“Bad remains Good” and 2023 Macro Themes - MIDDAY MACRO WEEKEND READ – 1/6/2023

Color on Markets, Economy, Policy, and Geopolitics

MIDDAY MACRO WEEKEND READ – 1/6/2023

Overnight and Morning Recap / Market Wrap:

Price Action and Headlines:

Equities are higher, helped by falling wages in this morning’s job report and a weaker service PMI reading, reducing worries the Fed will have to raise rates much further while indicating the economy still has positive momentum

Treasuries are higher, with the curve steepening due to a significant rally in the front end, with two-year yields lower by 18 basis points as traders reduce their terminal rate duration expectations

WTI is lower, giving up morning gains as the futures curve is in contango, signaling reduced supply worries moving forward as China’s reopening continues to struggle while Ural oil trades lower

Narrative Analysis:

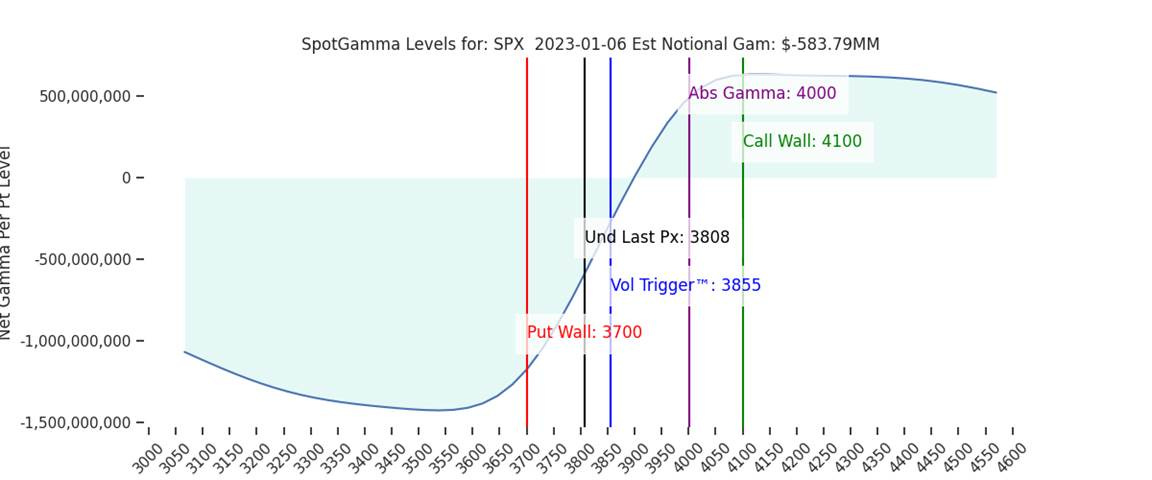

The right combination of economic data and more dovish central banker rhetoric today have risk assets ending the week near recent highs. Small caps continued to outperform as capital moved out of mega-cap growth for most of the week, limiting how far the S&P and Nasdaq could rally. Technicals remain challenged, with the multi-quarter downtrend still intact and the S&P still below its 50 and 200-DMAs. Optionality is also negative, as seen in the negative gamma picture and put-call ratios signaling a high level of defensiveness. However, rates are rallying on hopes that the Fed’s ultimate terminal rate level and duration there will be less than expected. Oil continues to face more headwinds as reduced global demand, and falling energy prices elsewhere have moved Brent and WTI back near recent lows. Copper is higher, reapproaching recent highs as concerns over future supply grow there. The agg complex was lower on the week due to improving weather and reduced geopolitical concerns. Finally, the dollar is lower, with the $DXY back to 104 due to broad strength elsewhere during a more risk-on session.

The Russell is outperforming the Nasdaq and S&P with Small-Cap, High Dvd Yield, and Growth factors, as well as Materials, Cons. Staples, and Industrial sectors are all outperforming on the day. The week had a more pro-cyclical growth tilt to it, with materials/industrials and small caps outperforming over tech and momentum (energy).

@KoyfinCharts

S&P optionality strike levels have the Zero-Gamma Level at 3897 while the Call Wall is 4100. SG expects a strong rally this month, catalyzed by OPEX flows, if the S&P can meaningfully regain 3900, which it is trying to do currently. However, any rally will be capped until the 1/12 CPI number. There was a shift down in the Put Wall to 3700 from 3800. The Put Wall rolling to lower strikes is generally a bearish indicator.

@spotgamma

S&P technical levels have support at 3860, then 3820 (major), with resistance at 3895, then 3955 (major). Since December 19th, we have bounced 9x off 3820 zone (either directly or after a brief bear trap undercut below), and this 3820-3895 chop zone is one of the longest, tightest consolidations in years. The move out of it is certain to be significant, but until then, this is a tactical, level-to-level day traders market.

@AdamMancini4

Treasuries are higher, with the 10yr yield at 3.57%, lower by 14.5 bps on the session, while the 5s30s curve is steeper by 8 bps, moving to -3 bps.

Deeper Dive:

The new year has seen the continuation of many of the same themes in markets persist. Still, today equities and rates may be finally pushing out of recent ranges as the jobs report, and ISM service data increased the likelihood of a softer landing. Our overarching view continues to believe that a softer landing is the most likely scenario this year due to the strong labor market and falling inflationary cost pressures, which will, in combination, increase real disposable incomes on aggregate and ensure growth and earnings don’t fall too far. Markets are looking for that fine line of cooling but not crashing data that will allow the Fed to stop hiking rates while still keeping growth momentum positive. Basically, “bad continues to be good” for a few more months until Fed rhetoric indicates a higher level of confidence that inflation is trending back to target. This is why today's weaker ISM service data helped move stocks to the top of their multi-week range after lower wage growth shed a more dovish tilt to the morning’s job report. Eventually, recessionary fears will completely drown out inflationary/tightening fears, and good data will again be needed to support risk, but we are not there yet. We see the Fed moving/staying too far into restrictive territory, given our belief that inflation will meaningfully fall below their 2% target into year-end due to improvements on the supply-side and further demand destruction from the lagged effects of already implemented policy. However, we have plenty of time to point this out, and for now, the focus is still on the week-to-week evolution of the current inflation and labor picture. This means markets will continue to exhibit high levels of volatility around key data prints and Fed events. We will continue to hold our mock portfolio as is, actually lowering stops for some positions due to our belief financial conditions will ease further, the macro backdrop is improving, and as a result, risk assets can rise, be it at a more tapered pace. We will delve further into market views next week as the bulk of today’s newsletter will be used to introduce our new 2023 macro themes below.

There may be less and less the Fed can due to weigh on financial conditions if inflationary data continues to trend lower while labor markets increasingly cool in Q1. Markets are already skeptical about how long they will hold at the terminal rate. If the Fed is genuinely data dependent, then we believe that the December message, delivered through the statement, presser, and SEPS, will be the maximum level of hawkishness we see in this cycle. It is our view they will downgrade their inflation projections while upgrading their UER and growth outlook throughout the first half of this year, effectively signaling the increased likelihood of a softer landing. As a result, real rates can stabilize, and financial conditions will continue to ease, allowing risk assets to break out of their ’22 downtrends/ranges finally. This is an optimistic view and pertains more towards the first half of the year due to the momentum/future we still see in consumer activity and the belief that inflation will increasingly fall faster, moving us into the final stage of the tightening cycle.

*Despite all the Fed jawboning, lower yields, USD, and falling levels of volatility in rates, equities, and some FX pairs have financial conditions easing

*We remain long U.S. equities, EM, Copper, and Oil, as well as short the dollar in our mock portfolio with returns since inception up 2.9%

As a reminder, the point of our macro themes is not to strictly make investment recommendations but instead to help frame the many individual stories and narratives constantly occurring in markets. We break the themes into medium-term and longer-term. This year's medium-term focus is on the cooling of U.S. labor markets and China's current Covid surge and eventual full reopening. Both have significant effects on policy and growth, which is why they are in focus. There are seven longer-term themes, and some mirror ones from last year, while others are brand new. We see these as multi-decade developments that will notably alter the real economy or investment landscape. As the year goes on, we will highlight articles and papers we found relevant to all the macro themes to help the reader stay abreast of developments there.

Medium-Term:

Labor Markets Loosening:

Summary: The U.S. labor market is historically strong despite tighter policy and financial conditions increasingly weighing on economic activity. Although leading labor market indicators, such as hiring intentions, initial claims, and job cuts, remain broadly positive, expectations are growing that reduced hiring and turnover, as well as increased layoffs, will better align supply and demand for labor, reducing wage pressures.

Policy Implications: The Fed has cited loosening labor markets as a precondition for policy to stop tightening, given wage-spiral inflationary worries. A reduction in job openings (and quits) to more historically normal levels, as well as falling increases in wages, is needed for monetary policy to stabilize and the tightening cycle to end.

Market Implications: As recessionary fears increasingly overtake inflationary ones, labor markets will need to cool just the right amount to enable the tightening cycle to end with a soft landing to still materialize. As a result, markets will be highly sensitive to any extreme beats or misses in labor market-orientated data, with volatility around these releases likely rising throughout the first half of 2023, even as inflation falls further.

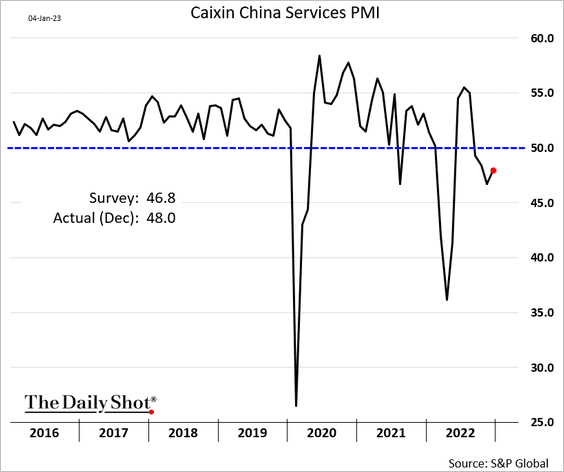

China’s Pandemic:

Summary: Beijing’s sudden reversal of its zero-Covid policy has caught much of the country unprepared, leading to a spike in cases/deaths and no reprieve to an already stagnating economy. The question is now whether China will experience a quick and deep spike in infections that result in a faster path to herd immunity while also increasing vaccination efforts that allow the economy to reopen in Q2 ’23 fully or if a longer drag on economic activity will occur.

Policy Implication: Due to the already declining levels of growth and Xi’s desire to start his third term on a solid foot, the current “pandemic” occurring in China, and the negative implications that it is having on activity and confidence will force officials to increase the level of fiscal and monetary stimulus, resulting in changing priorities away from “Common Prosperity” and “Dual Circulation” goals.

Market Implication: The initial reaction to the end of zero-Covid was very positive for risk assets, but spiking case counts and uncertainty over the effects it could have on growth have lowered sentiment somewhat. However, views that a quick and pronounced wave is being permitted (along with increased vaccination efforts) to reach herd immunity quicker, coupled with further policy support forthcoming, has helped Chinese markets outperform.

Longer-Term:

Energy’s Midlife Crisis:

Summary: The war in Ukraine and the general supply chain insecurity many nations faced during the pandemic have expedited the transition from traditional fossil fuels to renewables. Additionally, higher oil and natural gas prices created a barbell effect, supporting increased demand for renewables but also coal. As a result, energy markets are entering an uncertain transition period as changes in reliability/availability, national security concerns, environmental considerations, and higher costs are changing the future global demand and supply picture for all things energy.

Policy Implications: Governments are increasingly implementing policies that prioritize energy security. Depending on the nation, these policies are not always conducive to prioritizing environmental concerns, but in general, more capital is being allocated to the production of renewable over traditional sources due to fiscal and regulatory incentives.

Market Implications: Fears over energy insecurity are currently overblown, but given the geopolitical backdrop, vested interest in traditional fossil fuel markets, and reliance on China for crucial inputs into renewable production, the future supply picture for energy on the aggregate remains highly uncertain. Fiscal support, onshoring, and changing consumer preferences are increasingly moving the global portfolio to a more renewable-based outcome, changing the type of commodities demanded moving forward, but higher costs and uncertain supplies have also led to a renewal in coal use.

Cyber Life and Digital Rights:

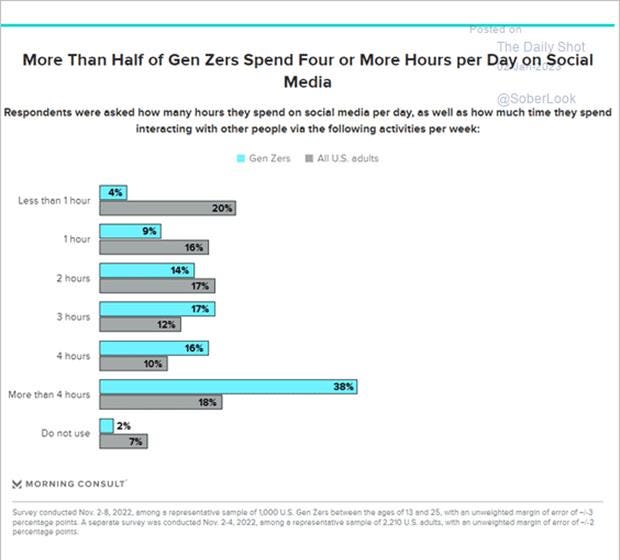

Summary: As our digital world grows, the rights and security individuals have are becoming increasingly important and often very different depending on the location/nation and level of sophistication of that individual. With nation-states and private actors (both rogue and legitimate) using cyberspace to track and attack “adversaries,” it will be increasingly important for individuals to secure information that can be used negatively against them.

Policy Implications: Nations will increasingly have to decide what side of the “moral line” they want to fall on, by either actively using cyberspace to control their citizens and attack rivals or creating laws that will ensure public/private data is secure and digital activity is safe. It is likely that most will engage in both sides as increased capabilities and evolving threats continue the current “arms race” for control of cyberspace.

Market Implications: People will continue to increase their digital footprint/activity, and as a result, the hardware and software needed to accommodate this will expand further into everything. The level of information collected/available will only increase, and the value of that data will fluctuate based on the state of the economy and domestic and international (geo)political stability. New industries that play into this greater connectivity and digital activity trend and how to secure it will increasingly attract capital.

Food- Security, Innovations, and Climate Change Implications:

Summary: With food prices rising due to a number of factors and the world’s population crossing the 8 billion mark, the future of food production and how it is impacted by climate change moving forward will be paramount in deciding the stability of nations.

Policy Implications: Studies have shown that high levels of food inflation lead to higher levels of unrest and often regime change. Governments will increasingly prioritize food security by supporting private and public sector initiatives to secure and increase supply.

Market Implications: Although not at levels seen last year following the invasion of Ukraine, food prices are historically high, reducing disposable income for other goods and services, especially among lower-income echelons in less developed nations. This increases geopolitical risk, and inflation more generally gives leverage to exporting/ nations, affecting FX and risk assets channels, as well as increasing soft power.

Authoritarianism in Trouble?:

Summary: 2022 saw a year of policy errors in China, an embarrassing war for Russia, and large protests in Iran. At the same time, many Western nations look to be entering significant growth downturns and are historically very politically divided. Will policy failure in authoritarian nations lead to regime changes, or will democratic ones, influenced by populism and special interest groups, move away from the rule of law?

Policy Implications: Response to the pandemic and growing populist movements have clouded the future for democracies, while “strong-man” authoritarian nations such as Russia and China are seeing unprecedented failures in their economies due to policy errors. It is unclear which structure of government will prevail and whether the rule-based system that has grown under the U.S. hegemony will endure.

Market Implications: Since the end of the Cold War, global trade and financial markets have benefited from a relatively low geopolitical risk period. Financial assets need to reflect a greater risk premium if the world is moving from a unipolar to a multipolar regionalized power structure.

ESG versus the World:

Summary: The ESG movement is increasingly meeting resistance as the recent “energy crisis” and socially woke culture push has emboldened pushback and led many to rethink the value of investing strictly through an ESG approach. The imperfect metrics to measure ESG and the inability to source food and renewables fairly and sustainably have also led to tougher questions on investing “responsibly.”

Policy Implications: ESG issues are increasingly becoming divisive political topics. Policy changes on the aggregate increasingly support ESG priorities in Western nations, but as seen in the U.S., anti-ESG populism has emboldened political pushback.

Market Implications: On the micro level, asset managers and private firms are faced with a greater level of challenges due to growing ESG uncertainty. Unable to appease everyone, actors are forced to balance moral considerations, fiduciary duties, and the desire for profits. As a result, markets may continue to skew towards allocating capital to ESG-friendly places, but the urgency to do so may diminish.

Asian Tigers 2.0:

Summary: Asian nations outside of China, especially Indonesia and India, will have growing global importance due to increased growth and geopolitical weight. As a result, the region’s actions and how other nations engage with individual nations there will become increasingly crucial to global growth and geopolitical stability.

Policy Implications: Indo-Pacific nations will garner more economic and political power, increasing the region’s ability to project hard and soft power. Policy decisions will become more critical in determining global growth and stability and help counter the power of larger nations such as the U.S. and China.

Market Implications: In the long run, capital flows to where it is best utilized, and improving macro stories in various countries in the Asia region will create compelling reasons for money to move out of more developed nations, enlarging real and financial asset markets there.

Cold Places (Deep Sea, Artic, and Space Colonization):

Summary: The race to secure earth’s remaining resources and space is already well underway, but efforts to secure these last remaining places will only intensify. The exploration of these final frontiers, which includes mining and fishing international waters to securing satellites in space, will be further enabled by technological innovations by public/private partnerships as national security concerns and capitalistic incentives align.

Policy Implications: Governments will be forced to secure resources to meet energy and food needs, forcing the few remaining areas of the world that are still open for exploration to be targeted. At the same time, accessing space will become increasingly more critical, and security concerns will force more active policies toward having assets in orbit.

Market Implications: New technologies are creating new opportunities, and once unattainable resources are increasingly becoming available at cost-effective prices. New technologies are also changing needs, such as which resources are essential and what type of cyber-infrastructure is necessary (ones that require space assets). As a result, the opportunity for disruptors to emerge and conflict to occur is growing.

Econ Data:

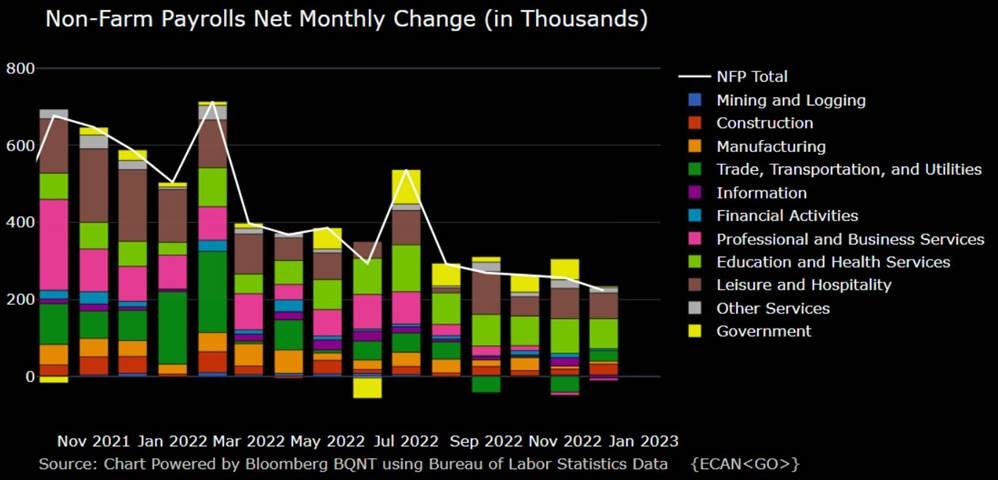

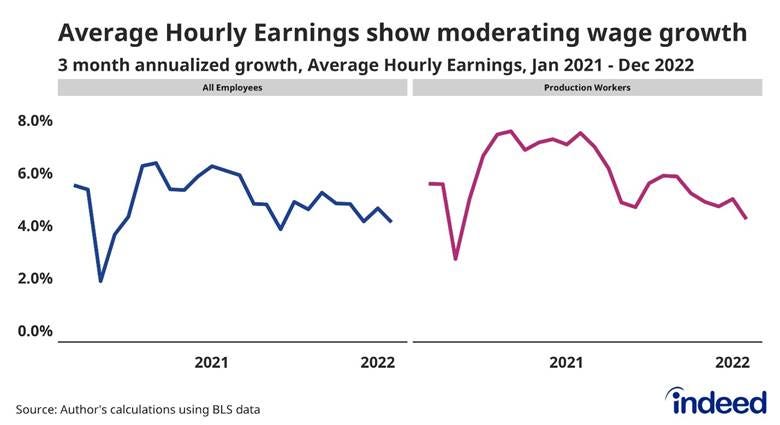

The U.S. economy added 223K jobs in December, the least since December 2020, after a downwardly revised 256K rise in November and beating market expectations of 200K. Notable job gains occurred in leisure and hospitality (67K), health care (55K), and construction (28K). A balance of 60.7% of industries in the private sector reported increases in employment in December, down from 63.9% in November. Payroll employment rose by 4.5 million in 2022, an average monthly gain of 375K, compared to 562K per month in 2021 and 168K in 2019. The unemployment rate fell to 3.5%, falling below market expectations of 3.7%. The U6 underemployment rate declined to 6.5% from 6.7%. The participation rate increased to 62.3% from 62.2% in the previous month. Still, it remained 1.0 percentage points below its pre-pandemic value in February 2020. Average hourly earnings rose by 0.3%, following a downwardly revised 0.4% gain in the prior month and below market forecasts of a 0.4% increase. This was the smallest growth in average hourly earnings in four months. The average hourly earnings of nonsupervisory employees rose by 0.2%. Over the past 12 months, average hourly earnings have increased by 4.6%, the least since August of 2021 and below market estimates of a 5% advance. The average workweek declined by 0.1 hours to 34.3 hours, compared with market estimates of 34.4 hours.

Why it Matters: This is a slightly hawkish to neutral report regarding how it will affect Fed policymakers' decision process moving forward. The household survey combined with the JOLTS data shows no increase in labor-market slack since the summer. The unemployment rate fell to a new post-pandemic low, and the number of jobs per unemployed job seeker rose to 1.83 in December. The establishment survey points to a slowing in job creation, but an average increase in payrolls of 247K per month since September versus an average increase in the labor force of 116K per month over the same period indicates the unemployment rate will remain low for some time. However, despite this tightness, average hourly earnings increases have slowed to 5.0% on a year-over-year basis. With even lower gains for nonsupervisory workers, an area that had witnessed the highest growth. By sector, the strongest increases were reported in education & health and leisure & hospitality, while the weakest area was professional & business services with temporary help down for the fifth straight month. Changes in temporary workers are often a leading indicator in overall hiring trends, so continued weakness there and the passage of the holiday period means that overall NFP gains may steadily trend lower in Q1, even if the UER is more sticky due to a lack of new entries. Bringing it back to the Fed, we believe weakening wage gains are more important than sticky low UER levels, but the labor market remains remarkably strong/tight given the macro backdrop.

*The three-month trailing average continues to indicate a cooling in job creation even as the UER stays at cycle lows

*Will education & health and leisure & hospitality continue to be a driver of job growth?

*Revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report. The upturn in wage growth in November, initially reported as +0.6%, was revised lower to +0.4%

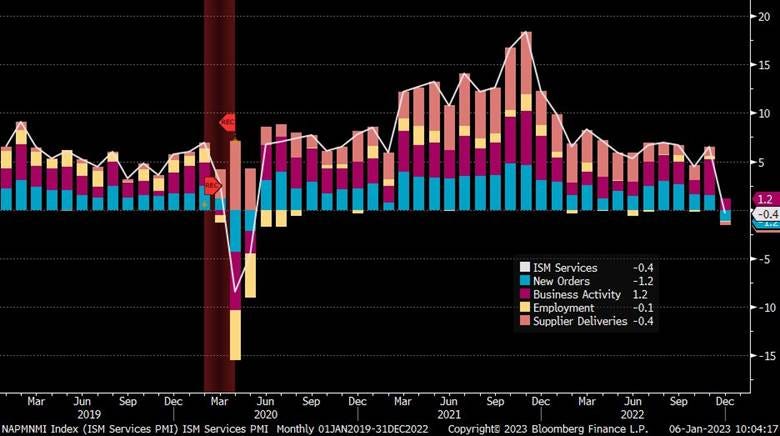

The ISM Services PMI fell to 49.6 in December, compared to a reading of 56.5 in November and well below market forecasts of 55. New Orders (45.2 vs. 56 in November) contracted sharply while the Backlog of Orders (51.5 vs. 51.8) was more stable, and New Export Orders (47.7 vs. 38.4) improved but remained contractionary. Imports (52.7 vs. 59.5) also fell. Employment (49.8 vs. 51.5) declined due to economic uncertainty and an inability to backfill open positions. Inventories (45.1 vs. 47.9) contracted at a faster pace despite overall Business Activity (54.7 vs. 64.7) dropping notably but remaining expansionary. Finally, Supplier Deliveries (48.5 vs. 53.8) fell, indicating increased capacity and improved logistics, which likely helped Price (67.6 vs. 70) pressures ease further, although they still remain highly elevated.

Why it Matters: The headline reading ended a 30-month period of growth, contracting for the first time since two straight months of sub-50 percent readings in April and May 2020. Despite the sub-50 reading on the overall index, 11 industries reported growth, while 6 reported declines in business. However, respondent comments reflected inflation problems easing but still elevated and year-end factors that supported demand as likely not to persist. Delivery times contracted in December for the first time since May 2019. Comments noted a better logistical situation also. The "notable" (ISM's word) 10.8-point drop in new orders was accompanied by an 11.7-point increase in inventory sentiment (55.9% of firms now see inventories as too high). Businesses are signaling they will be more defensive moving forward.

*The ISM Service PMI finally caught up to the Manufacturing PMI, recording its first contractionary print in 30 months

*Inflationary pressure-orientated sub-indexes continue to trend lower, with Delivery Times now contracting clearly

*Only two sub-indexes (New Export Orders and Inventory Sentiment) improved on the month, with the “Overall Economy” contracting

*Respondents were mixed in their assessment of their business, with positive and negative leaning comments indicating winners and losers depending on the industry

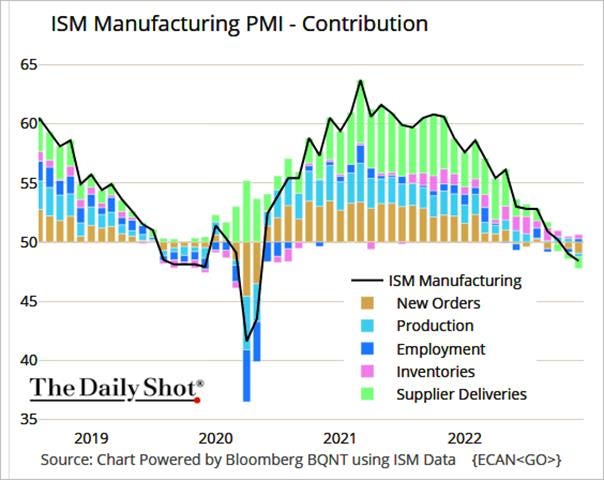

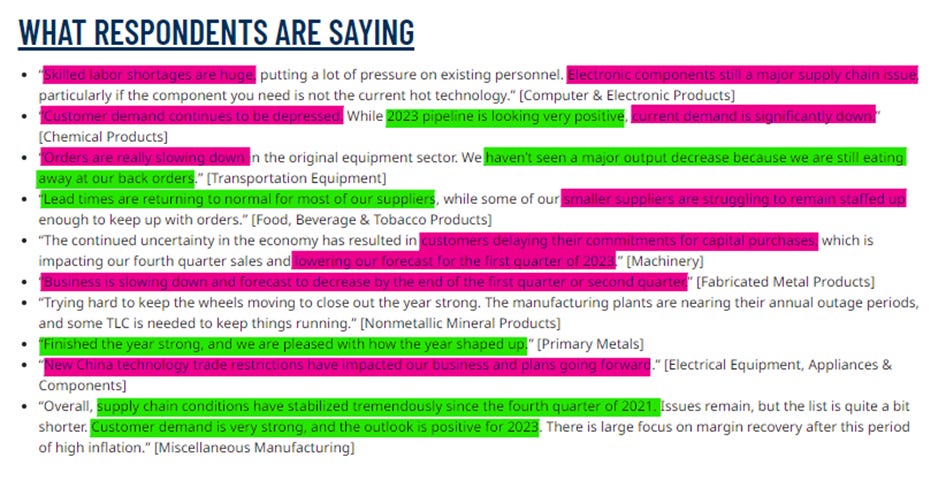

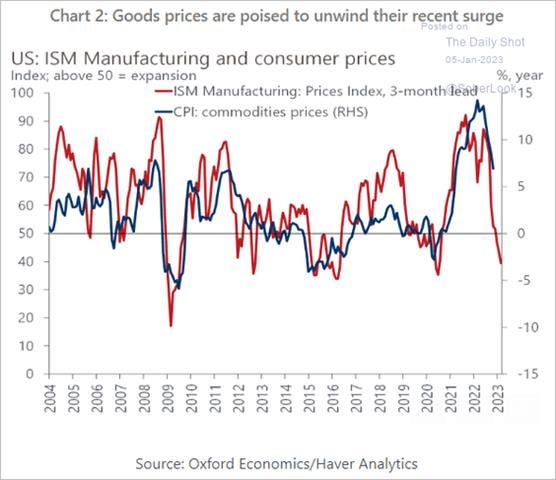

The ISM Manufacturing PMI fell to 48.4 in December from 49 in November, slightly below forecasts of 48.5. New Orders (45.2 vs. 47.2) and New Export Orders (46.2 vs. 48.4) declined further into contractionary territory, while the Backlog of Orders (41.4 vs. 40) improved slightly but remained highly negative. Production (48.5 vs. 51.5) fell into negative territory. On the other hand, Employment (51.4 vs. 48.4) rebounded back into expansionary territory. Inventories (51.8 vs. 50.9) also grew but remained near balanced levels. Prices (39.4 vs. 43) fell further into contractionary territory, the lowest since April 2020. Finally, Supplier Deliveries (45.1 vs. 47.2) were the best since March 2009. Only two manufacturing industries reported growth in December: Primary Metals and Petroleum & Coal Products.

Why it Matters: The reading pointed to the second month of contraction in factory activity and the biggest decline since May 2020. “Demand” continued to weaken, with new orders down for seven months and the backlog of orders and imports in highly contractionary territory. “Output/Consumption,” measured by production and employment readings, was neutral during the month. “Inputs,” measured by supplier deliveries, inventories, prices, and imports, indicated future demand growth. Electric Components are still in short supply *with rising prices) but overall, commodities prices continue to fall broadly.

*Only Employment and Inventories are still positively contributing to the overall ISM Manufacturing PMI

*Employment has remained near 50, indicating a more balanced level, while Prices Paid have continued to fall rapidly

*The “Overall Economy,” according to the ISM Manufacturing PMI, is now contracting for a second month in a row

*Highlighted respondent comments were more balanced in December, with demand sentiment more balanced and supply-side impairments still poor for labor but improving for materials

The number of job openings in the U.S. decreased by 54K to 10.5 million in November, compared with market expectations of 10 million. Over the month, the number of job openings fell in finance and insurance (-75K) and in federal government (-44K) but increased in professional and business services (+212K) and in non-durable goods manufacturing (+39K). Meanwhile, the number of hires was down by -56K to 6.1 million. The number of job quits rose by 126K from a month earlier to 4.17 million in November. Quits increased in health care and social assistance (+82K), transportation, warehousing, and utilities (+73K), and information technology (+19K) sectors. The so-called quits rate, which measures voluntary job leavers as a share of total employment, edged up to 2.7% from 2.6% in October but was still down from a record high of 3.0% seen at the end of 2021.

Why it Matters: Job postings have slowly declined since reaching a peak of 11.9 million in March of 2022. Total Separations remained little changed on aggregate but, in percentage terms, are falling fast with Hires and Quits, both leading indicators, now negative YoY, while job openings are also (less) negative on an annualized percentage basis. The more lagging layoffs remain positive. This report suggests that unemployment will start rising and labor markets are loosening even if headline numbers remain historically high. We also continue to believe that many of the openings are phantom postings, which employers have little to no desire actually to fill, and the new year may expedite their removal. Unfortunately, it won’t be till March that we get January’s data to confirm if this is true. We also see separation data quickly moving back to more normal levels, given the barrage of layoff headlines and growing recessionary fears.

*After rising in October, job openings again fell, although by less than expected, and remain well above historical levels

*Quits and Layoffs still remain out of their historically normal range/trend, but we expect the first half of this year to change that

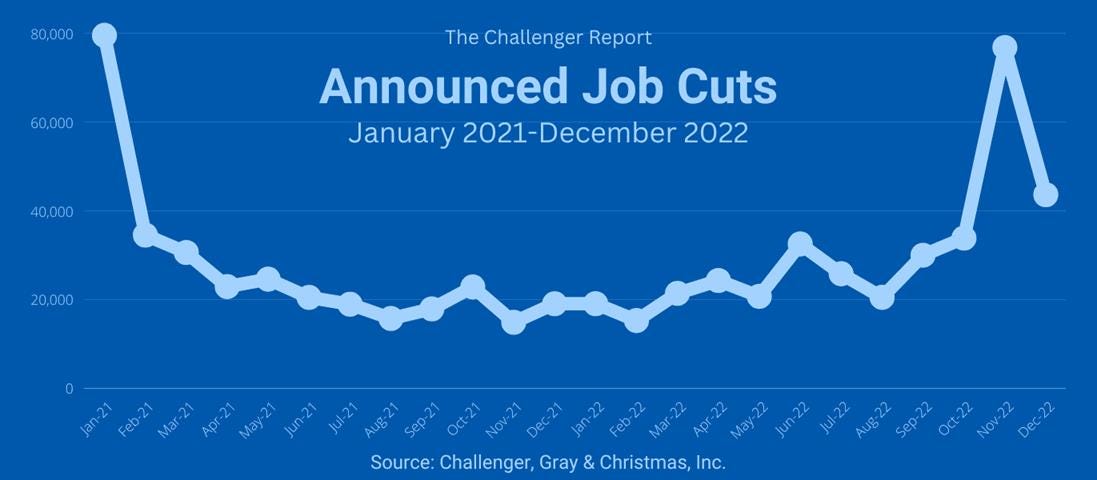

The Challenger Job Cuts Report showed employers announced 43,651 job cuts in December, less than 76,835 in November, which was the biggest since January of 2021. Demand Downturn and Market/Economic Conditions were the leading reasons for the month's cuts. Over 2022, employers announced plans to cut 363,824 jobs in total, up 13% from the 321,970 cuts announced in 2021. It is the second-lowest annual recorded total since Challenger began tracking monthly job cut announcements in 1993, with 2021 being the lowest. On the year, Cost-Cutting, No Reason, and Economic/Market Conditions were cited as the most come reason for cuts. Of the thirty industries' Challenger tracks, eleven have announced more cuts in 2022 than in the same period last year. The tech sector led the losses in ‘22 with a total of 97,171, with Fintech firms having 10,476 cuts. The automotive industry announced the second-most job cuts in ‘22 with 30,912. Hiring plans rose to 51,693 in December from 30,203 in November and compared to 89,984 in December of 2021.

Why it Matters: It is the second-highest number of monthly job cuts announced in 2022 and 129% above 19K cuts announced in the same month in 2021. “The overall economy is still creating jobs, though employers appear to be actively planning for a downturn. Hiring has slowed as companies take a cautious approach entering 2023,” said Andrew Challenger, Senior VP of Challenger, Gray & Christmas. Currently, the bulk of cuts remains in the Technology sector, with cuts in that sector up 649% from 2021.

*Cuts fell notably in December, with tech cuts falling to 1/3 of what they were in November

New orders for manufactured goods decreased by -1.8% in November, down following three consecutive monthly increases and after a downwardly revised 0.4% increase in October. It compared with market expectations of a -0.8% decline. Orders for durable goods dropped by -2.1%, mainly due to decreased orders for transportation equipment (-6.3%) and primary metals (-0.6%), while orders increased for computers and electronic products (0.6%). Also, demand for non-durable goods fell by -1.4% after a 0.1 percent increase last month. Excluding transportation, factory orders went down by -0.8%. Shipments increased by 0.2% MoM.

Why it Matters: A notable headline drop was mainly driven by declines in transportation equipment which was down significantly on the month, falling by -6.3%. On the positive side, machinery (1.4%) and computers (5.2%) both had solid gains. New Orders for nondefense capital goods fell by -7.6%, something which shows weak Capex spending and low business confidence. Of course, it could also be some payback after a robust year of investment there.

*Excluding transportation, New Orders were higher by 0.2%; however, the majority of sub-items were lower on the month

Construction spending rose 0.2% in November, rebounding from the downwardly revised -0.2% decline in the previous month and compared to market estimates of a -0.4% contraction. Spending on private construction rose by 0.3% MoM, offsetting the -0.1% decline in public construction spending. Total non-residential construction spending jumped by 0.9%, supported by spending on offices (0.4%), power infrastructure (0.9%), and transportation (0.7%). It was enough to offset the -0.5% decline in residential construction. Single-family construction fell by –2.9% MoM, while multi-family rose by 2.4% MoM.

Why it Matters: U.S. investment in housing fell for the sixth straight month in November, pulled down by a sharp decline in single-family activity. Investment in new semiconductor plants and electric vehicles (and their batteries) boosted manufacturing construction again. Public construction outlays are barely back to their pre-pandemic level despite higher costs (data not price adjusted).

*Increases in private non-residential, helped by new office, power, and education-orientated projects, helped offset declines in residential and public construction

*A tale of two cities, with non-residential spending picking up while residential is significantly contracting

Policy Talk:

The December FOMC minutes showed policymakers continued to anticipate that ongoing increases in the federal funds rate would be appropriate and that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2%, which was likely to take some time. Also, several participants noted that historical experience cautioned against prematurely loosening monetary policy. At the same time, no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. The Federal Reserve raised the fed funds rate by 50bps to 4.25% - 4.5% during its last monetary policy meeting in December 2022. It was the seventh consecutive rate hike and the fourth straight 75bp increase.

“Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function, would complicate the Committee’s effort to restore price stability.

“Several participants commented that the medians of participants’ assessments for the appropriate path of the federal funds rate in the Summary of Economic Projections, which tracked notably above market-based measures of policy rate expectations, underscored the Committee’s strong commitment to returning inflation to its 2 percent goal."

"No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy."

"Participants generally indicated that upside risks to the inflation outlook remained a key factor shaping the outlook for policy."

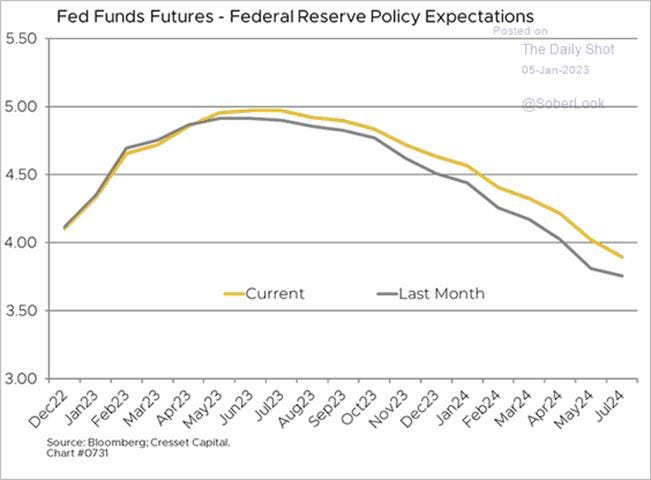

*The expected terminal rate has moved back up toward 5% following the release of the minutes this week

Federal Reserve Bank of St. Louis President James Bullard presented “The Prospects for Disinflation in 2023” on Thursday at an event hosted by CFA Society St. Louis. Bullard noted that GDP growth improved in the second half of 2022 while the labor market remained strong. Inflation remains too high but has declined recently, he added. He believes that the policy rate is not yet in a zone that may be considered sufficiently restrictive, but it is getting closer. In addition, front-loaded Fed policy has helped market-based measures of inflation expectations return to relatively low levels, he added.

“Perhaps the best interpretation is that real GDP growth is slowing to be in a neighborhood just below the potential growth rate of about 2% on a year-on-year basis after stellar growth in 2021,”

“Viewed in a historical perspective since the 1980s, the current labor market situation is unprecedented, with measures of labor demand significantly exceeding measures of labor supply.”

“During 2023, actual inflation will likely follow inflation expectations to a lower level as the real economy normalizes.”

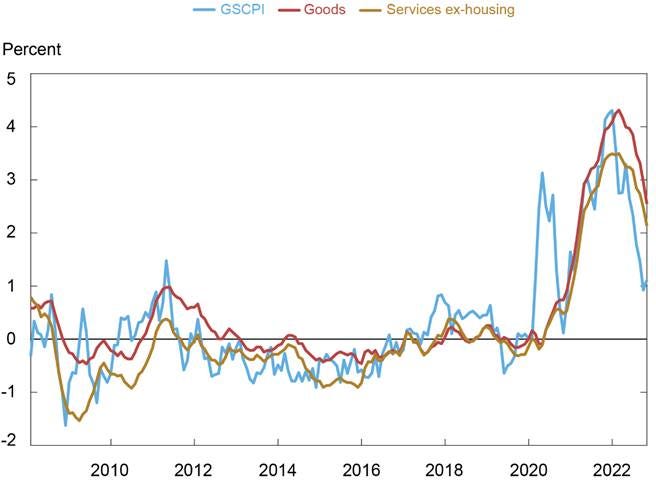

The New York Fed, in a follow-up to President Williams Onion” speech, dives deeper into how they see inflation trending in 2023. In a Liberty Street Economics blog post titled The Layers of Inflation Persistence, they highlight evidence of a decline in the size of the persistent component of core PCE inflation starting in September 2022. Dissecting the layers of aggregate inflation provides further insights: core goods and core services ex-housing have been moderating since early 2022, reflecting the evolution of the common component, while housing (as measured by official data) had continued to move up, driven by its own sector-specific trend. Recent movements lower in core goods and core services ex-housing correlate with declines in the NY Fed’s Global Supply Chain Pressure Index. Pandemic-related supply chain disruptions have long been identified as a primary contributor to goods inflation, and in the GSCPI often coincide with spikes in the trend in goods inflation. The GSCPI also appears to be a reasonable predictor of shifts in the trend in services ex-housing inflation, although the association is somewhat weaker.

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and on the week, and Mid-Cap Value is the best-performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day but higher on the week.

5yr-30yr Treasury Spread: The curve is steeper on the day but flatter on the week.

EUR/JPY FX Cross: The Euro is stronger on the day and the week.

Other Charts:

The Put/Call ratio remains at extreme levels, indicating a demand for downside protection or speculation.

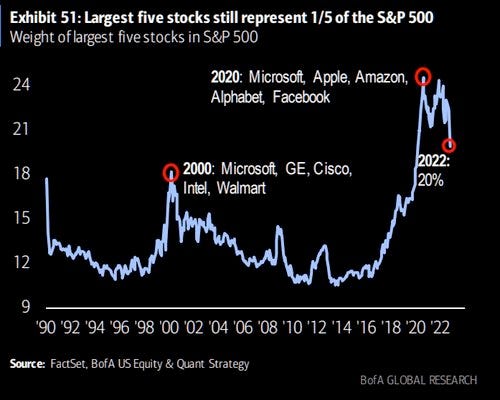

Mega Caps are still 20% of the S&P 500 - @DisruptorStock

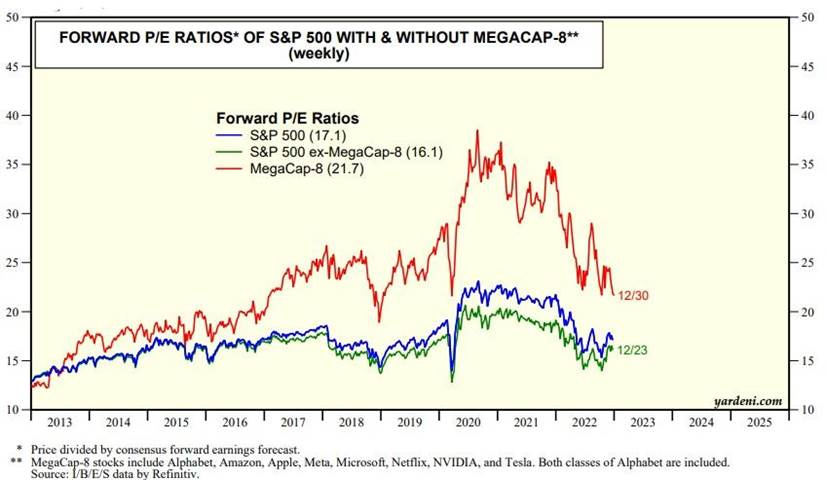

Collectively, the MegaCap-8 seemed to be the clear winners from the pandemic, as reflected in their combined forward P/E, which to a record high of 38.5 in August 2020. At the end of 2022, their forward P/E was back down to 21.7. The forward P/E of the S&P 500 with and without the MegaCap-8 is currently at 17.1 and 16.1. - @yardeni

S&P 500 EPS estimates are coming down faster than sales as profit margins are compressing - @MichaelMOTTCM

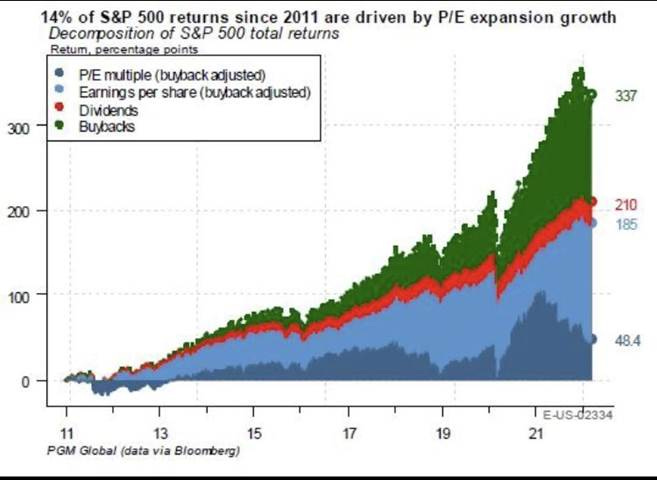

Since 2011, the S&P 500 has achieved a return of 337% (CAGR: 14.3%). The return consisted of the following components: Multiple expansion: 14.4%, Profit growth: 40.5%, Dividends: 7.4%, and Share buybacks: 37.7%. - @QCompounding

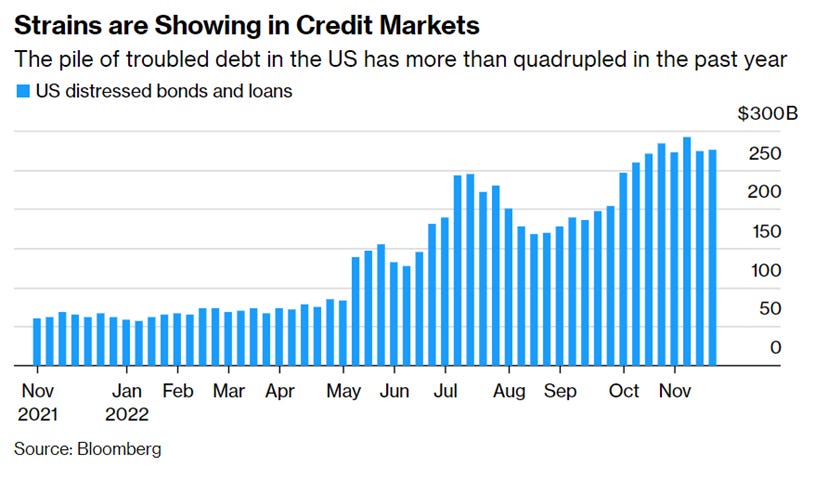

Nearly $650 billion in bonds and loans globally are now at distressed levels, and the amount of distressed debt in the US has increased more than 300% over the last 12 months.

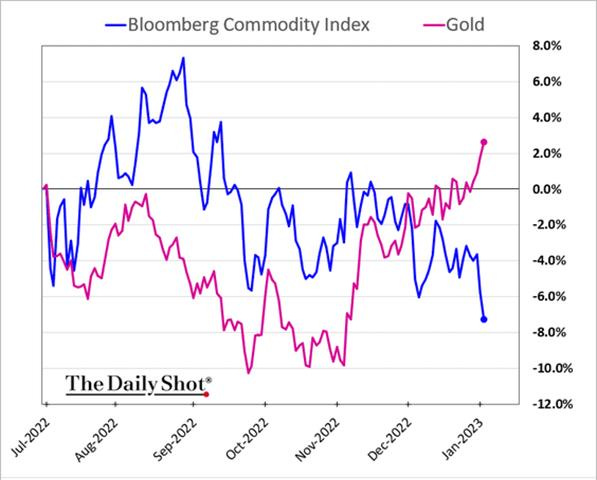

Gold has recently been an outperformer even as the commodity complex, more generally, is down.

A wage tracker developed by the Federal Reserve Bank of Atlanta shows that the 12-month moving average of annualized monthly wage growth for workers in the bottom quartile by income was 7.4% as of November.

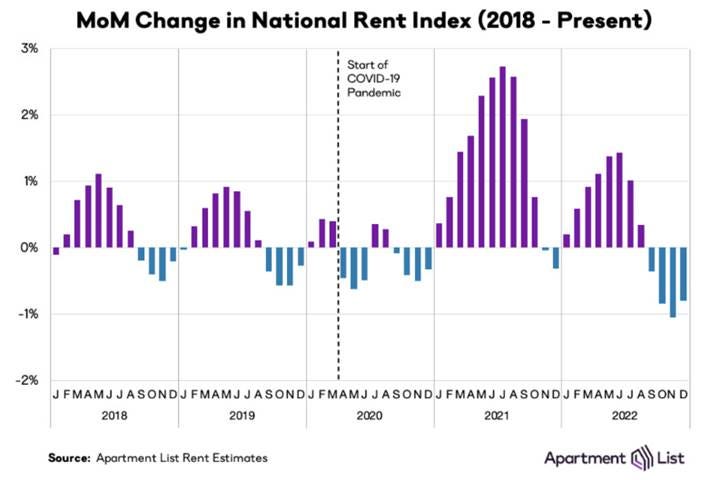

“Over the course of 2022 as a whole, the national median rent increased by a total of 3.8 percent. This means that last year represented a return to pre-pandemic rent growth levels, after the astronomical 17.6 percent spike in rents that we saw in 2021. Rent growth in 2022 still ranks as the second fastest year in the history of our estimates (going back to 2017), but it came in just barely ahead of the 3.5 percent rate from 2018.” - @calculatedrisk

ISM Price Sub-index indicates that a significant deflationary pulse is coming

Article by Macro Themes:

Medium-term Themes:

China’s Pandemic:

Opening the Spigots: China to boost spending in 2023 economic revival drive, top planner says – SCMP

China’s top economic planner aims to help boost domestic consumption and woo more foreign investors this year as it seeks to revive the country’s Covid-hit economy. In a People’s Daily interview published on Sunday, Zhao Chenxin, deputy chairman of the National Development and Reform Commission (NDRC), said authorities would align fiscal, monetary, industrial, technology and social policies to promote growth. The government would also give support to previously tightly regulated sectors such as property and internet companies as part of a wider push to increase consumer spending.

Why it Matters:

China’s weak growth in 2022 due to its zero-Covid policy was a mixed blessing, reducing inflationary pressures in some ways while also impleading supply chains, and hence causing inflationary pressures on others. All in all, the reduced real economic activity on top of the existing problems in the property sector, reduced the demand it traditionally had for industrial metals and energy commodities. Although the road will be bumpy and a full reopening is unlikely until the second half of the year, China will increasingly become a stronger growth and hence inflationary factor again on the global stage, especially if Beijing is committed to using policy to stimulate the economy.

Longer-term Themes:

Cyber Life and Digital Rights:

Getting Close: Chinese researchers claim to find way to break encryption using quantum computers - FT

Computer security experts were struggling this week to assess a startling claim by Chinese researchers that they had found a way to break the most common form of online encryption using the current generation of quantum computers, years before the technology was expected to pose a threat. The method, outlined in a scientific paper published in late December, could be used to break the RSA algorithm that underpins most online encryption using a quantum machine with only 372 qubits, according to the claims from 24 researchers from a number of academic bodies and state laboratories.

Why it Matters:

The latest research paper is the second time in less than a year that the field of computer security has been jolted by claims that online encryption was in imminent danger of being broken. “As far as I can tell, the paper isn’t wrong,” said Peter Shor, the Massachusetts Institute of Technology scientist whose 1994 algorithm proving that a quantum machine could defeat online encryption helped to trigger a research boom in quantum computing. Shor added, however, that the Chinese researchers had “failed to address how fast the algorithm will run” and said that it was possible it “will still take millions of years.” He said: “In the absence of any analysis showing that it will be faster, I suspect that the most likely scenario is that it’s not much of an improvement.”

Food: Security, Innovations, and Climate Change Implications:

Volatility: Wheat, Soybean, and Corn Prices Expected to Have Choppy 2023 – WSJ

Russia’s invasion of Ukraine sent U.S. grain futures soaring early in 2022 before their recent retreat. The new year promises to be another volatile one. Futures for wheat and soybeans reached record highs earlier in 2022, and corn futures notched their highest level in more than a decade. The war stifled supply, and so did dry weather in many crop-growing areas. Now, grain prices have fallen close to where they started 2022. The decline tracks with an overall easing of prices for commodities from natural gas to cotton and lumber, which have slipped in recent months after surging. More tightening of policy by the Federal Reserve and other central banks are expected to keep a lid on demand.

Why it Matters:

For grain prices, the outlook is uncertain, in part because they hinge so much on a war for which no end seems to be in sight. An agreement reached in July allowed for the safe passage of grain from war-torn Ukrainian ports, freeing up millions of tons of food products. In November, both sides extended the agreement for another 120 days. Still, the deal is fragile. Russia briefly backed out in October and continues to attack Ukrainian port cities. Ukraine’s grain exports remain below levels before the war began, according to data from the United Nations Food and Agriculture Organization. “The wild card for grains is the Russia-Ukraine shipping deal and its survivability,” said commodities analyst Jim Wyckoff. “It’s a shaky situation that grain traders will continue to monitor very closely.” However, farmers also are contending with higher operational costs, including for fertilizer and farm equipment, and that might keep grain prices elevated.

Weird Normal Weather: ‘Hydroclimate Whiplash’ Worsens California’s Storms and Drought - Bloomberg

After years of a megadrought that has left the land parched, California experienced so much heavy rain so quickly that the governor declared a state of emergency on Wednesday as another storm system prepared to unload on the state. Air made warmer by climate change is exacerbating both aridity and precipitation, leading to double-whammy weather cycles. When warmer air interacts with California’s natural pattern of aridness punctuated by rain, it essentially puts both dryness and precipitation on steroids. For example, atmospheric rivers (long, moisture-rich airflows in the sky) are not new occurrences. But the atmosphere’s capacity to hold water vapor increases exponentially for every degree of linear warming.

Why it Matters:

Climate change helps explain both the very wet and the very dry conditions, scientists say. They predict that atmospheric rivers, like the one that descended on California earlier this week, will become more common and more costly. Last summer, Swain and a colleague published a paper estimating that climate change has probably already doubled the risk of a flood event from these atmospheric rivers. And the rain is all the more dangerous because it falls on parched land with limited ability to contain runoff. That leaves California with the tricky task of managing water in an era when things are getting both hotter and drier, as well as occasionally much wetter hence Swain’s term “hydroclimate whiplash.” Given California’s important role in providing food, changing weather conditions there pose a risk to the whole nation/world.

Authoritarianism in Trouble?:

Pride Before the Fall: Putin’s Last Stand – Foreign Affairs

Russian President Vladimir Putin’s war in Ukraine was meant to be his crowning achievement. It hasn’t turned out that way. Kyiv held strong, and the Ukrainian military has been transformed into a juggernaut, thanks in part to a close partnership with Western allies. The Russian military, in contrast, has demonstrated poor strategic thinking and organization. There are now three possible outcomes. The first one, and least likely, is Russia admitting defeat and leaving Ukraine entirely. A second scenario for Russian defeat would involve failure amid escalation. The Kremlin would seek to prolong the war in Ukraine while launching a campaign of unacknowledged acts of sabotage in countries that support Ukraine itself. The final scenario for the war’s end would be defeat through regime collapse, with the decisive battles taking place not in Ukraine but rather in the halls of the Kremlin or in the streets of Moscow.

Why it Matters:

Putin has concentrated power rigidly in his own hands, and his stubbornness in pursuing a losing war has placed his regime on shaky ground. Russians will continue marching behind their inept tsar only to a certain point. Although Putin has brought political stability to Russia, his citizens could turn on him if the war leads to general privation. The collapse of his regime could mean an immediate end to the war, which Russia would be unable to wage amid the ensuing domestic chaos. However, a defeated and internally destabilized Russia would demand a new paradigm of global order. A diminished Russia would have an impact on conflicts around the globe, including those in Africa and the Middle East, not to mention in Europe. Yet a reduced or broken Russia would not necessarily usher in a golden age of order and stability.

ESG versus the World:

Rebranding: World’s largest money managers need a better ESG script – FT

The setting, Marshall, Texas, population 23,000, was unremarkable. But as a piece of political theatre, this month’s seven-hour hearing over the supposed heresies espoused by ESG’s corporate cheerleaders would have made the ringleaders of the Salem witch trials proud. Lone Star state senators, one of whom previously asserted that the “primary driver for global warming is the sun,” lined up to excoriate the world’s largest asset managers for neglecting their fiduciary duties with “woke” investment decisions and for using their votes at shareholder meetings to push their purported ecological and social agendas. Yet, the tactics and motives of Texas’s interrogators notwithstanding, the state’s criticism of ESG provided valuable insight.

Why it Matters:

With ESG being so broadly defined as to be rendered almost meaningless, there is scant evidence to suggest that the trillions of dollars worth of investments under its umbrella have underperformed more traditional assets. In the end, witnesses at the Texas spectacle struggled to reconcile their companies’ Davos-pleasing statements with their core missions as money managers. Bigger stages await these companies, and plaintiffs’ law firms are gearing up for a wave of ESG-related litigation in which evidence given at hearings will surely be cited. Rapidly retreating to an ESG strategy focused purely on what Oxford university professor Robert Eccles refers to as “managing material risk factors,” rather than loosely defined ethics, might neutralize some impending attacks even as it upsets progressives. At the very least, it would provide a better script for repeat performances on Capitol Hill.

Asian Tigers 2.0:

New Supply Needed: Vietnam becomes focus for new rare earths supply - Argus

Vietnam is positioning itself to play a key role in expanding the global rare earths supply chain away from China as demand for a range of applications increases and geopolitical concerns drive calls for a wider supply base. Vietnam is estimated to have the world's second-largest exploitable rare earths resource supply behind China, with 22mnt of reserves compared with China's 44mnt, according to US Geological Survey data.

Why it Matters:

More and more countries have started turning to Vietnam to secure supply before it comes out of the ground by investing in development projects. Japan is the world's second-largest producer of rare earths (containing permanent magnets) after China, and Japanese companies have been investing in projects in Vietnam over the past decade in a bid to secure non-Chinese material. The impetus for the development of Vietnamese supply stalled with the normalization of trade between China and Japan, but there is now renewed interest as the Japanese government has adopted a national security strategy encouraging companies to diversify their critical mineral supply chains. Other nations are following Japan as concerns about China’s ability to be a reliable trading partner grow.

Cold Places (Deep Sea, Artic, and Space Colonization):

The Final Frontier: What’s next in space - MIT

We’re going back to the moon in 2023. Multiple uncrewed landings are planned for the next 12 months, spurred on by a renewed effort in the U.S. to return humans to the lunar surface later this decade. Both private space companies and national agencies are set to make the trek to our celestial neighbor, where they will test landing capabilities, look for usable water ice, and more. That is not all 2023 has in store. We’re also likely to see significant strides made in private human spaceflight, including the first-ever commercial spacewalk, compelling missions heading out into other solar system destinations, and new rockets set to take flight.

Why it Matters:

“There’s a huge swathe of activity (coming),” says Jon Cowart, a former NASA human spaceflight manager now at the Aerospace Corporation in the US. Cowart. “I’m very excited about this year.” Previous years were “all about Mars,” says Jill Stuart, a space policy expert from the London School of Economics in the UK. “Now we’ve shifted back to the moon.” A number of other intriguing developments are expected in 2023. The article goes on to outline the coming year's likely schedule.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION