting 81K, the most since 2002. The auto sector announced the second-most job cuts this year with 30.6K. Most jobs were lost in California (103.4K), and most job losses were due to cost-cutting (77.1K). Employers announced plans to hire 30.2K workers in November, bringing the year-to-date total to 1,430K, down 14% from 2021.

Why it Matters: Led by tech, the number of cuts more than doubled from the prior month, all be it off a very low base. Outside of Tech, there would have been a drop in the level of cuts. Elsewhere, and to a much small degree of workers, Job cuts in the real estate industry are up 187% from the same period last year. Retail remained net positive on the month, an area of employment we will be watching closely after the holiday season ends.

*It looks like a bottom may be in for the historically low level of job cuts seen over the last year or so

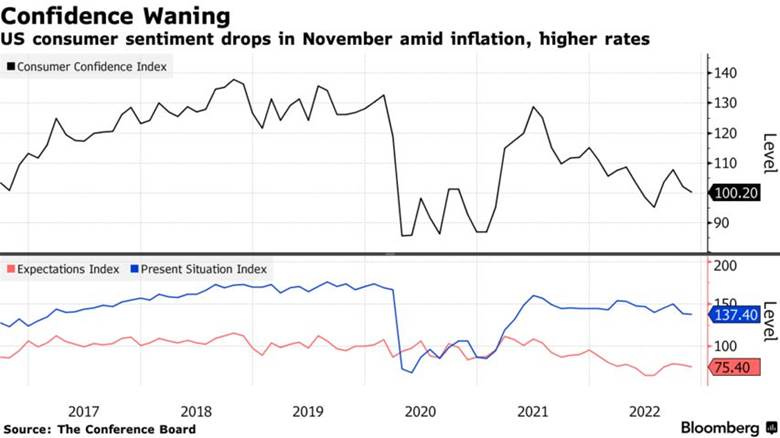

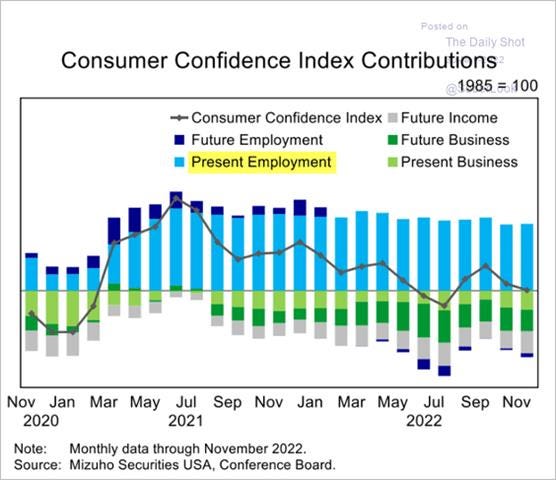

The Conference Board Consumer Confidence Index decreased to 100.2 in November, down from 102.2 in October. The Present Situation Index (based on consumers’ assessment of current business and labor market conditions) decreased to 137.4 from 138.7 last month. The Expectations Index (based on consumers’ short-term outlook for income, business, and labor market conditions) declined to 75.4 from 77.9. The decline in confidence was concentrated in the 55-and-over age group as well as among households with annual incomes below $50K. Consumers' 12-month inflation expectations increased to a four-month high of 7.2% from 6.9% in October, which the survey blamed on rising gasoline and food prices.The survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, rose to 32.8 from 31.8 in October.

Why it Matters: There was a larger decline in expectations, with business conditions and labor market outlooks worsening while consumers were also more pessimistic about their short-term income prospects. This contrasts with consumers’ more favorable appraisal of the labor markets and business conditions. It’s very likely the bottom is not in, given that the coming employment declines will likely outweigh any improvements in future or present business conditions, assuming inflation has peaked.

*The Conference Board’s reading on Consumer sentiment is still fairing better than the University of Michigan Survey’s reading and remains higher than early pandemic lows

*Present Employment readings remain stable, while other categories worsened in November

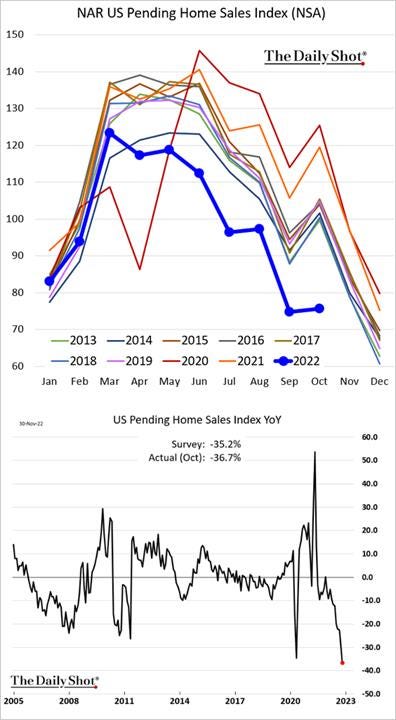

Pending home sales fell by -4.6% in October, slightly below market forecasts of a -5% retreat. The previous month was revised higher to -8.7% from -10.2%. Year-over-year, pending home sales have fallen by -37%, marking the 17th consecutive month of annual declines and the sharpest overall annual decline on record. Pending home sales fell for the fifth month in a row in the Northeast (-4.3%) and the South (-6.4%), while the West (-11.3%) slumped for a second month.

Why it Matters: Housing activity continues to weaken, but expectations are growing for some type of bottom to begin to form in Q1. "The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November," said NAR Chief Economist Lawrence Yun. “Pending home sales have fallen again, but one thing that has recently happened is that mortgage rates have fallen recently, and for the first time since rates rose, we have had four straight weeks of growth in the purchase application data,” Logan Mohtashami, HousingWire’s lead analyst, said. “This data looks out 30-90 days, so we might see this show up more in the January and February data. The year-over-year declines in the purchase apps data have also stopped going lower. Context is critical. We work from an extremely low bar in pending home sales and purchase apps. However, still an encouraging sign.”

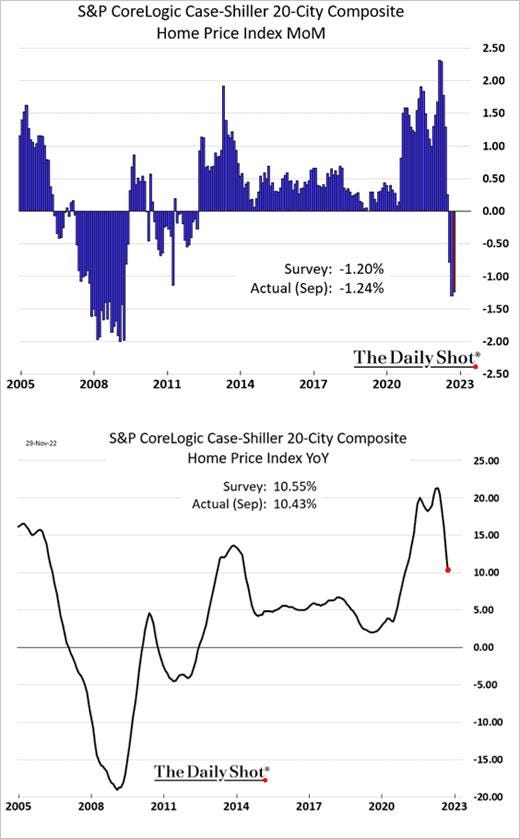

The S&P CoreLogic Case-Shiller 20-city home price index fell 1.5% month-over-month in September, moving the annual rate of increase to 10.4%, the lowest level since December 2020 and below market forecasts of a 10.8% increase. All 20 cities reported lower price increases. Still, Miami reported the highest gain (24.6%), followed by Tampa (23.8%) and Charlotte (17.8%). On the other hand, San Francisco and Seattle had the weakest gains.

Why it Matters: It has been the fifth consecutive month of deceleration as higher mortgage rates on top of already poor affordability continue to weigh on demand. “As the Federal Reserve continues to move interest rates higher, mortgage financing continues to be more expensive, and housing becomes less affordable. Given the continuing prospects for a challenging macroeconomic environment, home prices may well continue to weak,” said Craig J. Lazzara, Managing Director at S&P DJI.

*The U.S. National Index posted a -1.0% month-over-month decrease in September, while the 10-City and 20-City Composites posted decreases of -1.4% and -1.5%, respectively

*Prices are decelerating fast, with the three-month average falling to -2.1%

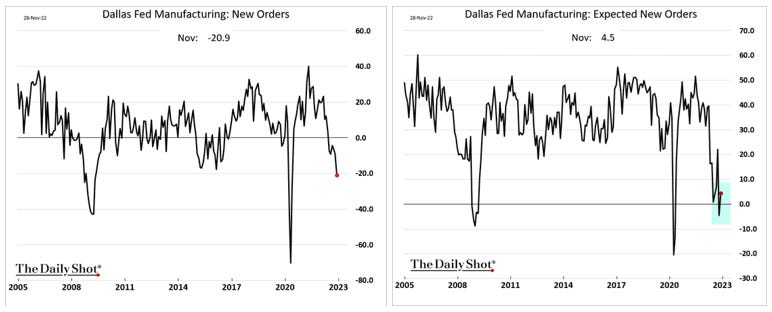

The Dallas Fed’s Manufacturing Index increased to -14.4 in November from -19.4 in the prior month. The majority of the current Sub-indexes weakened during the month. Production (0.8 vs. 6.0 in October) and Capacity Utilization (-3.1 vs. 9.1) moved to flat and into contractionary territory, respectively. New Orders (-20.9 vs. -8.8), Growth Rate of Orders (-19.9 vs. -13.2), and Unfilled Orders (-4.6 vs. -0.4%), all measures of current demand, worsened significantly. Measures of Shipments (-7.5 vs. -1.6) and Delivery Times (-2.8 vs. 1.5) contracted further while Inventory (2.2 vs. -12.6) levels increased into positive territory. Price measures for Paid (22.6 vs. 32) and Received (13.9 vs. 22.2) both dropped notably. The employment picture also cooled but, on the whole, remained positive, with overall Employment (5.9 vs. 17.1) and Wages (36.7 vs. 36.5) both still expanding while Hours Worked (-1.0 vs. -0.1) contracted further. Capital Expenditures increased further into expansionary territory. The six-month ahead future readings were notably more optimistic than the current ones. Respondents indicated that future production and demand should improve while supply-side pressures seen in price increases and logistics would improve. Employment expectations also increased significantly. Comments were mixed by industry, but the future outlook was tilted more negatively, and supply chain problems were often cited still.

Why it Matters: Despite an improvement in the general business activity reading, the majority of sub-indexes worsened, with only inventory and Capex improving. The future outlook was more mixed, as demand and employment expectations improved while supply-side readings regarding price pressures and logistics worsened, signaling less inflationary pressures. The future outlook seemed more stable when coupled with the comments, as opposed to the current business conditions, which worsened. Interestingly the comments were more split regarding inflationary pressures, with supply chain problems persisting in some areas while pricing pressures fell in others.

*Decreases in logistical and price-orientated sub-indexes trended the same way while demand, employment, and Capex ones differed between current and future readings

*A side-by-side comparison of current and future sub-indexes clearly shows the difference in November’s changes

*Price pressures fell further, with every category related to outright price or logistical readings improving

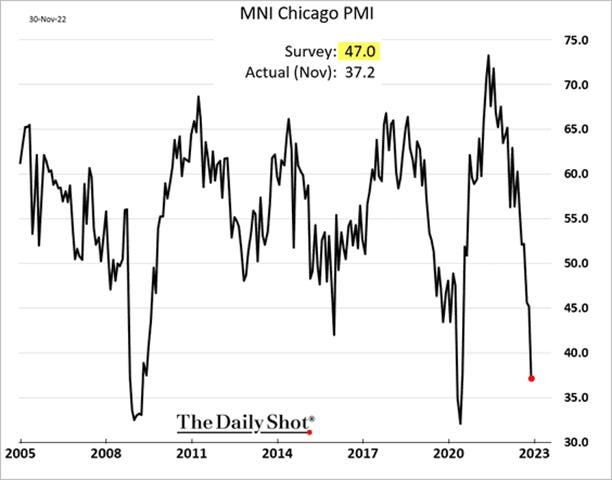

The Chicago PMI fell to 37.2 points in November from 45.20 points in the previous month and well below market forecasts of 47. Among the main five indicators, declines were seen in Production (down 9.2 points to 35.9), New Orders (-8.5 points to 30.7), and Orders Backlogs (-11.2 points to 36.1). Supplier Deliveries (-9.4 points to 49.9) and Prices Paid (-8.6 points to 66.2) also fell, moderating to more normal levels. Only the Inventories ( 2.9 points to 59.8) and Employment (1.5 points to 47.1) sub-indexes rose.

Why it Matters: A significant decline in the index marking the third consecutive month of contractions and an ominus sign for manufacturing activity more generally. The New Orders sub-index reached its lowest reading ever, with 46% of firms experiencing falling orders due to inflation concerns, higher inventories, and the slowing housing market. Delivery times are now near pre-pandemic levels, while falling freight costs contributed to the Prices Paid sub-index moving lower. In the month’s special question, firms were asked whether they were passing the higher cost of doing business onto customers. Around 30% of respondents were able to pass on higher costs, whilst the vast majority (60%) were able to do so only partly. 10% of firms were unable to charge higher prices to account for rising costs.

*Significant one-month drop in the Chicago PMI, with 90% of respondents noting lower production and the New Orders sub-index recording its lowest level ever

*The Chicago PMI has a good track record of predicting the ISM Manufacturing PMI, which means a further drop there is coming

Policy Talk:

Chairman Jerome Powell gave a speech titled “Inflation and the Labor Market” at the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution in D.C. His focus was mainly on inflation, citing core PCE “for the discussion.” He notes that it has been hard to predict inflation and that despite the FOMC forecasting a decline over the next year, the “true path remains highly uncertain.” Powell listed the various forces that had led inflation to its current high level, noting some improvement was occurring and identifying what the Fed would need to see to believe inflation was trending back to target. He summarized by saying the Fed needs to see a sustained level of below-trend economic activity, continued improvements in supply chains, higher frequency housing data to continue to show rents falling, and labor markets that are more in balance. The speech was followed by Q&A, where Powell mainly stayed on script. It is highly likely the December SEPs will show a higher terminal Fed funds level than September’s projection, but he confirmed that the Fed would be slowing down the level of hikes. The market took this as a sign that the Fed will not raise rates much higher than what is currently expected but instead stay at the level for longer.

“While October inflation data received so far showed a welcome surprise to the downside, these are a single month's data, which followed upside surprises over the previous two months. …down months in the data have often been followed by renewed increases. It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

“But as long as new lease inflation keeps falling, we would expect housing services inflation to begin falling sometime next year. Indeed, a decline in this inflation underlies most forecasts of declining inflation.”

“Recent research by Fed economists finds that the participation gap is now mostly due to excess retirements… These excess retirements might now account for more than 2 million of the 3‑1/2 million shortfall in the labor force.”

“Wage growth, too, shows only tentative signs of returning to balance. Some measures of wage growth have ticked down recently. But the declines are very modest so far relative to earlier increases and still leave wage growth well above levels consistent with 2 percent inflation over time.”

Vice Chair Lael Brainard gave prepared remarks at the 21st BIS Annual Conference titled “What Can We Learn from the Pandemic and the War about Supply Shocks, Inflation, and Monetary Policy?” in Basel, Switzerland. As suggested by the title, Brainard focused on how “the experience with the pandemic and the war highlights the challenges for monetary policy” in responding to supply shocks. She noted that a structural change in “supply” could also be slowly occurring as demographics, deglobalization, and climate change cause episodes of more volatile inflation than in the past, pushing up the general level of inflation more permanently. She reviews the post-pandemic inflationary pulses, a series of step-ups brought on by supply and demand imbalances that culminated early this year with the invasion of Ukraine. However, she sees the current slowing in inflation increasing as a prolonged rotation back toward pre-pandemic consumption patterns continues while supply chains also normalize. However, somewhat technical and leaning towards a higher r* theoretical posture, the speech was seen as dovish as it identified “transitory” inflation factors, such as the Ukrainian war, as the reason for the current high levels of inflation. She also stated that a high level of uncertainty over the current output gap warranted a more cautious approach to tightening policy, which reinforced the market's current view that the Fed would be slowing the rate of policy tightening.

“While a very slow rotation back toward pre-pandemic patterns of consumption has been underway for over a year, it remains incomplete more than two and a half years after the initial shutdown: In the most recent data, the level of goods spending remains 6 percent above the level implied by its pre-pandemic trend, while services spending remains a little more than 2 percent below its pre-pandemic trend”

“This is especially true in an environment of high uncertainty. The level of uncertainty around the output gap varies considerably over time, and research suggests that more muted policy reactions are warranted when uncertainty about the output gap is high. The unexpectedly long-lasting global pandemic and the sharp disruptions to commodities associated with Russia's war against Ukraine have contributed to substantial uncertainty.”

“Together, a combination of forces—the deglobalization of supply chains, the higher frequency and severity of climate disruptions, and demographic shifts—could lead to a period of lower supply elasticity and greater inflation volatility.”

New York Fed President John Williams gave a prepared speech titled “Peeling the Inflation Onion” to the Economic Club of New York. As indicated by the title, Williams delves into how he sees the current inflation situation, using an onion analogy to identify how price pressures have been changing. He notes that “lower commodity prices and receding supply-chain issues will not be enough to get inflation back to our 2 percent inflation goal.” Instead, the main problem is that he sees the “innermost layer,” or the broad-based rise in prices for services and the demand-supply mismatch in labor as taking “longer to bring back down.” He notes some improvements are beginning to emerge but acknowledges more is still needed on the policy front. He also highlights financial stability concerns, citing weaker liquidity in Treasury markets. He concludes by saying he expects unemployment to rise and inflation to fall in line with the median dots projected in the September SEPs.

“…a few forward-looking indicators paint a more encouraging picture. Growth in rents for new leases has slowed sharply recently, implying that average rent growth and housing shelter price inflation should turn back down. We're also seeing some signs that the heat of the labor market is starting to cool, with quits and job openings declining from the high levels of the spring, along with indicators of slowing wage growth.”

“The Fed's commitment to achieving and sustaining 2 percent inflation as a bedrock principle has no doubt had a positive effect on the public's inflation expectations… The benefits are evident in the stability of longer-run inflation expectations. Even during the current period of high and volatile inflation, longer-run inflation expectations in the United States have been very well anchored in the past year and a half. They are at levels broadly consistent with the FOMC's longer-run goal.”

Fed Governor Lisa Cook gave prepared remarks titled “The Economic Outlook and U.S. Productivity” at the Detroit Economic Club this Wednesday. She noted some improvement in inflationary pressures, citing October's weaker-than-expected CPI report and drops in PPI and slowing average hourly earnings. The body of her speech delved into the negative trends in productivity. She notes recent productivity data has been choppy, but the longer-term trend has shown that offshoring has skewed productivity lower domestically due to more specialized manufacturing that remained. Given the audience/location, she highlights that auto production has defied this trend. Governor Cook generally sees the manufacturing industry as healthy, mainly due to being in a more “dynamic environment.” She concludes by connecting the importance of productivity growth in helping reduce inflation. Stepping back, the speech focused on a contentious area in economics, measuring productivity, given the current models' differing success between understanding manufacturing and service sector output and the labor and capital needed. Given Governor Cook's still relatively new status on the Board, we thought it important to highlight her views on productivity and its effects on inflation.

“We have begun to see some improvement in the inflation data. The October report on consumer prices was encouraging, particularly the slowing in core inflation… Producer price inflation also moderated in October, suggesting that inflation pressures on businesses may be easing. Nonetheless, I would be cautious about reading too much into one month of relatively favorable data.”

“Indeed, the U.S. manufacturing sector is healthy. The recovery from the pandemic downturn has been remarkable, especially in comparison to the Great Recession. The sector is currently producing at 3 percent above its pre-pandemic level. And, importantly, October marked 18 consecutive months of increasing manufacturing employment.”

“That tightening is clearly slowing demand in sectors that are interest sensitive, especially housing, with residential investment contracting sharply. Consumer spending has remained resilient, however, supported by labor income growth and still-elevated savings.”

The Fed’s November Beige Book showed that economic activity was flat from the previous month, with only five districts reporting modest gains in activity while the rest experienced no change to a slowing. Overall, many contacts expressed greater uncertainty or increased pessimism concerning the outlook. Consumer spending was mixed but rose slightly, with inflation continuing to weigh on low-to-moderate-income consumer activity, especially regarding goods. Travel and tourism contacts, by contrast, reported moderate gains in activity, as restaurants and high-end hospitality venues enjoyed robust demand. Auto sales were mixed by district, as better inventory levels helped sales in certain areas. Manufacturing activity was also mixed but up slightly on average. As expected with higher mortgage rates, home sales fell sharply in certain districts while rental activity also slowed. Residential construction contracted further, and commercial leasing also weakened somewhat. Bank lending activity declined due to weaker demand and tighter standards. Agricultural conditions were flat or up a bit, and energy sector activity increased slightly on balance. Employment grew modestly in most districts helping wages to increase at a moderate pace, but two Districts reported flat headcounts and weaker labor demand overall. Hiring and retention difficulties eased further, although labor markets were still described as tight. Finally, consumer price rises moderated in most districts due to weaker demand and an improving supply chain situation.

The San Francisco Fed’s Research Group put out a paper titled “Monetary Policy Stance Is Tighter than Federal Funds Rate - FRBSF Economic Letter” which argues that due to forward guidance and balance sheet reduction, the actual effective fed funds level, or what they call a proxy Fed funds level, is much higher than the current real FF level. When using the full range of FOMC policy tools, the proxy Fed funds rate after the September FOMC meeting was closer to 5.25% instead of the 3.235% actual FF level. We highlight it given the weight some of the more dovish committee members may give to the model when deciding what the ultimate terminal rate should be and how long to stay there.

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and the week, and Large-Cap Growth is the best-performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and on the week.

5yr-30yr Treasury Spread: The curve is flatter on the day but steeper on the week.

EUR/JPY FX Cross: The Yen is stronger on the day and the week.

Other Charts:

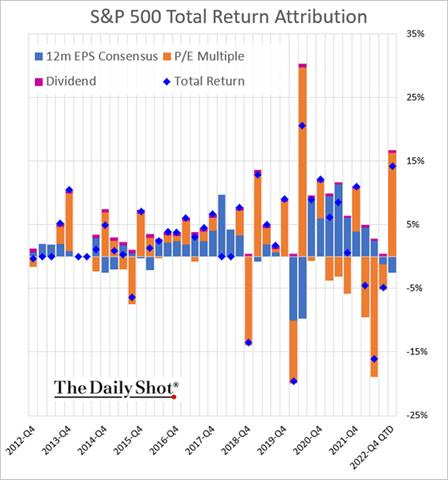

The S&P, up 14% this quarter, continues to be driven by P/E multiple expansion.

Risk appetite is still very low despite the recent rally.

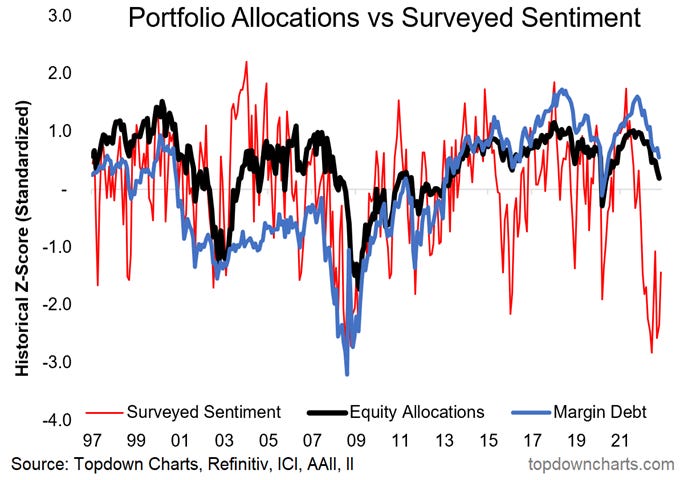

Investors are slowly but surely reducing equity allocations and de-leveraging margin debt positions - @topdowncharts

Margin debt contraction is approaching extremes seen during the Dot.com crash and GFC.

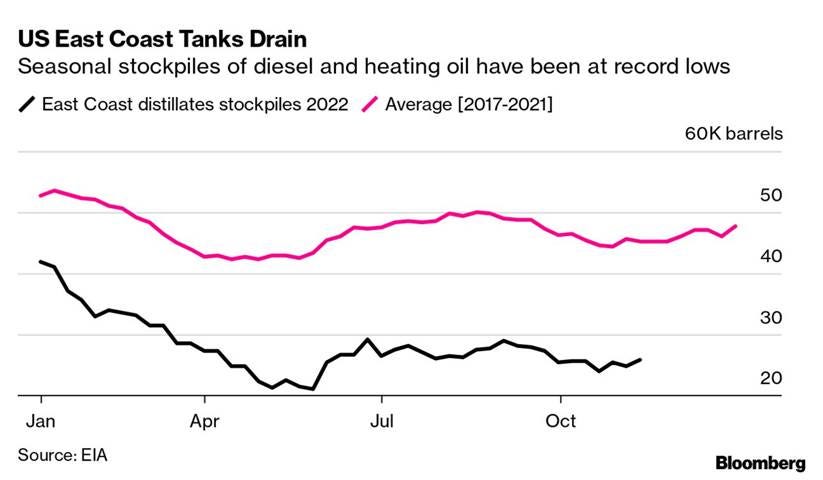

Gasoline inventories have begun to move back to levels more consistent with their five-year average range.

However, diesel and heating oil inventories remain very low, keeping prices elevated there, despite high refinery utilization.

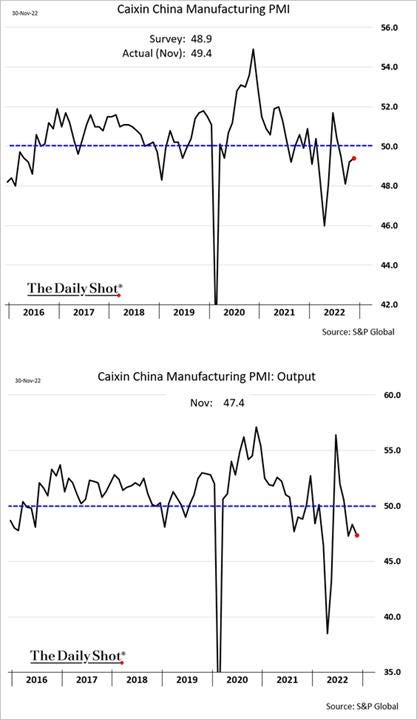

The Caixin China Manufacturing PMI was better than expected, but the index was below 50 for a third consecutive month, indicating a sustained decline in manufacturing activity.

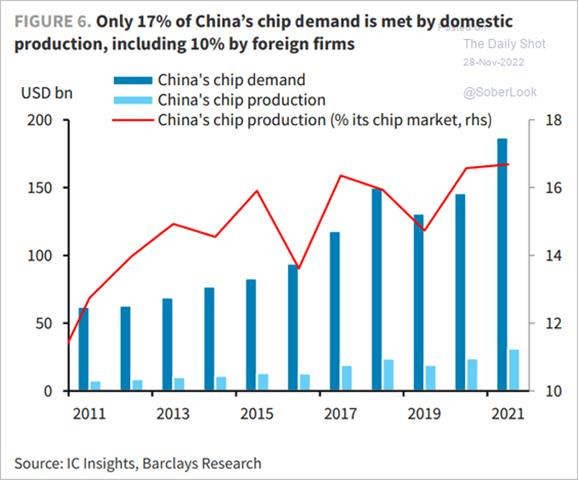

China relies heavily on chip imports, and the new sanctions will increasingly weigh on this and potentially hurt growth

Article by Macro Themes:

Medium-term Themes:

China Macroprudential and Political Situation:

Three Years: China Loosens Grip on Covid Exactly Three Years After First Ever Case - Bloomberg

Exactly three years since the first documented coronavirus patient developed symptoms in the central Chinese city of Wuhan, the country that fought the pathogen first and most fiercely is finally pivoting away from its extreme efforts to fight the pandemic. Authorities have started downplaying the severity of infections while avoiding “dynamic Covid Zero,” a term that refers to wiping out the virus. In the capital of Beijing, some low-risk patients are being allowed to isolate at home while the government is putting more effort into bolstering vaccination rates among the elderly and raising booster coverage.

Why it Matters:

While the central Chinese leadership has remained characteristically opaque on its intentions, the signs are unmistakable. China’s Covid czar described the country as being in a “new phase” of the pandemic. State-backed media, which have spent years demonizing the virus and showcasing the devastation and death toll in Western countries, are now playing up stories of Covid-19 survivors in a bid to reassure the same people they’ve frightened. The Global Times tabloid ran an article Thursday morning citing Chinese experts that people don’t need to panic over omicron, as it’s much less deadly. However, given the high case count currently, the level of lockdowns nationwide, and the very real health risk of letting the virus spread through its population like elsewhere, there is still a long road ahead.

Further Cuts: China’s Central Bank Takes Action as Record Covid-19 Outbreak Hits Economy – WSJ

The People’s Bank of China said last Friday that it would cut banks’ reserve requirement ratio by 0.25 percentage points. The move should free up around 500 billion yuan, equivalent to some $70 billion, that banks can direct to new lending. The cut, which will bring the average reserve requirement ratio across all banks to 7.8%, will take effect on December 5th. The PBOC last lowered the ratio in April, when its economy was similarly under strain during a two-month lockdown in Shanghai.

Why it Matters:

China’s economy grew just 0.4% year over year in the second quarter. Deteriorating readings from business surveys and falling exports were signaling slowing growth even before the latest round of restrictions. Economists at Goldman Sachs on Friday said in a report that they estimate that districts accounting for around 65% of China’s annual gross domestic product are classified by the government as mid- to high-risk areas and subject to tough restrictions on commerce and daily life. China’s economy is also struggling with a property sector burdened with heavy debts, unfinished projects, and falling sales, and it faces new headwinds from a U.S. decision to ban exports to China of advanced semiconductor chips and technology.

Longer-term Themes:

National Security Assets in a Multipolar World:

Rapidly Transforming: U.S.-Europe Trade Booms as Old Allies Draw Closer - WSJ

The U.S. has imported more goods from Europe than from China this year, a big shift from the 2010s when China emerged as America’s dominant trade partner. This is helping Europe’s embattled manufacturers wrestling with skyrocketing energy prices. And it is pushing East Coast ports ahead of their West Coast counterparts in container volumes after years of a U.S. pivot to Asia. Germany’s exports to the U.S. surged by almost 50% year-over-year in September alone. The weak euro is giving European firms an extra edge in the vast U.S. market. European companies are also pouring resources into North America, including Mexico, lured in part by access to cheap energy.

Why it Matters:

The burgeoning trans-Atlantic relationship is part of a reorganization of the global economy along East-West lines. Russia’s cutoff of European energy supplies and fears of over-reliance on China have changed how companies trade. On both sides of the Atlantic, governments have encouraged firms to produce critical products locally instead of in Asia. Some German companies have started exporting to the U.S. out of plants in Germany instead of China, partly to avoid tariffs, trade groups say. “We like the U.S. even more in the current geopolitical context,” said Ilham Kadri, chief executive of Solvay SA, a Belgium-based chemical company with about €11 billion in annual sales. It recently unveiled an $850 million investment to build battery-making facilities in the southern U.S., including in Georgia, aiming to benefit from booming electric-car sales.

No Workers: Russia’s Labor-Starved Economy Pays Price of Putin’s Call-Up - Bloomberg

Two months after the Kremlin announced the mobilization in late September, a record depletion of workers is fast spreading across a country already hobbled by an aging and shrinking population and with unemployment near the lowest ever. A study by the Gaidar Institute in Moscow in November found that up to a third of Russian industry may face a deficit of personnel because of the draft, the most severe crunch since 1993. Labor shortages may become a major vulnerability as Russia heads for a downturn likely to extend well into next year, especially as other parts of the economy come under pressure from sanctions imposed by the US and its allies.

Why it Matters:

The mobilization of 300,000 men, combined with an even bigger wave of emigration it triggered, will reduce the male labor pool by 2%. That’s among the main reasons that Bloomberg Economics now puts Russia’s potential economic growth rate at just 0.5%, or half its pre-war level. A third of companies lost some employees to the call-up, with nearly a fifth saying they haven’t yet been able to replace them, a November survey showed. Among infrastructure builders, the vast majority is experiencing an increasing lack of qualified labor and expects shortages to get worse in the coming quarters, according to a report. No workers, no ability to produce what is needed to ensure national security.

Electrification and Digitalization Policy:

No More Gunslinger: How Xi Jinping leveled-up China's hacking teams - CyberScoop

From the early 2000s to 2015, China’s hacking teams caused havoc for private companies and U.S. and allied governments. In a series of high-profile breaches, they poached government databases, weapon system designs, and corporate IP. From the breach of the Office of Personnel Management, to Marriott, to Equifax, to many, many others, China’s digital warriors demonstrated the full potential of digitally mediated espionage. But if Chinese President Xi has his way, this litany of breaches represents only the beginning of China’s digital prowess. The article goes on to highlight all the steps Beijing/Xi has taken to grow China’s domestic hacking capabilities.

Why it Matters:

A year after coming to power in 2013, Xi began to prioritize cybersecurity as a matter of government policy, focusing the bureaucracy, universities, and security services on purposefully cultivating talent and funding cybersecurity research. During his time in office, the Chinese state has systematized cybersecurity education, improved students’ access to hands-on practice, promoted hacking competitions, and collected vulnerabilities to be used in network operations against China’s adversaries. In the coming years, current policies will further produce a growing level of competencies. This means that China’s hacking teams, when considered as a whole, will no longer be dominated by the gunslingers of the past. Instead, defenders will have to contend with masses of nameless civil servants, each specializing in any one particular skillset, managed by a bureaucracy that has matured over the last decade.

Commodity Super Cycle Green.0:

Constrained: Tesla supplier warns of graphite supply risk in ‘opaque’ market - FT

Western supply of graphite will be constrained in the coming decade by the “opaque” market for the key battery material, the world’s largest natural graphite producer outside China has warned. Shaun Verner, chief executive of Australia’s Syrah Resources, a Tesla supplier that operates a huge mine in Mozambique, said that the graphite market’s lack of transparency over pricing was making bankers hesitant to fund new projects. “The single biggest impediment to new investment is the opaque nature of the market because to get the commercial debt in place is really challenging,” he added.

Why it Matters:

Natural graphite demand is set to triple in the next four years as sales of electrical vehicles soar. However, currently, a battery’s anode, which is made of graphite plus increasingly a silicon additive, is more dependent on China than other materials as the country mines 65% of graphite, processes 85%, and is home to the world’s six largest anode material producers, according to the International Energy Agency. The centralized nature of the graphite market means that supply agreements are done bilaterally through long-term deals between producers and consumers. That leaves small volumes traded on exchanges, providing limited pricing transparency. As a result, the future Western supply of graphite is being hurt by the graphite market’s structure.

First Flight: Rolls-Royce tests hydrogen-fuelled aircraft engine in aviation world first - FT

Rolls-Royce has successfully used hydrogen instead of conventional jet fuel to power a modern aircraft engine in a world first for the aviation industry, according to the company. The ground test used green hydrogen generated by wind and tidal power. Rolls-Royce used a converted AE 2100-A turboprop engine that powers civil and military aircraft to conduct the test in partnership with EasyJet. It marks another step in the industry’s attempts to prove that hydrogen could play a viable role in helping companies reduce harmful carbon emissions that contribute to climate change.

Why it Matters:

The Rolls-Royce led trial, although not involving flying an aircraft, is part of a new hydrogen demonstration program launched in the summer by the FTSE 100 group in partnership with easyJet after research showed there was market potential for hydrogen-powered aircraft. The Race to Zero pledge, backed by the United Nations, is committed to achieving net zero carbon emissions by 2050, and airlines are pushing to use more sustainable fuels as an alternative to petroleum-based jet fuel. Flying is one of the most difficult industries to decarbonize and technologies such as electricity or hydrogen-powered aircraft are still years from carrying a plane full of people over long distances.

ESG Monetary and Fiscal Policy Expansion:

Something: How a Flawed But Historic Climate Deal Emerged From COP Chaos – Bloomberg

The COP27 summit adopted an accord that doesn’t increase ambitions on lowering emissions or take new steps to preserve the 1.5 degrees Celsius limit for warming temperatures. It also commits to creating a loss-and-damage fund that, if details can be worked out at future talks, will send aid to vulnerable countries wrecked by the irreversible harms of global warming. However, the final COP27 document, which had withdrawn crucial progress on emissions, came about, in part, from a concerted effort by petrostates such as Saudi Arabia and Russia to fend off more carbon-cutting ambition and pledges that would undermine the oil and gas production that fuels their economies.

Why it Matters:

After more than two weeks of climate haggling involving nearly 200 nations, all of which had to agree on the final text, COP27 has revealed a marked shift in power within the diplomatic process that produced the 2015 Paris Agreement. Bold new agreements to curtail emissions are now harder, in large part because of the energy crisis that prompted a worldwide scramble for new natural gas supplies. At this moment, cooperation meant to tackle inequities between developed and developing nations is more doable. As a result, the final version of the loss-and-damage text targeted funding to “developing countries that are particularly vulnerable to the adverse effects of climate change.” The proposal leaves the door open for contributions from developing but high-emitting nations, such as China. And, in a win for the US, the language makes clear the new fund isn’t meant to duplicate existing efforts.

Last Man Standing: U.S. Is Focused on Regulating Private Equity Like Never Before – Bloomberg

While buyout firms have been busy protecting their lucrative carried interest fee structure in Congress, the Biden Administration securities and antitrust departments have quietly been undermining the industry’s business model by proposing tough rules, slow-walking deals, and scrutinizing acquisitions that would consolidate industries or result in job losses. Its rules would require investment firms to make quarterly reports that include specific measures of performance and account for all costs. The proposal would also make it easier to sue fund managers for breach of fiduciary duty.

Why it Matters:

Democrats have long criticized private equity firms for harming workers and destroying the long-term value of acquired companies. Now, regulators are aiming at some of the industry’s hallmarks: its fee structure, opacity, dominance over industries, and use of overlapping directors at competing companies. “The Biden administration is moving forward with a range of regulatory proposals that target private capital and ultimately discourage local investment,” says Drew Maloney, president, and chief executive officer of American Investment Council, an advocacy group for private equity.

Appendix:

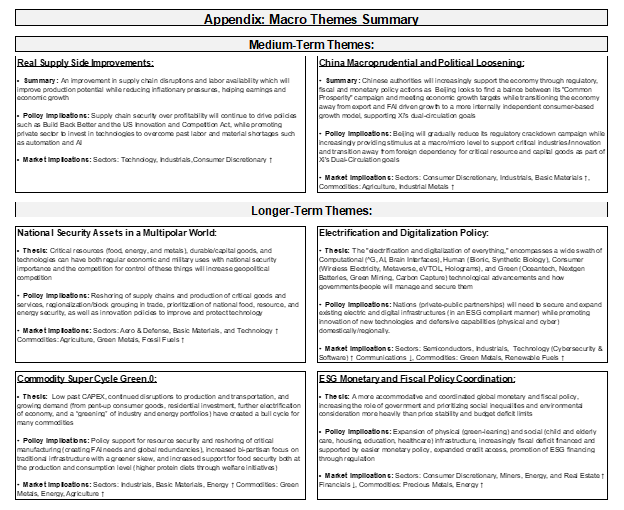

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION