2025 Costanza Trades – LAST MIDDAY MACRO

Midday Macro - Color on Markets, Economy, Policy, and Geopolitics

This will be our last Midday Macro newsletter for the foreseeable future. I will be joining Bloomberg as a macro strategist at the beginning of January.

It’s been an interesting experience writing this newsletter (of which we have published 274 times), and it has given us a deep respect for those who put out content on markets for a living.

First, it’s tough to have an edge in this business, a legitimate one that can consistently produce alpha. It takes a large team, vast amounts of data, and the know-how to do data analysis that produces actionable results.

We certainly don’t have a large team, and although we love digging into what is moving markets, to be honest, we often find ourselves uncertain about what is coming next. As a result, given our mock portfolio track record and general thoughts conveyed here over the last three years, we give ourselves a passing grade but have plenty of room for improvement.

With that said, we are now joining a large organization that specializes in connecting the right people with tons of data that, when combined, delivers an edge that traders can use to generate real alpha-returning trading strategies.

In our last newsletter, we will cover our “Costanza Trades” for 2025 and then conclude with some final thoughts on the Fed and markets.

Costanza Trades for 2025

We are taking a page from one of our mentors who used to write a note called the Macro Scan, which at the end of each year would take a “twist” and present the following year’s “Costanza Trades” or “Not Top Trades.” A kind pushback against all the sell side “year ahead” pieces that tend to be the consensus views of market participants.

As most know, George Costanza, on the sitcom Seinfeld, had terrible luck when it came to employment, dating, and life in general. In one episode, George realizes that if every instinct he has is wrong, then doing the opposite must be right. George resolves to start doing the complete opposite of what he would do normally.

For example, he introduces himself to a beautiful woman at the diner that he usually would never have the nerve to talk to by saying, “My name is George, I’m unemployed, and I live with my parents.” To his surprise, she is impressed with his honesty and agrees to date him! Doing the opposite was the right thing.

Employing the Costanza approach to trading is an exercise that is worthy of doing before the start of a new year. What are the trades that make complete rational sense and market consensus say are right and now consider the opposite?

If you can identify these non-consensus trades and make a contrarian case using fundamental and technical justification, there is potentially a high amount of alpha in these trades.

Since this year is ending with stronger-than-expected U.S. growth momentum, a Fed still easing but now more hawkish, and an incoming Trump administration perceived to be more supportive of business, it is no surprise U.S. equities are near all-time highs while yields have risen.

Costanza believes growth will weaken notably, causing deflation, forcing central banks to ease further, and breaking down risk sentiment which would move Treasuries higher while equity volatility increased.

“I just threw away a lifetime of guilt-free sex and floor seats for every sporting event in Madison Square Garden. So please, a little respect. For I am Costanza, Lord of the Idiots!” - George Costanza

2025 Costanza Trades (in no particular order):

Short Dollar

Short Bitcoin

Treasury Curve Flattener

Long Euro/Yen

Short EU Fixed Income

Long Copper

Short U.S. Large-Cap Stocks

Short Dollar:

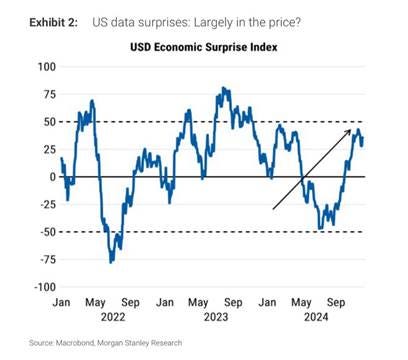

Expectations of a continued strong U.S. economy, a less dovish Fed, and increased tariffs under Trump 2.0 have led to a stronger dollar since the beginning of October. With the U.S. > RoW growth narrative expected to continue due to growth worries increasing in Europe, the U.K., Canada, and other major currency crosses, dollar appreciation is expected to continue in 2025.

Inflation is expected to be a major driver of FX markets. Weaker growth in certain countries should support continued disinflationary progress, or at least that is what policymakers believe. This is expected to widen interest rate differentials further in favor of the U.S. dollar moving forward.

At the same time, Trump’s expected tariffs will likely reduce the U.S.’s trade deficit, supporting the dollar over major trading crosses. Further, we know that China intends to devalue its currency to buffer the effects of the expected increased tariffs on them. Others may follow.

Instinct: Strong growth momentum and stalled-out disinflationary progress will keep the Fed from cutting rates as much as expected. Increased expectations for a further slowing in other major economies will increase the level of monetary policy easing elsewhere, increasing rate differentials in favor of the dollar. Add in pro-dollar fiscal policies and expectations for a continuation of the current stronger-dollar trend.

Costanza: The market’s perception of Fed hawkishness due to stronger growth and stickier inflation is at a high level and could easily fall if growth slows or disinflation progress resumes. Growth expectations for RoW are very low and could easily change if China’s stimulus starts to bite and the Eurozone private consumption normalizes or there is a larger-than-expected fiscal stimulus response there. Fundamental valuations based on standard FX models also indicate that the dollar is overbought while the majority of other currencies are “cheap.” Costanza, ever the pessimist, sees this as a crowded trade based on variables that could quickly change.

Short Bitcoin:

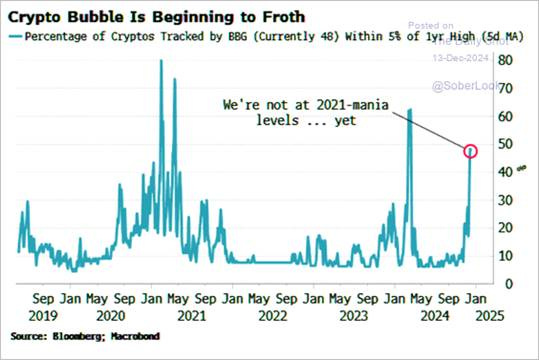

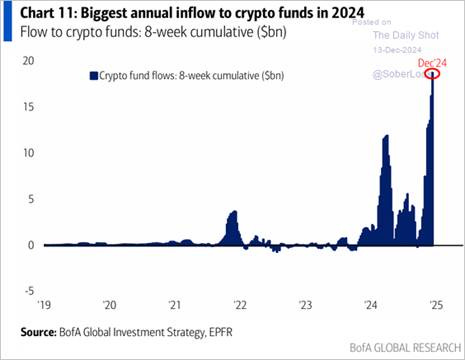

Bitcoin, near $100K, is ending 2024 near record highs with much of the crypto universe also moving higher following Trump’s election win and the perceived regulatory relief and greater acceptance that will bring to the asset class.

Costanza’s call here has a few different drivers:

A play that Bitcoin is overbought, and this is just another example of the general “pump-and-dump” nature that it has exhibited in the past

A play that the regulatory changes and Trump’s national Bitcoin reserve, all of which will give greater “legitimacy” to Bitcoin, will take longer to be enacted or never materialize.

A play that higher real rates and reduced liquidity will weigh on risk sentiment, hurting higher beta and more speculative areas of the market, such as crypto.

Instinct: Momentum is currently strong, with animal spirits in full speculation mode, while the regulatory environment and adoption by institutional managers have hopes for a better fundamental backdrop in 2025.

Costanza: Costanza would see this run-up in Bitcoin as a classic “buy the rumor, sell the news” situation, with no more dry powder or catalysts left to keep the bull run going. Further, suppose the Fed is turning meaningfully more hawkish. In that case, there will be less liquidity in the system due to a larger balance sheet reduction and the remote possibility of a rate hike, all of which do not bode well for more speculative assets such as Bitcoin.

Treasury Curve Flattener:

The steepener has been a very popular macro trade this year. The view at the beginning of the year was that inflation was falling while the economy was slowing. As a result, the Fed would cut, and the front end would fall while the back end would remain more stable or rise as the future growth would improve due to Fed easing. Add in growing fiscal worries (despite who won the election), and the steepener trade worked from July into the election.

With the Fed looking like it may not have as many cuts in store as expected and incoming Treasury Secretary Bessent’s 3-3-3 goals, as well as past comments from Trump saying he doesn’t want to expand the deficit, should reduce deficit worries, a flatter Treasury curve looks possible in the first half of 2025 due to reduced term-premium demand.

Further, the U.S. economy is due for a payback period of more trend-level growth, as it has been running hot for several quarters now, which, if it came, would put pressure on long-end yields. Admittedly, this cooling was expected throughout 2024 and never came.

Instinct: The economy is humming along, disinflation progress has stalled, and Trump does not look good for the fiscal deficit, with increased levels of tax cuts likely coming. With the Fed’s terminal rate now higher but still 150bps lower from current levels and investors demanding more term premium in the long end, the Treasury curve should continue to steepen.

Costanza: Trump’s policies will create a more inflationary macro backdrop domestically, keeping the front end pegged near current levels. Powell also left the door open for a rate hike down the road one day as the Fed turned more hawkish at their December FOMC meeting despite the rate cut. At the same time, investors reduce risk exposure and buy longer-dated Treasuries in a bid for safety. Further, Bessent and more fiscal hawkish GOP-leaning members reduce government spending and limit additional tax cuts.

Long Euro/Yen (long Euro vs. short Yen):

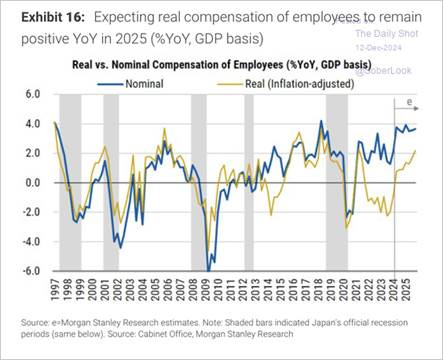

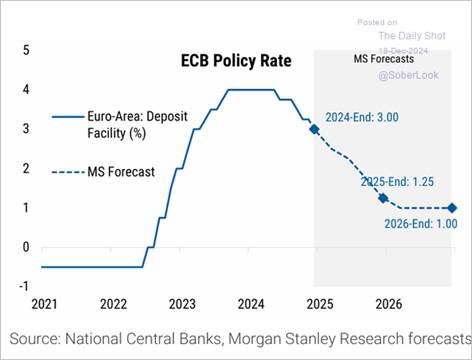

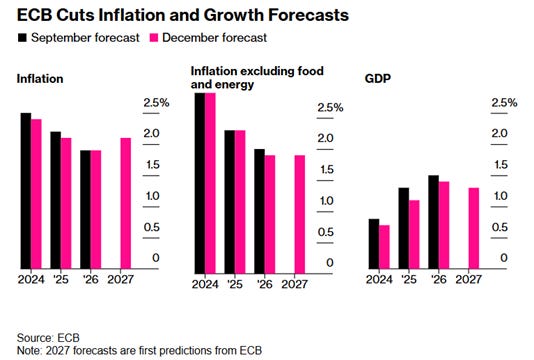

Costanza’s call here is simply taking a contrarian approach to where rate differentials between the Eurozone and Japan are expected to go in 2025. With the ECB lowering its growth and inflation forecasts, leading to markets to price in a lower terminal rate, while the BoJ is expected to raise its rates by 25 bps, it isn’t hard to understand the consensus view.

However, the BoJ is notorious for delaying policy actions, and although wage pressures indicate a more sticky inflationary backdrop, worries about growth may change the perceived path of policy. Governors may also eventually deliver a dovish hike in January, indicating they will be more patient with any further actions.

On the other hand, views on Eurozone growth are very negative, causing markets to price in what could be too low a terminal rate for the ECB. The already weaker currency may reduce disinflationary progress, while rate cuts occurring now could stabilize growth. The political dysfunctionality hanging over France and Germany should settle down, supporting consumer/business confidence. At the same time, more negative growth now should increase the odds of a larger, more positive fiscal pulse in 2025, driving real rates to rise further.

Instinct: Europe is looking bad, while Japan’s growth backdrop should improve, and as a result, growth/rate differentials will widen further to support an oversold Yen over the Euro.

Costanza: Europe isn’t that bad, and markets have priced in too much easing by the ECB. At the same time, the BoJ will underwhelm market expectations in its tightening of policy. We are currently at max expectations for both in the wrong direction, and as a result, the Euro will outperform the Yen notably in 2025.

Short EU Fixed Income:

In a similar trade to the above, Costanza would not be positioned long in European fixed income in 2025.

With the ECB ending 2024 with its third straight cut and signaling a more dovish stance due to growing growth concerns, expectations are for yields to fall across most major govies in the Eurozone.

Despite no firm commitment, back-to-back decreases in borrowing costs are widely expected to continue through mid-2025 as Europe’s already sluggish economy endures political upheaval in Germany and France, plus a potential jolt to global trade from Donald Trump’s return to the U.S. presidency. Economists see the terminal rate settling at 2%, while investors reckon a more aggressive campaign will leave them at 1.75%. Some see even lower levels.

Instinct: The fear is that sub-par growth will decrease inflation, currently 2.3%, to a below-target level, driving the ECB to move its policy stance to an outright accommodative stance. As a result, yields across the major government bond markets are expected to decline.

Costanza: With the growth outlook near peak negativity and inflation fears subsiding, Costanza would focus on the prospect of greater fiscal spending from more disjointed government coalitions. He would also question the growth drag from the yet-to-be-announced tariffs by the U.S. while noting that stalled disinflationary progress in the U.S. could spread to the Eurozone.

Long Copper:

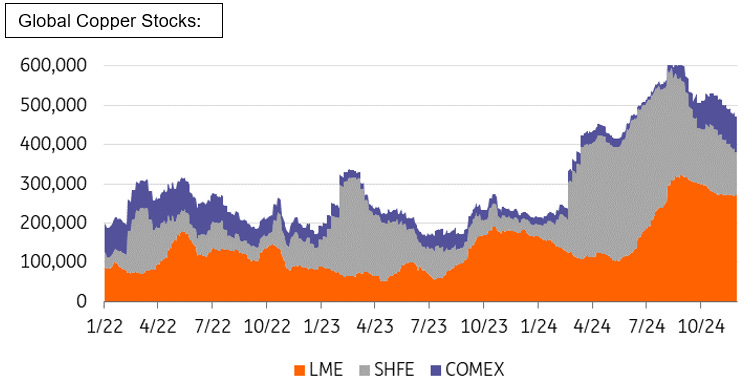

Despite the increased signaling by Beijing to provide further stimulus, the growth outlook for China continues to be weak. As a result, industrial metals, especially copper, have been trending lower in price.

Looking forward, China’s copper importers are reining in the amount of tonnage they buy in 2025, as seen through annual supply contracts, and opting for spot buying instead. Also, hitting copper has been a rally in the greenback following the re-election of Donald Trump, as traders bet on tighter-for-longer Fed policy.

Global copper stocks remain elevated, underscoring soft spot demand with exchange-tracked stockpiles near their highest level for this time of year since 2017. The rise in stocks has come along with a surge in Chinese exports, which have jumped to record levels this year as supply from China’s smelters expands while demand from manufacturing and construction sectors lag.

World copper mine output is expected to be slightly higher in 2025, with global growth mainly benefitting from a further ramp-up in capacity at mines in the DRC, Mongolia, and Russia. Several expansions and the opening of medium and small mines will also add to production.

Instinct: Any sustained pick up in metals prices will depend on the strength and speed of the rollout of China’s stimulus measures. Even if this occurs, supply is high, and as a result, prices will be unlikely to stage any meaningful rally.

Costanza: Costanza believes China has turned a corner. RoW demand will also be higher than expected as the electrification of all things continues to grow. EV expectations are too low, and despite populist rhetoric against it, the push for more renewable energy sources will support the demand for copper. All in all, Costanza is a buyer, thinking copper is oversold on a too-pessimistic global growth outlook while supply is tighter than thought moving forward.

Short U.S. Large-Cap Stocks:

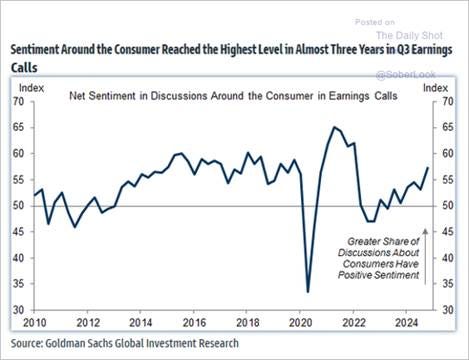

Being long large-caps was one of the best and most straightforward trades this year. The view at the beginning of the year was that the economy would slow as the U.S. consumer finally ran out of excess savings and persistently high prices eroded real disposable income. As we know now, this is not what happened, and corporate earnings continued to grow while P/E multiples also expanded, supporting price appreciation despite rich valuations.

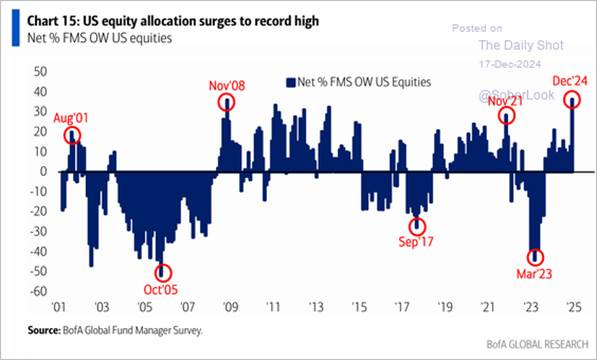

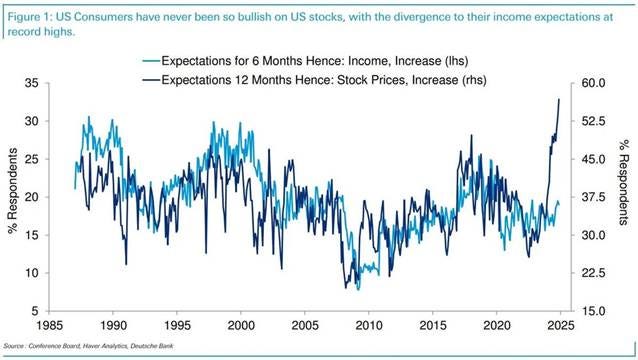

With the S&P ending the year near its all-time high and the “Magnificent 7” above 30% of the S&P by market cap, it’s been a good run for large-caps, especially the “megas.” Allocation by the major types of investors seems to be at record levels. The level of bullishness expressed by surveys and optionality positioning is at “exuberant” levels.

All in all, although the U.S. economy continues to defy expectations of softness and the consumer is powering through, equity markets are pricing an almost perfect scenario for 2025.

Instinct: Momentum is strong both on the price and earnings front. The Fed is easing policy while the economy is growing at an above-trend level, with productivity improving and supporting investment and labor markets. There is no reason why equity prices can’t continue to appreciate with positive fundamentals and bullish animal spirits.

Costanza: Last year, the S&P increased 26%; this year, it is on track for a nearly 30% increase. Since the 1920s, there have only been three other instances of +25% returns in back-to-back years, with the following third-year results being -35%, 7%, and 21%. Costanza would gravitate towards the more negative outcome of these historical results, arguing that things have been too good in the land of U.S. stocks and the market is due for a correction. Further, increased fiscal and monetary policy uncertainty will increase volatility and weigh on risk sentiment in what looks to be an overleveraged market.

The Fed changes its tune as disinflation progress has stalled…

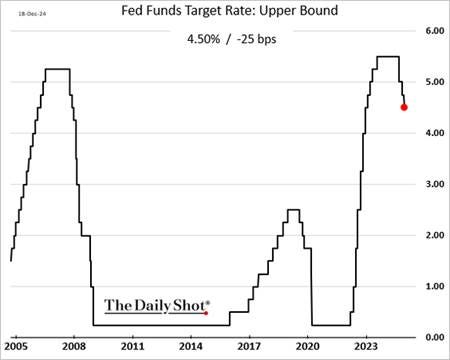

The Fed delivered a hawkish cut at their December FOMC meeting this week, with members signaling they expect only 50bp more of easing in 2025. Powell shifted to a more patient tone, conceding the December cut was a close call, with one official dissenter but additional members indicating they were against the cut.

“Today was a closer call, but we decided it was the right call,” Powell noted during the press conference, later adding, “From here, it’s a new phase, and we’re going to be cautious about further cuts.”

The new December SEPs showed Fed officials expect inflation to be stickier next year than previously anticipated, growth to be stronger, and UER to be slightly changed. Powell said many members took anticipated policy changes by President-elect Donald Trump into account when making their projections, and others did not.

As a result, interpreting the dots has become even messier. The Fed can no longer deny that it is beginning to think about what Donald Trump means for future growth and inflation, with initial expectations clearly skewing to fewer rate cuts and a higher terminal Fed funds rate

Previously, Powell has publicly insisted that there is too much uncertainty in what presidential policies will be pursued, and what their impacts will be, for the Fed to start factoring them into its decision-making on rates. But there were multiple clues on Wednesday that this is changing.

In totality, the overall message was a notable shift after the Fed initiated rate reductions with a larger-than-usual half-point cut in September in the midst of expectations (only a few weeks ago) that a steady sequence of cuts could follow.

Despite indications it would be a hawkish cut, markets still sold off hard…

On top of the more hawkish interpretation of the December FOMC meeting results, DC drama with the CR bill and mixed earnings results have had both equities and rates under further pressure going into today’s rather large December OPEX Friday.

As of this writing a relief rally seems underway. However,it’s clear markets are starting to sour on the Trump trade, with the Russell below where it was before the election and even the crypto universe pulling back recently. Further, a steepening of the Treasury curvy indicates that inflation fears are rising, with greater term-premium being demanded.

Final thoughts on the macro backdrop….

Today’s softer core PCE reading reinforces our view that inflation will move sideways in Q1. Higher levels of consumer price sensitivity and excess inventories, as well as no meaningful cost-push pressures for firms, will likely mean cooler monthly increases than Q4. Once Tariffs start being implemented and deportations occur, all bets are off.

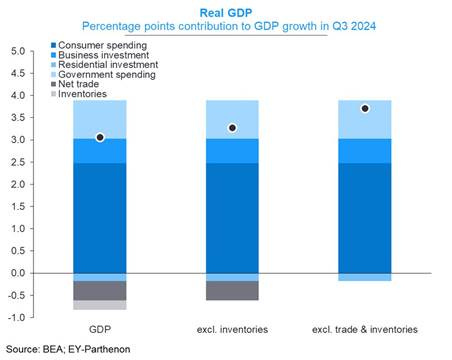

Growth momentum will slow in Q1, with real final domestic demand gravitating to a more sustainable 2% level from its current 3% trajectory for much of 2024. We are dubious on increased levels of investment and hiring from firms due to the political change (and anticipated pro-business policies). PMIs indicate firms in both the manufacturing and service sectors are seeing more neutral readings and greater uncertainty regarding what the Fed and DC will do will keep real activity balanced.

Our bias is to be short U.S. equities and for a flatter Treasury curve in Q1. We also see the dollar appreciation as overdone. Growth expectations, and hence earning expectations, seem too high. At the same time, although increased inflation is likely in the second half of the year, it will not materialize immediately. This means the Fed, which has turned hawkish, may pivot again in Q2, but the front-end will remain sticky while the long-end may increasingly reflect increasing growth worries.

We will leave it there!

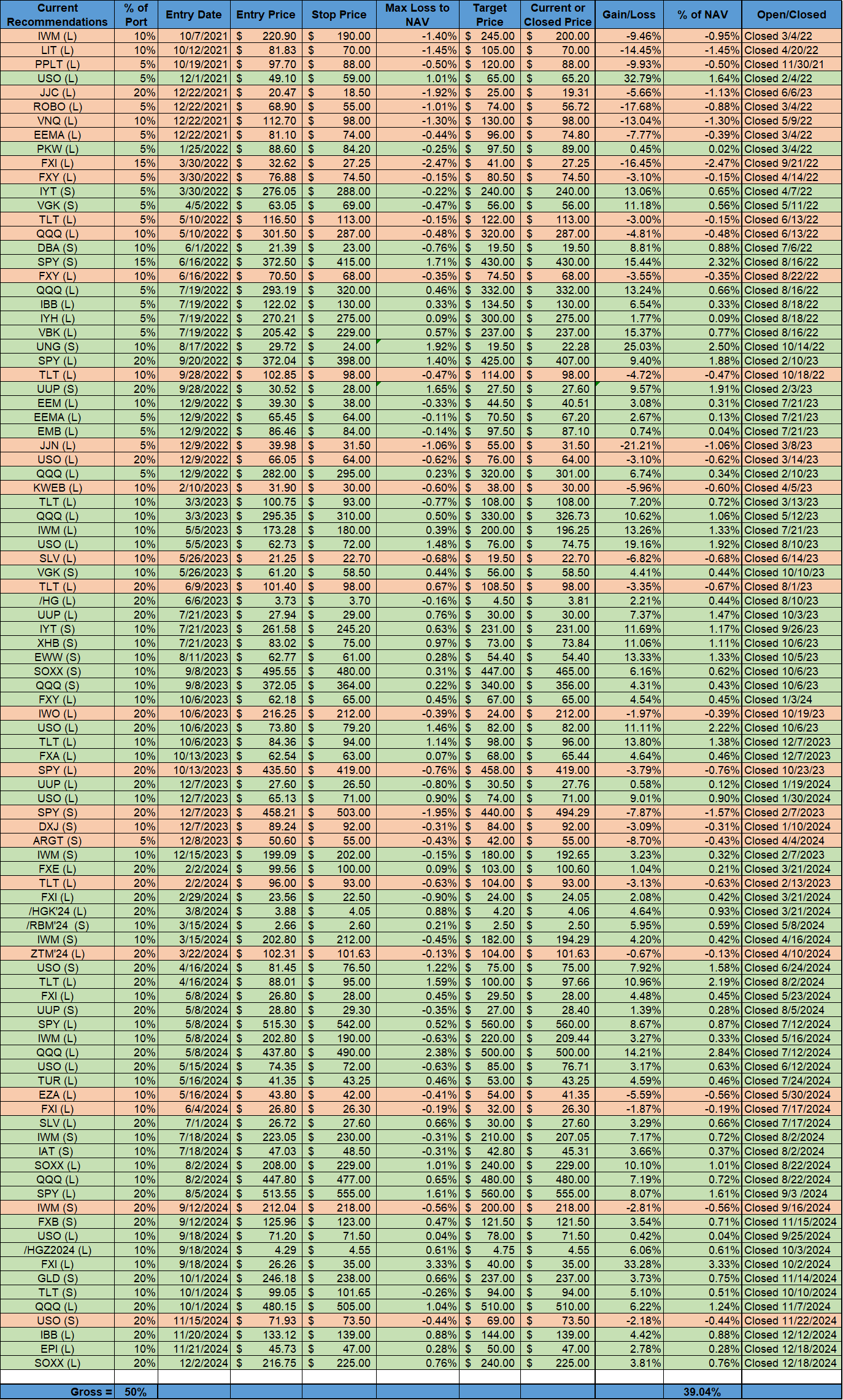

Our mock portfolio ended up producing a near 40% return (on a stand alone postion addition metric), and we are proud of our postive hit rate.

As always, thank you for reading, and look for us on Bloomberg. – Michael Ball, CFA, FRM

VIEWS EXPRESSED IN “CONTENT” ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, “CONTENT DISTRIBUTION OUTLETS”) ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT. THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKE NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION. I MAY OR MAY NOT HAVE POSITIONS IN ANY STOCKS OR ASSET CLASSES MENTIONED. I HAVE NO AFFILIATION WITH ANY OF THE COMPANIES OTHER THAN EXPLICITLY MENTIONED.

F